Table of Contents

Retail traders are increasingly active in anticipating price fluctuations and considerate marketplace subtleties. Twenty to thirty years ago, central banks and economic organizations could influence markets without ordinary traders knowing. Retail traders may now join the large guys and utilize block orders with advanced trading platforms and tools. This article explains forex order blocks, how to recognize them, and the order block dealing technique.

What is an Order Block in Forex?

Order blocks represent high-volume orders from big trading institutions such as central banks. The trading chart shows that order blocks are high-volume supply and demand areas that can create strong bullish and bearish trends.

Trading blocks on charts are areas of high or low demand or supply. These “blocks” are special orders that financial firms and central banks employ to buy and retail valued possessions that ordinary people may put to practical use.

Please watch my video about Order Blocks:

Central banks usually divide their orders into chunks and continue in this manner until they have completed their mission. So, for example, if a central bank has to acquire 500 million euros in US dollars, it may do so in more than 3-5 transactions.

Furthermore, they frequently employ complex orders to conceal their market participation. For instance, even though they have a thousand, they place a single order on the buy or sale side. Because of this, reserve banks may achieve their aim without increasing market volatility or dramatically altering prices, as this information is confidential for other traders.

Examples of Order Blocks in Forex Trading

As we’ve already discovered, order blocks are groups of orders placed by central banks, governments, and big trading institutions.

