A Doji candlestick can indicate markets’ inability to make decisions and the possible changes in a particular direction. Doji candlesticks are famous and extensively accepted by traders because they are apparent candles to point out, and their work serves as outstanding information for planting stops.

What is a Doji candle?

The Doji candlestick pattern or Doji candle represents a reversal pattern candle where the open and close price levels have the same value or are approximately equal for the given period. Usually, the doji candle indicates a possible change in the trend or trend reversal.

Standard Doji is an alone candlestick, which does not add up too much itself. To realize the meaning of this candlestick, dealers notice the previous price activity adding up to the Doji.

The deals depended on Doji candlestick patterns, which should be considered. In this case, a Standard Doji moving upward may show a bit of preservation of the current upward flow.

Dojis form when a currency pair opens and closes on a similar stage in the time-lapse of the chart on which the Doji appears. Despite the fluctuation in rates between the opening and closing of the candle, the truth is that the opening and closure occur at nearly similar rates when the market cannot decide whether to take the duo upward or downward.

The deals diverted to longer-term trends are the ones with higher chances. When a Doji appears at the base of a retrievement in an upper direction or the elite in a downward trend, the opportunities to deal with Doji are more significant. In an upward trend, the spot will go beneath the bottom wick of the Doji, and in a downward trend, the spot will go beyond the top of the wick.

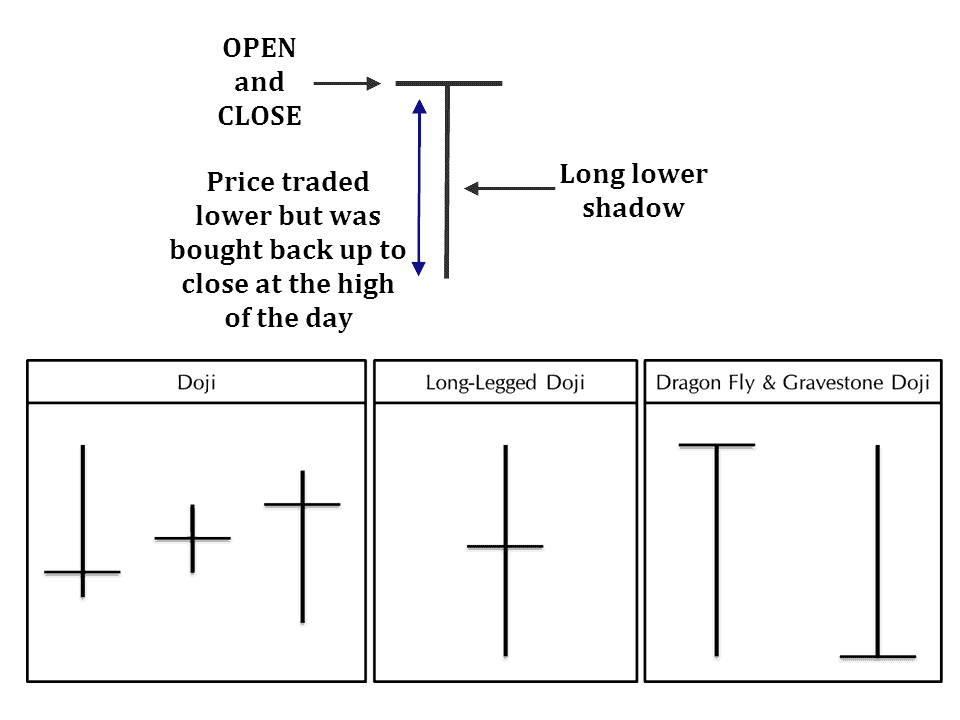

It becomes prominent in a market that is neither dominated by the bulls nor by the bears. However, there are five variations of the Doji candlestick, and none highlights indecision in the market.

Since each pattern indicates a different type of market, every trader needs to understand how these candles are formed and how they can predict prices in the future in the Forex market.

This article will teach you about Doji candlesticks, including the five different Doji patterns and their uses in forex trading. We will highlight some top trading strategies using the Doji candlestick pattern.

