Table of Contents

Investors hold Tesla stock in high esteem for many reasons. These include the company’s innovative technology, commitment to sustainability, and position as an electric vehicle market leader. In addition, Tesla has gained a reputation for pushing the boundaries of what is possible with electric vehicles, resulting in many investors flocking to buy its stock.

Tesla’s history has been shaped by several key moments, including its initial public offering (IPO) in 2010, which raised $226 million. Since then, the company has grown from strength to strength, with its stock price experiencing a meteoric rise. This has been due to several factors, including the company’s strong financial performance, impressive Model S and Model X vehicles, and growing global presence.

One of the primary reasons investors like Tesla stock is its potential for future growth. The company constantly expands into new markets, develops new technologies, and invests in research and development. This has resulted in a growing demand for its products, which has led to an increase in its stock price.

Tesla has also become a symbol of sustainability, focusing on reducing emissions and developing more environmentally-friendly technology. This has resonated with many investors, who view the company as a force for positive change in the world.

In conclusion, Tesla’s history is one of strong growth and innovation, resulting in many investors being drawn to its stock. In addition, the company’s commitment to sustainability, its position as a leader in the electric vehicle market, and its potential for future growth have all contributed to its success. Despite some setbacks and controversies in recent years, Tesla’s stock remains a popular choice for investors looking to capitalize on the company’s long-term success.

Tesla Stock Price Today Chart

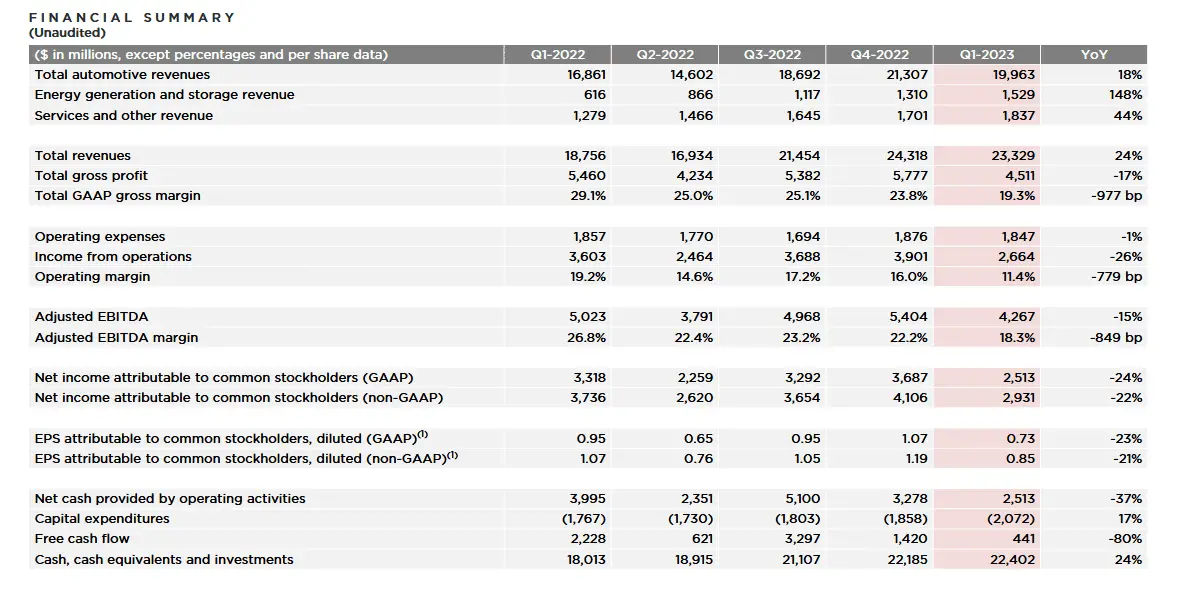

Tesla Stock Financial Summary 2023

Tesla (TSLA), the global leader in Electric Vehicles (EVs), recently announced a significant decline in their first-quarter earnings, causing quite a stir in the financial world. The company’s Q1 earnings report disclosed a noticeable decrease in profits, with a profit margin falling below 20%, indicating its challenges amid an aggressive price-cutting strategy. This has created a common bearish sentiment among investors, resulting from a lack of confidence in Tesla’s profitability outlook. Moreover, the company’s revenue also missed estimates for the first quarter, adding to the concerns related to this development.

As the news circulated, Tesla’s stock price also took a blow on Thursday; analysts revised their stock price targets downwards, contributing to the selling pressure. This selloff, in turn, coincided with the broader stock market’s downward performance, which may have contributed to the overall loss of investor confidence in the stock.

This substantial decline in earnings is likely due to the price slashing Tesla is using as part of its strategy to increase its market share further. Moreover, with growing competition in the EV space, the global giant could find it more challenging to maintain its position as the leader and maintain its margins.

