Table of Contents

One can venture into the world of Forex trading with limited investment. Some Forex brokers even let their clients open an account with a minimum deposit as low as $100. Whether you have limited capital or not, everyone wants to use a higher sum than their actual investment to make more profits. This is possible with leverage.

Leverage is vital in Forex trading and is offered by the broker. Let’s explore the term, its advantages, and its disadvantages.

What is leverage?

Leverage means using something to maximum advantage. In finance, leverage is using borrowed money to invest.

For a layman, leverage is a small thing that can be used for more significant purposes. Forex trading leverage is the ratio at which a small investment in your trading account controls a more substantial investment operating in the market.

What is Leverage in Forex Trading?

Leverage in forex represents the ability to make larger positions with a smaller amount of actual trading funds using borrowed capital from the broker. It is the ratio of the trader’s funds to the size of the broker’s credit. Brokerage accounts allow traders to use leverage as borrowed funds to increase trading positions. The leverage ratio can amplify both profits and losses.

This difference in the two capitals is also known as the trading on margin in the stocks or forex market. Interest is charged on this margin in the stock market, but this is not true in the Forex market. Traders are not required to pay any interest on this margin, irrespective of their credit and account types. Your Forex broker will offer you a margin that you can use to trade.

In our article, you can read more details about leverage in forex.

What is 1:100 leverage?

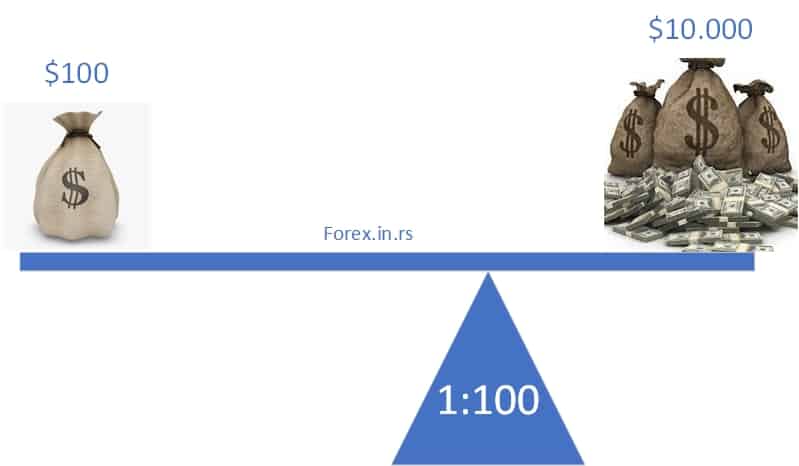

Leverage 1:100 means that for every $1 in the trading account, traders can trade up to $100 in value in the market, and the required margin is 1%. The lower the margin requirement, the more leverage can be used on each trade. The leverage ratio in the foreign exchange markets is commonly as high as 1:100.

1:30 leverage

Leverage 1:30 means that for every $1 in the trading account, traders can trade up to $30 in value in the market, and the required margin is 3.3%.

Below, you can see a Table with maximum leverage and required margin:

| Margin Requirement for leverage | Maximum Leverage |

|---|---|

| 5.00% | 1:20 |

| 3.00% | 1:33 |

| 2.00% | 1:50 |

| 1.00% | 1:100 |

| 0.50% | 1:200 |

| 0.25% | 1:400 |

Additionally, you can read a similar article about 1:50 leverage.

What is leverage in forex for beginners?

The best leverage in forex for beginners is 1:30 or 1:50. In this case, new beginner traders will learn to risk smaller amounts of money and not be able to open risky prominent positions. The best way to trade as a beginner trader is to risk less than 1% of the equity at the time.

Small risks can protect your account and portfolio. If you risk too much money, you will need a lot to recover your lost positions. See Table as proof:

What is the difference between margin and leverage in forex?

