Table of Contents

Investors like Tesla stock because of the company’s innovative approach to electric vehicle technology, which has disrupted the traditional automotive industry. Tesla’s focus on sustainability and renewable energy has also attracted investors interested in socially responsible investing. Additionally, Tesla has shown strong revenue growth and has a large and growing market share in the electric vehicle market.

The history of Tesla stock is relatively short, as the company went public in 2010. Since then, Tesla’s stock has seen significant fluctuations in price, with periods of rapid growth and declines. In 2020, Tesla’s stock price skyrocketed, with a 743% increase in value from January to December. This was partly due to the company’s strong financial performance, with four consecutive profitable quarters, and its inclusion in the S&P 500 index.

However, Tesla’s stock has also faced criticism and skepticism from some investors due to concerns about the company’s valuation and profitability. Some critics argue that Tesla’s stock price is overvalued, given the company’s relatively small production volume and the competitive landscape of the electric vehicle market. Additionally, Tesla has faced production and supply chain issues, leading to delays and quality control issues with some of its vehicles.

Despite these challenges, Tesla remains a popular stock among investors, particularly those interested in environmentally sustainable and socially responsible investments. The company’s focus on innovation and disruption in the automotive industry and its strong financial performance in recent years have helped drive investor interest and enthusiasm for Tesla’s stock.

This article will try to make a Tesla stock 2025 price projection.

Tesla Stock Price Today Chart

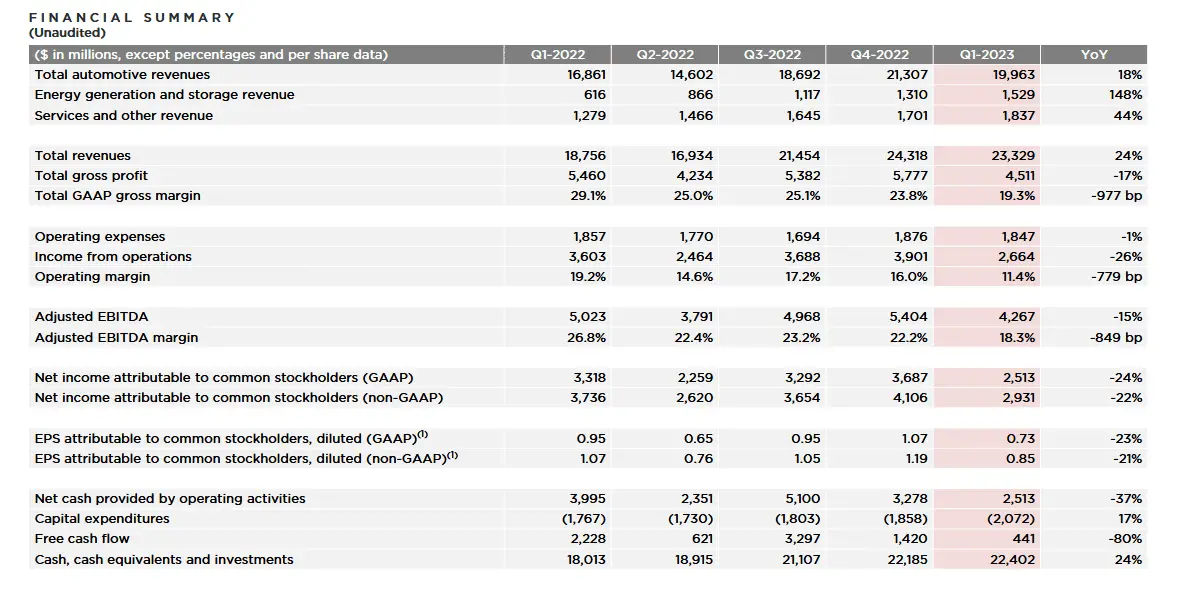

Tesla Stock Financial Summary 2023

In April 2023, Tesla (TSLA) revealed a significant decline in first-quarter earnings, disappointing investors and causing the stock price to tumble the following day. While the tech company’s revenue missed views, perhaps the profit margins were the most concerning aspect of the earnings report. At just under 20%, they are well below what analysts would expect from a significant player in the electric vehicle (EV) industry.

