Table of Contents

A trader’s journey is rarely a straight ascent; instead, it is characterized by a series of peaks and troughs, victories and setbacks. No trader, irrespective of their skill or experience, can boast of a portfolio that only sees uninterrupted growth. The market’s inherent volatility ensures that portfolios oscillate, experiencing periods of gain and decline. This inevitable decline from a peak, experienced by all traders at various points in their careers, is what the trading world calls a “drawdown.”

Understanding drawdown and its implications can significantly enhance a trader’s risk management practices and long-term sustainability in the market.

What is Drawdown?

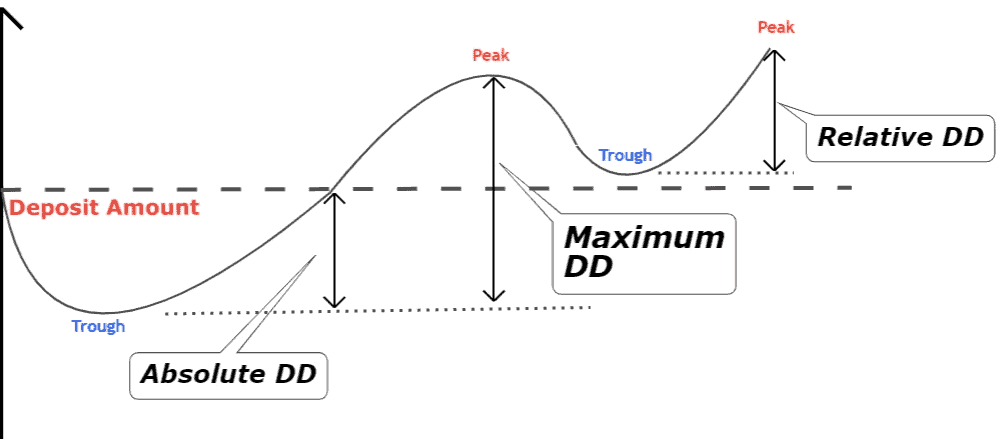

Drawdown refers to the decline in the equity of a trading account. Maximum drawdown refers to the most significant percentage drop from a peak to a trough in an account’s value. Relative drawdown is the most significant decline in percentage terms from the account’s Peak, while absolute drawdown represents the most significant decline from the initial deposit amount.

Please see my video about drawdown:

Imagine a forex trader starting with an account balance of $10,000. Over a period, the balance increases to $15,000 due to profitable trades. However, subsequent trades lead to losses, and the account balance drops to $12,500.

Calculation of Drawdown:

- Peak balance: $15,000

- Trough (lowest point after the Peak): $12,500

- Drawdown = (Peak – Trough) / Peak

- Drawdown = ($15,000 – $12,500) / $15,000

- Drawdown = $2,500 / $15,000 = 0.1667 or 16.67%

In this example, the trader experienced a drawdown of 16.67% from the peak balance of $15,000. This means the account value declined by 16.67% from its highest point before recovering or any new peak is established.

Let us see the difference between various drawdown types.