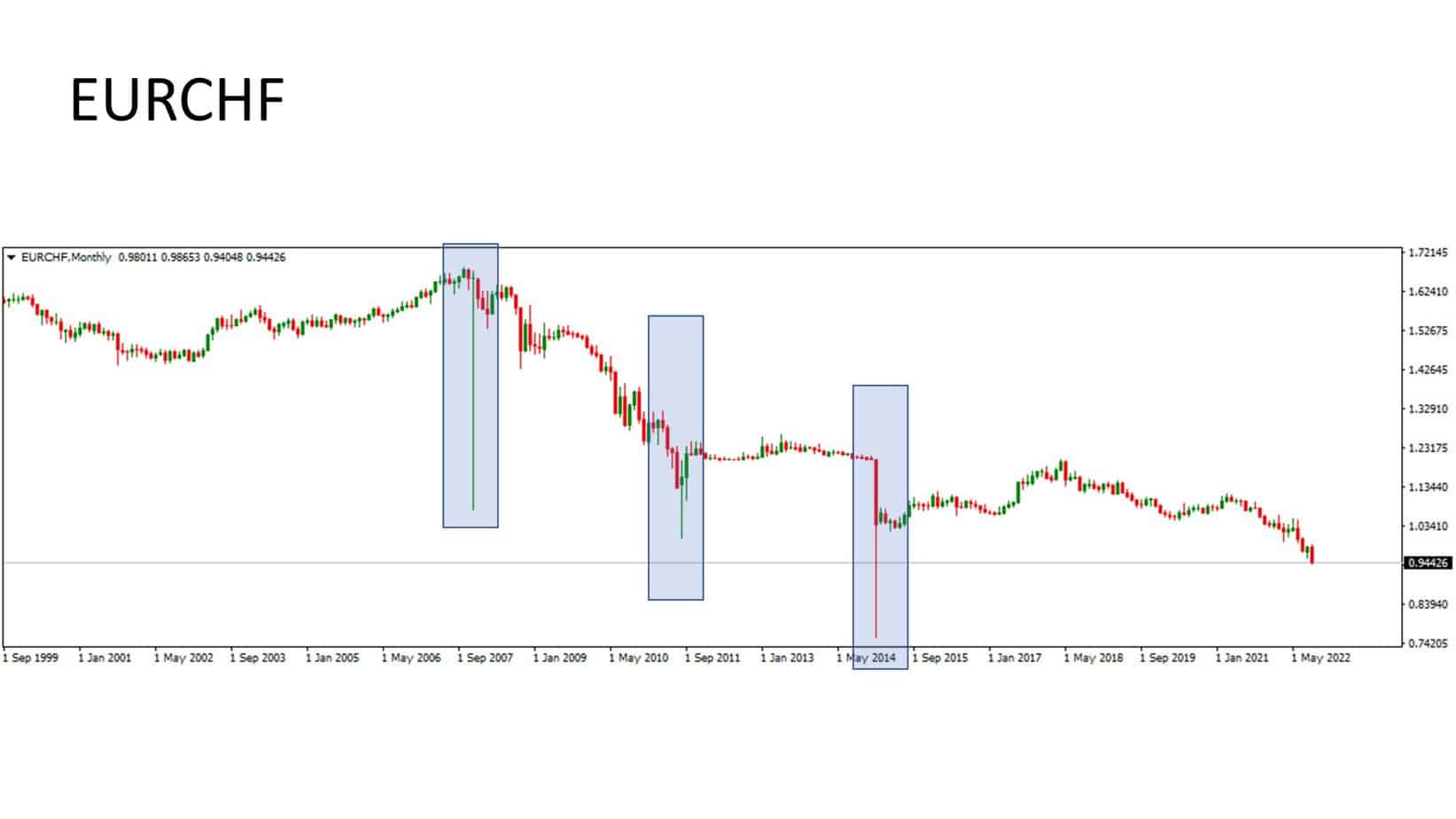

For example, important economic news or interventions represent typical order blocks like on EURCHF:

With the help of market data at level 2, you may spot them if they consistently place large orders without considering the pricing. Buying a significant quantity of an asset within a tight price range is standard practice for central banks. Please read more in our article on how banks trade forex.

