Table of Contents

In any investment, it is essential to be aware of the risks that come with it. One such risk is known as a drawdown. A drawdown measures any performance and how much it can absorb a loss before it goes into profits. It is related to a single position where you enter, and the price may go against you and put you in a relative loss before going up again.

It is also measured on a whole portfolio, where you take the winners and the losers together to determine the highest sequence of accumulating losses in the portfolio. Knowing these risks can help you make more informed decisions about your investments and help protect your money.

What is the drawdown in trading?

In trading, drawdown represents a percentage of how much your trading account balance is down from the peak before it recovers back to the peak. However, traders recognize three types of drawdown: Maximum, Absolute, and Relative.

So, you need to imagine drawdown as the difference between the high point in the balance of your trading account and the subsequent low point of your account’s balance. Usually, we see drawdown as something wrong because it reflects lost capital due to losing trades.

What is Absolute Drawdown?

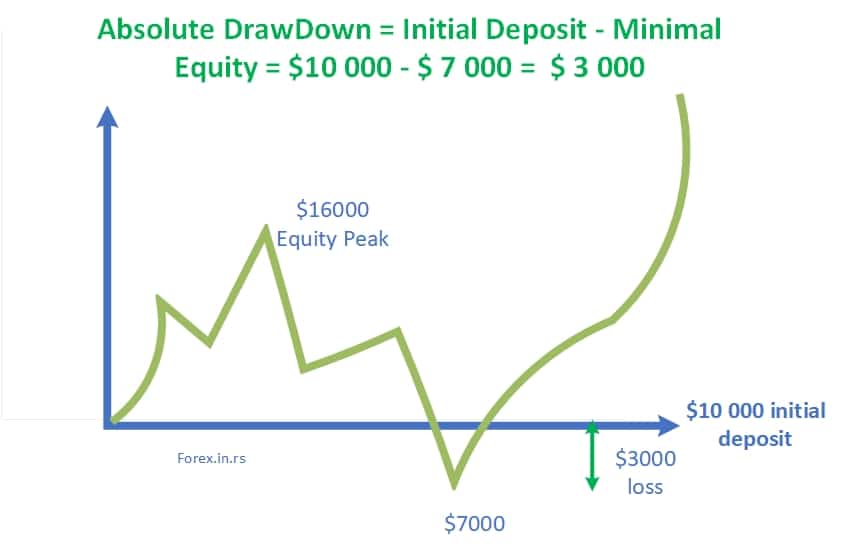

The absolute drawdown represents the difference between the initial deposit and the minimal point below the deposit level. For example, if the deposit amount is $10000, the maximum portfolio value is $16000, and the minimum is $7000, the absolute drawdown is $10000-$7000=$3000.

Absolute drawdown measures the amount of initial risk involved in the investment. The absolute drawdown shows how big the loss is compared to the initial deposit during the trading. If the absolute drawdown value is 0, no capital is at risk.

Formula: Absolute Drawdown = Initial Deposit – Minimal Equity

Absolute drawdown forex example

Please watch the video that I created on my youtube channel about absolute drawdown:

As we can see, the distance from $10 000 to $7000 is $ 3000, and it is the distance from the initial balance to a value below the initial balance.

What is the maximum drawdown?

