Table of Contents

A technical analysis trader uses many patterns to predict the market trends and decide the entry and exit time. It helps them to get more odds of winning trades. There are various trading patterns, though the flag pattern is trendy among them.

What is a Flag pattern?

A flag pattern is a breakout chart pattern that follows the main price trend and has a rectangular shape resembling a flag. It suggests if the trend would continue for a long time frame or would be reversed in a swift motion.

This information works like a charm for traders in flag trading.

Bullish and bearish flags

Bullish flag chart pattern

The bullish flag chart pattern or bull flag pattern represents the bullish breakout pattern during the main bullish trend and after a short period of consolidation, formed in an area less than 50% of bullish retracement.

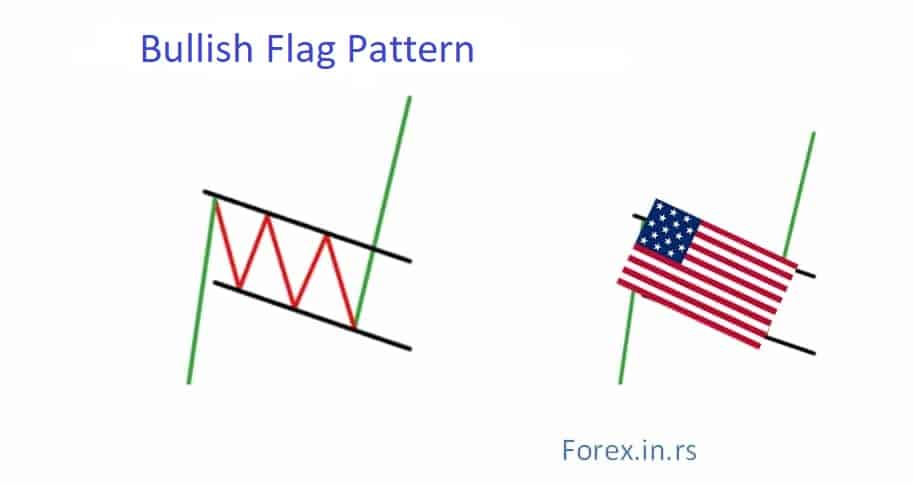

Price oscillation during the period of consolidation can usually be presented as a flag (Figure 1).

Figure 1: Bullish flag pattern

As we can see in Figure 1, if on the chart, the main trend is the rising trend (green color) in some moment, retracement (consolidation) will happen. The period of consolidation has a shape like a rectangle. Interestingly, this consolidation range will happen between 23.6 till 50% (Fib. levels) retracement range. Fibonacci levels can be used in Flag pattern trading strategies for better accuracy in trading.

In practice and the stock market, the bull flag is very often used.

Let us see one example in this video below:

Bear flag chart pattern

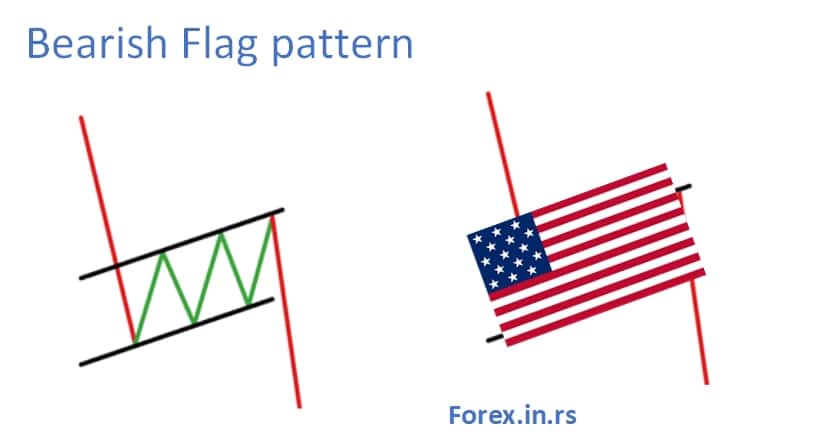

The bear flag chart pattern represents the bearish breakout pattern during the main bearish trend, after a short period of consolidation, formed in an area less than 50% of bearish retracement.