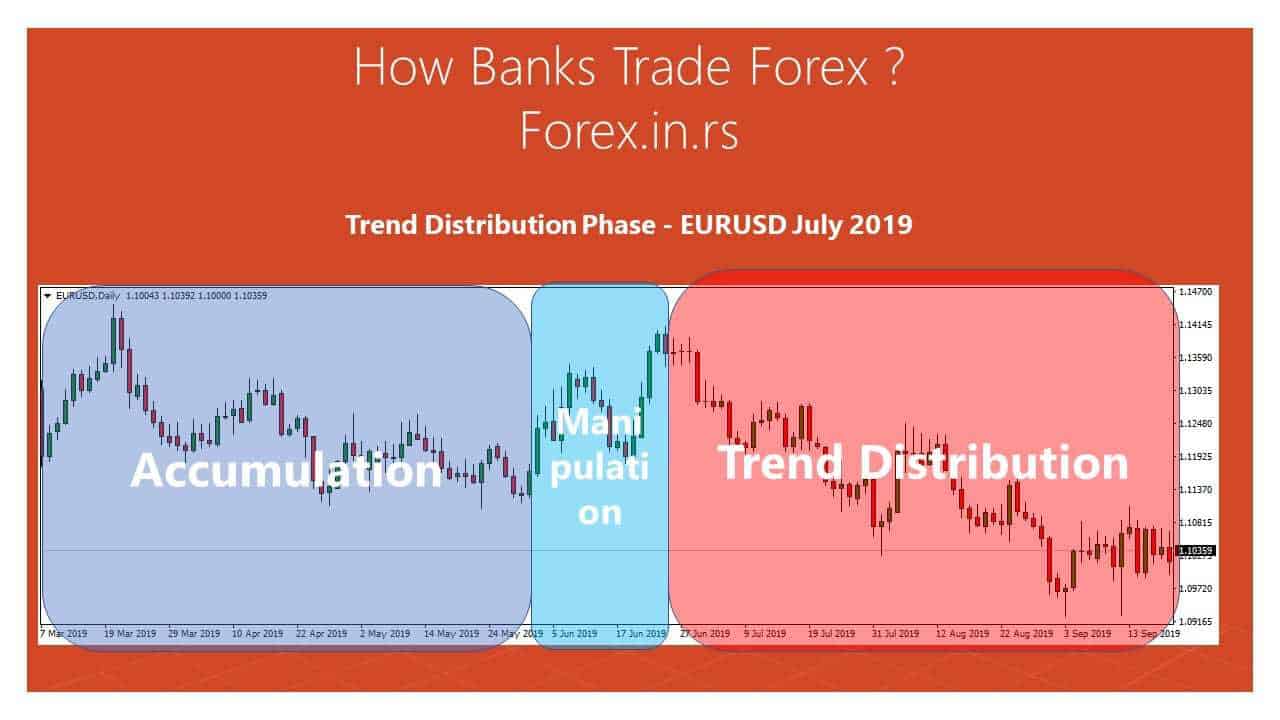

Let’s assume, though, that you’re only accessing market Intelligence, Level 1, and relying heavily on trade charts to understand the underlying structure of the market. This calls for analyzing price charts to determine whether we are in an aggregation or dispersion phase. A bullish order block is the first, while a bearish order block is the second.

