A common occurrence in trading is a drawdown that can blow a trader’s account balance. To minimize the effects of a drawdown, traders should set stop losses at important price levels and have a solid money management plan.

But let us start from main definition:

What is the drawdown in trading?

In trading, drawdown represents a percentage of how much your trading account balance is down from the peak before it recovers back to the peak. However, traders recognize three types of drawdown: Maximum, Absolute, and Relative.

We wrote more about absolute drawdown in our previous article.

What is the maximum drawdown?

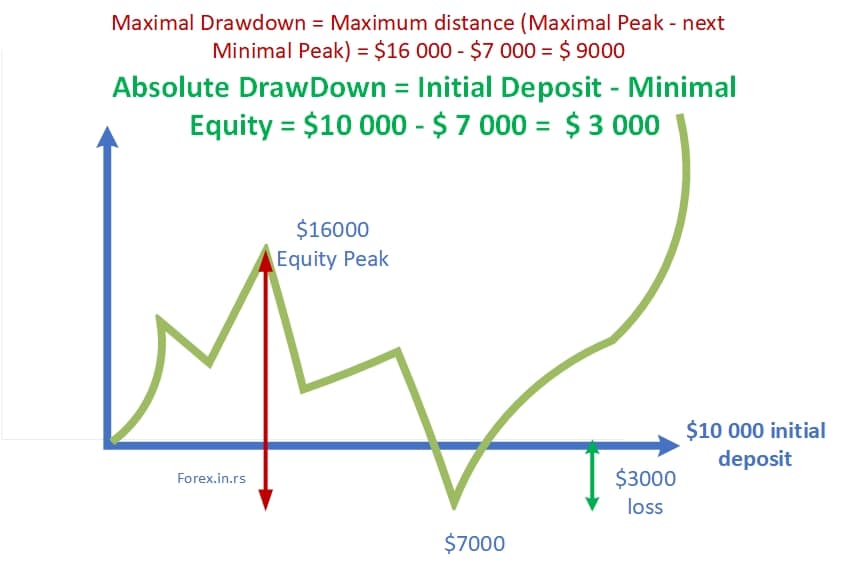

The maximum drawdown represents the price difference between the maximum portfolio value (peak) and the most significant decline (minimal portfolio price level) during some trading periods. For example, if the deposit amount for your trading account balance is $10000, the maximum portfolio value, for example, was $16000, and the minimum was $7000, then the maximum drawdown is $16000-$7000=$9000.

Maximum drawdown formula is:

Maximal drawdown = Maximum distance (Maximal Peak – next Minimal Peak)

Please see the maximum drawdown example on the chart:

So explaining maximum drawdown is very easy.

Practically, you have a trading account with a balance of $10000. In one moment, you make maximum profit and reach, for example, $16000. Now, if you, in one moment, have a minimum balance of $7000, we can say that the maximum drawdown is the difference between your portfolio maximum ($16000) and portfolio minimum ($7000).

Please watch my video about maximum drawdown:

Conclusion

A drawdown is a normal moment in trading because each trader has ups and downs. However, drawdowns need to be as low as possible because big fluctuations can lead to losing money in trading. For example, I am trying to keep my maximum drawdown below 10 percent. When I manage money for big corporations, I need to maintain a drawdown of less than 5%.