Table of Contents

One of the key advantages of trading in the forex market is that it never sleeps; there is always someone somewhere actively trading. This makes it possible for investors to react more quickly to news and events impacting currency prices than would otherwise be possible. The ability to trade around the clock also offers increased liquidity and lower transaction costs than other markets.

In recent articles, we covered European stock market open and close times, US market open and close, and Asian market open and close. Additionally, we presented S&P 500 trading hours, best forex sessions, when the forex market opens, and where the forex market closes on Friday. Finally, we explained when the stock market is open on Saturdays and when it is open on Sundays.

Another factor that affects when the forex market closes on Friday is daylight saving time (DST). During DST periods in many parts of Europe and North America, trading hours will be shifted forward one hour so that traders have an extra hour of daylight each day throughout the summer. This means that rather than closing at 5 pm New York time as usual on Fridays during DST periods, those same markets will close at 6 pm New York time instead during those months.

It is tough to tell when the forex market closes on Friday because each broker has its own time of closure. For example, UK forex brokers, US forex brokers, or Australian brokers are in different time zones.

So we did one research and concluded that the majority of forex brokers close on Friday at 22 GMT (5 pm EST):

When does the forex market usually close?

The forex market closes on Friday at 5 pm EST (22 GMT) and opens on Sunday at 5 pm EST (22 GMT) during Winter Time for majority brokers. The forex market closes on Friday at 4 pm EST (21 GMT) and opens on Sunday at 4 pm EST (21 GMT) during Summer Time (daylight saving time). Forex trading exists over the weekend through central banks and other organizations but is closed to retail traders. As a result, a weekend price gap occurs because there is often a difference in price between Friday’s close and Sunday’s opening.

I usually say because each broker is part of a different time zone, it is tough to determine Friday’s close time.

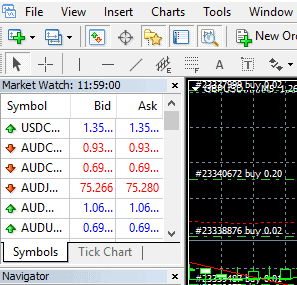

The trader needs to know the trading server (for example, MetaTrader platform ) time. For instance, for Metatrader, in the up corner, we can see the time :

Read more. When does the forex market open in our article?

We must know our country’s time; the market will close at 22 hours GMT. The best thing is to think and work based on the trader’s country’s time. In that case, you will always know.

The Forex market trades currencies that are currently in high demand. Therefore, the market opens at 5 pm Sunday (EST) and closes at 4 pm Friday (EST). In addition, as currency trading has an extensive international scope, there is a constant demand for a specific currency to meet trader requirements worldwide.

Is Forex 24 7?

No, the forex market is not open 24 hours, seven days per week. For most brokers, the Forex market is open five days a week from 5 pm EST on Sunday until 4 pm EST on Friday. Traders trade in different international time zones.

What time does forex close on Friday, and what time does the market open

When does the forex market open?

The Forex market usually opens at 5 pm EST on Sunday (10 pm GMT) in the wintertime. The exact time to start trading depends on the broker and the international time zone to which the broker belongs. The forex market is open 24 hours a day, during working days, in different parts of the world, from 5 pm EST (10 pm GMT) on Sunday until 4 pm EST (9 pm GMT) on Friday.

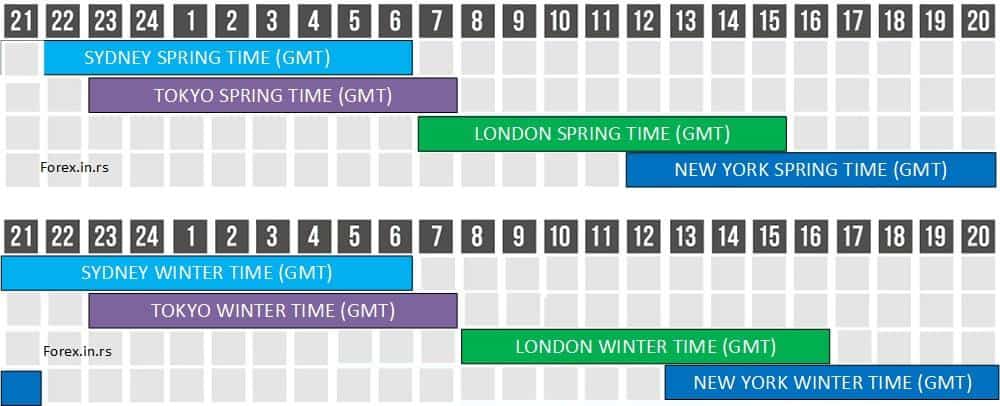

Major trading sessions Open and Close Times for stock markets:

- Sydney Open 10 pm GMT (summer) / 9 pm GMT (winter)

- Sydney Close 7 am GMT (summer) / 6 am GMT (winter)

- Tokyo Open 11 pm GMT (summer) / 11 pm GMT (winter)