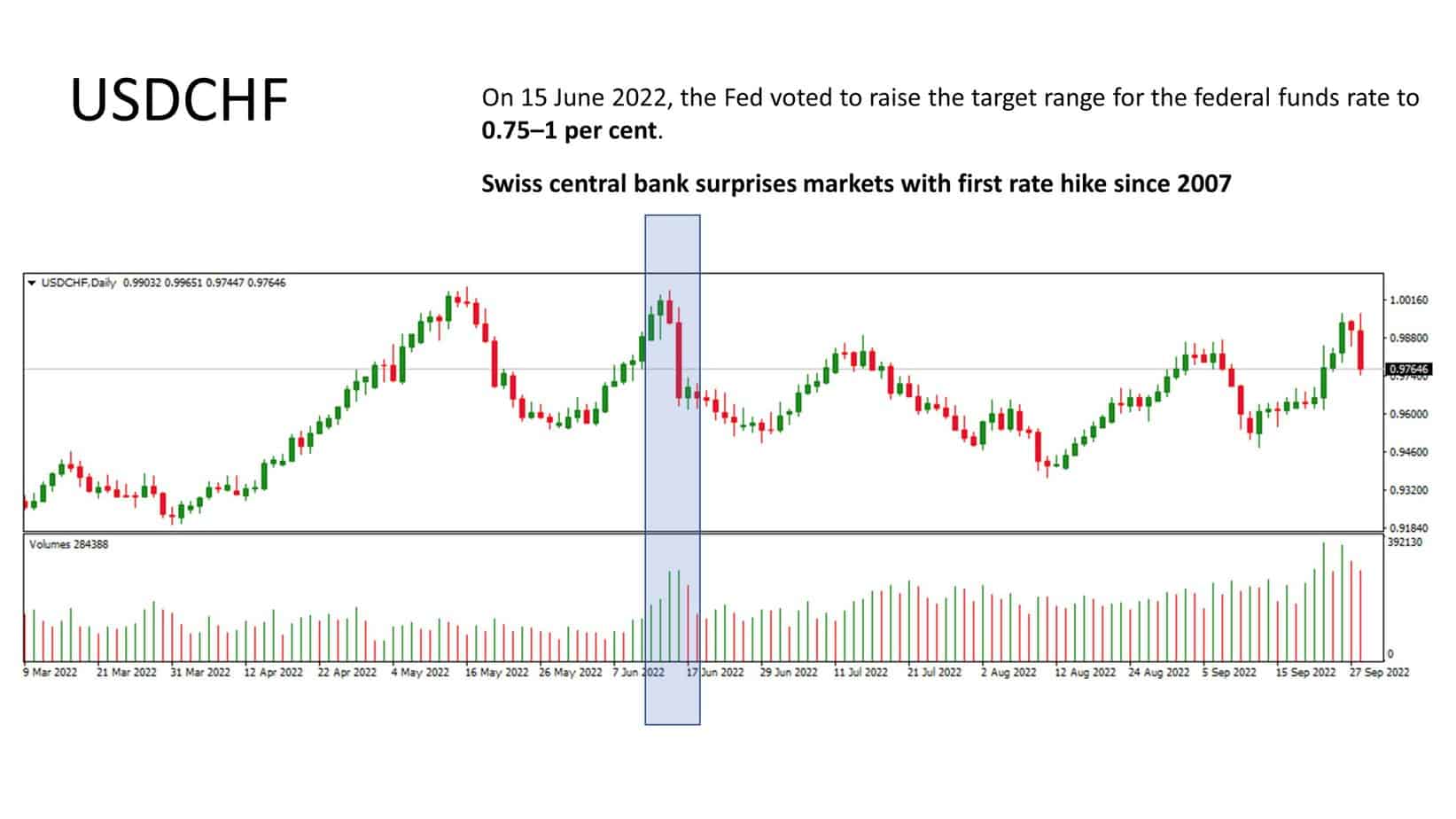

Bearish USDCHF Order Block

Suppose a central bank is entering the market to sell the counter currency and enhance the value of its currency as part of the reverse currency war. This USD/CHF (U.S. Dollar/Swiss Franc) example is a bearish order block.

The US and Swiss increased their interest rates in mid-June in two days. The Swiss central bank surprised the market with its first rate hike since 2007.

Order blocks are a novel trading approach that investors seeking market direction may implement. By revealing what banks and other financial organizations intend to do in a specific market, they can help traders predict the direction prices will go.

How do we determine Order Blocks on the chart?

- Use volume indicator

Combining volume indicators is another critical consideration when implementing order block trading techniques. The goal is to identify whether or not a significant actor accumulates the asset in question inside a specific supply or demand zone and whether or not the accumulation phase is characterized by high volume.

We’ve already shown that order blocks provide the impression of a ranging market, but it doesn’t imply that every range is an order block. Therefore, a volume indicator should be used to verify that the trade volume is abnormal to guarantee the content is an order block scenario.

- The range expands in direct proportion to the magnitude of the shift.

In the dissemination or accretion stage, markets frequently engage in lateral trading before shifting in the initially anticipated direction once the pile-up is completed. Remember that whenever anything like this happens, the more extensive the series, the more profound the movement will be.

Since this is the case, the Wyckoff graph arrangement and market structure are required. The trader will join the market as soon as the price cessations through the conflict or the support level.

In several situations, central banks and large institutions seek to lengthen the range period to finish their purchase at roughly the equivalent level of charges and avoid dealing with significant instability and trending marketplaces. Because of this, they want to maximize their chances of finishing their purchase at the same level price.

- Order blocks do not occur every day.

You may safely believe that order blocks are not something you can look for or use in your forex trading strategy. This is because no one can predict when central banks or other significant participants will enter a market, and you won’t receive any warnings before they do. As an additional note, order blockages are a very uncommon occurrence.

As a result, you shouldn’t make order blocks the foundation of your trading strategy; instead, include them in your system and employ them as you gain experience spotting order blocks in the market.

