Table of Contents

What is a rising wedge pattern?

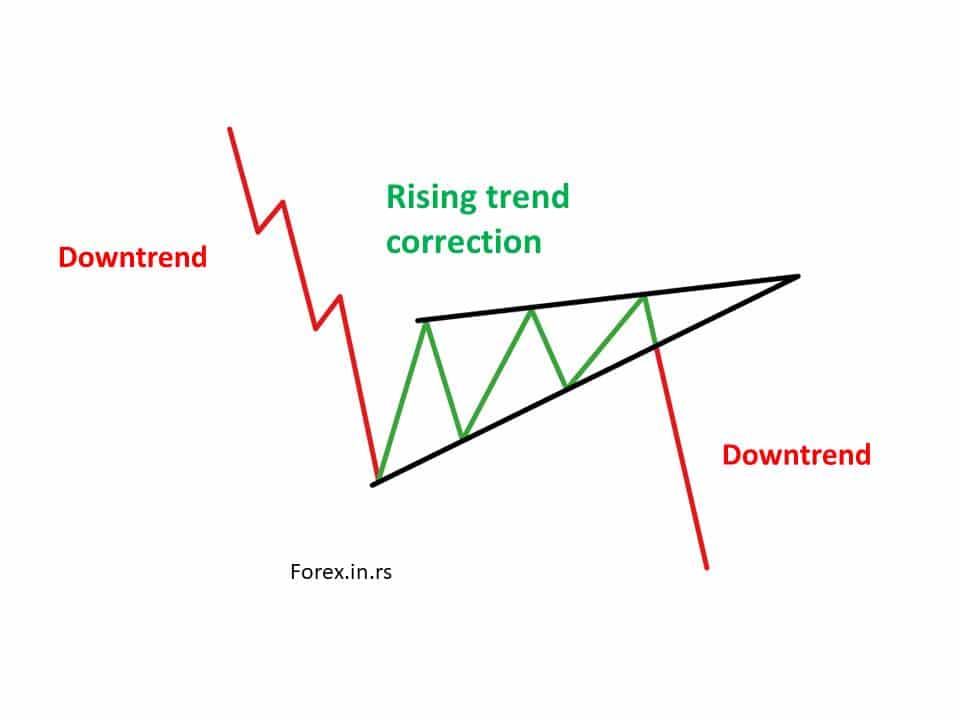

The rising wedge pattern represents a bearish continuation pattern that is formed after the rising correction. In a bullish trend, price bounces between two slopings begin wide at the bottom and contract as prices move higher. After the rising correction, the continuation patterns follow the major downtrend.

Primarily observed in downward trending markets, the rising wedge pattern stands opposite the falling wedge pattern. Therefore, the traders must know both falling wedge patterns and rising wedge patterns to identify the trend and make the best trading decisions.

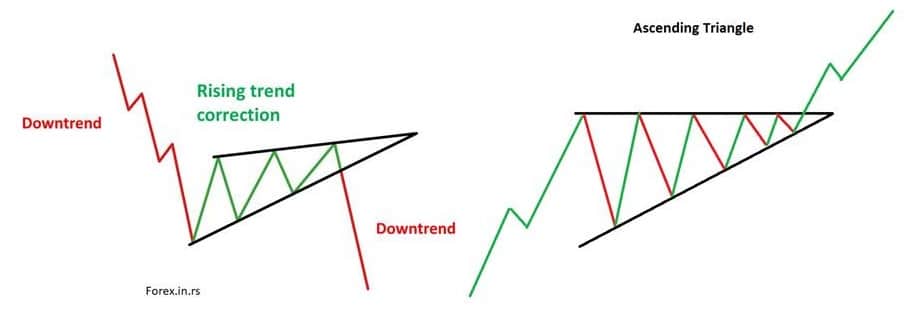

Ascending triangle vs. rising wedge

The difference between a descending triangle and the falling wedge is:

- The Ascending triangle has a flat top with higher lows or a rising trendline, while the rising wedge doesn’t have a flat top.

- The rising wedge is a bearish pattern and follows the major bearish trend, while the descending triangle is a bullish pattern.

