Table of Contents

Tesla, Inc., an American electric vehicle and clean energy company, has gained global recognition for its pioneering role in sustainable transportation and energy solutions. Founded in 2003 by a group of engineers and currently led by CEO Elon Musk, Tesla has disrupted the automotive industry with its range of electric vehicles, including the popular Model S, Model 3, Model X, and Model Y. The company’s commitment to innovation extends beyond vehicles into solar energy and battery storage solutions, aligning with its mission to accelerate the world’s transition to sustainable energy. Tesla’s financial fundamentals have shown robust growth, marked by increasing vehicle sales and expanding global market presence, despite facing challenges typical of a rapidly growing enterprise in a competitive sector. The company’s stock has attracted significant investor interest, reflecting its potential for long-term growth in the burgeoning renewable energy and electric vehicle markets.

Tesla Company

Tesla represents a famous company that produces sustainable energy with electric cars

Tesla needs no introduction. Whether using mind-blowing technology in cars or creating expensive and exclusive boxers, the company gives this world no reason to forget its existence. It is always on the mind of every other person, and the financial news is. The EV (electric vehicle) company shows an unprecedented year-to-date growth rate. When writing this article, Tesla was trading at $2.238, recording a growth of 435%.

It is a moment of celebration for those who believed their Tesla stocks would see a bullish market, but such vast growth can make anyone wonder if things are too good to be true. So, while Tesla amateurs enjoy their earnings, many analysts wonder if Tesla stock prices are overestimated. Some even think that they are detached from reality. So, they are looking for a solid grounding behind such an increment.

So, who is correct, the doubtful analysts or the Tesla amateurs? Read this article to see where TTesla’s stock will be in 5 years.