Despite this, Tesla remains a central figure in the electric vehicle market. It retains a leading EV position, with a 30% global market share. Still, the company must strike a difficult balance between capturing a larger market share and maintaining profitability. This will be difficult for them as their competitors further ramp up their production, making the market more crowded and competitive.

Tesla Stock Price Prediction 2050.

Tesla’s stock price prediction can show a moderate price strength to $2900 in 2050. An average price rise will impact the percentage growth of electric cars in 2050 and the highly competitive automotive industry, where stock-rising trends are usually moderate.

Tesla is one of the leading electric car manufacturers globally, with a market cap of over $600 billion. With continued advancements in battery technology and sustainable energy, the demand for electric cars is set to skyrocket in the coming decades. This increased demand will likely lead to a rise in the stock price of electric car companies such as Tesla.

The projected Tesla stock price of $2900 in 2050 represents a significant increase from its current price level. However, this price increase is not unrealistic when considering the strong growth potential of the electric car industry. Furthermore, the highly competitive nature of the automotive industry means that stock-rising trends are often modest. Therefore, the projected moderate price strength of Tesla’s stock price increase is reasonable.

There could be several reasons why the automotive industry stocks may only rise moderately, and Tesla’s cache may not necessarily be high in 2050. Here are a few possible explanations:

- Market Saturation: The automotive industry may become saturated as more companies enter the market, resulting in increased competition and lower profit margins. This could lead to slower growth in the industry and, consequently, moderate stock price increases for automotive companies.

- Government Regulations: Governments may introduce stricter regulations on the automotive industry to reduce carbon emissions and promote sustainable transportation. Compliance with these regulations could increase automakers’ costs, which could impact their profitability and stock prices.

- Electric Vehicle Adoption: While electric vehicles (EVs) are expected to become more prevalent, their adoption may not necessarily translate to high stock prices for EV manufacturers like Tesla. As more automakers enter the EV market and competition increases, it may become more challenging for Tesla to maintain its market dominance and high valuation.

- Economic Conditions: The automotive industry, like any other industry, is impacted by economic conditions such as inflation, interest rates, and overall economic growth. If the global economy experiences a downturn in the future, it could result in lower stock prices for automotive companies.

- Technological Advancements: While Tesla is currently at the forefront of EV technology, other automakers may catch up and develop their advanced technologies. This could reduce Tesla’s competitive advantage and lead to lower stock prices.

Will Tesla continue to be the leader in EV automotive industry in 2050?

It’s difficult to predict with certainty whether Tesla will stay the leader in the electric car industry in 2050. While Tesla has been at the forefront of EV technology and has achieved significant market share in the industry, several factors could impact its future position in the market.

Firstly, other automakers invest heavily in EV technology and develop their electric cars. This could increase industry competition, making it harder for Tesla to maintain its market dominance.

Secondly, technological advancements could lead to breakthroughs in EV technology that could disrupt the market. For example, advances in battery technology could lead to longer ranges and faster charging times, making electric cars more attractive to consumers.

Thirdly, government regulations could impact the EV market, particularly regarding emissions standards and incentives for electric car adoption. Changes in these regulations could impact the competitive landscape and market demand for electric cars.

Lastly, consumer preferences and trends could change over time, impacting the demand for electric cars and the companies that produce them. For example, it’s possible that new players could emerge in the market or that consumer preferences could shift towards different types of vehicles.

Tesla Stock Price Prediction 2050. Features

- Tesla Corporate Earnings: This feature refers to the profits or earnings generated by Tesla. Higher wages can lead to a rise in stock prices, while lower yields can cause the stock price to fall. Including this feature in an ML model can help capture the impact of payments on Tesla’s stock price.

- Tesla P/S Ratio and Company Revenue: This feature includes Tesla’s revenue, the amount of money the company earns from sales, and the P/S (price-to-sales) ratio. The P/S ratio compares the company’s stock price to its sales per share. If Tesla’s revenue grows, the stock price may rise, while declining revenue can cause the stock price to fall. Including these features in an ML model can help capture the impact of revenue growth and the P/S ratio on the stock price.

- Tesla Company Debt: This feature includes Tesla’s debt level, which can impact its stock price. If the debt levels are high, investors may hesitate to invest in the company, leading to a decline in its stock price. Including this feature in an ML model can help capture the impact of debt levels on the stock price.

- Economic Indicators: This feature includes economic indicators such as GDP growth, inflation, and interest rates. These factors can impact Tesla’s stock price in the long run. A strong economy can lead to higher stock prices, while a weak economy can cause stock prices to fall. Including these features in an ML model can help capture the impact of economic indicators on the stock price.