Order Block Practical example

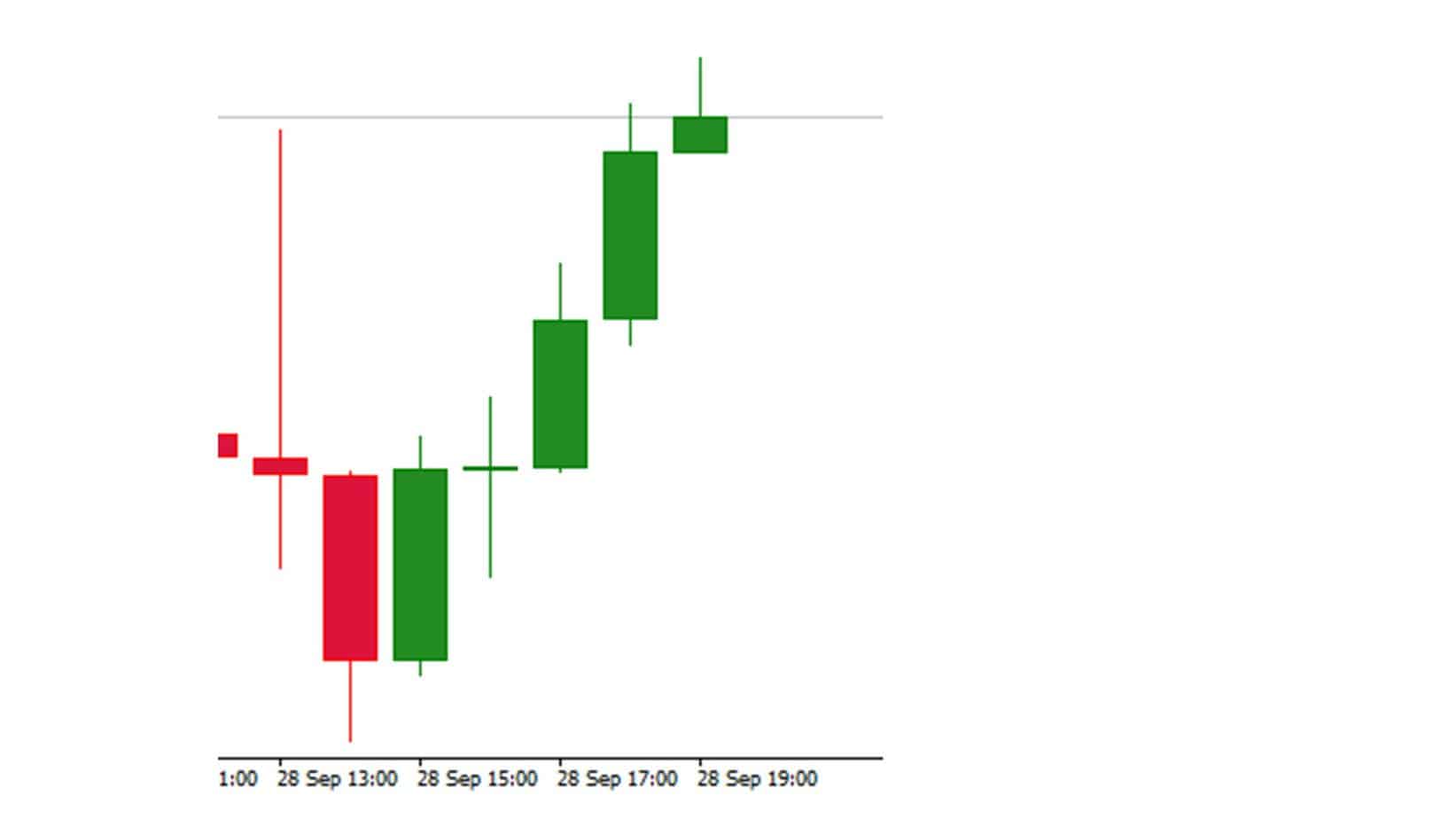

In September 2022, there was a considerable GBPUSD drop, and this pair almost hit the 1.00 price level. RSI for GBPUSD was below 20 on the daily chart.

Bank of England decides to do bank intervention:

After this news, there was a significant bullish daily trend on GBPUSD and several trading blocks. GBPUSD price went up:

Cons and Pros of the Order Blocks in Forex

Order Blocks Advantages

- Excellent tool for finding strong trends

- The ideal combination of fundamental and technical analysis.

- You get information from governments and banking institutions

Order Blocks Disadvantages

- It is hard to detect Building Blocks

- It would help if you had a technical and fundamental reason

Forms of Sequential Building Blocks

In trading, two distinct order blocks correspond to a specific order type.

- Bearish order block

- Group of bullish orders

1. Block of bearish orders

After a price range or block has been broken, a bearish order block will occur if a bearish impulsive wave has begun to build. We will initiate sell orders once the worth moves back into the bearish order block area.

2. Group of bullish orders

A bullish order block is formed when an up-trending impulsive wave occurs after breaking a range-bound market structure or block. When the price returns to the order block zone, we’ll start placing purchase orders with institutional traders.