Is rising wedge bearish or bullish?

A rising wedge is always a bearish pattern. By definition, a rising wedge usually follows a major downtrend and has three stages: major downtrend trend, correction, and continuation of a bearish trend.

A rising wedge pattern, one of the most popular reversal patterns, helps predict the direction and distance of the next move in prices. The reason behind the popularity of the pattern rests in its easy application and identification. Read with us to gather knowledge on the rising wedge pattern, identify and trade using the rising wedge pattern, and the pros and cons of using this pattern.

The rising wedge pattern also referred to as the ascending wedge, is a price pattern that comes into formation when the price is bound in the middle of two upward rising trend lines. It is possible to ascertain the reversal and continuation patterns from the bearish chart formation based on the location and the ongoing trend. However, irrespective of the position of this trend, you must keep in mind that this trend is always bearish.

To quickly identify the rising wedge pattern, you must also know how the falling wedge pattern appears. A falling or a descending wedge pattern is majorly distinguished from the rising wedge pattern by a slant of the triangle. The falling wedge can be seen descending downwards in the middle of the two converging trend lines, finally reaching the apex point, which identifies the bullish pattern.

Identification of the Rising Wedge Pattern While Trading

There can be doubts in identifying the pattern owing to its possible interpretation as both a bearish continuation and a bearish reversal pattern. In both these cases, there are different measures of identification that must be kept in mind.

A rising wedge continuation pattern identification:

- A fixed downtrend would be present

- The formation of a rising wedge consolidation can be observed

- A link of the lower lows and higher highs with the help of the trend line that forms towards the narrow point

- Look for the divergence among price and volume by employing the volume function (You can use MACD as well)

- Confirmation of the overbought signals by using technical tools such as oscillators

- Keep an eye on the break occurring under the support point for making a short entry

A rising wedge reversal pattern identification:

- A fixed uptrend would be present

- The formation of a rising wedge consolidation can be observed

- A link of the lower lows and higher highs with the help of the trend line that forms towards the narrow point

- Look for the divergence among price and volume by employing the volume function (You can use MACD as well)

- Confirmation of the overbought signals by using technical tools such as oscillators

- Keep an eye on the break occurring under the support point for making a short entry

A rising wedge pattern can be observed both as a continuation and a reversal pattern, as has been mentioned already. Let’s consider the rising wedge pattern occurring as a continuation. One can observe the uptrend pattern by employing the volume tool on the chart that points at a fading volume in link to the ascending price prevalent in the market. This is also referred to as divergence, which signifies that the uptrend movement is almost finished.

There can be an entry point once the trend support line has been breached on the rising wedge. The two common ways of making an entry are either by waiting for a candle below the point of support trend before making an entry or entering the short position just when the support line is broken by the price irrespective of the candle close.

The stop level is identified from the top point of the pattern on the trending line of resistance. Once it is identified, you can quickly locate the stop level for the trader. It helps in giving the trader a positive ratio of risk and reward in all cases.

The Pros and Cons of the Rising Wedge Pattern

There are multiple pros and cons of each pattern, which help the trader identify the best pattern for themselves. Therefore, before trading with the rising wedge pattern, you must consider its pros and cons.

Wedge Pattern trading Advantages:

- The rising wedge pattern is easy to identify if proper steps are followed, especially for experienced traders.

- This pattern is a common occurrence in the financial markets

- It points out the stop, entry as well as limit levels

- It has a high chance of rewarding you with a positive ratio of risk and reward

Wedge Pattern trading Disadvantages:

- With the dual possibilities, identifying the rising wedge pattern can be difficult for new traders.

- There is a high chance of incorrect identification of the pattern

- There is a need to employ other indicators for confirmation purposes, such as technical indicators and oscillators

- It can indicate both reversals as well as a continuation pattern

Therefore, the rising wedge pattern can be beneficial if one can identify it correctly and trade with it at the right time. There is a high possibility of having a positive ratio of risk and rewards. However, if you cannot identify the trend correctly, you must think twice before trading with it. Before using any direction in the forex market, it is essential to know how it works and the correct usage and identification of a trend.