Table of Contents

EAs are sophisticated pieces of programming code that act as personal trading consultants. They tap into complex algorithms to analyze market data in real-time, providing traders unprecedented speed, accuracy, and insight. With the rise of these digital dynamos, it is becoming increasingly clear that the future of Forex trading is not merely human – it’s algorithmic.

However, while the power of EAs is undeniable, their efficacy is not set in stone. Every EA is the product of its programming, and like any software, it’s susceptible to glitches and oversights. Therefore, to truly harness their potential, rigorous EAs testing is paramount.

Through an accurate backtesting and forward-testing process, traders can ensure their EA is robust, reliable, and fine-tuned to their specific trading strategy. This rigorous vetting process ultimately leads to more confident trading decisions and a successful Forex journey.

This article will teach us how to properly use the MT4 platform Strategy tester.

MT4 Strategy Tester

The Strategy Tester in MetaTrader 4 (MT4) is a powerful tool that allows you to test and optimize trading strategies using historical data. In addition, it provides various features to help you assess the performance of Expert Advisors (EAs) and indicators.

Let’s explore the key features of the MT4 Strategy Tester and how you can use them:

- Expert Advisor (EA): An EA is an automated trading system that executes trades based on predefined rules. You can select an EA in the Strategy Tester and run it against historical data to evaluate its performance.

- Symbol and Model: The Symbol parameter allows you to choose the financial instrument (currency pair, stock, etc.) for which you want to test your strategy. The Model parameter determines the method by which prices are simulated during testing. For example, it can be based on available prices only (Open Prices model) or include high, low, and close prices (Every Tick model) for more accurate backtesting.

- Period: This parameter allows you to select the timeframe of the historical data you want to use for testing. You can choose from various timeframes such as 1 minute, 5 minutes, 1 hour, etc.

- Expert Properties: This feature allows you to customize the settings and parameters of the selected EA. You can adjust parameters such as lot size, stop loss, take profit levels, and other variables specific to the trading strategy you are testing.

- Optimization: The Optimization feature enables you to find the optimal parameter values for your EA. You can specify ranges for different parameters, and the Strategy Tester will perform multiple tests with different parameter combinations to determine the most profitable settings.

- Visual Mode: The Visual mode allows you to visualize the progress of your strategy in real time during the backtesting process. It displays the chart with the simulated trades, showing entry and exit points, stop loss and take profit levels and other relevant information.

- Results: The Strategy Tester provides detailed results and statistics once the testing is complete. You can analyze the total number of trades, profit factor, maximum drawdown, average profit/loss per trade, and more. These results help you evaluate the performance and profitability of your strategy.

- Graphs: The Strategy Tester also generates various graphs, including balance, equity, drawdown, and profit distribution. These graphs visually represent the strategy’s performance over time and provide insights into its strengths and weaknesses.

By leveraging the features of the MT4 Strategy Tester, you can thoroughly analyze and optimize your trading strategies before deploying them in live trading. In addition, it allows you to gain confidence in the strategy’s performance and make informed decisions based on historical data.

How to Backtest Forex Trading Strategy in MT4?

To properly backtest Forex trading strategy Expert Advisor, you must load EA, choose an extensive testing period, and test 1 trade per time for several trading symbols. After each test, change EA inputs to find a high-profit factor and low drawdown strategy.

Please watch my video about MT4 Strategy tester and testing principles:

Detailed steps on how to backtest the strategy:

- Download and Install MetaTrader 4:

- If you haven’t installed MT4, download it from the official MetaQuotes or your forex broker’s website. The installation process is straightforward. Follow the instructions provided by the installer to set it up.

- Open MetaTrader 4:

- Launch the MT4 platform after installation.

- Access Historical Data:

- In the “Tools” menu, select “History Center” or press F2. This will display a window that shows all available instrument data.

- Find the currency pair on which you want to test your strategy and double-click it to expand and show the available time frames.

- Double-click the time frame you need. Then click the “Download” button to ensure you have as much historical data as possible.

- Open the Strategy Tester:

- Access the Strategy Tester by clicking “View” from the top menu, then select “Strategy Tester” or press Ctrl+R.