As we know, large organizations and banks are watching order block zones closely. Orders from large trading firms tend to be placed in these areas. We should remember these price ranges so that we will be prepared to make trades after the charge inevitably yields to these areas in the prospect. In the event of order blockages, I have outlined below a primary criterion for opening purchase and retail orders.

When it appears, put an awaiting purchase boundary order some pips beyond the bullish order block area on the chart. In addition, setting a stop-loss order for some pips underneath the region is recommended.

When a bearish order block zone appears on the chart, place a stop loss order above it and a pending sell limit order a few pips below it. Remember that this is an essential order placement procedure. In the financial markets, this is not a strategy. A trader’s approach consists of advanced technical tools, risk assessment, and psychological aspects of trading.

As a trader, how can I map out a block zone for my orders?

The first step in drawing an order block is recognizing the price range or price block on a chart.

- Follow this by circling the extremes of the pricing range.

- Make a horizontal line that extends between the order block’s high and low points. We can use this space as a chokepoint for incoming orders.

- It would help if you always tried to make purchases and sales within this order block area.

Retail traders feel disappointed when their approach fails. A failed deal may not represent incompetent traders or understanding. Sometimes, they lose due to liquidity issues. Institutional traders have the most significant edge in the crowded FX market. They can control market pricing with a substantial market cap. What should ordinary investors do?

Order blocks can boost your trading. Many individual investors succeed with this method to avoid liquidity searches and increase their chances of success. It may be forward-looking if you could find order blockages and use them in your dealing approach. It’s everything here.

Order blocks relate to the aggregation (when bullish) and dispersal (when bearish) of orders after fiscal organizations and banks. It reveals where established agents stack orders before entering the marketplace. These entities are the fundamental price drivers of the market; thus, understanding their strategies will help you make trading judgments.

Using an approach that integrates institutional trader behavior may improve your odds. Institutional traders deal in large volumes. They should organize wisely. They spent countless currency on market analysis to improve trading results. Executing a large order is a new difficulty for them.

Every purchase order must have an opposing sell order. However, due to their large orders, institutional traders may have trouble finding a counterparty to fulfill them. As a result, financial institutions and other businesses sometimes divide orders into slighter agreements and carry them out in stages.

A bank needs to buy EUR 100 million/USD. Liquidity limits the market to $20 million. The bank may acquire fifty million dollars in the second stage and thirty million in the third. They may execute orders at the desired price without chasing the worth or disturbing the market. When $100 million is traded, the price typically jumps.

Order Blocks vs. Supply/Demand

Order blockages and supply/demand are controversial. Some sites say they’re the same. Order blocks are a form of supply/demand range. They think placing order blocks in the array association zone produces supply/demand zones. This precisely doesn’t seem right.

Supply/demand occurs in the commodities market, where maize, wheat, and soybeans are traded. When supply is low, prices increase; when demand rises, prices decrease. However, Forex isn’t like this.

Forex price movements seek liquidity above or below recent highs and lows. However, financial organizations heavily impact currency values, which adjust the weight to appropriate locations so they may make orders. Once the price exits the order block region, it’s not because supply or demand is growing but because significant players shift it to the opposed section of the liquidity pools to retail their possessions.