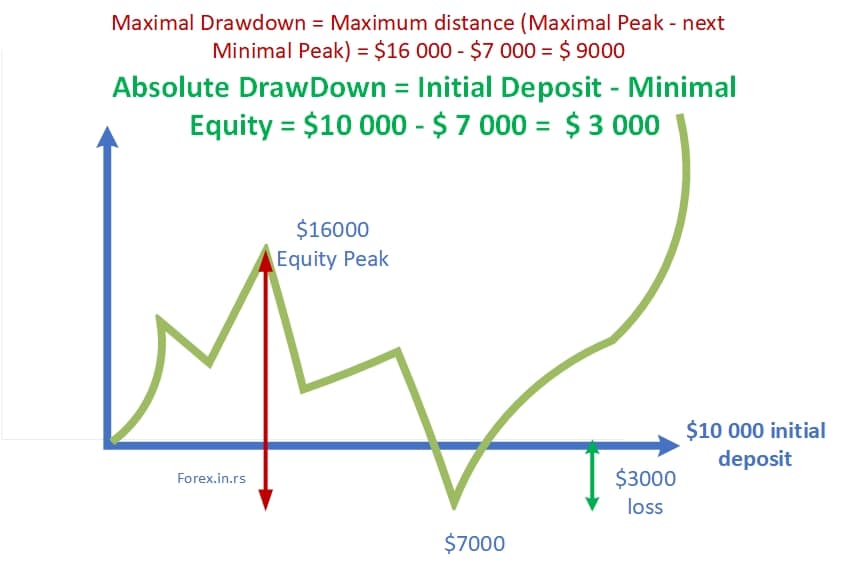

The maximum drawdown represents the difference between the maximum value (peak) and the most significant decline (minimal portfolio level) during some trading periods. For example, if the deposit amount is $10000, the maximum portfolio value is $16000, and the minimum is $7000, then the maximum drawdown is $16000-$7000=$9000.

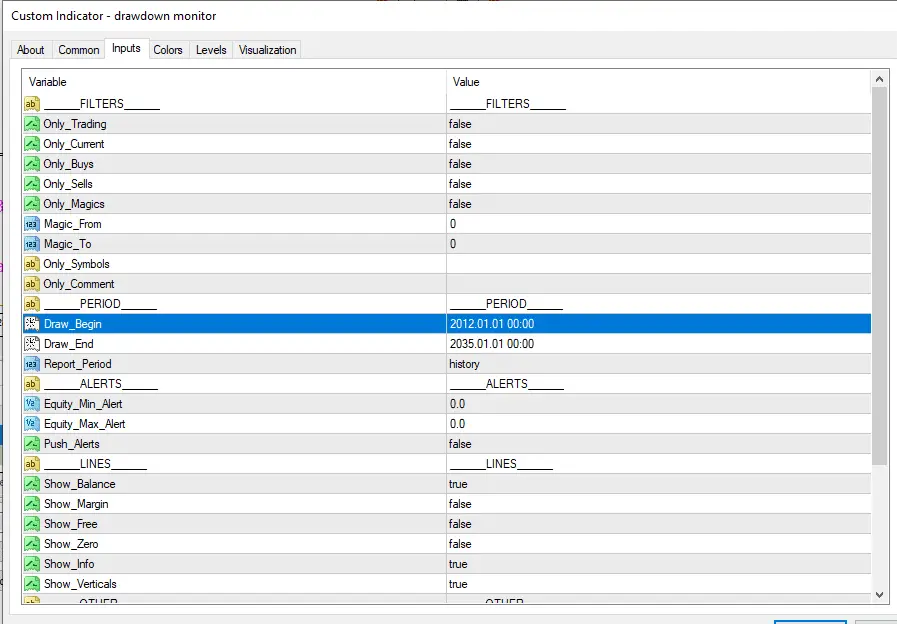

The drawdown and equity monitor indicator is presented below:

Download the drawdown indicator below:

Absolute drawdown vs. maximum drawdown vs. relative drawdown

In its most basic sense, drawdown refers to the relative risk involved with a particular securities investment.

When faced with any investment decision, it would be wise for investors to consult as many and as several various indices as possible before making that purchase or sell. One of the most critical indicators is the general capital trend associated with security.

This article will explain the concepts of maximum, absolute, and relative drawdown as those terms relate to securities trading.

In its simplest sense, the drawdown refers to just how much you could lose with a particular investment; thus, it makes it a relatively strong indicator of the overall risk of a security.

For example, if you risk $100 and lose $50, your drawdown is 50% because you have lost half of your initial investment value. To put it in the simplest terms, the drawdown is the difference between a high in the capital and a low point in the capital value.