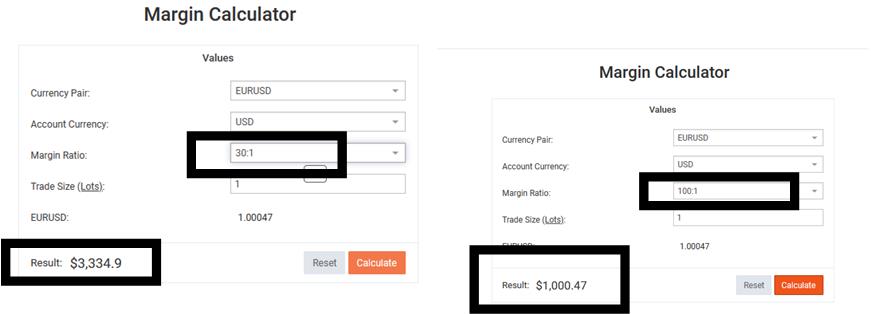

The margin represents the money required to open a position, while leverage represents buying power multiplying exposures to account equity. However, margin, leverage, and lot size are interconnected. For example, if your EURUSD lot size is one lot, leverage 1:100, and your margin is around $1000. On the contrary, if your lot size is one lot, leverage 1:30, so your margin is over $3000.

What is the difference between leverage and lot size?

The difference between leverage and lot size is that leverage represents buying power multiplying exposures to account equity, while lot size represents trading size position. Together, several lots and leverage determine your trading margin. For example, if your EURUSD lot size is one lot, EURUSD price is 1, and leverage is 1:100, your margin is $1000.

What is maximum leverage in forex trading?

The maximum leverage in forex trading is usually 1:1000, and significant brokers offer this ratio. However, the majority of traders use 1:100 or 1:500.

What is the best leverage to use in forex?

The best leverage in forex is 1:100 because it is standard leverage. However, European traders need to use 1:30. Even if you have a high-leverage opportunity from your broker, you should not risk more than 2% of your money at any moment.

Do you have to pay back leverage forex?

You do not need to repay leverage in forex trading because brokers will not add their capital to your account. The broker only gives you more extensive buying power. For example, if you have $1000 in your account and 1:100 leverage, your broker will not add $100 000 borrowed money into your account. You will be able to buy more (100 times more extensive buying power), but at the same time, you can lose more money if the price is against you.

What are the Benefits of Trading Using Leverage?

Leverage is an important feature offered by Forex brokers. It helps you trade with higher capital and make more profits. For example, consider operating with a 1:100 leverage. This is the most common leverage in Forex. It means that with an investment of $1, you will be working on an investment of $100 in the market. $1 is your money, and $99 is the borrowed money, your leverage. Since your operating amount is $100, you can make more profits. Your broker will sponsor this borrowed money, which must be repaid.

Before leverage was introduced in the Forex market, a 10 % movement in the account for a year was expected. Everything was slow, but leverage changed it. Thus, the benefit of leverage is that it allows you to quickly invest more money in the market to fetch more profits.

How do you calculate leverage and trading margin?

The main leverage formula is:

Margin-Based Leverage Ratio = Total Value of Transaction / Margin Required

If the Margin-Based Leverage Expressed Ratio is 1:100, the Margin Required for the Total Transaction Value will be 1.00%. The margin requirement for 2% is 1:50 leverage.

Different Leverages

The brokers fix leverage amounts at their discretion. Different brokers have different ratios to offer to their clients. Their terms and conditions also vary. The most popular ones are explained below:

- 50:1 – This leverage is on the lower side, which means you can use $50 to trade in the market for every dollar in your account. For example, if you have a deposit of $100 with a broker, you can trade with an amount that is 50 times higher. In this case, $5000.

- 100:1 – As mentioned earlier, this is the most popular leverage in Forex trading and is usually offered to standard lot account holders. You get to trade $100 for every dollar in your account. As the minimum deposit amount for a standard account is typically $2000, you can trade with an amount equivalent to $200,000.

- 200:1 – This leverage amount is offered to mini-account holders with a typical minimum deposit of $500. With this leverage, you can trade 200 times the amount in your account. You can still control $100,000 in the market if you only have a minimum deposit.

