Table of Contents

Amazon, founded by Jeff Bezos in 1994, went public on May 15, 1997, with an initial public offering (IPO) price of $18 per share. Today, Amazon is one of the largest companies in the world by market capitalization, with a current market cap of over $1.6 trillion as of May 2023. Despite its significant growth, Amazon is known for being a relatively volatile stock, fluctuating significantly over the years. For example, from 2015 to 2020, Amazon’s stock price increased from around $300 per share to over $3,000, making it one of the best-performing stocks. However, in September 2022, the stock experienced a sharp decline, losing almost 20% of its value in just a few weeks due to concerns over regulatory issues and slowing growth.

Amazon’s stock price today USD chart

How many shares of Amazon stock are there?

[stock_market_widget type=”inline” template=”generic” assets=”AMZN” markup=”There are exactly {shares_outstanding} Amazon shares of Amazon stock based on the latest update on {last_update}. ” display_currency_symbol=”true” api=”yf”]

Amazon stock when it started?

The first Amazon stocks started in May 1997. Amazon.com Inc. held its initial public offering (IPO) on the Nasdaq on May 15, 1997, for $18 per share. So suppose you invested $10K in Amazon stock from May 1997 to May 2021. you would have around $22 million.

Did Amazon stock ever split stocks?

Yes, Amazon had three splits. The first Amazon split took place in June 1998. For its first stock split, Amazon offered two shares for every one share held. Amazon’s second split took place on January 05, 1999, after the shares had rocketed to $355. Finally, the last third split was in September 1999, 2-for-1, when the stock was trading under $120 each.

Amazon’s stock split in 2022 probably will not happen because company politics thinks Amazon’s stock and market share continue to grow without a split. Currently, big investors can afford to buy Amazon shares, and small investors can use buy fractions of shares. Dow’s index is overrated, and Amazon does not want to be on the Dow list.

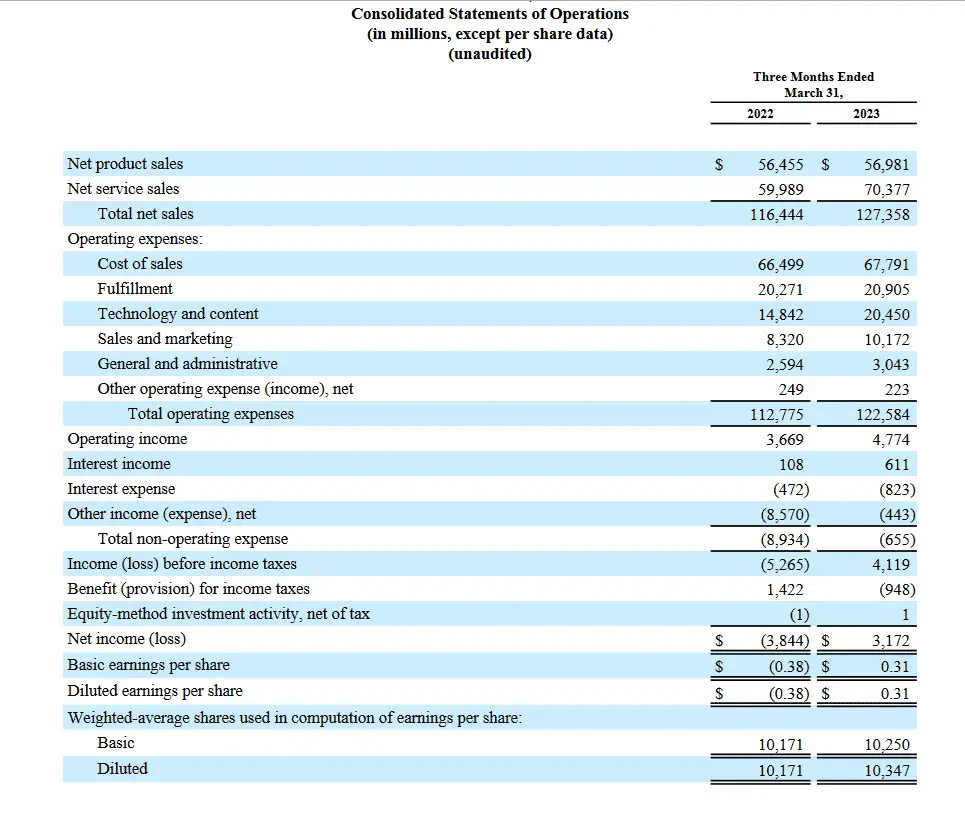

Amazon fundamental analysis 2023

Amazon Stock Price Prediction 2025

Based on Amazon’s 1997-2023 year forecast using the ensemble ML model, Amazon’s stock price prediction for 2025 is $85 (end of the year). However, stocks can decline significantly because of the high probability of stock market decline and economic recession in the next several years.

