Table of Contents

Amazon’s stock (AMZN) has been among the most successful and talked-about stocks in recent years. Founded by Jeff Bezos in 1994, Amazon started as an online bookstore and has since grown to become one of the largest e-commerce companies in the world. In 2021, the company’s stock price exceeded $3,000 per share, making it one of the most valuable companies in the world, with a market capitalization of over $1.5 trillion. Despite concerns over antitrust regulation and increased competition, Amazon continues to dominate many markets and is expected to remain a significant player in the e-commerce and cloud computing industries for years.

Amazon’s stock price today USD chart

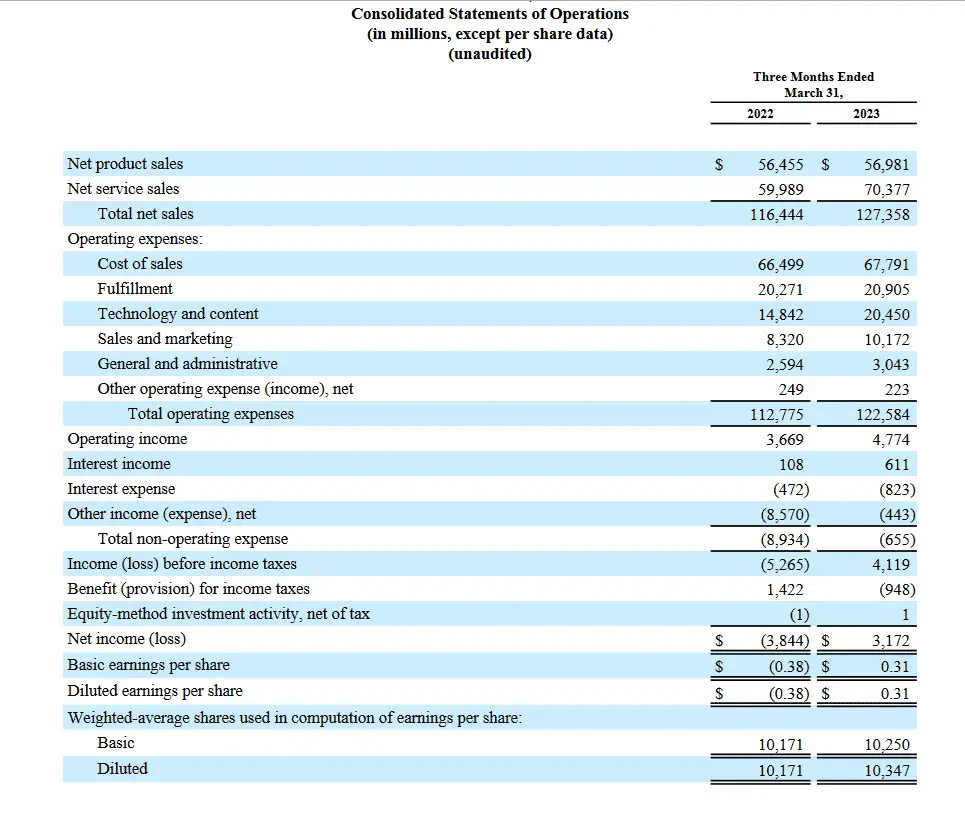

Amazon Stocks Analysis 2023

Amazon Stock Price Prediction 2050. Methodology

Based on the methodology described above, predicting the Amazon stock price in 2050 would require analyzing data from 1997 to 2050 using multiple features and techniques. The ensemble model combining ARIMA, SVR, and Random Forest would be an excellent choice to capture both linear and nonlinear relationships in the data and handle the stock price’s noisy and non-stationary nature.

Factors such as Amazon’s corporate earnings, company revenue, debt level, and economic indicators would continue to impact the stock price in the long term. Daily price levels, RSI indicator values, technology industry trend ratings, and competitive landscape ratings could be used as features to make more accurate predictions.

Amazon stocks price prediction 2050 features are:

- Amazon corporate earnings: Higher earnings can lead to higher stock prices, while lower earnings can cause stock prices to fall.

- Amazon company revenue: Growing revenue can cause the stock price to rise while declining revenue can cause the stock price to fall.

- Amazon company debt: High debt levels can make investors nervous, potentially causing the stock price to fall.

- Economic indicators: Strong economic indicators such as GDP growth, low inflation, and low-interest rates can lead to higher stock prices, while weak economic indicators can cause stock prices to fall.

- Amazon’s daily price levels from 1997 to 2023: Historical price levels can provide insights into past trends and patterns in the stock price.

- RSI indicator values from 1997 to 2023: The Relative Strength Index (RSI) is a technical indicator that can provide insights into the stock’s momentum and overbought or oversold conditions.