- 400:1—This leverage is on the higher side. None of the brokers offer this leverage. You can usually get this if you hold a mini-account. The minimum deposit is around $500, so you can control $200,000 in the market.

1:50 leverage vs. 1:100

In trading, 1:50 leverage is twice the buying power of 1:100 leverage. 1:50 means that for every $1 in the trader’s account, a trader can place a trade worth up to $50. 1:100 means that for every $1 in the trader’s account, a trader can place a trade worth up to $100.

For example, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:100, your trading margin is $1000. That means you can not open a one-lot position if you do not have at least $1000. However, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:50, your trading margin is $500. That means you can not open a one-lot position if you do not have at least $500.

Let us see one example:

1:100 leverage vs. 1:500

In trading, 1:100 leverage is five times more minor buying power than 1:500 leverage. 1:100 means that for every $1 in the trader’s account, a trader can place a trade worth up to $100. 1:500 means that for every $1 in the trader’s account, a trader can place a trade worth up to $500.

Please read our detailed article with examples of 1:100 leverage vs. 1:500

For a 1:100 Leverage Ratio:

- Leverage: 1:100 means you can control $100 for every $1 in your account.

- Margin Requirement Per Lot: $1,000 = (1 Lot × 100,000 units) / 100

- Maximum Number of Lots: With $10,000, you can trade up to $10,000 / $1,000 = 10 lots

For a 1:500 Leverage Ratio:

- Leverage: 1:500 means you can control $500 for every $1 in your account.

- Margin Requirement Per Lot: $200 = (1 Lot × 100,000 units) / 500

- Maximum Number of Lots: With $10,000, you can trade up to $10,000 / $200 = 50 lots

- With 1:100 Leverage: You can trade ten lots in a $10,000 account.

- With 1:500 Leverage: You can trade a maximum of 50 lots in a $10,000 account.

For example, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:100, your trading margin is $1000. That means you can not open a one-lot position if you do not have at least $1000. However, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:500, your trading margin is $200. That means you can not open a one-lot position if you do not have at least $200.

Leverage 1:200 vs. 1:500

In trading, 1:200 leverage has 2.5 times more minor buying power than 1:500 leverage. 1:200 means that for every $1 in the trader’s account, a trader can place a trade worth up to $200. 1:500 means that for every $1 in the trader’s account, a trader can place a trade worth up to $500.

For example, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:200, your trading margin is $500. That means you can not open a one-lot position if you do not have at least $500. However, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:500, your trading margin is $200. That means you can not open a one-lot position if you do not have at least $200.

1:500 vs. 1:1000 leverage

In trading, 1:500 leverage has two times more minor buying power than 1:1000 leverage. 1:500 means that for every $1 in the trader’s account, a trader can place a trade worth up to $500. 1:1000 means that for every $1 in the trader’s account, a trader can place a trade worth up to $1000.

For example, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:500, your trading margin is $200. That means you can not open a one-lot position if you do not have at least $200. However, if the EURUSD price equals 1, and you trade one lot with a leverage of 1:1000, your trading margin is $100. That means you can not open a one-lot position if you do not have at least $100.

How to Handle Leverage Professionally?

High-leverage amounts do not blind professional traders. They generally use 20:1 or 10:1 leverage and make several small trades, safeguarding their capital. Do not invest in one trade if you want to take full advantage of leverage. Move gradually and aim for consistent returns rather than a miraculous one-time deal. These professional tricks followed by veteran traders and investors will help you establish yourself as a Forex trader.

The best option for traders is to have brokers that can offer various leverages. In that case, the trader can change the leverage ratio in the broker’s website dashboard.

A Word of Advice

Leverage is nothing but buying power. You can make more profits with it, but it can also take an ugly turn. It only promises extra investment, not profit. Many aspects govern whether there will be gains or losses. Many traders, especially the new ones, aim for higher leverage, like Fx trading 400 leverage, hoping to make more profits. Higher leverage does not necessarily translate into higher profits. It can lead to equally high losses. We suggest you aim for leverage that you can easily manage and remember that the chances of making losses are real. Instead of having an optimist approach, have a realist approach towards leverage and Forex trading.