Table of Contents

In the vast landscape of commerce and entrepreneurship, understanding the difference between a scam and a regular business is crucial for consumers and potential business partners. While regular businesses and scams can sometimes share surface similarities — such as offering products, services, or investment opportunities — they operate on fundamentally different principles and impact their stakeholders differently.

In past articles, we analyze forex rigging scandals and various forex scams, including forex signals scams. We know that forex as a business is not a scam, and forex is not rigged. Businesses can be legitimate, but some people can be greedy or unethical, leading to big corporate scandals.

A regular business operates on the tenets of honesty, transparency, and providing value. Its goal is to offer goods or services that satisfy customer needs or wants, thereby earning a profit. It adheres to legal and ethical standards, respects its obligations towards customers, employees, and the community, and aims for sustainable growth.

On the other hand, a scam is a deceptive scheme designed to defraud people of their money or personal information. Scammers use manipulation, false promises, and, sometimes, sophisticated fraud techniques to lure unsuspecting victims. They often present themselves as legitimate businesses, but their primary objective is to deceive and profit illicitly.

Distinguishing between a scam and a regular business is essential to protect one’s interests and investments. This distinction requires awareness, skepticism, and knowledge about the common signs of scams. The following discussion will delve deeper into these aspects, helping readers discern legitimate business opportunities from deceptive scams.

Is forex trading a scam?

No, forex trading is not a scam. Forex trading is a regular CFD trading business like stocks or commodity trading. However, in each business, like forex trading, scammers present quick, rich schemes and take money from inexperienced traders.

Forex trading is a legitimate and profitable business regulated by global supervisory bodies. Forex business is not rigged and is not a pyramid scheme. However, forex scandals, Forex Rigging, and fx manipulation exist.

In my video, I recently explained why forex trading is a legit business:

Trading in forex exchange (forex) is advertised extensively online as a quick way to make considerable money online. However, due to the increasing number of forex scams, many are wary of anything that offers vast profits since it is often hype. Also, research indicates that most retail traders dealing in forex are making a loss. So, while many people who read the advertisements are interested in trading in forex to make additional money, they would also like to find out if forex is a scam. Though some traders make profits trading in forex, there are many scams that the trader should be aware of before investing his money.

Why is forex a Legitimate business?

- Regulation: Forex markets are overseen by established financial regulatory bodies worldwide, such as the U.S. Commodity Futures Trading Commission (CFTC), the U.K.’s Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC). These regulatory bodies supervise forex trading to ensure fairness and transparency.

- Global Recognition: Forex trading is globally recognized and constitutes the world’s largest financial market, with daily trading volumes exceeding $6 trillion. Major financial institutions, corporations, governments, and retail traders participate in forex trading daily.

- Access to Established Exchanges: Forex trading often occurs on established exchanges and through reputable brokers. These institutions provide a structured and regulated environment where buyers and sellers can transact.

- Economic Necessity: Forex trading plays a vital role in the global economy. It allows exchanging one currency for another, enabling international trade and investment.

- Analytical Foundations: Forex trading is grounded in analyzing economic fundamentals and technical data. Traders use well-established economic indicators, financial news, and charting tools to make informed decisions.

- Educational Resources: Numerous credible educational resources are available for learning forex trading. Reputable brokers often provide educational materials to their clients, and many books, courses, and online resources are available.

