Table of Contents

Tesla, Inc. is a high-tech automobile company that designs, develops, manufactures, and sells electric cars, energy storage solutions, and solar products. It is one of the most innovative and promising companies in the automotive industry and has been praised for its groundbreaking technology and sustainable business practices. Investors are particularly attracted to Tesla stock because of its strong growth potential and ability to disrupt traditional automakers.

Tesla’s stock has been on a rollercoaster since the company went public in 2010. In the early years, the stock struggled to gain momentum, as investors were skeptical of the company’s ability to deliver on its promises. However, after several years of consistent revenue growth and successful product launches, Tesla’s stock price began to take off.

You can read our article to learn about the best momentum indicator.

Since then, Tesla has become one of the market’s most valuable and sought-after stocks. The company’s innovative products, such as the Model S sedan, Model X SUV, and Model 3 compact car, have garnered a loyal following among consumers. This has led to impressive sales figures and a growing market share in the electric vehicle space.

Investors are also drawn to Tesla’s leadership in autonomous driving technology and renewable energy solutions. The company’s Autopilot system is considered one of the most advanced self-driving features in the market. Tesla’s battery storage products are helping to drive the transition toward a low-carbon economy.

Furthermore, Tesla has a strong financial track record, consistent revenue growth, and a solid balance sheet. In 2020, the company reported an impressive $31.5 billion in revenue, up from $24.6 billion in 2019. A combination of increasing demand for electric vehicles and a growing global market for renewable energy has fueled this growth.

Tesla Stock Price Today Chart

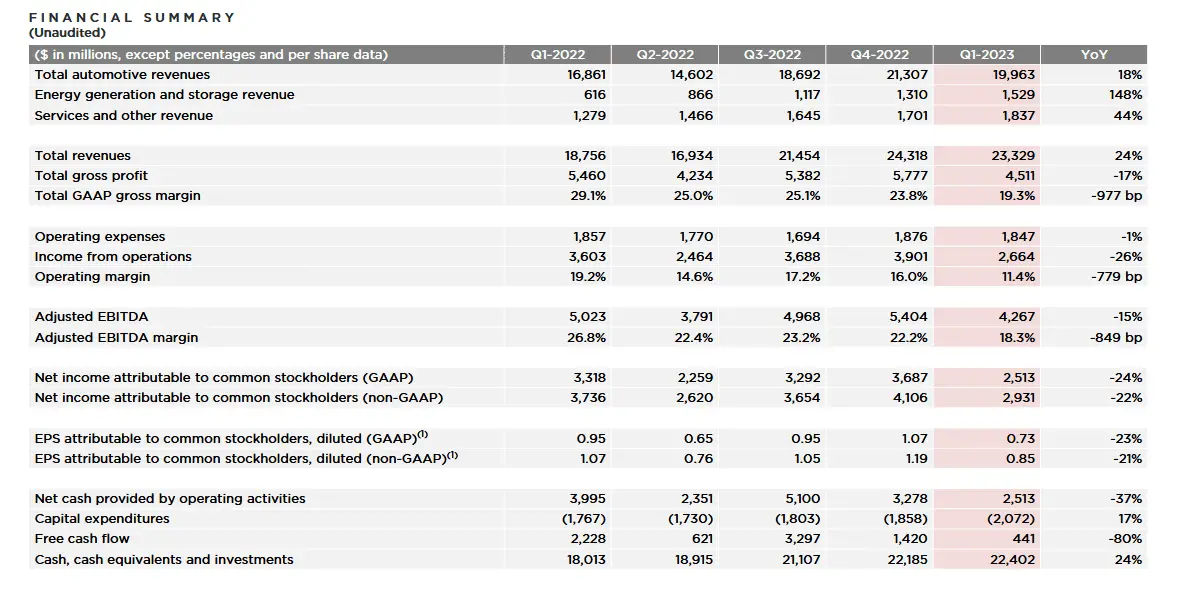

Tesla Stock Financial Summary 2023

In the latest earnings report from Tesla (TSLA), the electric vehicle manufacturer posted a significant decline in first-quarter profits. The numbers showed that the company’s aggressive price-slashing strategy had taken its toll on its earnings. Furthermore, the revenue generated fell below the expected views set by analysts.