Price oscillation during the period of consolidation can usually be presented as a flag (Figure 2).

Figure 2: Bearish flag pattern

Now let us see how to recognize the bear flag pattern in practice:

What is Flag Trading Strategy?

A flag formation occurs when the price movement shows a reversal trend succeeding in a sharp price change. The flag trading strategy is made by consolidating 5 to 20 price bars. The flag formation can show bullish or bearish trends; it is not specific. The bottom line is that the flagpole’s lower body should avoid exceeding the middle part of the flagpole.

Let us understand the characteristics of Flag trading now. There are five of them.

- The breakout

- The previous trend

- A consolidating channel

- The volume of trade pattern

- Confirmation on price moving the direction of the breakout

Whether it is a bullish trend or a bearish trend, the flag pattern holds the same structure. The only difference is in the direction of trend and volume patterns.

In a bullish volume trend, the volume increases in the preceding trend while the consolidation decreases. In the bearish volume trend, the beginning happens the same way as the bullish pattern with increased volume, but it tends to hold after that.

Flag Trading- Pennant or Wedge

Flag trading can also be identified in the consolidation area through markets. If the flag lines converge, the flag formation can be a pennant or a wedge pattern. These are also the most trustworthy patterns as they accurately suggest the best entry and exit points to day traders.

These patterns follow breakout or volume patterns. These patterns can be identified by reducing trade volume after a hike at the initial stage. It suggests that traders were willing to trade the asset with enthusiasm first, but now they no longer want to continue the trend. Thus, the volume trend has reduced. It creates the opportunity for a new trend after the consolidation is over.

Day traders who can identify this trend can benefit by selling at the right time and starting the new trend before others.

How to Trade Flag Pattern?

Flag trading is not as tough as it seems. As a day trader, all you have to do is pick a strategy and look after only three particulars: the entry point, stop loss, and profit target.

1. Entry Point:

Often, the market gives false breakout signals; thus, you must wait for the initial breakout to occur as a trader. Most traders prefer to enter the trade after a day of the initial breakout when the prices have closed above the long position in case of a bullish market and below the short position in a bearish market.

2. Stop Loss:

Stop-loss is a risk management tool and a must for all traders. In flag trading, traders keep the stop loss at the opposing side of the flag. So, if the long position in a flag trading is at $40 for a stock, and the short position is at $35 per stock, the traders would keep the stop loss at any price below $35 (if they are trading in a bullish trend.)

3. Profit Target:

Setting a profit target differs from trader to trader, though many traders prefer to consider the difference between high and low in deciding the target. For example, if the difference is $5, and the breakout happened at $20, the profit target would be $25.

In contrast, many traders also look at the high flag patterns and the base of flagpoles for deciding the profit. Let’s take an example if the flagpole base is $24 and the high is $38, considering that the breakout entry point is at $30, the profit target would be $44 ($30+$11.)

The Bottom Line

As a trader, you have to understand that no indicator or pattern is perfect, and nothing would be all the time right. It would help if you also looked after other things such as global events and other price trends to jump into the market. The best you can do is keep yourself updated and learn from your mistakes.

Key Points to Remember

Here are the top five key points to give you a summary of this article.

- The flag pattern trading helps traders knowing the prevailing counter-trend, which may replace the short-term trend, creating a shape like a flag.

- To better predict the trend, traders often use other indicators like volume or price action.

- Flag trading is based on trading when a trend is about to break or a reversal is accepted after a long-term trend.

- Three main points can help you gain advantages for flag trading: the entry point, stop loss, and profit target.

- You also need to keep yourself updated and learn from your mistakes to sustain yourself in the market for the long term.