Table of Contents

What is a piercing line candlestick pattern?

Piercing line candlestick pattern or piercing candlesticks represent a two-day reversal pattern on the daily chart from strong bullish trend to downtrend and vice verse. The chart shows this pattern as a substantial gap between the first day’s closing price and the second day’s opening price.

What is a bullish piercing candlestick pattern?

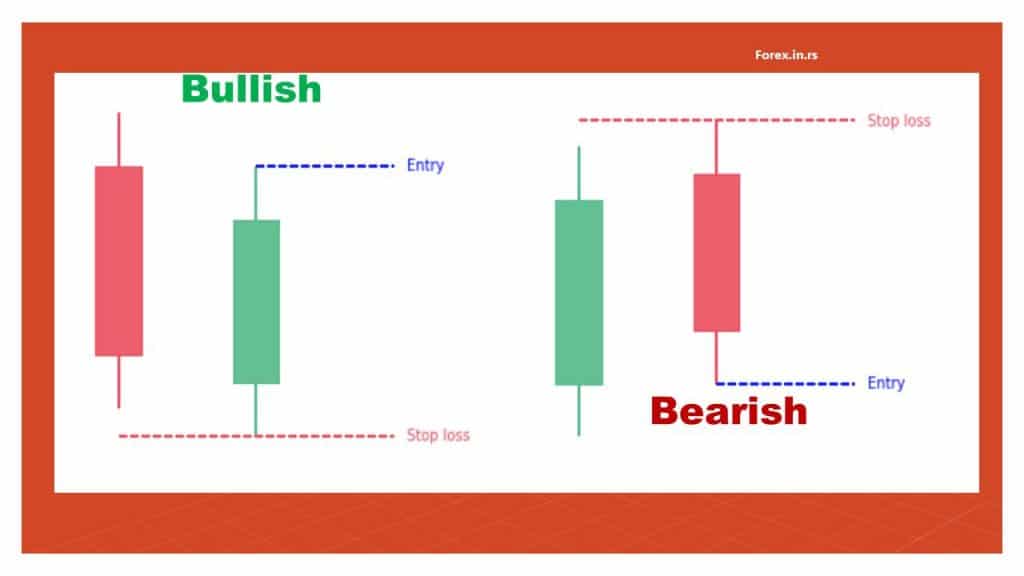

Bullish piercing candlestick pattern has the first bearish daily candle, a substantial gap lower from the first day’s closing price to the second day’s opening price and the second strong bullish candle.

A 2-day candlestick valuation pattern spots an efficient short-ended rebound, heading uptrend through a downtrend. This pattern covers the initial day commencing adjacent to highs and ending adjacent to lows, accompanied by a regular or a more extensive business scope.

The piercing pattern also covers a crack downward at the end of day one and initiation of day two, starting from lows and ending adjacent to highs. The closure has to be a candlestick which includes friction of the uptrend length at its minimum from red candlestick from earlier days.

What is a bearish piercing candlestick pattern?

Bearish piercing candlestick pattern has the first bullish daily candle, a substantial gap higher from the first day’s closing price to the second day’s opening price and the second strong bearish candle.

Major Outcomes

A two-day candlestick valuation pattern spots an efficient short-ended rebound, heading uptrend through a downtrend and vice versa.

Piercing Pattern gives a projection for five days only on the daily chart

There are three aspects of the pricking pattern that covers a downtrend before the pattern, a crack as the day one ends & a rigid rebound as the 2nd candlestick into the pattern.

Working of Piercing Pattern

Piercing patterns characterize 2 days out of which the 1st day is firmly motivated by auctioneers and the 2nd day is recognized by eager purchasers. This efficiently indicates the number of stock people in the market who wish to auction has reduced to a certain level. Also, the value of shares has dropped to the extent that people are procuring more and has been noted. Such aggression looks dependable for short-term uptrend assumptions.

Formation of the piercing pattern

It is considered among the crucial candlestick patterns that professionally investigate typical marks on the value sequence chart. A duo makes the piercing pattern of successive candlesticks voiced earlier & has 3 more crucial aspects.

A downtrend value anticipates the piercing pattern. (it might be a slight downward flow, yet if the candlesticks are noticed next to rising in value, then it’s not a crucial rebound indication)

Cracks in value initiate from low on the 2nd day. (such pattern is generally observed in stock as its capability of facing cracks overnight compared to rest currencies or all-time flowing resources. However, such patterns might take place in any resource upon a weekly graph).

The 2nd candle should seize beyond the middle spot of the 1st candlestick. (It represents that the purchaser overpowered the auctioneer that day.)

The 1st candlestick is generally dusk colored or red, representing a downward day, and the 2nd is green or luminous colored, representing a day that will close high compared to its opening. Thus, when a dealer is looking for a bullish rebound, a random red candle pursued by a white candle can be a signal to be cautious; however, the piercing pattern proves to be a certain signal as the rebound is mostly unpredictable for major shareholders of the market.

Piercing pattern is a tactical investigation for being an efficient bullish rebound (bearish vice verse). Emergence in its severe mode is not often, however, in the case of performing a good protracted downward trend in its front. At the time of tactical research by Stochastic, MACD, or RSI indicating bullish diversity, a piercing pattern is observed, intensifying the possibilities of the two-day pattern.

White candle reversal on the 2nd day through a downward crack to a median ending higher than expected can also signal that a backing level has arrived. This might happen because the crucial stakeholders of the market have settled the initiating values low compared to a closure of the previous day. As this occurs when the market opens, eager purchasing agents might move forward and switch the values from the commencement of the dealing hours.

Hence, a piercing pattern could be affirmed if it happens on the back front line of a valuation route, where purchasing is already an active part. This pattern is traditionally an efficient indication for a rebound; thus, by concentrating on a piercing pattern, a dealer can think of observing a separating crack. The piercing pattern pursued by a break-away gap can be a rigid indication of rebound happening.

In a bullish rebound, dealers usually get two well-known choices. First, they are allowed to purchase a share from an upward momentum. Also, they might decide to purchase a share in the cash call options with a smacking value beneath the market’s present value.