The profit margins for the global EV giant were also disappointing, falling below 20%, reflecting the company’s strategy of cutting prices to remain competitive in an increasingly crowded market. The company’s CEO, Elon Musk, has been vocal about making Tesla’s electric cars more affordable, as their sales volumes have historically been limited to high-end consumers.

Following the weak earnings report, several analysts revised Tesla’s stock price targets, leading to the stock tumbling on the Thursday following the release. With the company’s profitability taking a hit, it remains to be seen how that will affect Tesla’s long-term financial stability. However, the company’s ongoing commitment to innovation and continued expansion into new markets should provide some reason for optimism among investors.

Tesla Stock Price Prediction 2030

Based on the Tesla stock ML price model, Tesla’s stock price prediction can show an extreme price strength to $860 in 2030. A significant price rise will impact the percentage growth of electric cars in 2030 because of planned non-carbon regulations.

Tesla’s stock price prediction for 2030 is an essential indicator of the company’s potential growth trajectory. The predicted price strength of $860 is supported by various factors, including Tesla’s impressive track record of disrupting the automotive industry, its strong brand recognition and innovation in the electric vehicle (EV) space, and increasing global demand for sustainable transportation solutions.

Furthermore, regulations aimed at reducing carbon emissions are expected to be implemented in many countries worldwide, accelerating EV adoption until 2030. This is particularly significant for Tesla, as it is currently the leading EV player and well-positioned to capitalize on the expanding demand for clean energy cars. As a result, the projected price growth is a sign of confidence in Tesla’s long-term prospects and its ability to innovate and adapt to the changing market landscape.

However, it is essential to note that stock price predictions are inherently uncertain and subject to various external factors such as economic conditions, global political developments, and industry-specific trends. Therefore, while the predicted price strength for Tesla’s stock in 2030 is promising, there is no guarantee that it will be realized. Nonetheless, the projected growth indicates the importance of sustainable transportation and the potential for companies like Tesla to drive this shift toward a more eco-friendly future.

Tesla is overvalued right now in 2023 because of the following:

There are several reasons why Tesla’s stock may be overvalued in 2023:

- High P/S Ratio: Tesla’s P/S ratio is significantly higher than that of its competitors in the automotive industry. This suggests that investors are paying a premium for Tesla’s sales relative to its peers, despite generating significantly less revenue than its competitors. This overvaluation in the P/S ratio suggests that the market is emphasizing Tesla’s potential growth prospects more than its current financial performance.

- High Market Capitalization: Despite selling only 2.02% of all vehicles in the US, Tesla’s market capitalization is significantly higher than its competitors, suggesting that investors are placing a premium on Tesla’s potential for growth rather than its current financial performance. This level of dominance in the automotive industry is non-existent, and the overvaluation in Tesla’s market capitalization reflects unrealistic expectations for future growth potential.

- High P/E Ratio: Tesla’s P/E ratio is significantly higher than its automotive industry peers. This suggests that investors are paying a premium for Tesla’s earnings relative to its peers, even though its P/E ratio is much higher than the average P/E ratio of its competitors. This overvaluation in the P/E ratio suggests that the market is emphasizing Tesla’s potential for growth over its current financial performance.

- High P/S Ratio compared to other high-growth companies: Tesla’s P/S ratio is significantly higher than that of other high-growth companies like Amazon, suggesting that investors place a more significant premium on Tesla’s sales growth than its peers. This overvaluation in the P/S ratio relative to other high-growth companies indicates that the market may overestimate Tesla’s growth potential.

Tesla 2030 price prediction ML Model Features

- Tesla Corporate Earnings: The earnings or profits of Tesla can significantly impact its stock price. We can include this feature as a predictor in the ML model to capture the impact of payments on the stock price.