- Tesla Daily Price Levels from 2010 to 2023: This feature includes Tesla’s daily price levels from 2010 to 2023, which provide valuable information about the company’s stock price trends. Including this feature in an ML model can help identify patterns in the stock price and make informed predictions.

- RSI Indicator Values: The Relative Strength Index (RSI) is a technical indicator that measures the strength of a stock’s price movement. RSI values range from 0 to 100; above 70 are considered overbought, while below 30 are considered oversold. Investors use RSI values to identify potential buying or selling opportunities in the stock market. Including this feature in an ML model can help capture the impact of the stock’s price movement on the stock price.

- Automotive Industry Trend and Competitive Landscape Ratings: These custom indicators can help capture the impact of the automotive industry trend and Tesla’s competitive position on the stock price. Including these features in an ML model can help identify the impact of these factors on Tesla’s stock price.

The Tesla 2040 price prediction ML model is aimed at forecasting Tesla’s future stock price based on various informative features. These features include corporate earnings, Tesla’s P/S ratio and company revenue, Tesla company debt, economic indicators such as GDP growth, inflation, and interest rates, Tesla’s historical daily price levels from 2010 to 2023, and RSI indicator values. The model also considers automotive industry trends and competitive landscape ratings to comprehensively and accurately predict Tesla’s future stock price.

Corporate earnings are a key factor that can significantly affect Tesla’s stock price. As such, the model leverages historical earnings data to assess their impact on the company’s stock performance. Similarly, the model considers Tesla’s P/S ratio and revenue growth as important indicators which can significantly influence its stock price. This information helps to accurately estimate Tesla’s future market value and inform price projections.

Another significant feature of the model is Tesla’s debt levels. The model considers the company’s outstanding debts and liabilities as they can have immediate and long-term effects on the stock price. In addition, economic indicators such as GDP growth, inflation, and interest rates can also impact Tesla’s stock price—the model factors in these indicators to provide a well-informed forecast of Tesla’s future stock performance.

Tesla’s daily price levels from 2010 to 2023 are strong indicators whose patterns reveal essential information about the company’s stock trends. Analyzing and interpreting this data helps the model identify consistent cycles and trends that can impact future stock prices. The RSI indicator values are another critical factor that the model considers, as they measure the stock’s momentum and can aid in predicting future price direction.

You can read our article to learn about the best momentum indicator.

Lastly, the model considers automotive industry trends and competitive landscape ratings to provide a complete and granular picture of Tesla’s potential market position. Understanding the overall trends and shape of the industry and assessing Tesla’s place relative to other companies is crucial for predicting its future performance.

In conclusion, the features used in the Tesla 2040 price prediction ML model are diverse, comprehensive, and interconnected, providing a highly accurate and informed projection of Tesla’s future stock price. By analyzing these variables, the model can offer insights to aid investors and analysts in making informed decisions to maximize investment potential.

Tesla Stock Price Prediction 2050. Methodology

To predict Tesla’s stock price in 2050 using an ensemble model that combines Support Vector Regression (SVR) and Random Forest, the following methodology can be used:

- Data Collection: Historical data on Tesla’s financial performance, daily price levels from 2010 to the present, economic indicators, and automotive industry trends and ratings will be collected.

- Data Preprocessing: The collected data will be preprocessed to remove any outliers, fill in missing values, and normalize the data to ensure all features are on the same scale.

- Feature Selection: The most relevant features that can impact Tesla’s stock price, such as corporate earnings, P/S ratio and company revenue, company debt, economic indicators, daily price levels, RSI indicator values, and automotive industry trends and ratings, will be selected.

- Data Partitioning: The historical data will be split into training and testing datasets. The training dataset will be used to train the SVR and Random Forest models, while the testing dataset will be used to evaluate the performance of the models.

- Ensemble Model Creation: The SVR and Random Forest models will be combined into an ensemble model to predict Tesla’s stock price in 2050. The two models will be trained on the same training dataset, and their predictions will be averaged to obtain the final predicted stock price.

- Model Evaluation: The performance of the ensemble model will be evaluated on the testing dataset using metrics such as mean squared error (MSE), root mean squared error (RMSE), and coefficient of determination (R-squared). The model will be refined until the performance metrics are satisfactory.

- Prediction: The ensemble model will predict Tesla’s stock price in 2050 based on the selected features.

- Analysis and Interpretation: The predicted stock price will be analyzed and interpreted based on the selected features to provide insights into the factors that may impact Tesla’s stock price in the future.

Conclusion

The industry’s growth potential, coupled with Tesla’s strong market position, makes its stock a compelling investment option. Additionally, the moderate price strength predicted for 2050 aligns with typical stock-rising trends in the automotive industry, ensuring a stable and sustainable growth trajectory.