Table of Contents

What is Key Reversal?

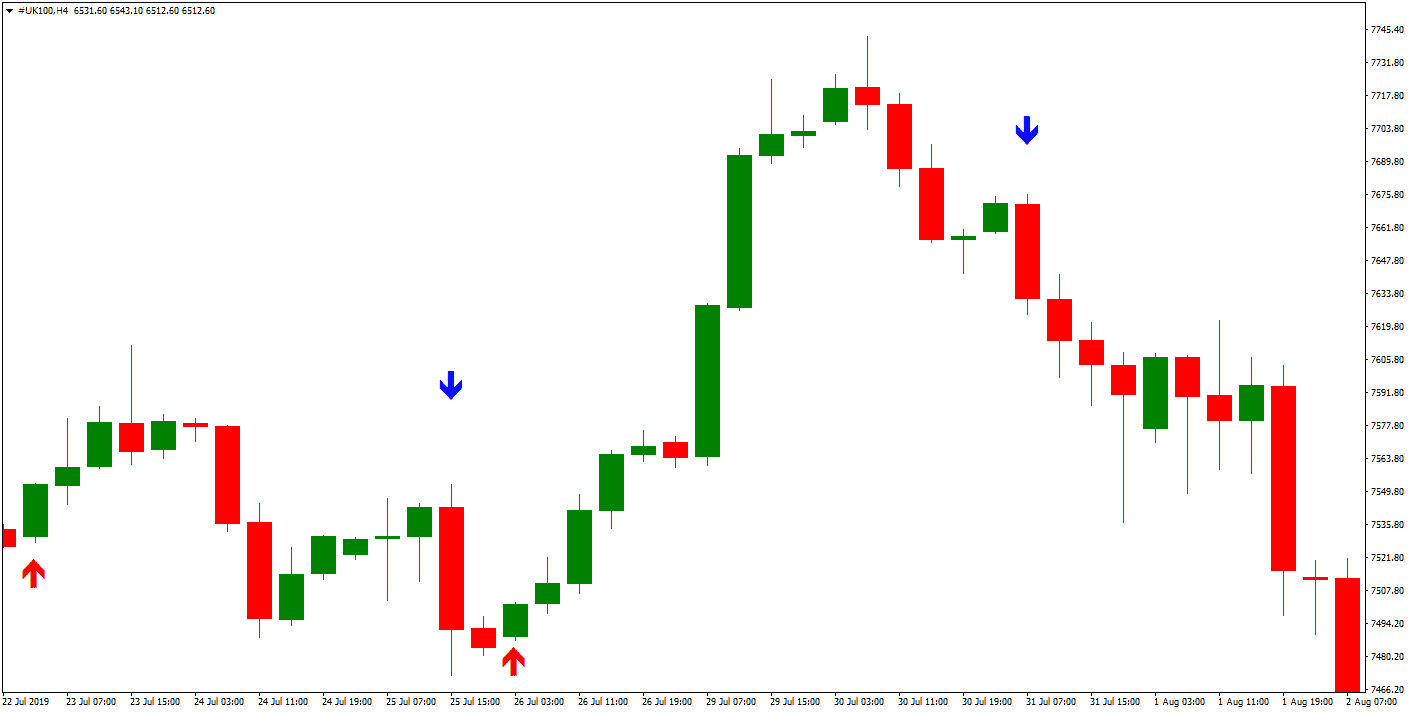

A key reversal or reversal day and a one-day reversal is simple pattern recognition tool that helps traders identify possible trend reversals. Traders can use this information and capitalize on possible market conditions.

Key reversal day is the day candle when significant trend reversal.

Please, you can download the free key reversal indicator: Download key reversal indicator.