- Tesla P/S Ratio and Company Revenue: The revenue of Tesla and its P/S ratio are essential factors impacting its stock price. Including these features in the ML model can help to capture the impact of revenue growth and P/S ratio on the stock price.

- Tesla Company Debt: Tesla’s debt levels can impact its stock price, and including this feature in the ML model can help capture the impact of debt levels on the stock price.

- Economic Indicators: Economic indicators such as GDP growth, inflation, and interest rates can impact Tesla’s stock price in the long run. We can include these features in the ML model to capture the impact of economic indicators on the stock price.

- Tesla Daily Price Levels from 2010 to 2023: Tesla’s daily price levels from 2010 to 2023 provide valuable information about the company’s stock price trends. We can use this feature to identify patterns in the stock price and make informed predictions.

- RSI Indicator Values: Including the Relative Strength Index (RSI) values as a feature in the ML model can help to capture the impact of the stock’s price movement on the stock price.

- Automotive Industry Trend and Competitive Landscape Ratings: These custom indicators can help to capture the impact of the automotive industry trend and Tesla’s competitive position on the stock price.

Tesla Stock Price Prediction 2030. Methodology

To predict Tesla’s stock price in 2030 using an ensemble model that combines Support Vector Regression (SVR) and Random Forest, we can follow the following methodology:

- Data Collection: Collect historical data on Tesla’s stock price and the relevant features mentioned in the previous answer, such as Tesla corporate earnings, Tesla P/S ratio and company revenue, Tesla company debt, economic indicators, Tesla daily price levels from 2010 to 2023, RSI indicator values, automotive industry trend rating, and competitive automotive landscape rating.

- Data Preprocessing: Preprocess the collected data by handling missing values, removing outliers, scaling the features, and encoding any categorical variables.

- Feature Selection: We set our custom features (see below) on Tesla’s stock price using feature selection techniques like correlation analysis, feature importance, and domain expertise.

- Data Splitting: Split the preprocessed data into training and testing sets. The training set will be used to train the ensemble ML models, and the testing set will be used to evaluate the performance of the trained models.

- Ensemble Model Training: Train the SVR and Random Forest models using the preprocessed training data. These models are chosen because they can handle nonlinear relationships and capture complex interactions between the input features.

- Model Evaluation: Evaluate the performance of the trained ensemble models on the testing set using performance metrics like Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and R-squared (R2) score.

- Model Tuning: Tune the hyperparameters of the ensemble models using techniques like Grid Search and Random Search to optimize the performance of the models.

- Ensemble Model Prediction: Once the ensemble models are trained and optimized, combine their predictions using a weighted average or other ensemble techniques to obtain the final predicted stock price.

- Model Visualization: Visualize the predicted stock price using techniques like line plots, scatter plots, and bar charts, and compare them with the actual stock price to evaluate the model’s accuracy.

By using an ensemble model that combines SVR and Random Forest, we can leverage the strengths of both models and improve the accuracy and reliability of the stock price prediction. SVR can capture the nonlinear relationships and complex interactions between the input features, while Random Forest can handle high-dimensional data and identify the essential elements. As a result, the combination of these models can help to reduce the risk of overfitting and increase the robustness of the prediction.

Conclusion

The utilization of ML to forecast the Tesla stock price has yielded promising results, indicating that Tesla’s stock price can experience a substantial increase to reach $860 by 2030, which could have a profound impact on the electric vehicle market. Stricter environmental regulations are being implemented as the world strives to reduce carbon emissions and transition towards renewable energy sources.

Tesla, as a leading manufacturer of electric vehicles, is poised to benefit tremendously from this trend. Moreover, as technological advancements and innovations in electric vehicle batteries and charging infrastructure continue to increase, this could create further demand for Tesla’s products, leading to even more significant growth potential. Therefore, investing in Tesla’s stock could prove to be a sound financial decision for those looking to capitalize on the electric vehicle revolution and the exciting opportunities ahead.