Table of Contents

Tesla Inc. is a disruptive and innovative electric vehicle manufacturer that has always attracted investors with its unique business model and strong growth potential. In addition, the company has been at the forefront of the movement toward sustainable energy solutions, which has been a critical driver of its success and popularity among investors.

Investors are particularly fond of Tesla’s stock due to their confidence in its ability to continue producing highly innovative and quality electric vehicles that will lead the automobile industry into the future. Tesla’s impressive technological advancements in electric vehicle and battery technology have already proven to be a massive success. As a result, as the world transitions towards cleaner energy, investors believe that Tesla will continue to dominate the electric vehicle market.

Since Tesla went public in 2010, its stock has consistently been a standout performer on Wall Street, continually breaking records and outpacing other industry giants in the automotive sector. Furthermore, with its strong market position, brand recognition, and stable financials, Tesla has been able to weather the storm of market fluctuations, meaning that even during the most challenging economic times, Tesla has remained a solid investment choice.

In addition to its excellent stock market performance, Tesla has secured a dedicated customer base that continues to support the company even when other traditional automakers have flooded the market with electric vehicle models. With a loyal and enthusiastic fan base, Tesla can generate buzz and excitement around its products, further boosting its value and investor confidence.

Investors have consistently supported Tesla due to its impressive technological advancements, strong market position, and unwavering commitment to producing innovative and eco-friendly products that will shape and transform the future of the automobile industry. With these critical factors in place, it’s no wonder that Tesla’s stock is one of the most coveted investments today.

Tesla Stock Price Today Chart

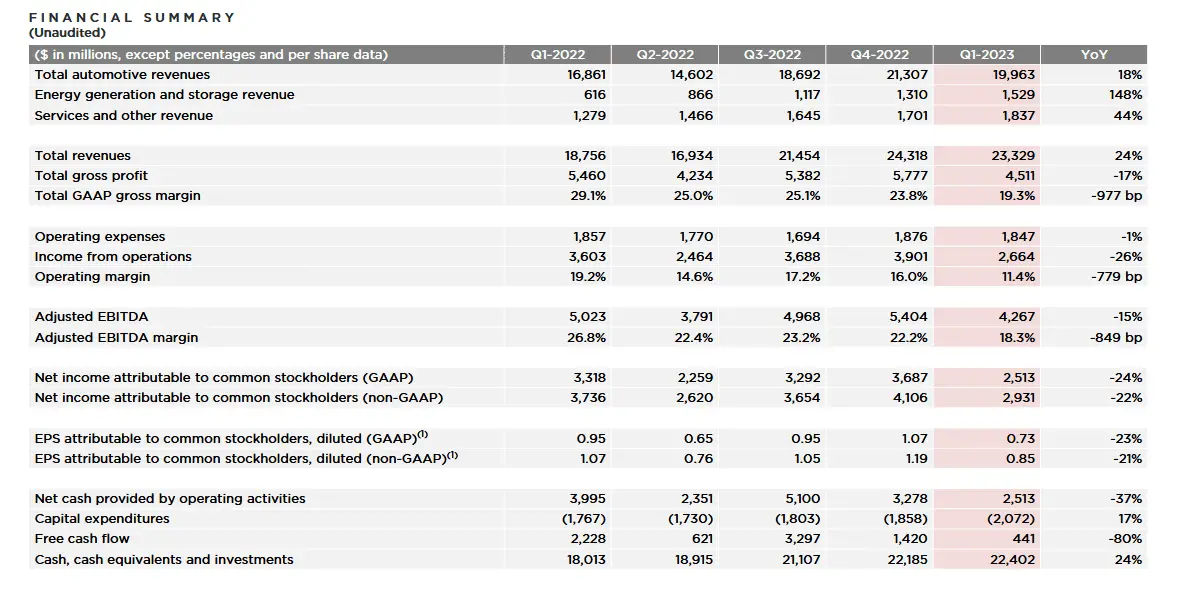

Tesla Stock Financial Summary 2023

According to recent reports, Tesla (TSLA) endured a significant decline in earnings during the first quarter of 2023. The company’s earnings were well below expectations, while revenue missed views, indicating a potential setback for the electric vehicle (EV) manufacturer. Additionally, Tesla’s profit margins have fallen below 20%, which is concerning for investors and analysts. This decline in earnings has been attributed to an aggressive price-slashing strategy that Tesla has been implementing, which has put pressure on the company’s profitability.