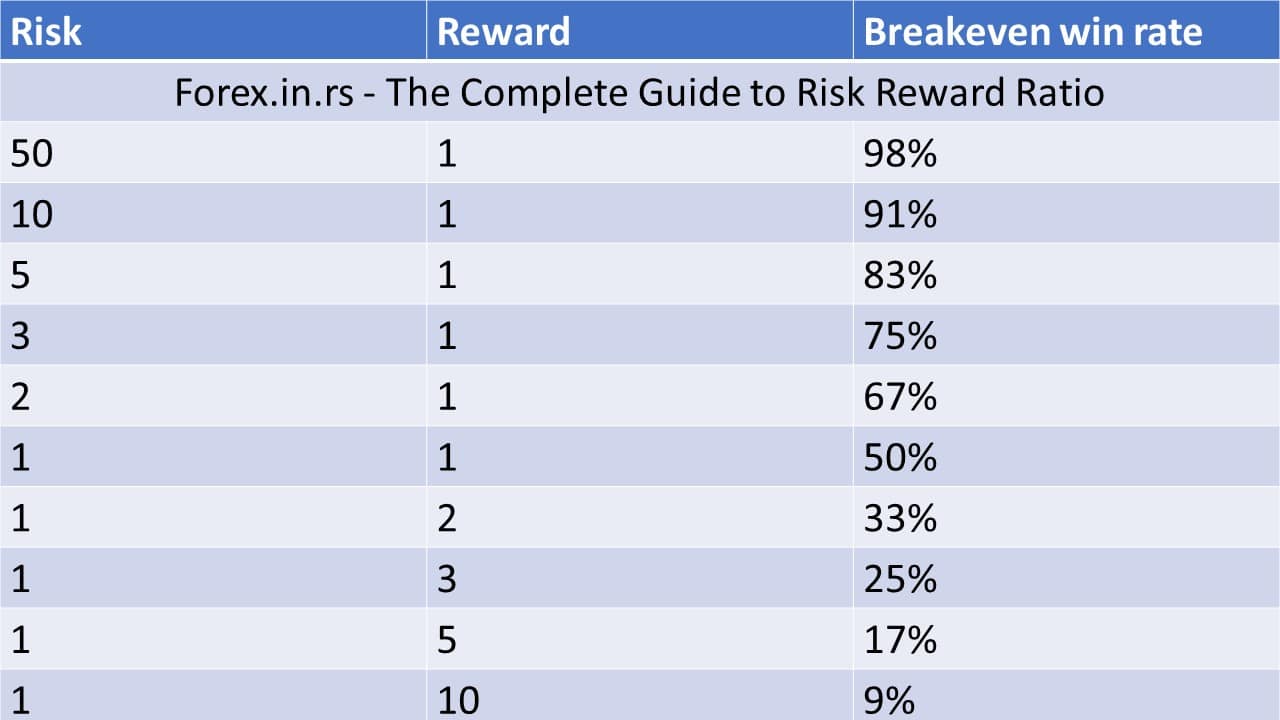

- Risk Management Tools: Legitimate forex trading involves a high degree of risk management, including stop-loss orders, take-profit orders, and proper leverage levels, which most reputable forex brokers provide.

Before investing money in forex, all traders should know that forex is a zero-sum game. Though one trader will make a profit, if the exchange rate of a currency increases, the trader dealing in the declining currency will make a loss at the same time. Additionally, the trader will have to pay the forex dealer or broker a commission for each trade, reducing the trader’s profit. The broker’s commission for each trade is relatively high; hence, making a significant profit from forex trading is difficult.

Please read our article about the pyramid scheme.

The forex market has many experienced professional traders like banks and hedge funds that have access to the latest market information and are handling vast amounts of money. These traders have a significant advantage over the smaller retail traders with limited information and less money for forex trading. Retail traders must also pay higher trading expenses regarding the spread and brokers’ commissions. Hence, it is observed that retail traders are usually less likely to profit from forex trading than professional forex traders.

Forex Trading Risk

Forex trading is inherently risky, and understanding these risks is crucial to navigate the market successfully. Here are some critical points about forex trading risks, highlighting why a majority of accounts might be at risk due to poor risk management and high trading expectations:

- Leverage Risk: Forex markets allow significant leverage, which means traders can borrow large amounts of money for their trades. While this can amplify profits, it can also lead to devastating losses, sometimes even exceeding the initial investment.

- Market Volatility: The forex market is incredibly volatile due to many factors, including economic indicators, geopolitical events, and market sentiment. This volatility can lead to significant price swings, resulting in substantial losses.

- Overtrading: High expectations often lead to overtrading, which involves opening more trades than necessary, increasing the risk of substantial losses. Overtrading often happens when traders attempt to recover lost funds or achieve high profits quickly.

- Poor Risk Management: This involves not setting appropriate stop-loss or take-profit levels, risking too much capital on a single trade, and not diversifying the trading portfolio. A lack of proper risk management can quickly lead to substantial losses.

- Lack of Planning: Failing to have a well-constructed trading plan or strategy can lead to impulsive decisions based on emotions rather than sound analysis. This lack of planning contributes to making poor trades that result in losses.

- Inadequate Knowledge: Forex trading requires a comprehensive understanding of financial markets and strategies. Many traders enter the market with minimal knowledge or training, leading to ill-informed trading decisions.

- Psychological Factors: Greed, fear, and other emotional responses can negatively impact trading decisions, leading to risky behavior and potential losses.

Investing in forex is risky since the trader can make a loss and lose the money invested, especially if he has no experience and no information. Forex brokers are getting a commission on every trade routed through them.

Hence, they are encouraging investors to trade in forex, luring them with false promises that they will make huge profits quickly and without much effort. However, in many cases, the inexperienced trader makes mistakes while trading and loses part of his entire capital. Hence, not warning the forex trader of the risk is a significant scam for some brokers.

95% of traders lose their money because of inadequate risk management, greed, overtrading, and lack of knowledge. When some traders realize that a quick-rich scheme is impossible in the forex industry, they say that trading is a scam.