Tesla stock price Live Chart

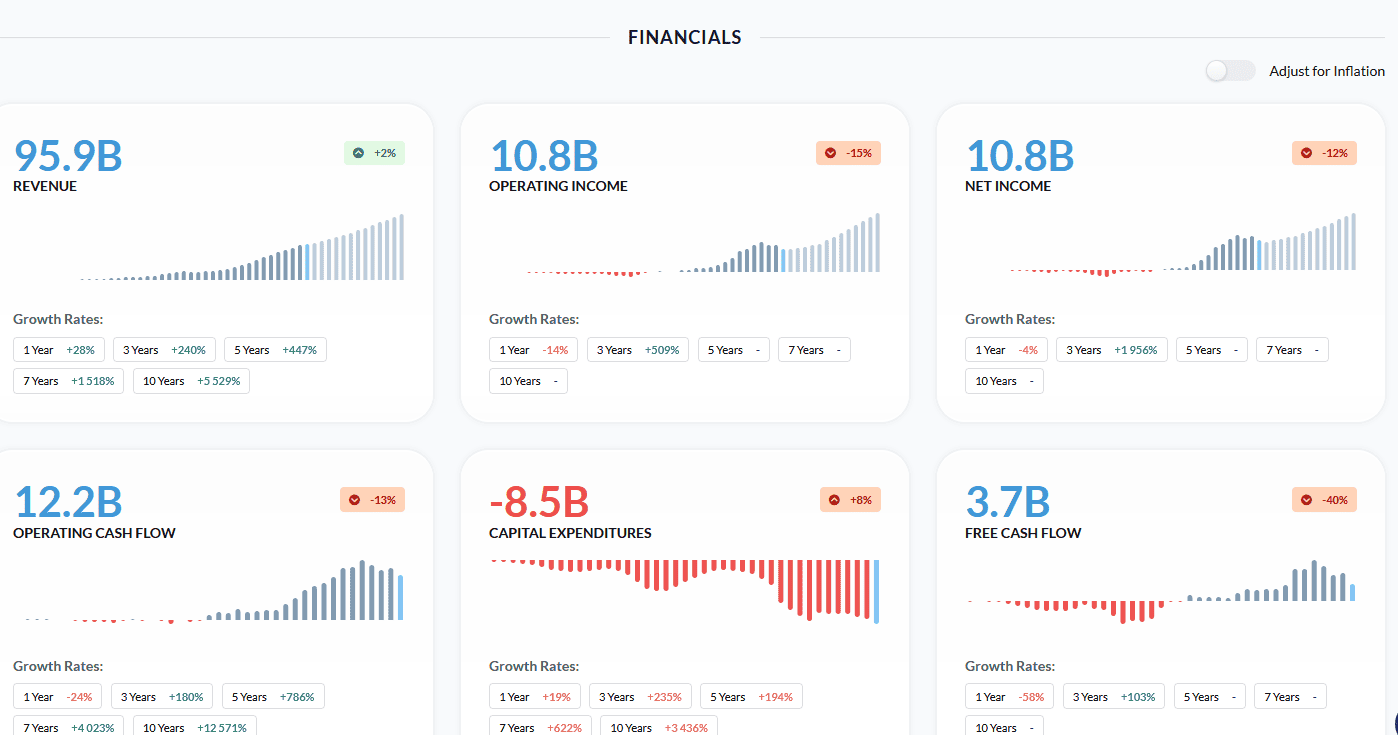

Tesla Financials

Tesla Stocks Predictions 2024

Tesla’s close stock price projection for the end of 2024 is around $300 because of interest cut rates, which can increase stock prices. However, any future crisis can speed Tesla’s price decline. On January 1. 2024, the Intrinsic Value of Tesla Inc (TSLA) was 223 USD. This value is based on the model Discounted Cash Flows (Growth Exit 5Y).

- Strong Fundamentals: The company is positioned well with better growth, profitability, debt, and visibility metrics than over 70% of other companies.

- Short-Term Investment Perspective: Currently, the company shows a weakened fundamental situation for short-term investments.

- High ESG Score: The company has a commendable Refinitiv Environmental, Social, and Governance (ESG) score, indicating strong performance relative to its industry.

Strengths:

- Increasing Business Volume: Analysts forecast a significant rise in the company’s business volume, with high growth rates anticipated in the upcoming years.

- Strong Financial Situation: The firm’s sound financial health provides substantial room for investment.

Weaknesses:

- High Earnings Multiples: The company’s projected Price-to-Earnings (P/E) ratio is considerably high for the current and next fiscal years.

- High Valuation Levels: Current pricing reflects a notably high company valuation.

- Relative to Tangible Assets: The company’s valuation seems high when considering the value of its tangible assets.

- Valuation vs. Cash Flows: The company’s valuation is perceived as excessively high compared to the cash flows it generates.

- Downgraded Sales Expectations: There has been a significant reduction in sales expectations for the current fiscal year compared to the previous period.

- Reduced Sales Outlook: Sales forecasts for the coming years have been revised downward in the last four months, with no anticipated recovery in the group’s activities.

- Declining EPS Expectations: Analysts have consistently lowered their expectations for the company’s Earnings Per Share (EPS) over the past 12 months.

- Downward Earnings Forecast Revision: In recent months, analysts have been reducing their earnings forecasts for the company.

- Lowered Price Target: The average price target set by analysts has seen a significant downward revision over the past four months.

- Deteriorating Analyst Consensus: The general opinion among analysts covering the stock has worsened over the past four months.

- Significant Downward Revision in Consensus: There has been a notable downward adjustment in the analysts’ consensus over the past year.

- Diverse Analyst Price Targets: Different analysts’ wide range of price targets suggests challenges in accurately evaluating the company and its business prospects.

However, plenty of risks could still cause Tesla’s share price to drop significantly. The ongoing pandemic has caused havoc across the world economy, and any future financial crises could devastate Tesla’s performance. Additionally, while Tesla has made significant advances in electric vehicles and autonomous driving technology, increased competition from other automakers, such as General Motors or Volkswagen, could also disrupt Tesla’s ambitious plans.

Another factor for investors to consider is the potential for political changes in 2023; if incentives for electric vehicle ownership were to decrease or be removed altogether, it could reduce demand for Tesla vehicles and put a massive dent in revenues. Furthermore, if laws and regulations surrounding autonomous driving were to tighten, Tesla may struggle with costly fines or investments in updating its technology.

Despite these factors, most analysts believe that the long-term prospects for Tesla remain positive and that its stock should remain relatively stable throughout 2023 and beyond. This is mainly because more and more countries are becoming eager to incentivize electric vehicle owners to reduce their carbon footprint and air pollution levels. As such, this presents an opportunity for Tesla to capitalize on these growing markets and expand its global presence.

While there will undoubtedly be some bumps along the way, high-risk investors should still view an investment into TSLA as worthwhile over time – particularly given its impressive record of returns so far this year! With more countries beginning to focus on environmental policies as part of their economic recovery efforts after COVID-19, TSLA may become even more attractive in 2021 and beyond – so keep your eye out!

Tesla Stock Price 2025

Tesla’s stock price projection for 2025 shows that this stock can reach up to $420. However, high US inflation and a possible market crash or crisis can decrease Tesla’s price.

Tesla is determined to be an even more significant success in the future and has answered many questions to solidify its investors’ interest. The main questions that investors had for Tesla were:

- First, is there an actual market for electric cars?

- How effective would the battery of these cars be?

- Finally, will making mass-market electric vehicles prove to be viable and profitable?

Tesla, in its way, answered all these questions. It fluctuated over $2000; its CEO, Elon Musk, even took to Twitter to claim that Tesla will be even more prominent in the next few months.