- Configure the Strategy Tester:

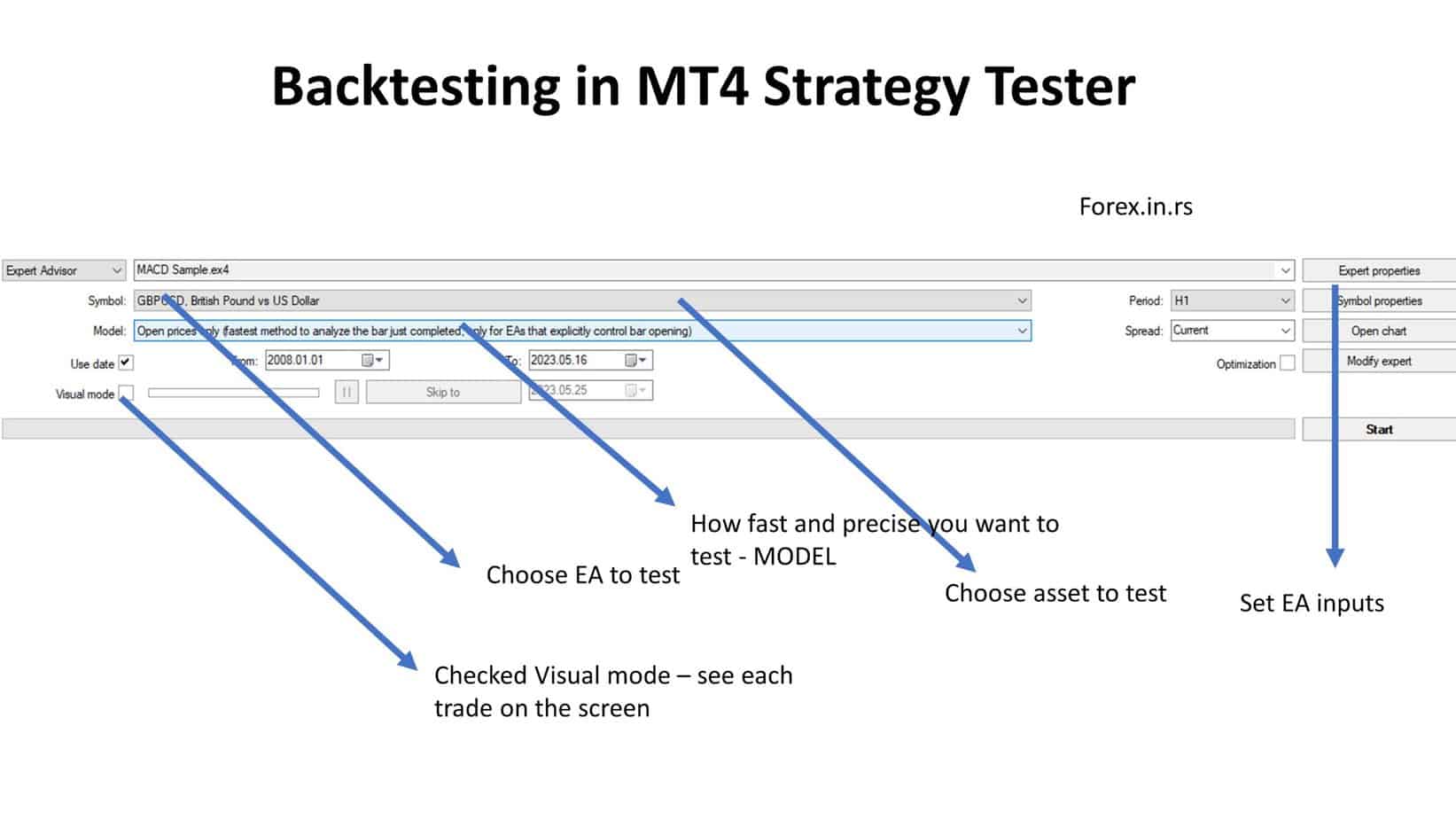

- At the top of the Strategy Tester window, choose the Expert Advisor (trading strategy) you want to test from the dropdown menu.

- Choose the currency pair and timeframe you wish to backtest.

- Under “Model,” select the level of data quality you want to test with. The best option is “Every tick,” which will take the longest but is the most accurate.

- Set the date range for the backtest under “Use Date.” Ensure the dates you set are within the period you downloaded historical data.

- Configure your initial deposit under the “Expert properties.”

- Set the Inputs:

- Click on the “Expert Properties” button in the Strategy Tester.

- Then, set your Initial Deposit value under the “Testing” tab.

- Next, go to the “Inputs” tab to set your strategy’s parameters.

- After setting your parameters, click OK.

- Start the Backtest:

- After configuring all the settings, press the “Start” button in the Strategy Tester window. The backtest will now run.

- Analyzing the Results:

- While the test runs, you can see the results live in the chart and under the “Results” and “Graph” tabs of the Strategy Tester.

- Once the backtest is completed, you can further analyze the results in the “Report” tab. This tab provides detailed performance metrics of the backtest, such as profit factor, expected payoff, drawdowns, and many others.

- The ‘Results’ tab shows every trade executed during the backtest, and the ‘Graph’ tab shows the balance and equity curve.