The forex broker is getting a commission on each forex trade. Hence, the broker encourages the trader to sell and purchase forex more often, sometimes more frequently than the trader can afford. Though the trader may profit from the trade in some cases, the commission paid will reduce the profit made significantly. The investment value may be reduced significantly if there are many trades in the forex account, called churning. Churning is considered one of the most common forex scams, so traders and investors should be careful while choosing their broker.

Nonregulated forex brokers

While in some countries like the United States and the United Kingdom, forex brokers are highly regulated, there is no regulation of forex brokers in many countries. Anyone can pay a few thousand dollars and start a forex brokerage in these countries. All forex traders are routing their trades through the broker and deposit money with the forex broker when they open an account for trading. There have been cases when the forex brokers have disappeared with the money of the traders who opened their accounts. Hence, it is essential to ensure that the broker has a phone number and address where he can be contacted.

Forex brokers are regulated by various financial regulatory bodies worldwide, depending on the country they operate in. These regulatory bodies enforce financial laws and regulations, monitor forex brokers’ operations, and protect consumers from potential fraud or abuse. Here’s a brief overview of how forex brokers are regulated:

- Licensing: For a forex broker to operate legally, they must first obtain a license from a financial regulatory body. The process typically involves submitting an application, undergoing a thorough review, and paying a licensing fee.

- Compliance: Once licensed, a broker must comply with various regulatory requirements. These could include capital adequacy rules, which require brokers to hold a certain amount of capital reserves to cover potential losses. They may also involve transaction reporting, where brokers must regularly report their transactions to the regulator for scrutiny.

- Consumer Protection: Regulatory bodies also enforce rules designed to protect consumers. These may include rules on how brokers advertise their services, what information they must disclose to their customers, and how they handle customer funds. For instance, many regulators require brokers to keep customer funds separate from the broker’s operational funds in segregated accounts.

- Monitoring and Enforcement: Regulators continually monitor brokers for compliance with these rules and regulations. The regulator can impose penalties for violating a broker, including fines, license suspension, or revocation.

Forex Scams

Forex scams are deceptive practices by unscrupulous individuals or organizations to defraud people interested in currency trading. While not an exhaustive list, here are some of the most common types of forex scams:

- Fake Forex Trading Investment Funds: Scammers lure investors with the promise of high returns from investments in a forex fund. After collecting money, these scammers may disappear or explain why the fund is not making money.

- Signal Sellers: Signal sellers offer a system to identify favorable times for buying or selling a currency pair. They promise high returns and may use false testimonials and records to appear legitimate. However, these signals often fail to deliver as promised.

- Robot Scams: Also known as Expert Advisors or EAs, these programs automate trading decisions. Scammers sell these robots, promising high profits with little effort. However, these robots often perform poorly and can lead to significant losses.

- Fake Forex Trading Software: Scammers will sell trading software they claim has superior predictive ability for currency price movements. The software may be rigged to produce false signals that lead to losing trades.

- Phony Forex Trading Investment Scams: This type of scam involves a person or a company who claims to have advanced knowledge of the forex market. They ask for an investment in exchange for high returns. The scammer usually runs away with the money, leaving the investor with a loss.

- Margin Scams: This scam offers unrealistically high leverage and encourages traders to make big trades without fully explaining the risks involved. When the trades result in losses, the trader owes more money than initially invested.

- Forex Ponzi or Pyramid Schemes: In these scams, existing investors’ returns are paid for by new investors’ money. Scammers usually attract new investors by promising high returns with little risk. The scheme collapses once new investors stop coming in, and most investors lose their money.

Forex scams prey on a lack of knowledge and the promise of easy returns. To protect oneself, it’s crucial to educate oneself about forex trading, be skeptical of too-good-to-be-true promises, and only deal with reputable, regulated brokers and service providers. Remember that if something seems too good to be true in forex trading, it probably is.

Conclusion

Forex trading is undeniably a legitimate business activity as a form of investment and financial speculation. Its legitimacy is anchored in various aspects that lend it credibility, transparency, and an integral role in the global economy. Regulated by trusted financial authorities worldwide, it offers a structured trading environment for institutional and retail traders.

Moreover, the currency exchange it enables is an economic necessity, facilitating international trade and investment. Its impact on the world’s financial landscape is enormous, with daily trading volumes in trillions of dollars.

Additionally, forex trading is underpinned by tangible analytical foundations. Economic indicators, technical data, geopolitical events, and market sentiment guide traders’ decision-making. It’s far from a game of chance or a get-rich-quick scheme, as it requires knowledge, skill, discipline, and a well-plotted strategy to succeed.

Educational resources provided by reputable sources further affirm the legitimacy of forex trading. These include learning materials from regulated brokers, established online courses, seminars, webinars, and books from respected traders and analysts.

Risk management is also an intrinsic part of forex trading, making it a far cry from fraudulent activities. Reputable forex brokers offer numerous tools to manage and limit risk, ensuring traders can set parameters to protect their investments.