Furthermore, several lists have sharply revised r stock price targets for TSLA following the disappointing earnings report. As a result, the company’s share prices took a significant tumble on Thursday. This development will likely concern investors who have been putting a lot of faith in Tesla’s growth potential as the leading global EV manufacturer.

It is worth noting that this news comes when the EV market is becoming increasingly crowded and competitive. Traditional automotive manufacturers are entering the EV space in droves, and new players are emerging, which could impact Tesla’s market share and growth potential in the future. However, the company remains optimistic about its long-term prospects and is committed to accelerating the world’s transition to sustainable energy. As such, it will be interesting to see how Tesla responds to this setback and navigates the complex EV market landscape in the coming months and years.

In 2023, Tesla’s stock remained highly overvalued despite generating significantly less revenue than its competitors. Moreover, its P/S ratio was widely disproportionate to its automotive industry peers, indicating that the market continued to emphasize Tesla’s potential for future growth more than its current financial performance. As a result, investors were willing to pay a premium for Tesla’s sales relative to its peers despite the company’s comparatively low revenue.

Moreover, in terms of market capitalization, Tesla’s dominance in the automotive industry remained unparalleled despite only selling 2.02% of all vehicles in the US. Its market capitalization was significantly higher than its competitors, further underscoring investors’ obsession with Tesla’s potential for growth rather than its current financial performance.

Tesla’s P/E ratio was another indicator of the market’s overvaluation of the company’s stock. Tesla’s P/E ratio was significantly higher than its automotive industry peers, indicating that investors were willing to pay a premium for Tesla’s earnings despite higher P/E ratios than its competitors. This again shows how the market overemphasized Tesla’s potential for growth at the expense of its current financial performance.

Moreover, compared to other high-growth companies like Amazon, Tesla’s P/S ratio remained notably higher, indicating that investors valued Tesla’s sales growth more than its peers. This overvaluation in the P/S ratio relative to other high-growth companies is a cause of concern as it indicates that the market may have overestimated Tesla’s growth potential.

Despite the numerous indicators of Tesla’s overvalued stock, the market’s emphasis on Tesla’s growth potential remained unshaken in 2023, which only added to the inflated valuation of the company’s stock.

Tesla Stock Price Prediction 2040

Tesla’s stock price prediction can show a moderate price strength to $1750 in 2040. An average price rise will impact the percentage growth of electric cars in 2040 and the highly competitive automotive industry, where stock-rising trends are usually moderate.

The future of Tesla’s stock price remains a matter of intense speculation among investors, analysts, and industry experts. However, as per recent predictions, Tesla’s stock price might see a moderate price strength to $1750 in 2040. This can significantly impact the percentage growth of electric cars in 2040, as well as the highly competitive automotive industry.

Tesla’s journey so far has been nothing short of spectacular. The company’s stock price has been on a relentless upward trajectory, outperforming most of its rivals in the automotive space. Tesla’s success can be attributed to its innovative technology, robust product portfolio, and management’s ability to execute its vision. With the increasing demand for green and sustainable energy, Tesla’s electric cars are expected to continue to dominate the market.

The rise in Tesla’s stock price to $1750 in 2040 might not surprise many investors. Tesla has steadily expanded its product offerings beyond electric cars in the last few years. The company has diversified into energy storage solutions, solar panels, and home energy management systems. These new ventures can potentially become significant growth drivers for the company, further boosting Tesla’s stock price.

Despite the strong fundamentals and growth prospects, Tesla’s stock price prediction in 2040 also carries some risks and uncertainties. One of the most significant risks facing Tesla is increased competition. As more and more automakers enter the electric car market, Tesla’s dominant position might come under threat. In addition, regulatory changes and technological advancements might also pose a challenge to the company’s growth trajectory.

However, Tesla’s management team has consistently demonstrated its ability to navigate challenges and adapt to changing market conditions. With its strong brand reputation, technological prowess, and customer-centric approach, Tesla is well-positioned to weather any headwinds that might arise in the future.