Double Doji Pattern

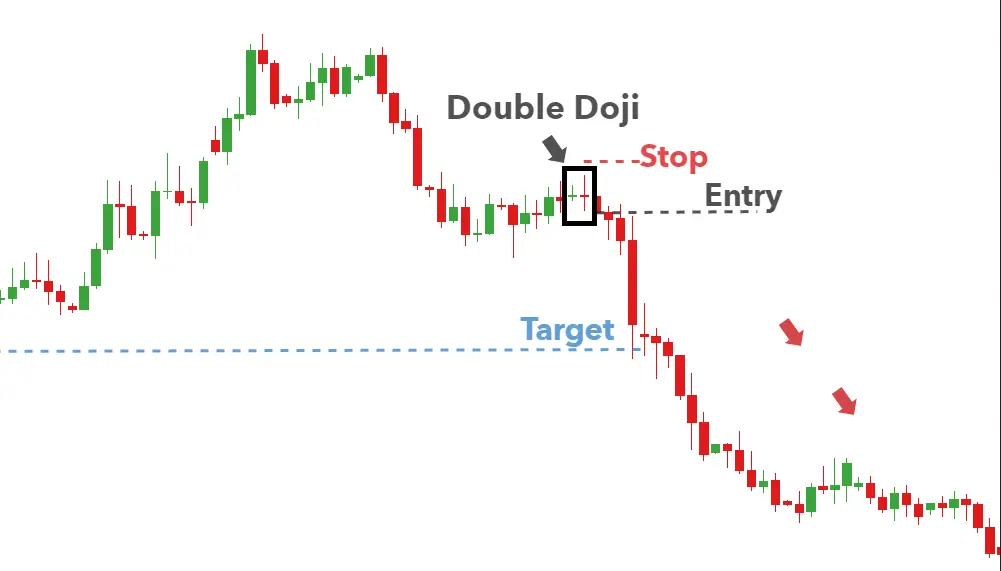

The double Doji pattern consists of two candles, one after the other, representing a solid reversal pattern. The double Doji pattern is rare and usually has more muscular reversal strength than single Doji.

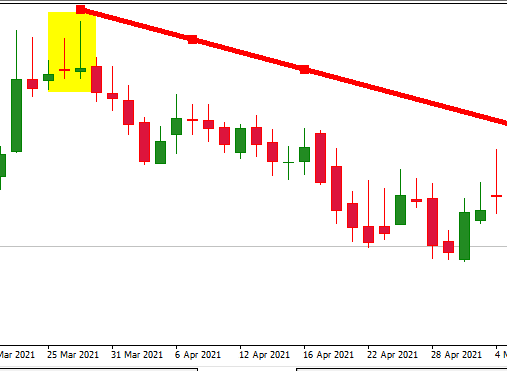

Below, we can see two doji candlesticks in a row (yellow color on the screen)

Double Doji is presented with a yellow color in the image above.

The double doji pattern is formed when two consecutive doji candlesticks appear within the same price range, as seen in the image above. A doji candle is characterized as opening and closing at or near the same price level, creating a “cross” shape on a chart. This indicates that buyers and sellers are essentially in balance; therefore, no clear market direction can be ascertained from this single candle alone. It’s only when two consecutive dojis form within the same price range that traders should take notice, as this could potentially signal an upcoming trend reversal.

The first step to identifying a potential double doji pattern is to look for two consecutive long-legged (or “gravestone”) doji with bodies at or near the same price level. Once these two candles have been identified, traders should look for other signs of support or resistance to confirm whether they are looking at an excellent double doji pattern. For example, suppose a significant volume exists on one side of the market (either buy or sell). In that case, it may suggest that buyers or sellers are trying to push through their desired direction, which would invalidate any potential double doji pattern forming.

Once the validity of a double doji pattern has been confirmed, traders should watch closely for any follow-up signals, such as trending prices, moving averages, oscillators, etc., which may suggest a continuation in either direction once the consolidation period ends (i.e., when prices break out). Also, since there is no clear directional bias associated with a double doji pattern, traders need to use proper risk management techniques when trading this type of setup to minimize losses if the trade does not go according to plan.

We know that the Doji Star or Single Doji reflects the indecisions in the market. Where the Single Doji ends, the Double Doji begins. By the end of the single Doji, the indefinite period ends, and the Double Doji pattern shows a significant change in the trend direction.

A Single Doji is usually a strong reflector of reversal, but the two consecutive Dojis present a much greater indication, often ending in a strong breakout. This strategy allows you to capitalize on solid directional moves in the market that unfold when there has been a period of indecision. The traders can look for the desired trend after the Double Doji and trade accordingly.

Double Doji Implementation in Trading

After the Double Doji pattern on the chart, we will have a higher probability of a more substantial reversal in the trend. The Double Doji pattern is solid in the Daily, Weekly, and Monthly charts because it can bring large movements.

In conclusion, understanding how to identify and trade off double doji patterns can be very beneficial for new and experienced traders; however, always remember to use proper risk management techniques when trading any setup to ensure you’re minimizing losses and maximizing profits over time.