The first step in backtesting any trading strategy is to ensure that you are using high-quality historical data. This data is the foundation of your backtesting process and will provide you with the most reliable results. MT4 has a vast range of historical data, so you should have no problem finding the data you need. Choose a data source that covers an extensive period and has minimal gaps.

Once you have your historical data, you must decide on the testing period. Testing your strategy on at least 20 years of data is recommended. This will give you a better understanding of its performance over different market conditions. During this testing period, testing only one trade position per time is essential to avoid martingale and multiple losing positions in your strategy.

Testing your strategy in both buy and sell modes is also essential. This will help you understand how it performs during bullish and bearish trends. Effective trading strategies should avoid trading in poor market conditions. Testing multiple currency pairs and timeframes will give you a broader understanding of your strategy’s strengths and weaknesses.

Transaction costs such as spread, swap, and commission can significantly impact your strategy’s performance. Therefore, it is essential to incorporate these costs into your backtesting process to ensure accurate results.

While backtesting can provide valuable information about the potential performance of an EA, it should be noted that backtesting does not account for future market conditions. The market constantly evolves, and past performance does not guarantee future success.

To increase the accuracy of your backtesting, use the “Every Tick” mode. This mode simulates actual trading conditions as closely as possible, resulting in more reliable results. It is also important to stress test your strategy under extreme market conditions. This will give you an idea of how it might perform during significant news events or market shocks.

Moreover, risk management is crucial in Forex trading. Therefore, italuating the risk and drawdown associated with your strategy during the backtest is essential. High returns may not be worth it if they are associated with high risk and large drawdowns. Therefore, you should frequently retest and tweak your EA to ensure it stays in tune with the current market conditions.

As you backtest your Forex trading strategy in MT4, you may be tempted to optimize your EA to perfection. However, over-optimizing can lead to overfitting. An overfitted strategy performs exceptionally well on historical data but may fail in live trading. To avoid overfitting, test your EA on unseen data in a significant period.

MT4 Stratergy Tester Backtesting Tips

- Use High-Quality Historical Data: The quality of your data is vital. The more accurate and complete your data, the more reliable your backtesting results will be. Ensure your data has minimal gaps and covers the most extensive period possible. Usually, MT4 has good historical data.

- Test on at least 20 years period: Large period shows EA quality.

- Test 1 trade position per time: Avoid martingale and multiple losing positions in EA strategies.

- Test only buy and only sell mode: check how your strategy performs during bullish and bearish trends with only buy or only sell trades. Good EAs avoid trading in bad market conditions.

- Backtest Multiple Currency Pairs: Don’t limit your backtesting to just one currency pair. Understanding how your EA performs under different market conditions is beneficial, and testing with multiple pairs can provide a broader understanding of its strengths and weaknesses. For example, if EA shows consistent results on all assets, it is robust EA.

- Backtest Various Timeframes: Like testing multiple pairs, backtest your EA on different timeframes. Some strategies perform better on higher timeframes, while others may excel on lower ones.

- Consider Transaction Costs: Transaction costs like spread, swap, and commission can significantly impact your EA’s performance. Therefore, ensure you incorporate these costs in your backtest.

- Understand the Limitations of Backtesting: Backtesting can provide valuable information about the potential performance of an EA, but it’s not a guarantee of future success. Market conditions are constantly changing, and backtesting doesn’t account for this.

- Backtest Using Every Tick Mode for More Accuracy: This is the most accurate method for running a backtest as it simulates actual trading conditions as closely as possible.

- Stress Test your Strategy: In addition to testing your strategy under normal market conditions, it’s also wise to stress test it under extreme market conditions. This will give you an idea of how the EA might perform during significant news events or market shocks.

- Evaluate Risk and Drawdown: Consider the risk and drawdown associated with the EA during the backtest. High returns may not be worth it if they’re associated with high risk and large drawdowns.

- Optimize, but Avoid Overfitting: While optimizing your EA to perfection on historical data is tempting, be aware that too much optimization can lead to overfitting. An overfitted strategy will perform exceptionally well on historical data but may fail in live trading. You will avoid overfitting if you test EA over time on unseen data.

- Retest Periodically: Market conditions evolve, and so should your strategy. Regularly retest and tweak your EA to ensure it stays in tune with current market conditions.

Conclusion

Remember that backtesting is just one part of the evaluation process for a trading strategy. Real-time trading conditions can differ, and past performance does not necessarily predict future results. Also, consider transaction costs (like spread or commission) while backtesting.

In conclusion, backtesting is essential for developing a successful Forex trading strategy. Following the steps outlined in this guide, you can backtest your strategy using MT4 with accuracy, efficiency, and rigor. Remember that the market is constantly changing, so retest and tweak your strategy to ensure it remains effective and profitable.