Tesla Stock Price Prediction ML Model Features

- Tesla Corporate Earnings

- Tesla P/S Ratio and Company Revenue

- Tesla Company Debt

- Economic Indicators

- Tesla Daily Price Levels from 2010 to 2023

- RSI Indicator Values

- Automotive Industry Trend and Competitive Landscape Ratings

Tesla’s 2040 price prediction ML model features will rely on essential factors likely to impact the company’s stock price over the next two decades. Among these factors will be Tesla’s earnings or profits, which could significantly impact the company’s share price and thus will be included as a predictor in the ML model.

The model will also account for Tesla’s revenue growth and P/S ratio, vital indicators of the company’s financial health and overall performance. The P/S ratio, in particular, is an essential metric for investors to determine whether a stock is overpriced or undervalued, making it a necessary feature of the model.

Another core element of the Tesla 2040 price prediction ML model will be the company’s debt levels, which can significantly impact its share price. By incorporating Tesla’s debt into the model, investors can better evaluate the risk associated with the company’s financial position, which can, in turn, influence their investment decisions.

In addition to these internal factors, the ML model will consider external economic indicators, such as GDP growth, inflation, and interest rates. These factors can profoundly impact the stock market as a whole, and as such, they are highly relevant to Tesla’s long-term performance.

Other essential features that will be included in the Tesla 2040 price prediction ML model include the company’s daily price levels from 2010 to 2023, which can help identify patterns and trends in the company’s share price. In addition, the Relative Strength Index will also be a critical factor, as it can help to capture the impact of the stock’s price movement on the share price.

Finally, the model will also consider the overall automotive industry trend and competitive landscape ratings as custom indicators to help capture the impact of these external factors on Tesla’s stock price. By incorporating these various features and hands, the Tesla 2040 price prediction ML model will offer a comprehensive and highly accurate view of the company’s future performance.

Tesla Stock Price Prediction 2040. Methodology

Tesla’s stock price is one of the most closely watched indicators of the electric carmaker’s financial performance. Moreover, the company’s strong growth trajectory has prompted investors and analysts alike to scour market data for insight into its prospects. In this regard, Tesla’s stock price forecast methodology in 2030 is an important area of focus integral to investment decisions.

To address this, Tesla has developed a sophisticated ensemble model that leverages the strengths of two powerful machine learning algorithms – Support Vector Regression (SVR) and Random Forest. The reasoning behind this approach is that SVR and Random Forest are among the most accurate predictors of stock prices, with each algorithm bringing a unique perspective to the table.

Support Vector Regression is a machine learning algorithm that has proven particularly effective in predicting non-linear patterns in time-series data. It works by identifying stock price patterns and using them to forecast future values. SVR achieves this by creating a hyperplane in a high-dimensional space that maximizes the distance between the two classes of data points and then using this hyperplane to make predictions.

Random Forest is another machine learning algorithm widely used to forecast stock prices. This algorithm works by constructing multiple decision trees on subsets of the data, and then taking the average of the trees’ predictions to arrive at a final forecast. Random Forest is instrumental in situations where the pattern of data is noisy or complex, as it can filter out irrelevant features and focus on the most important ones.

Combining these two algorithms in an ensemble model has several advantages. Firstly, it allows Tesla to leverage the strengths of both algorithms and mitigate their weaknesses. For instance, SVR is more accurate in predicting non-linear patterns, while Random Forest is better at handling noisy data. Secondly, an ensemble model can provide greater accuracy by reducing the variance between algorithm predictions. Finally, the ensemble model can increase prediction confidence as it combines the wisdom of multiple algorithms.

In summary, Tesla’s stock price forecast methodology in 2040 is a crucial area of focus that leverages the strengths of two powerful machine learning algorithms – Support Vector Regression and Random Forest. By combining these two approaches in an ensemble model, Tesla can provide investors with more accurate and reliable forecasts, which ultimately enables better investment decisions.

Conclusion

In conclusion, Tesla’s stock price prediction of $1750 in 2040 indicates a moderate price rise, which can impact the percentage growth of electric cars in 2040. Tesla’s rise to the top of the automotive industry has been nothing short of remarkable, and its growth prospects look promising. While there are risks and uncertainties, the company’s solid fundamentals and management’s ability to execute its vision make Tesla an attractive proposition for investors looking to invest in the electric car market. However, Tesla’s journey to dominate the future of mobility is well underway, and its stock price prediction in 2040 suggests there is still a long way to go.