Drawdown types

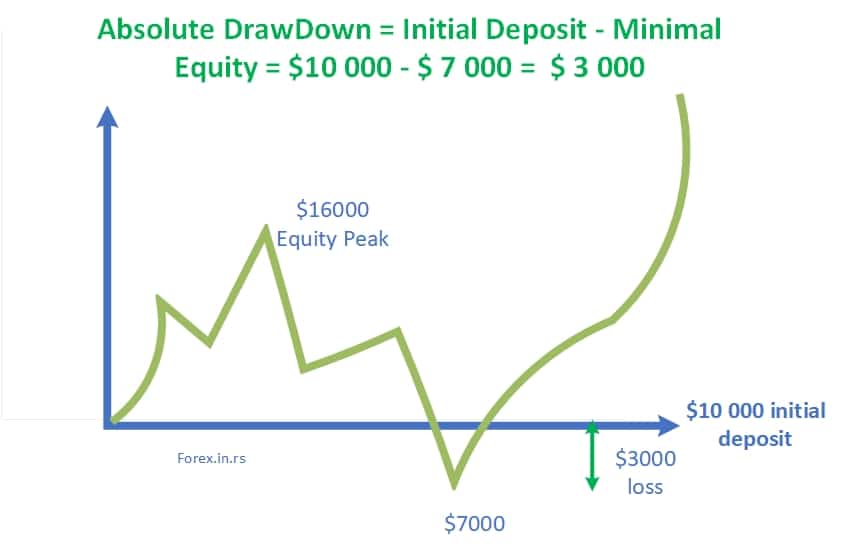

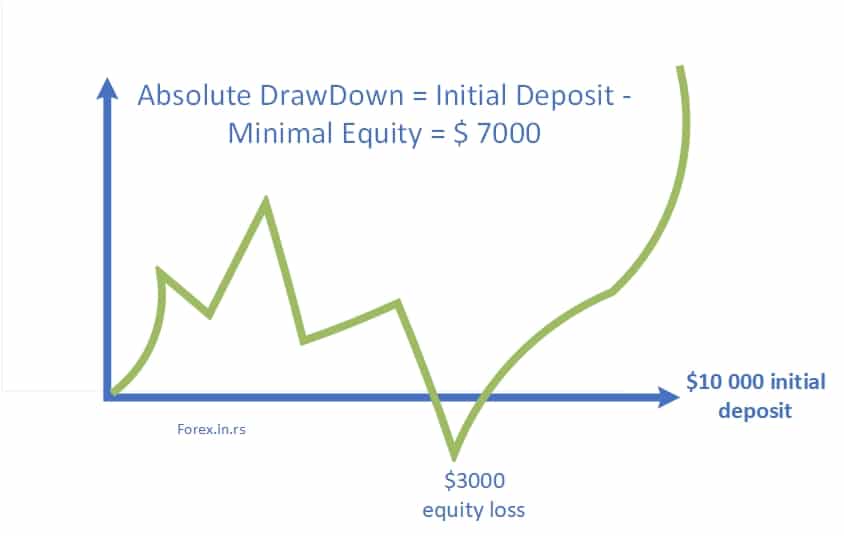

Drawdown can be an absolute drawdown, maximum drawdown, and relative drawdown. In our article, absolute drawdown refers to the sum difference between the initial capital risked and a minimal point below that level.

The relative drawdown is the percentage of the maximal drawdown that shows the ratio between the maximal drawdown and the respective local upper extremum (of equity).

Relative Drawdown = MaxDrawDown % = Max Drawdown / its MaxPeak * 100%

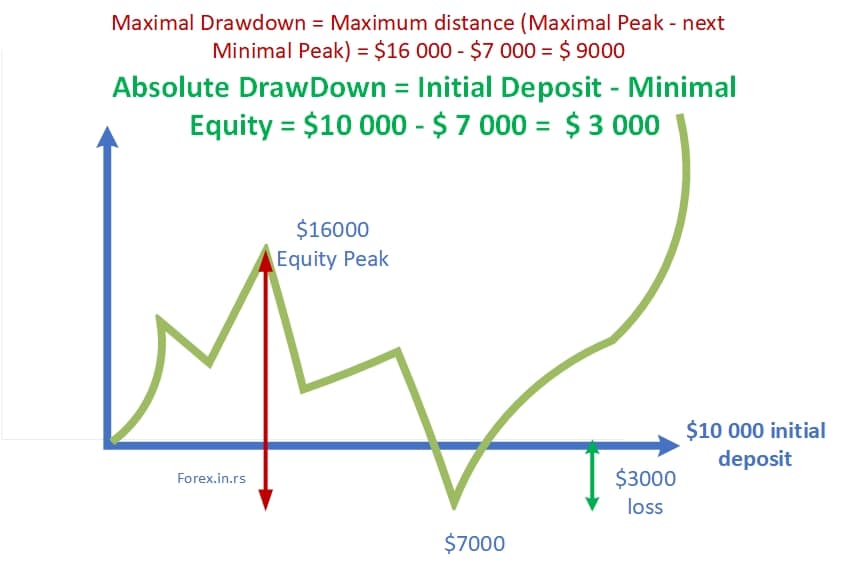

Maximal Drawdown = Maximum distance (Maximal Peak – next Minimal Peak)

The difference between maximum and absolute drawdown

Given:

- You started with $10,000 in your trading account.

- At its best, the account grew to $16,000.

- Later, due to some losses, the account’s lowest value reached was $7,000.

1. Maximum Drawdown (MDD): To calculate the maximum drawdown:

- You would first look at the difference between the highest point, $16,000, and the lowest point reached after that, $7,000. The difference between these two values is $9,000.