To explain this decline in profits, Tesla pointed to their aggressive price-slashing strategy. This approach was designed to make EVs more accessible to the average consumer, but it appears to have come at a cost to the company’s bottom line. Despite these struggles, however, it’s important to note that Tesla remains a massive player in the growing EV market. Their vehicles are still among the most popular and sought-after in the world, and the company enjoys significant support from dedicated fans and investors alike.

Even so, the decline in earnings has led to several analysts revising their stock price targets downward. This suggests some skepticism about Tesla’s long-term prospects, at least in the short term. It remains to be seen whether the company can rebound from this disappointing quarter and return to sustained profitability. In the meantime, the world will be watching closely to see how Tesla navigates the ever-changing landscape of the EV industry.

Tesla Stock Price Prediction 2025

Based on the custom ML model, Tesla’s stock price prediction shows a price decline to $120 in 2025. Significant impacts have been the world economic recession and the low percentage growth of electric cars in the world. In addition, Tesla’s price has been overrated in the last several years based on current cash flow and P/S ratio.

Firstly, Tesla’s price-to-sales ratio (P/S) is significantly higher than that of its competitors in the automotive industry. For example, the combined P/S ratio of the listed competitors is 0.56, while Tesla’s P/S ratio is 15.87, which suggests that investors are paying a premium for Tesla’s sales relative to its peers. This is especially notable considering that Tesla has only generated $62.19 billion in revenue compared to its competitors’ combined income of $1.38 trillion.

Secondly, Tesla’s market capitalization reflects a level of dominance in the automotive industry that is non-existent. Despite selling only 2.02% of all vehicles in the US, Tesla’s market cap is significantly higher than its competitors, suggesting that investors are placing a premium on Tesla’s potential for growth rather than its current financial performance.

Thirdly, Tesla’s price-to-earnings ratio (P/E) is significantly higher than that of its peers in the automotive industry. Tesla’s P/E ratio of 113.81 is much higher than the average P/E ratio of its competitors, which suggests that investors are paying a premium for Tesla’s earnings relative to its peers. This is particularly noteworthy given that Tesla’s growth factor is often used to justify its high P/E ratio. Still, other high-growth companies like Facebook have a much lower P/E ratio despite growing significantly from more prominent starting positions.

Lastly, Tesla’s P/S ratio is significantly higher than that of other high-growth companies like Amazon, suggesting that investors place a more significant premium on Tesla’s sales growth than its peers. For example, while Amazon has grown its revenue by $341.76 billion over the previous 3.25 years, compared to Tesla’s $40.73 billion revenue growth, its P/S ratio is only 11.31, much lower than Tesla’s P/S ratio.

These factors suggest that Tesla’s stock may be highly overvalued relative to its peers in the automotive industry and other high-growth companies. However, it is essential to note that market valuations are subjective and can be influenced by various factors, including investor sentiment, market trends, and company-specific developments. Therefore, any analysis of a company’s valuation should be taken as one perspective among many, and investors should conduct their research and analysis before making any investment decisions.

Tesla Stock Price Prediction 2025. Methodology

To predict Tesla’s stock price for 2025 using the ensemble ML method to combine Random Forest and Support Vector Regression (SVR), we can follow the following methodology:

- Data Collection: Collect historical data on Tesla’s stock price, as well as the custom indicators mentioned in the previous question, such as Tesla corporate earnings, Tesla P/S ratio, Tesla company revenue, Tesla company debt, economic indicators, Tesla daily price levels from 2010 to 2023, RSI indicator values, automotive industry trend rating, and competitive automotive landscape rating.

- Data Preprocessing: Preprocess the collected data by handling missing values, removing outliers, scaling the features, and encoding any categorical variables.

- Feature Selection: Select the essential features that can significantly impact Tesla’s stock price using feature selection techniques like correlation analysis, feature importance, and domain expertise.

- Data Splitting: Split the preprocessed data into training and testing sets. The training set will be used to train the ensemble ML models, and the testing set will be used to evaluate the performance of the trained models.

- Tesla Ensemble Model Training: Train the ensemble ML models, such as Random Forest and SVR, using the preprocessed training data. These models are chosen because they can handle nonlinear relationships and capture complex interactions between the input features.