Will Tesla Stocks Remain This High in the Next 5 Years?

When stocks of a company continue to create new highs, people start doubting. Of course, it is the general nature of traders, and we cannot blame them for being cautious, but if we are talking about Tesla and its growth, a few factors can give traders and investors a degree of assurance.

One of the most crucial factors is innovation in electric cars. Tesla has built a strong reputation for being the pioneer in bringing new technologies to electric vehicles. Before Tesla, EVs were generally considered less-sufficient alternatives for conventional cars that environmentalists drove. Tesla, however, changed the game. Its electric cars are at par with traditional luxury models, if not better. Like the Ford Mach-E and Porsche Taycan, many tried to defeat Tesla but couldn’t survive in the competition. Right now, it seems like Tesla has the monopoly in creating ‘cool’ electric cars, which will remain unbeatable for the next five years, at the very least.

Tesla rose from critical reviews received for its futuristic Cybertruck and created a profitable market. The company ramped up the production of Model 3. Tesla’s mass-market model allows the company to generate a considerable cash flow and boost profits. The company has received a solid pre-order for its Cyberstuck as well!

What Do the Analysts Believe?

Money manager Catherine Wood of Wall Street believes that the bull will remain in Tesla, and the company’s stock prices can reach as high as $7000. Wood is also the founder and CEO of Ark Investment. She is highly optimistic about Tesla’s price target. She firmly believes that the chances of TSLA reaching $7000 are very high.

- Ark’s experts came to this conclusion after carefully considering several factors. First, they deduced the probability of the stock reaching this high after analyzing ten scenarios; bankruptcy is one. This claim is based on two factors – the growing demand for Tesla cars and its ability to reduce battery costs.

- In an interview conducted by CNBC in June 2020, billionaire investor Ron Baron said that Tesla would continue to see its meteoric rise in the future. Therefore, he firmly believes that Tesla is a good buy and should be invested in. According to his long-term predictions for Tesla, he asserted that TSLA stocks would trade somewhere between $2000 to $3000 in the next five years. He also thinks that this will include multiple after these five years. This is not unimaginable given that the company stocks surged over $2000 in less than a couple of months.

- Joe Osha, a JMP Securities analyst, has a lot of faith that Tesla will outperform the market. This was reaffirmed when Tesla exceeded its number of estimated deliveries in Q2. The estimation was 70,000 deliveries, but the company made 90,650 deliveries. Osha thinks that if a company can make such a vast number of deliveries during global crises, it can easily manage approximately 757,000 deliveries by the end of 2021. As a result, Osha is highly optimistic about Tesla. He thinks the company will grow and make $100 billion in revenues by 2025. He also feels that it will deliver 2.5 million vehicles by then.

- GLJ Research’s CEO and founder, Gordon Johnson, has different opinions about Tesla. In an interview with Yahoo Finance, he exclaimed that Tesla is not keeping up with reality. He pointed out that Tesla has traded at over twice VW’s market cap. This happened when Volkswagen sold 11 million units in 2019, but Tesla sold less than 370,000 cars. The analyst highlighted that the company’s credit revenue sales saved it. Otherwise, it would have faced a loss of $300 million in the second quarter of 2020. He predicts that TSLA’s price target by the end of 2021 will be just $87.

Tesla Stock Prices: Current Technical Analysis

- Tesla’s stock (TSLA) is currently showing a moderately bullish trend, but there’s selling pressure evident, suggesting a potential shift towards a bearish movement in the future.

- The stock’s moving averages present a mixed view; the 8-day Simple Moving Average (SMA) and 8-day Exponential Moving Average (EMA) signal a ‘Sell,’ whereas the 20-day, 50-day, and 200-day SMAs and EMAs suggest a ‘Buy.’

- Technical analysis indicators like the MACD (Moving Average Convergence Divergence) at 5.04 and the Relative Strength Index (RSI) at 52.08 are in the ‘Buy’ zone, indicating positive momentum and potentially higher prices ahead.

- The Chaikin Money Flow indicator doesn’t provide a clear buy or sell signal, pointing to uncertainty in money flow and investor sentiment.

- Bollinger Bands for both 25-day and 100-day periods indicate a ‘Buy,’ suggesting that the stock price is currently at a relatively low level within its recent price range, which might attract buyers.

Conclusion

Tesla is doing something unconventional that makes it controversial. It has always been highly volatile, which means you can gain and lose more with this stock. Despite garnering mixed reviews, it has never dropped off the radar.

2020 saw many companies and even world economies trying hard to stay afloat. Many companies filed for bankruptcy, but Tesla surged by over 400%.

Elon Musk is a visionary, and there is no doubt about that. Unfortunately, he proved everyone who bet against him wrong.

If you are still unconvinced, invest in less risky financial instruments like CFDs.