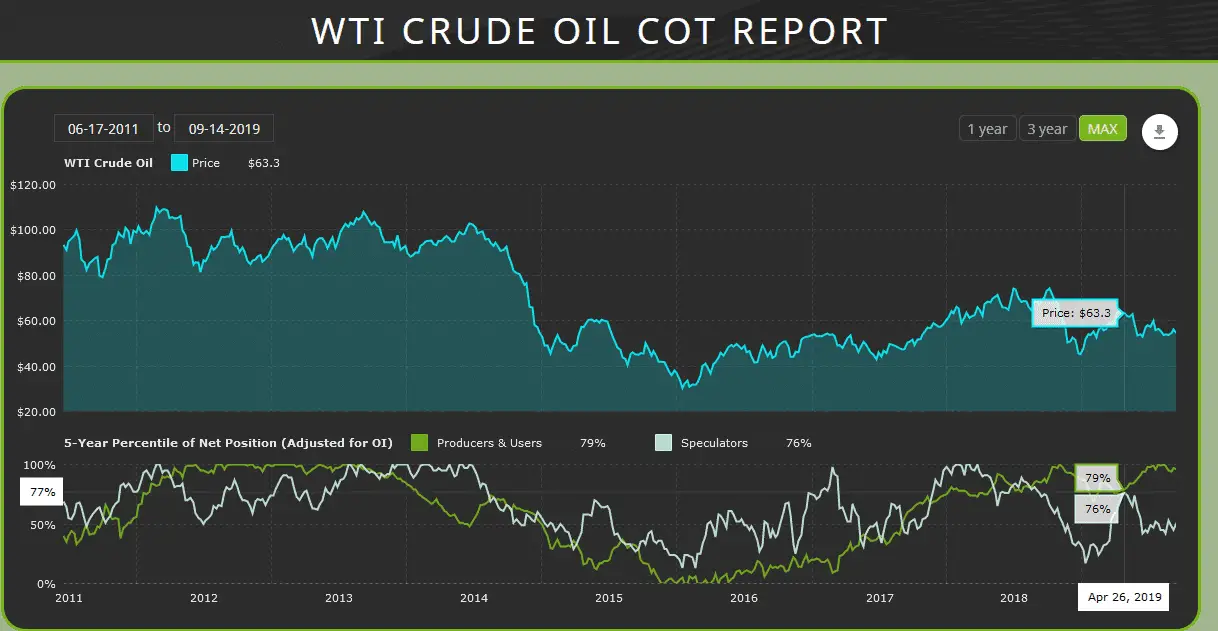

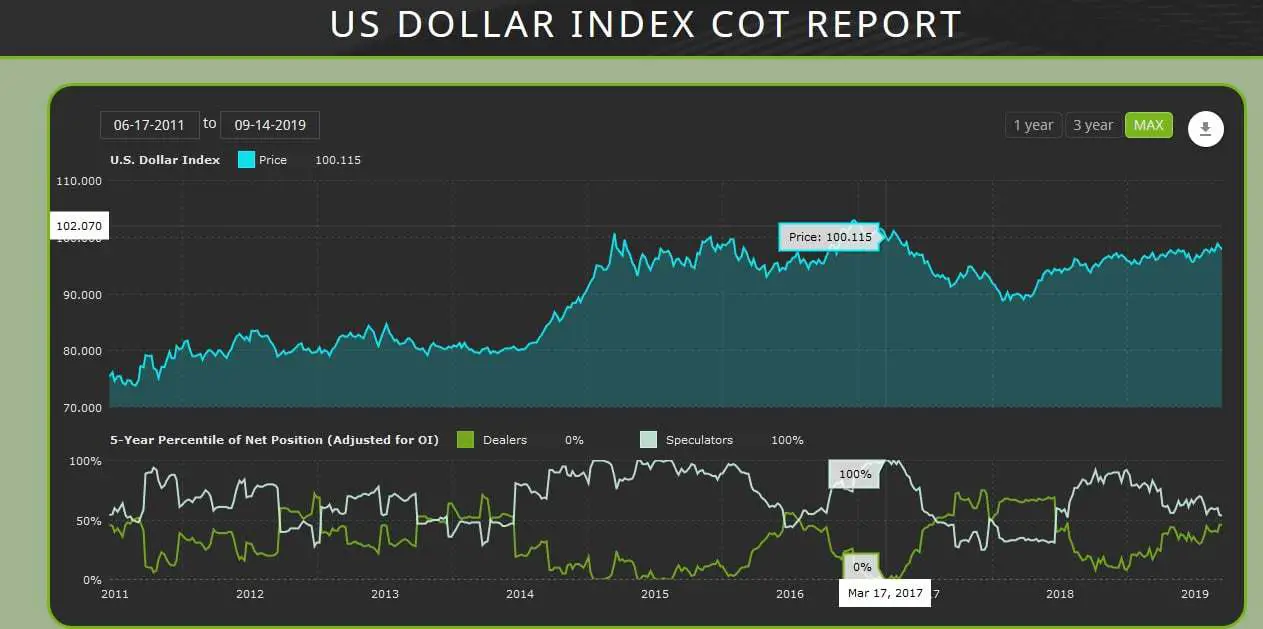

Order Block and COT report

Retail traders must grasp what institutional traders do in the marketplace. The commitment of Traders (CoT) report is used for this. You should declaim the information, discover essential bits for your profession, and then connect the dots. Unfortunately, the report doesn’t include intraday activity; therefore, it’s not helpful for temporary investors.

Order blocks offer you a greater understanding of what organizations are undertaking since you can see their traces in the digital world. As a result, you’ll mark more innovative trading selections with a speedier procedure. Order blocks may be employed in many marketplaces and dealing tactics; thus, they’re valuable for numerous traders.

Finding order blocks on the chart is the first step in learning how to practice them in your dealing system. In the work of large organizations and banks, order blocks can be seen over more extended periods following a market association. Generally, consolidation zone candles are more minor than Order block candles.

The best way to monitor what big trading institutions do in the forex market is to watch the COT report.

Watch for a bearish candle before a significant bullish advance to detect order blockages in a bullish market. Once you notice order blocks, you can change them depending on the price’s direction. Not every order block is lucrative and likely. Observe some qualities to determine if an order block is worth employing.

If this criterion does not exist in the graphic representation, the chance of the order block is minimal, and you should reconsider your analysis in light of this finding. First, you should look for a merging array where establishments are buying (a bullish order block) or selling (a bearish order block), and then you should examine price variations.

As soon as the rate arises in the opposite direction of the order block, it would help if you drew a rectangle beginning at the order block’s height and terminating at its lowest, extending its scope to span the portion of the graph on the right. Ensure the price stays above the order block’s middle range.

Higher-frequency events

