Double-top and double-bottom trading patterns are among my favorite tools in technical analysis because they offer clear, actionable signals that can be used to make trading decisions. Traders widely recognize these patterns for their reliability and straightforward nature.

However, in the market, we can see Bearish head-and-shoulder patterns or Quasimodo Patterns , which are very similar but rare.

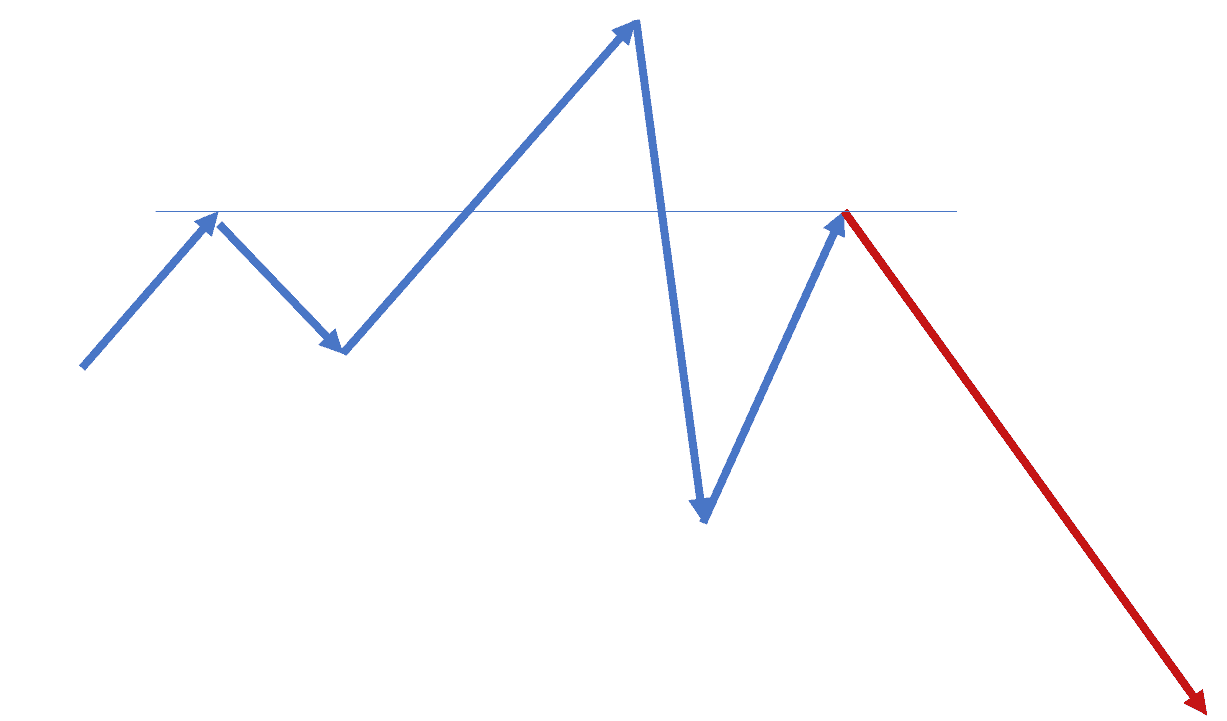

The Quasimodo Pattern or Bearish Head and shoulder pattern represents a trading pattern consisting of one lower top as the left shoulder, another highest top (Head), and another lower top (right shoulder). The last leg usually signs a future bearish trend.

Please see my video from youtube channel about this pattern:

Quasimodo Pattern: An Overview

The Quasimodo Pattern, less commonly known as the Over and Under pattern, is a relatively new concept in technical analysis that highlights potential reversal points in the market. This pattern is particularly valued for its ability to identify shifts in market dynamics, often occurring at the end of a bullish or bearish trend.

Structure of the Quasimodo Pattern

The Quasimodo Pattern consists of five key points:

- Left Shoulder (LS): The initial peak, followed by a decline.

- Head (H): A higher high that surpasses the level of the Left Shoulder.

- Right Shoulder (RS): A decline from the Head, followed by a rally that does not exceed the height of the Head.

- Right Shoulder’s High (RSH): This high is lower than the Head but typically higher than the Left Shoulder.

- Neckline Break: The final and most critical aspect occurs when the price breaks below the low point between the Head and the Right Shoulder, confirming the pattern.

Trading the Quasimodo Pattern

Traders typically enter a short position when the price breaks through the neckline after forming the Right Shoulder. The rationale is that a significant downward move is expected following the pattern’s confirmation. Stop losses are often placed above the most recent high within the pattern to limit potential losses from unexpected reversals.

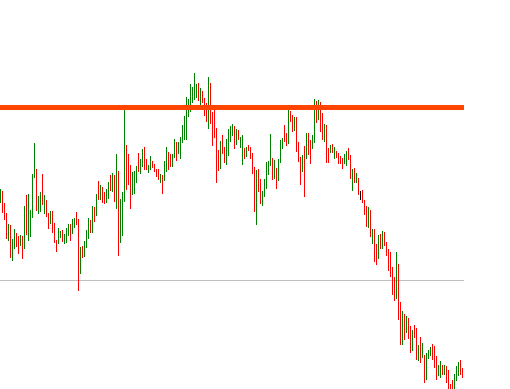

Please see the Quasimodo Pattern or Bearish Head and shoulder pattern in action on the m30 gold chart:

As we can see, spotting this pattern on the chart is sometimes hard.