Traders engaged in stock market trading can aim for returns higher than the market average, but it is vital to approach such targets with caution. Aiming for a consistent annual return of 10% to 20% can be considered a reasonable goal for experienced stock traders. However, achieving these returns requires diligent research, risk management strategies, and identifying potential market opportunities.

However, experienced forex traders often aim for returns of 10% to 50% per year. It is important to note that these figures are subjective and can differ significantly depending on market conditions and trading style.

See my video about this topic:

Can You Make 1 Percent a Day Trading Return?

No, traders can not make a 1% %-a-day trading return every single time because, in that hypothetical case, after 260 trading working days, the annual return would be around unrealistically 1230%. However, by risking a maximum of 1% of portfolio equity during trading, the best traders can achieve 20% of annual profit.

For example, if you earn 1 dollar and one daily %, during around 260 working trading days in the year, you will have around $13.29 or 1230% of annual profit. So, to put it into perspective, 1% daily returns would compound to an annual return of around 1230% given approximately 260 trading days in a year.

This return rate is significantly higher than the average stock market return, which historically has been around 7-10% annually after adjusting for inflation. Additionally, it is far higher than the typical performance of professional fund managers, who typically aim for a yearly return of 10-20%. Therefore, consistently achieving such a high return is unlikely and could suggest using risky and potentially unsustainable trading strategies.

Most experienced traders have losing positions that provide losing strikes very often. Even the best traders make a loss at the end of the week and the end of the month.

Promoting trading strategies with exaggerated win rates, such as claiming an 80% or 90% success rate when the reality is closer to 50%:50%, is a deceptive practice that misleads viewers and potential traders. This type of behavior can be considered a bad practice for several reasons:

- Misrepresentation of risk: By inflating the win rate, promoters create an illusion of low risk and high profitability. Traders who believe these claims may be inclined to invest more money without fully understanding the potential risks involved. It sets unrealistic expectations and can lead to financial losses.

- Lack of transparency: Accurate and transparent information is crucial for trading. Promoters who misrepresent the success rate are not honest with their audience. Traders deserve to know a strategy’s actual performance to make informed decisions.

- Cherry-picking data: Promoters who claim high win rates often cherry-pick specific trades or periods that showcase their strategy’s success. They may ignore the losing trades or conveniently omit periods when the strategy underperformed. This selective presentation of data can mislead viewers and give an inaccurate picture of the strategy’s overall performance.

- Overemphasis on winning trades: Focusing solely on winning trades without addressing the potential risks or losses creates a skewed trading perspective. Successful trading involves managing risk and minimizing losses, not just maximizing gains. These promoters fail to provide a balanced view of the strategy by downplaying or ignoring the losing trades.

- Lack of evidence and verification: Without proper verification and evidence of the claimed win rates, viewers have no way of confirming the accuracy of these statements. Evaluating strategies based on robust data, backtesting, and real-time performance is essential, preferably verified by a trusted third party. Without such verification, the claimed success rates can be baseless or exaggerated.

- Conflict of interest: Some YouTubers and promoters may have financial incentives to promote specific trading strategies or platforms. They may receive compensation or referral fees for driving traffic or generating sign-ups. This creates a conflict of interest and raises questions about their motivations and the integrity of the information they provide.

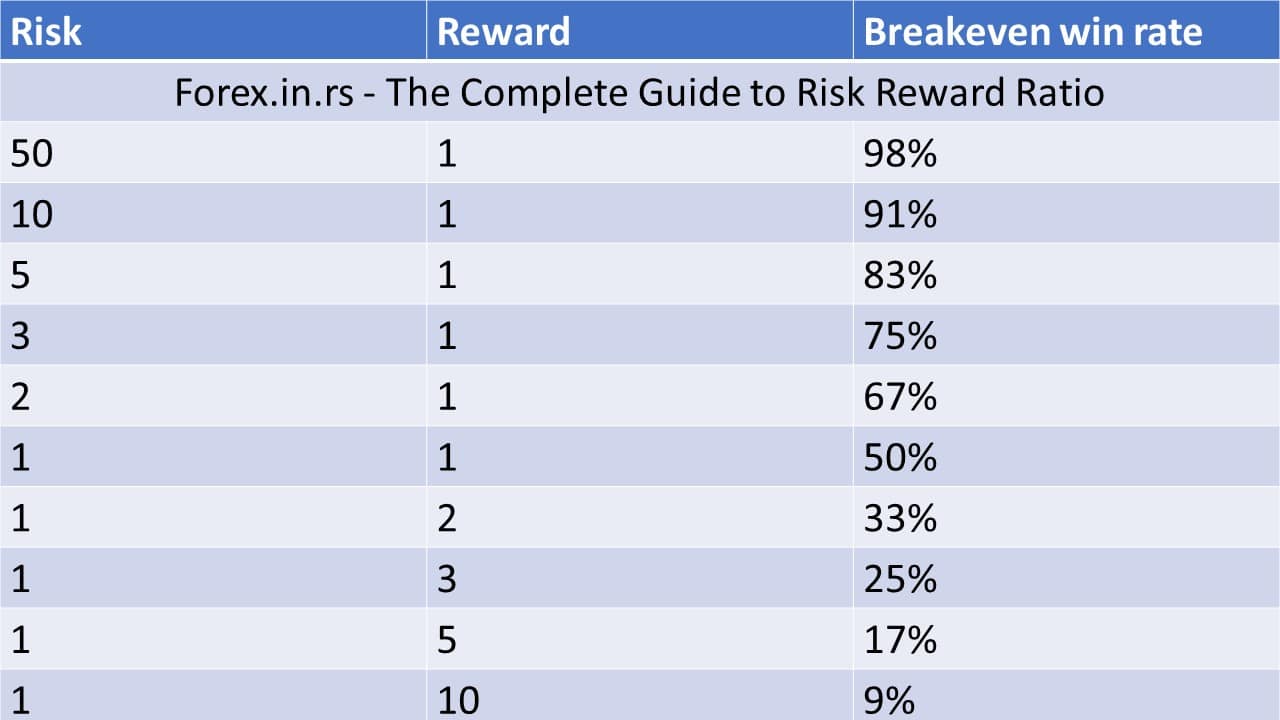

Regarding trading, the risk-reward ratio refers to the potential profit compared to the potential loss on a trade. A high risk-reward ratio suggests that the potential profit is significantly greater than the potential loss. While a high risk-reward ratio can attract traders due to the potential for more significant profits, it is essential to understand that it can lead to a lower success rate. Here’s an explanation of the situation:

- Fewer winning trades: A high risk-reward ratio often means you aim for more enormous profits on each trade. You might set your profit targets further away from your entry point to achieve this. However, the further the profit target, the less likely it is to be reached. This means you may have fewer winning trades overall because the market may not move in your favor to hit the higher profit targets.

- Increased risk of stop-loss being hit: Setting a broader profit target often requires placing a broader stop-loss order to accommodate the increased potential loss. A wider stop-loss means the trade has more room to move against you before closing. Consequently, there is an increased risk of the stop-loss being hit, leading to more losing trades.

- Need for higher accuracy: With a lower success rate, you must be more accurate in your trade selection to maintain profitability. In addition, a higher risk-reward ratio requires a higher success rate to offset the losses incurred from unsuccessful trades. This can put more pressure on your trading decisions and make it more challenging to achieve positive results consistently.

- Emotional impact: Experiencing a lower success rate can be emotionally challenging for traders. The psychological impact of having more losing trades can lead to self-doubt, frustration, and potentially even making impulsive or irrational trading decisions. Therefore, maintaining discipline and a rational mindset to manage the emotional aspects of trading is crucial.

- Longer time horizon: Achieving a high risk-reward ratio may require longer holding positions to allow the market enough time to reach the desired profit target. This means that your trading style may shift towards longer-term trading, which requires patience and the ability to withstand potential market fluctuations. It also means that your trading frequency may decrease, resulting in fewer overall trades.

So, even if you use strategies with excellent high risk-reward ratios (1:3, 1:4, 1:10), you will have a bad winning ratio, and in the end, you will still hardly accomplish big profits such as a 1 Percent Day Trading Return. This is because a 1% monthly profit is more realistic than 1% per day.

Day trading is not more profitable than Swing or position trading.

- Time commitment and stress: Day trading requires constant monitoring of the markets throughout the trading day. Traders must actively execute trades, analyze charts, and manage positions. This level of involvement can be mentally and emotionally demanding, leading to increased stress. On the other hand, swing and position trading typically involves holding trades for extended periods, allowing for more flexibility and reducing the need for constant monitoring. This can lead to a more relaxed trading experience and potentially better decision-making.

- Transaction costs: Day trading involves frequent buying and selling of securities within short time frames. This can lead to higher transaction costs due to commissions, spreads, and other fees. These costs can eat into potential profits, making it more challenging to generate consistent returns. On the other hand, swing and position trading typically involves fewer trades, resulting in lower transaction costs and potentially more favorable risk-reward ratios.

- Market noise and volatility: Day trading relies on short-term price movements and intraday trends. However, the shorter the time frame, the more susceptible trading becomes to market noise and volatility. This can lead to false signals, whipsaws, and unpredictable price movements, making it harder to profit consistently from day trading. Swing and position trading, which focuses on longer-term price trends and market dynamics, may provide a more stable and reliable trading environment.

- Emotional biases and impulsiveness: Day trading requires quick decision-making under pressure, which can lead to emotional biases and impulsive trading behavior. Traders may be tempted to chase after quick profits or make hasty decisions based on short-term market fluctuations. With their extended time frames, Swing and position trading allow traders to take a more strategic and calculated approach, reducing the impact of emotional biases and impulsive actions.

- Skill and experience requirements: Successful day trading requires high skill, experience, and discipline. Traders must deeply understand technical analysis, risk management, and market dynamics. They must also be able to adapt quickly to changing market conditions. Swing and position trading, while still requiring knowledge and expertise, may be more forgiving for traders who are still developing their skills or have limited time to dedicate to trading.

The transaction costs of day trading are so high that beginner traders do not see them often.

For example, when you make one trade to achieve 20 pips profit, your transaction cost of 1 pip is already a 5% loss for your trading strategy. So, if you have a high 55% winning strategy when you risk $1 to achieve $1, you will be on zero profit because of 5% transaction costs.

For example, if you risk one pip and try to get ten pips, your winning rate will be around 9%:

1 Percent Portfolio Trading Risk Rule

The 1% trading risk rule represents a simple risk management strategy in which traders try to have less than 1% risk in their portfolio at any time. In that case, the maximum drawdown will always be less than 15% on average, and traders can avoid fast and colossal capital loss.

This strategy is a common strategy for a lot of traders. Usually, traders can control the maximum portfolio drawdown at less than 15% in the worst case. (Learn maximum drawdown and absolute drawdown)

The image above shows that if traders keep their portfolio loss at less than 10%, they can quickly recover any losses. So, keep the portfolio drawdown to less than 10%; you must risk less than 0.5%-1% at any time.

The 1% risk rule is considered excellent trading advice because it helps manage risk and preserve capital. By limiting each trade’s risk to 1% of the trading account balance, traders minimize the impact of personal losses and protect against significant drawdowns. In addition, this disciplined approach promotes long-term sustainability, allowing traders to withstand market fluctuations and make informed decisions based on risk management principles.

For me, a one percent-a-day trading return is unrealistic!