- Next, to turn that into a percentage relative to the highest value, you’d see that $9,000 of the $16,000 peak was lost. This translates to 56.25% of the peak value. This 56.25% is the Maximum Drawdown.

2. Relative Drawdown: For the relative drawdown:

- First, consider the difference between where you started, $10,000, and the lowest point the account reached, $7,000. This difference is $3,000.

- Considering the original amount, you lost $3,000 out of the initial $10,000. This means you lost 30% of your starting balance. This 30% is the Relative Drawdown.

In Summary:

- Maximum Drawdown tells us that the account lost 56.25% of its value from its highest point.

- Relative Drawdown tells us that the account lost 30% of its value from the starting amount.

Drawdown in forex is crucial as it provides insights into the risk level of a trading strategy, enabling traders to assess volatility and compare the safety of various systems. Additionally, while returns are often the primary focus, considering drawdown offers a comprehensive perspective on a strategy’s overall performance, balancing rewards and potential risks.

- Risk Assessment: Drawdown helps gauge the risk associated with a particular trading strategy. A high MDD might indicate that the trading approach is too volatile or risky.

- Comparison: Drawdown allows for the comparison of various trading systems and strategies. A system with a lower drawdown may be preferable over one with higher returns but a significantly higher drawdown.

- Performance Metric: While many traders focus primarily on returns, understanding drawdowns gives a more holistic view of performance, combining profit potential and risk.

What drawdown teaches you?

A drawdown also helps you know how long your trading system can survive in the forex market. Your position may not be defendable if your drawdown is significant.

For instance, an investor has to work hard to recover his capital loss if his drawdown is 50%. To secure his equity position from breaking, he must get a 100% profit on the remaining capital.

When a forex trader has a drawdown, the best options are to readjust his system and implement reasonable risk-management procedures instead of trading aggressively to recover his breakeven point. Usually, the result of the trader’s aggressive approach to recovering the breakeven point for his capital can be adverse. The reason behind it can be his emotional decisions, over-trading, and using leverage even to back his account of trade.

Drawdown and Risk Management

Understanding drawdown is paramount for effective risk management. A few critical implications include:

- Stop-Loss: Implementing stop-loss orders can help limit potential drawdowns by setting a predetermined exit point if the market moves against a position.

- Leverage: Using excessive leverage can amplify losses, leading to significant drawdowns. Using leverage judiciously and in line with one’s risk tolerance is crucial.

- Diversification: Just as diversification can reduce risks in traditional investment portfolios, diversifying trades across different currency pairs and strategies can help mitigate drawdown in forex.

Recovery from Drawdown

Recovering from a significant drawdown requires earning profits and often earning much more than the percentage lost. For instance, if a trader suffers a 50% drawdown from their peak capital, they would need to make a 100% return on the remaining capital to return to the original Peak.

Recovering from a drawdown requires a disciplined and strategic approach, especially if the aim is to mitigate risk. First, traders often re-evaluate and modify their trading strategies to align better with current market conditions.

Second, they reduce their position sizes, ensuring potential losses are more manageable and won’t significantly deepen the drawdown.

Third, they diversify their trades, spreading risk across different assets or currency pairs to avoid exposure to a single market movement. Fourth, traders implement stricter stop-loss orders, ensuring they exit unprofitable trades early and preserving capital.

Finally, patience is vital: rather than aggressively chasing profits, successful recovery often involves waiting for high-probability trade setups, ensuring each trade aligns with its refined strategy.

Psychological Impacts and Drawdowns

Beyond the numerical aspects, drawdowns can be challenging mentally and emotionally for traders. Extended periods of drawdown or sudden sharp drawdowns can lead to:

- Loss of Confidence: Doubt regarding one’s trading abilities or strategy.

- Overtrading: Trying to ‘make up’ for losses by taking on more prominent positions or trading more frequently.

- Deviation from Strategy: Changing or abandoning a strategy out of fear or impatience can often exacerbate losses.

Conclusion

Drawdown is a critical metric in forex trading that highlights a trading strategy’s potential risks and vulnerabilities. While pursuing high returns is a primary goal for most traders, understanding and managing drawdown is critical to long-term success and psychological well-being in the often turbulent world of forex trading.

Before entering a trade, ingfixing a point to stop loss for that trade can be the most vital tip. It will help in reducing the loss due to drawdown. Instead of making emotion-based trading decisions, you should minimize losses by using strategies to manage risk before making any exciting trades.

The majority of trades have some drawdown, even profitable trades.