- Tokyo Close 8 am GMT (summer) / 8 am GMT (winter)

- London Open 7 am GMT (summer) / 8 am GMT (winter)

- London Close 4 pm GMT (summer) / 5 pm GMT (winter)

- NY Open noon GMT (summer) / 1 pm GMT (winter)

- NY Close 9 pm GMT (summer) / 10 pm GMT (winter)

Forex sessions EST and GMT are presented below:

| Time Zone forex.in.rs | EST Spring | EST Winter | GMT Spring | GMT Winter |

|---|---|---|---|---|

| Sydney Open | 6 PM | 5 PM | 10 PM | 09 PM |

| Sydney close | 2 AM | 1 AM | 06 AM | 07 AM |

| Tokyo Open | 7 PM | 7 PM | 11 PM | 11 PM |

| Tokyo close | 3 AM | 3 AM | 7 AM | 7 AM |

| London Open | 3 AM | 4 AM | 7 AM | 8 AM |

| London close | 11 AM | 12 AM | 3 PM | 4 PM |

| New York Open | 8 AM | 9 AM | 12 PM | 13 PM |

| New York Close | 4 PM | 5 PM | 8 PM | 9 PM |

Below are presented forex sessions in GMT:

Forex trading sessions GMT (spring and winter time)

Now, below are presented forex sessions in EST:

Forex trading sessions EST (spring and winter time)

Forex trading sessions are a vital part of the currency market, and understanding them is essential for any would-be trader. Knowing when different trading sessions begin, who participates in them, and what strategies are most successful can all help maximize returns on your forex investments.

The forex market is open 24 hours a day, five days a week, meaning it is somewhat continuous compared to other markets that have set opening and closing times. This allows traders to make money from anywhere at any time. But despite this global availability, the market has distinct trading sessions – though these overlap at times. Generally speaking, the four primary trading sessions are Sydney (Australia), Tokyo (Japan), London (United Kingdom), and New York (United States).

The Sydney session runs from 5:00 pm to 2:00 am Eastern Standard Time (EST), beginning each day in the early evening of the previous day EST. It is not as heavily traded as other sessions – with less liquidity – but it can still be necessary for those looking to capitalize on Asian news and events. The Tokyo session runs from 7:00 pm to 4:00 am EST and sees more volume than Sydney, making up nearly 30% of all forex trades globally. The London session goes from 3:00 am until 12 noon EST, making it the most actively traded period of the day as much of Europe’s heavy industry takes place during these hours. Finally, the New York session runs from 8:00 am until 5:00 pm EST and accounts for around 20% of all global trades due to the large number of US-based traders active during this window.

Different investors use different strategies depending on which session they’re operating in; some focus on long-term trends, while others look for short-term opportunities or “scalping” opportunities, where they try to make quick trades based on slight fluctuations in price action across various currency pairs. Understanding which approach works best for each session will significantly increase forex profitability.

For example, scalping strategies often perform better in more volatile conditions, such as during Tokyo’s busiest hours leading up to 11 pm EST or during London’s morning rush before 8 am EST. In contrast, more conservative long-term trends tend to do better during calmer periods, such as after 10 pm EST when both Tokyo and London are winding down their respective activities or between noon and -3PM EST when both cities have closed shop. Still, New York has yet to kick into gear – allowing investors time to observe overall market movements more clearly without getting bogged down by intra-session fluctuations seen during peak activity hours within a single region or country.

It should also be noted that there may be other regional holidays that affect liquidity levels significantly – especially with regards to pairs involving currencies from countries in those regions – due to banks being closed for business, resulting in reduced participation rates within specific currency pairs at certain points within these trading sessions which could potentially lead to wider spreads or slippage caused by lack of order flow participating at those particular moments inside those windows making it hard for traders trying to capitalize on intra-session opportunities.

I am trading during London time. What time does the London forex market open? London forex market opens at 7 am GMT.

Best Time for Forex Trading

Please think of the Forex market as a working clock system with hours. When do you trade? The volatility and liquidity vary between sessions, starting as the market opens in Sydney and then Tokyo. As London markets open, Sydney is closed, but significant hedge funds and banks are active. The peak occurs after New York markets open.

For example, the best time to trade USD pairs is when Euro and USA sessions overlap. JPY is the best to trade during Asia and USA sessions because of the volatility and economic news.

Please read our article Best time to trade USDJPY for more details.

Traders need to know when liquidity and volatility are good. Generally, London or New York is open, preferably overlapping. This offers the most balanced combination of volatility and liquidity. Meanwhile, the worst periods to trade are after the New York session closes and the Sydney session opens.

Overall, understanding how different forex trading sessions work is an essential tool needed by any ambitious investor looking for success in this lucrative but complex investment arena. With knowledge comes power, so gaining a solid grasp of these concepts can quickly put you well ahead of your peers when navigating today’s fast-paced international currency markets.