The drawdown is the difference between maxima and minima on your Forex chart. This measures the amount of risk-loss involved in your proposed security trade. This number is further divided into maximum drawdown and absolute drawdown. We will explain those terms now.

Understanding that a drawdown is essential when choosing a PAMM provider or a Zulutrade signal provider is necessary.

Absolute drawdown vs. maximum drawdown

In your chart, the maximum drawdown refers to the difference between a local max and the following minimum. This spread can show you the potential profit value locked in the trading pair you have selected. If the maximum drawdown is higher than the currency pair’s profit potential, it might not be an investment you want to consider. One of the most central strategies traders use to guide them in this number is determining a ratio that the trader is comfortable with and avoiding trading pairs that vary wildly from that dynamic.

Maximal drawdown = Maximum distance (Maximal Peak – next Minimal Peak)

So we need to find the highest high till lowest low in trading balance $16000 – $7000 = $ 9000.

What is relative drawdown?

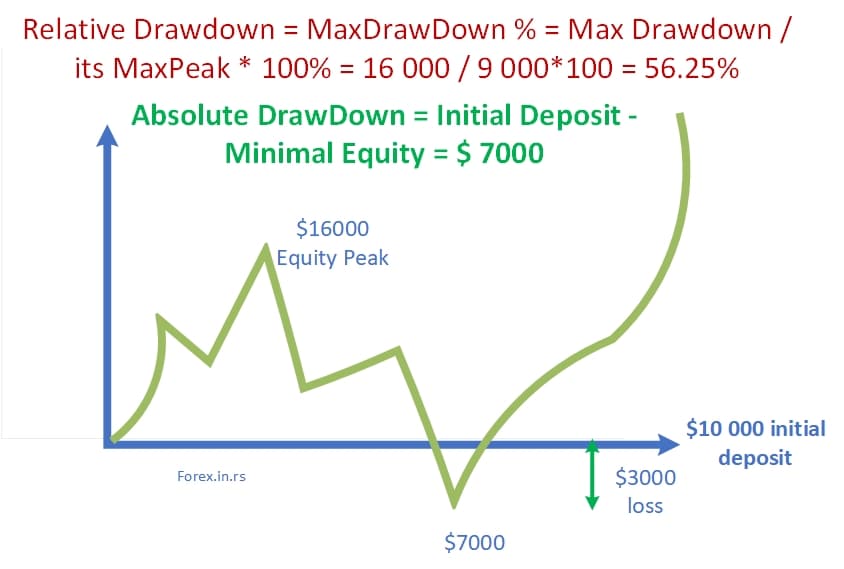

The relative drawdown is the maximal drawdown percentage that shows the ratio between the maximal drawdown and the respective local upper extremum (of equity) value.

Relative Drawdown = MaxDrawDown % = Max Drawdown / its MaxPeak * 100%

Absolute drawdown vs. Relative drawdown

While relative drawdown is the maximal drawdown percentage, absolute drawdown represents the difference between the initial deposit and the minimal point below the deposit level.

What is a suitable drawdown in forex?

The suitable drawdown in forex is less than 5% maximum drawdown based on major prop trading companies’ trading rules. However, retail traders imply that a maximum drawdown of less than 20% is optimum for a trading account. Usually, retail traders risk more money, and their perception differs from professional traders who manage significant funds.

Conclusion

Forex trading often relies upon keen intuition and interpretation for charts and data relating to the drawdown. Because of its highly volatile nature – or its tendency towards wide swings in some currency pairs – having a keen sense of risk is often the most powerful tool an investor has in their arsenal.

The most important thing is to measure Maximum Equity Drawdown because this is the most important criterion for measuring a good portfolio. If we look only at balance, many traders who do not stop-loss or use broad stop-loss will avoid showing absolute equity drawdown, bringing huge problems to investors’ or traders’ minds. The worst thing is when the trader thinks he has an excellent strategy and strategy because of the vast equity drawdown.

Absolute drawdown is an excellent measure of our performance in the first months of trading and comparing it with the initial balance. Still, maximum and relative drawdown are much better solutions for long-term portfolio analysis.