Table of Contents

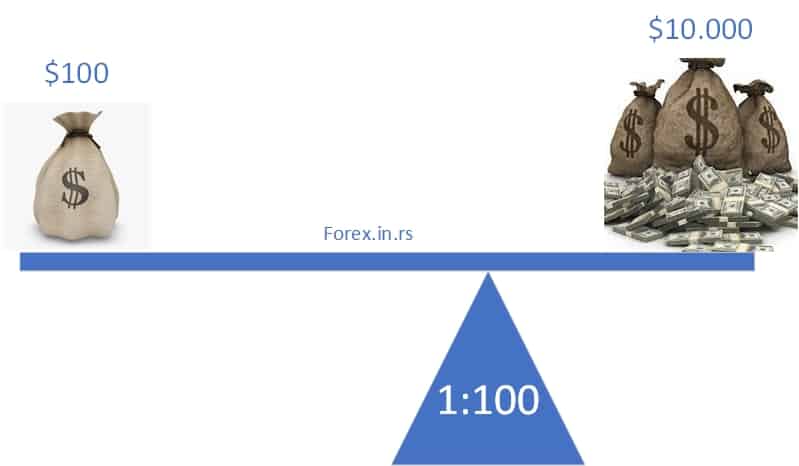

Leverage is a cause that refers to using borrowed funds to increase the potential return on investment. It is using debt or borrowed capital to amplify potential gains or losses from an investment.

In finance, Leverage can be used in various ways, such as:

- Financial Leverage: Financial Leverage refers to using borrowed funds to finance an investment. For example, a company may issue bonds to raise capital to fund its operations, which increases its debt-to-equity ratio and Leverage.

- Trading Leverage: Trading leverage refers to using borrowed funds to enter a trade in the financial markets. For example, a trader may use a margin to enter a position in a financial asset, increasing the potential return or the possible loss.

- Operating Leverage: Operating Leverage refers to the degree to which fixed costs are used in a company’s operations. A company with high fixed costs and low variable costs has high operating Leverage, which means that a small change in revenue can significantly impact its profitability.

What is the Turn of Leverage?

Turn of Leverage, also known as the leverage ratio or debt service coverage ratio (DSCR), is a financial metric that measures a company’s ability to manage and service its debt. It compares the company’s financial borrowings with the income needed to cover its debt payments, excluding the impact of interest, taxes, depreciation, and amortization.

To calculate the Turn of the Leverage ratio, you can use the following formula:

Turn of Leverage = EBITDA / Total Debt Service

Here, EBITDA represents earnings before interest, taxes, depreciation, and amortization, and Total Debt Service represents the company’s total debt obligations, including principal and interest payments.

Let’s break down each component of the formula:

- EBITDA: This measures a company’s operational performance that removes the impact of non-operating expenses, such as interest and taxes, and non-cash expenses, like depreciation and amortization. EBITDA is used in this ratio to provide a clearer picture of a company’s ability to generate cash flow from its core operations, which is essential for servicing debt.

- Total Debt Service: This represents the total amount of principal and interest payments a company needs to make on its borrowings during a specific period. It includes both short-term and long-term debt obligations. Total debt service is an essential component of the Turn of the Leverage ratio, as it measures the company’s financial commitments regarding debt repayment.

When analyzing the TuTurnf Leverage ratio, higher values indicate that a company has a greater capacity to service its debt, implying lower financial risk. Conversely, lower values suggest that the company may struggle to meet its debt obligations, signaling higher financial risk.

Turn of Leverage or tuTurnf debt or yield per tuTurnf Leverage represents an organization’s debt ratio to EBITDA leverage. This has also been called the yield per leverage turn.

Let’s suppose two debt turns would mean that the leverage ratio of the company would be double. Such a ratio is commonly required to calculate an organization’s ability to pay off the debt and the approximate time under which it is also to clear out all the debts. Moreover, stakeholders and credit agencies use such a metric to identify the probability of and urbanization of the debts.

Generally, a higher value would indicate that the firm wouldn’t be appropriately servicing the debt.

The calculation method of the Term of Leverage would be EBITDA/Debt.

What does one tuTurnf Leverage mean?

Turns Leverage (1 turn of Leverage) means that the company’s leverage ratio is 1x, fours of debt means the company’s leverage ratio is 4x, etc. This ratio represents the ability of the company to pay off its debt.

What is Half a Turn of Leverage?

A Half Turn of Leverage means the company’s EBITDA is only half the amount needed to cover its total debt service (principal and interest payments).

To put this into perspective, let’s use the Turn of Leverage formula:

Turn of Leverage = EBITDA / Total Debt Service

A Turn of Leverage of 0.5 means that the company’s EBITDA is only half the amount needed to cover its total debt service (principal and interest payments). In other words:

0.5 = EBITDA / Total Debt Service

A Turn of Leverage of 0.5 signifies a higher financial risk for the company, as it does not generate enough income to meet its debt obligations fully. This situation may lead to difficulty repaying debt, potential default, and financial instability.

It’s crucial to consider multiple financial metrics and ratios to evaluate a company’s financial health and risk profile rather than relying solely on the Turn of Leverage or DSCR. Other essential financial ratios include the debt-to-equity, current, and interest coverage ratios. By analyzing these ratios together, you can better understand a company’s ability to manage and service its debt.

Turn of Leverage Calculation Example

Let’s consider a hypothetical company, ABC Corp, to illustrate how to calculate the Turn of Leverage, also known as the Leverage Ratio or Debt Service Coverage Ratio (DSCR). We will use the financial data below to compute the ratio:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): $500,000

- Total Principal Payments (Annual): $200,000

- Total Interest Payments (Annual): $50,000

First, we need to calculate the Total Debt Service, which is the sum of the principal and interest payments:

Total Debt Service = Total Principal Payments + Total Interest Payments Total Debt Service = $200,000 + $50,000 Total Debt Service = $250,000

Now, we can calculate the Turn of Leverage using the formula:

Turn of Leverage = EBITDA Courtesytal Debt Service

Turn of Leverage = $500,000 / $250,000 Turn of Leverage = 2.0

In this example, ABC Corp has a Turn of Leverage of 2.0. This indicates that the company g times the amount of EBITDA required to cover its debt service obligations more significantly. Conversely, leverage greater than 1 suggests the company has sufficient income to cover its debt service requirements. In the case of ABC Corp, a ratio of 2.0 implies that the company is in a relatively strong position to service its debt. However, it’s important to remember that this is just one financial metric, and a comprehensive assessment of the company’s financial health should include financial ratios and economic indicators.

For a company formed with a $5 million investment from investors, company equity can be $5 million. This would be the money company uses for its operation. The company uses debt financing for borrowing $20 million now. It would have $25 million to invest in different business operations with an opportunity for inclining value, making it ideal for shareholders borrows bn automaker burrows money to create a new factory. This newly built factory would increase the number of products while making higher profits.

Conclusion

Through analysis and balance, investors can efficiently study equity and debt on the books of different firms. As a result, they can invest in companies putting Leverage on working on behalf of businesses.

Various statistics like equity debt, equity return, and the return on employed capital help investors determine how the company can deploy the employed capital and the total capital burrowed by these companies.

In business, companies use Leverage to find out and generate shareholder wealth. However, it might also fail to do such, as the default credit risk and interest expense result in diminished shareholder value.