- Technology industry trend rating: A custom indicator that rates the trend and growth potential of the technology industry can help predict the prospects of Amazon’s stock price.

- Competitive landscape rating: A customized rating system that assesses the industry’s competitive landscape can provide insights into the future prospects of Amazon’s stock price.

However, predicting stock prices over such a long-term horizon can be challenging and subject to many uncertainties. Therefore, any predictions made should be taken cautiously and treated as the best estimate based on current knowledge and understanding.

Ensemble learning is a technique in machine learning that combines multiple models to improve the overall prediction accuracy and reduce the risk of individual model biases or errors. In an ensemble model, the individual models work together to produce a single prediction or a weighted average of forecasts.

When combining support vector regression (SVR) and random forest in an ensemble model, the idea is to use each model’s strengths to complement the other. SVR is a regression algorithm that can be used for both linear and non-linear data. It works by finding a hyperplane in a high-dimensional space that maximally separates the data points into different classes or groups. On the other hand, random forest is a decision tree-based algorithm that works by building multiple decision trees on subsets of the data and averaging the results.

In an ensemble model, the SVR and random forest models are trained on the same dataset, combining their predictions to produce a final prediction. One approach to integrating the projections is to take a weighted average of the individual model predictions, where the weights are determined by the model’s accuracy on the training data. Another approach is to use a voting system, where each model makes a prediction, and the most common outcome determines the final prediction.

The advantage of combining SVR and random forest in an ensemble model is that it can capture the data’s linear and non-linear relationships. SVR is better suited for linear data, while the random forest is better for non-linear data. Combining both models’ strengths, the ensemble model can produce more accurate and robust predictions than either model alone.

Amazon stock forecast 2050.

Based on Amazon’s 25-year forecast using the ensemble ML model, Amazon’s stock price prediction for 2050 is $3950 (end of the year). This high price depends on the assumption that Amazon can also be a technological leader in the next 20 years.

However, it is essential to note that stock price prediction is subject to various uncertainties and external factors that could significantly impact the stock price in the long term. Therefore, it is crucial to analyze the factors that could affect Amazon’s stock price in 2050.

One of the main factors that will impact Amazon’s stock price in 2050 is the company’s corporate earnings. Amazon’s revenues, or profits after all expenses, can significantly impact the stock price. Higher earnings can lead to higher stock prices, while lower earnings can cause stock prices to fall. In the last few years, Amazon’s earnings have consistently increased, which has led to a rise in the company’s stock price. If Amazon continues to experience growth in earnings in the long term, it is reasonable to predict that the stock price will continue to rise.

Another crucial factor that will impact Amazon’s stock price in 2050 is the company’s revenue. A company’s revenue, or the amount of money it earns from sales, is another critical factor impacting its stock price. If a company’s revenue grows, its stock price may rise, while declining revenue can cause the stock price to fall. Amazon’s revenue has consistently grown in the last few years. If the company continues to experience revenue growth in the long term, it is reasonable to predict that the stock price will continue to rise.

Amazon’s debt level will also be critical in determining the company’s stock price in 2050. High debt levels can make investors nervous, as it may be difficult for the company to repay its debts and continue to grow. However, Amazon has consistently been able to manage its debt and has a relatively low debt-to-equity ratio compared to its industry peers. Therefore, if Amazon continues to manage its debt effectively in the long term, it is reasonable to predict that the stock price will continue to rise.

Economic indicators such as GDP growth, inflation, and interest rates will also play a role in determining Amazon’s stock price in 2050. A strong economy can lead to higher stock prices, while a weak economy can cause stock prices to fall. However, if the economy continues to grow in the long term, it is reasonable to predict that the stock price will continue to rise.

In addition to these factors, Amazon’s daily price levels from 1997 to 2023, RSI indicator values from 1997 to 2023, technology industry trend rating, and competitive landscape rating will also impact the company’s stock price in 2050. Therefore, by analyzing these factors and combining them using an ensemble ML model, it is possible to predict Amazon’s stock price in 2050.

However, it is essential to note that stock price prediction is subject to various uncertainties and external factors that could significantly impact the stock price in the long term. For example, unexpected global events such as pandemics, natural disasters, or political instability could affect Amazon’s stock price. In addition, the company’s competition could also evolve, impacting the stock price.

In conclusion, based on the analysis of various factors that could impact Amazon’s stock price in 2050, it is reasonable to predict that the stock price will continue to rise if the company experiences growth in earnings and revenue, effectively manages its debt, and if the economy continues to grow in the long term. However, it is crucial to remember that stock price prediction is subject to uncertainties and external factors, and investors should carefully consider their investment decisions.