- Model Evaluation: Evaluate the performance of the trained ensemble ML models on the testing set using performance metrics like Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and R-squared (R2) score.

- Model Tuning: Tune the hyperparameters of the ensemble ML models using techniques like Grid Search and Random Search to optimize the performance of the models.

- Model Prediction: Once the ensemble ML models are trained and optimized, they can be used to predict the future stock price of Tesla for 2025, given the input values of the custom indicators.

- Model Visualization: Visualize the predicted stock price using techniques like line plots, scatter plots, and bar charts, and compare them with the actual stock price to evaluate the model’s accuracy.

Overall, the ensemble ML model combining Random Forest and SVR can leverage the custom indicators to predict the future stock price of Tesla for 2025.

Some features we predicted using current stats and economic projections.

Tesla 2025 price prediction ML Model Features

- Tesla Corporate Earnings: Tesla’s earnings or profits can significantly impact its stock price. Higher wages can lead to higher stock prices, while lower yields can cause stock prices to fall. Therefore, if Tesla reports strong earnings, investors will likely become more bullish on the company’s prospects, increasing its stock price.

- Tesla P/S Ratio and Company Revenue: Tesla’s revenue, or the amount of money it earns from sales, is another critical factor impacting its stock price. If Tesla’s revenue grows, its stock price may rise, while declining revenue can cause the stock price to fall. Additionally, the P/S ratio, which compares the stock price to the company’s sales per share, is an essential factor that investors consider when valuing a company.

- Tesla Company Debt: A company’s debt level can also impact its stock price. High debt levels can make investors nervous, as it may be difficult for the company to repay its debts and continue to grow. Therefore, if Tesla’s debt levels are high, investors may hesitate to invest in the company, leading to a decline in its stock price.

- Economic Indicators: Economic indicators such as GDP growth, inflation, and interest rates can also impact Tesla’s stock price in the long run. A strong economy can lead to higher stock prices, while a weak economy can cause stock prices to fall. Therefore, investors often closely monitor economic indicators to determine the economy’s overall health and make investment decisions accordingly.

- Tesla Daily Price Levels from 2010 to 2023: Tesla’s daily price levels from 2010 to 2023 provide investors with valuable information about the company’s stock price trends. Investors can use this information to identify patterns in the stock price and make informed investment decisions.

- RSI Indicator Values: The Relative Strength Index (RSI) is a technical indicator that measures the strength of a stock’s price movement. RSI values range from 0 to 100; above 70 are considered overbought, while below 30 are considered oversold. Investors use RSI values to identify potential buying or selling opportunities in the stock market.

- Automotive Industry Trend and Competitive Landscape Ratings: Custom indicators that measure the automotive industry trend and competitive landscape can also impact Tesla’s stock price. These indicators provide investors with valuable insights into the overall health of the automotive industry and Tesla’s competitive position within it.

In summary, a combination of factors, including Tesla’s corporate earnings, revenue, debt levels, economic indicators, daily price levels, RSI indicator values, and the automotive industry trend and competitive landscape, can all impact the company’s stock price. Accordingly, investors often consider these factors when making investment decisions in the stock market.

Conclusion

Based on the information, the custom ML model predicts Tesla’s stock price decline to $120 in 2025. This prediction is attributed to two significant factors: the economic recession and the low percentage growth of electric cars worldwide.

The world economic recession can lead to a decline in consumer demand, which may negatively impact Tesla’s sales and revenue, leading to a reduction in stock price. Additionally, the low percentage growth of electric cars in the world could limit Tesla’s growth potential and competitiveness in the market, which may also contribute to the predicted decline in stock price.

Furthermore, the information provided suggests that Tesla’s stock price has been overrated in the last several years based on its current cash flow and P/S ratio. This means the stock price may have been driven more by investor hype and speculation than by the company’s financial performance and growth prospects.

However, it is essential to note that stock price prediction is a challenging task, and the accuracy of any prediction depends on several factors, including the quality of the data, the chosen ML algorithms, and the prevailing market conditions. Therefore, any stock price prediction should be taken cautiously, and investors should conduct their research and analysis before making investment decisions.