The year 2025 is just around the corner, and investors are curious about what to expect from Amazon’s stock price. Based on Amazon’s 1997-2023 year forecast using the ensemble ML model, the company’s stock price prediction for 2025 is $85 (end of the year). However, it is essential to note that stock price prediction is subject to various uncertainties and external factors that could significantly impact the stock price in the short term.

One of the main factors that will impact Amazon’s stock price in 2025 is the company’s earnings. Amazon’s corporate earnings can significantly impact the stock price. Higher earnings can lead to higher stock prices, while lower earnings can cause stock prices to fall. In the last few years, Amazon’s earnings have consistently increased, which has led to a rise in the company’s stock price. If Amazon continues to experience growth in earnings in the short term, it is reasonable to predict that the stock price will continue to rise.

Another crucial factor impacting Amazon’s stock price in 2025 is the company’s revenue. A company’s revenue is another critical factor affecting its stock price. If a company’s revenue grows, its stock price may rise, while declining revenue can cause the stock price to fall. Amazon’s revenue has consistently grown in the last few years. If the company continues to experience revenue growth in the short term, it is reasonable to predict that the stock price will continue to rise.

However, it is essential to note that stocks can decline significantly because of the high probability of stock market decline and economic recession in the next several years. In addition, the market is susceptible to uncertainties and external factors that could significantly impact the stock price in the short term. For example, global events such as pandemics, natural disasters, or political instability could affect Amazon’s stock price. Changes in government policies, regulations, or tax laws could also impact the company’s stock price.

Furthermore, Amazon faces stiff competition in e-commerce, and the match could evolve. New competitors could enter the market, or existing competitors could innovate and disrupt the market, impacting Amazon’s stock price. The company’s ability to stay ahead of the competition and continue to innovate will be a critical factor in determining its stock price in 2025.

Amazon Stock Price Prediction 2025. Methodology

Based on the methodology outlined for Amazon’s stock price prediction for 2040, an ensemble model combining ARIMA, SVMR, and Random forest is likely to be used to forecast Amazon’s stock price for 2025. The approach begins with applying ARIMA to the time series data to capture the underlying trend and seasonality. The residual errors are then fed into the SVMR and Random forest models, which can capture any remaining patterns in the data that ARIMA may have missed. Finally, the predictions from all three models are combined using an ensemble method to create the final prediction.

The advantage of this ensemble model is that it can capture both the linear and nonlinear relationships in the data and handle the noisy and non-stationary nature of stock prices. Additionally, the ensemble method can help to reduce the impact of any individual model’s weaknesses or biases, leading to improved accuracy and reliability. However, it is important to note that predicting stock prices is a challenging problem that requires analyzing large amounts of data and identifying complex patterns. Therefore, the accuracy of the Amazon stock price prediction for the year 2025 using this ensemble model cannot be guaranteed.

Amazon Stock Price Prediction 2025 features

- Amazon corporate earnings

- Amazon company revenue

- Amazon company debt

- Economic indicators (GDP growth, inflation, interest rates)

- Amazon’s daily price levels from 1997 up to 2023

- RSI indicator values from 1997 up to 2023 (values from 0 to 100)

- Technology industry trend rating (custom indicator from 0 to 100)

- Competitive landscape rating (customized hand from 0 to 100)

Conclusion

In conclusion, based on Amazon’s 1997-2023 year forecast using the ensemble ML model, the company’s stock price prediction for 2025 is $85 (end of the year). However, it is essential to note that stock price prediction is subject to various uncertainties and external factors that could significantly impact the stock price in the short term. Therefore, investors should carefully consider their investment decisions and monitor the market and global events to make informed decisions.