Higher-level temporal scales can give you a more comprehensive picture of price movement and a greater understanding of order blocks. After a solid up-and-down motion, blocks of order arise. After the worth exits the order block region with significant momentum, it retraces to collect market orders. If this circumstance lasts too long, the market is wandering. To what extent the price must deviate from the order block before a reversal is permitted is not specified. Still, a more extended period may assist you in viewing the better picture and deciding what to do next.

After a market shift, follow the trend.

Pay attention to bearish order blocks if the market arrangement changes and the tendency turns negative. You should enter a short position with a target price under bullish order blocks. The inverse is also true with this principle. If there is an improvement in the market’s structure, traders should look for liquidity pools that can overcome bearish order blocks and concentrate on bullish order blocks.

Conclusion

Overall, order blocks are the most efficient method for spotting and following financial organizations’ and banks’ requests. Therefore, I strongly advise traders to familiarize themselves with and use this naked chart trading strategy in their approaches. Doing so will do wonders for their dealing profession.

In conclusion, order blocks are an excellent instrument for determining which aspects of market activity have the most significant impact. Central banks frequently participate in the foreign exchange market to influence the worth of their currencies, which positions them as substantial participants in the market. However, even though this strategy is quite effective at taking in present market statistics, there is no widespread agreement on how exactly order blocks should be put into dealing coordination.

The most prudent thing is to keep this trading method close and routinely apply it whenever you identify accretion or dispersal zones brought about by the actions of central banks and other essential entities in the marketplaces.

After a significant purchase by a central or investment bank, most traders wait for the price to break between the resistance and assistance levels before entering a position.

Although the foreign exchange market is regionalized, it is commonly recognized that central banks substantially contribute to ” deploying ” their exchanges’ values. All at once, central banks must preserve the constancy of their currency’s exchange rate, which means they cannot put a large order on the market that would scare away other market players.