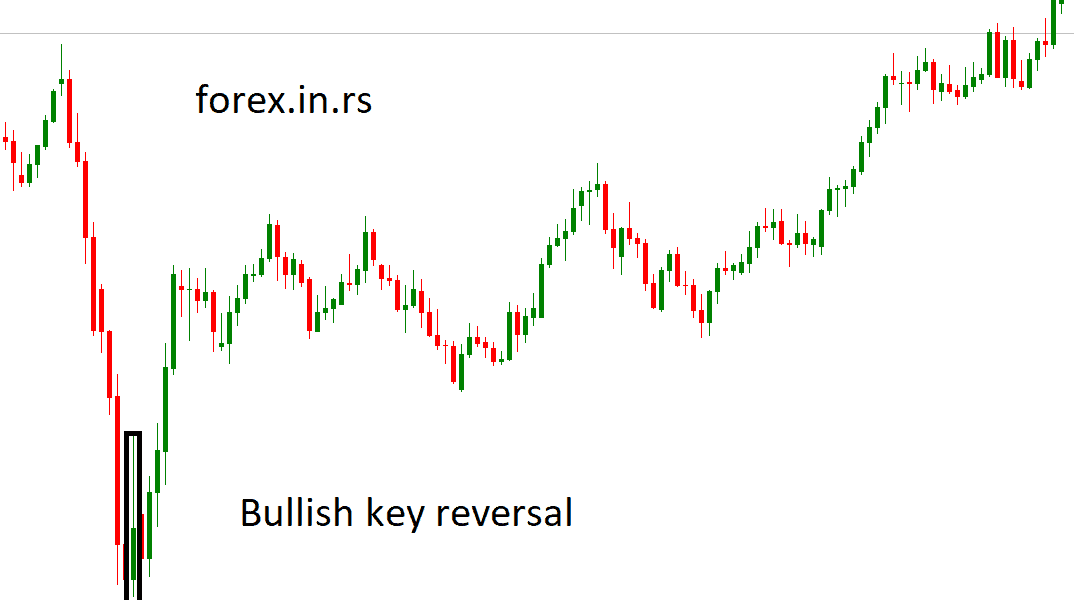

What is bullish key reversal?

Bullish Key Reversal day represents a daily candle on the chart from which the declining trend stops and the rising trend occurs on the chart.

Reversal day is presented with the black box below:

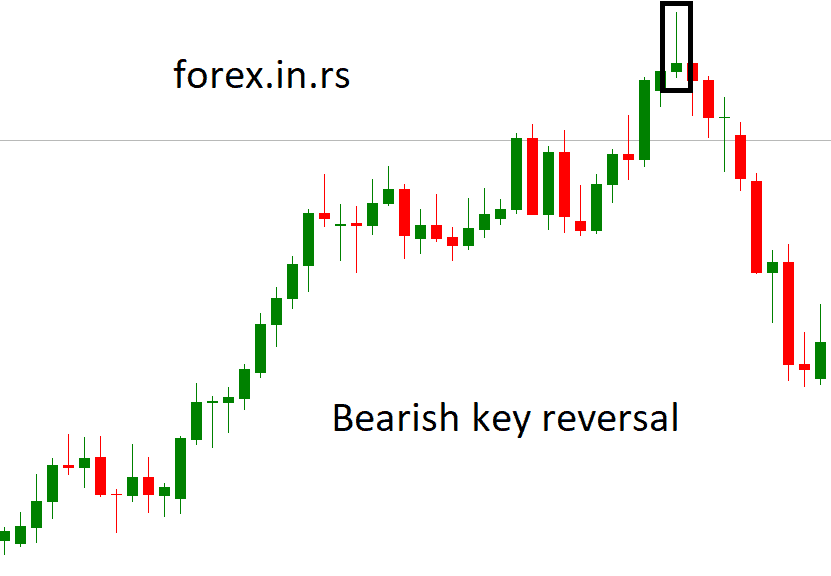

What is a bearish key reversal?

Bearish Key Reversal day represents a daily candle on the chart from which the bullish trend stops and the bearish trend occurs on the chart.

Reversal day is presented with the black box below:

Why is a Key Reversal Important?

Traders do technical analysis using various indicators, and a key reversal is an essential part of it. It allows traders to predict how a current trend will move. Traders can you this knowledge to find profitable entry and exit points. Traders, however, need to keep in mind that key reversals should not be used in solitary. Instead, use them in conjunction with other indicators like the Moving Averages.

Working of Key Reversals

The occurrence of a key reversal is not very common. It depends predominantly on the type of stock that you are trading. Key reversals might not take place all the time, but you can rely on them when they do. This is when a key reversal day occurs:

When there is an uptrend: an asset’s prices reach a new high before closing near the last day’s lows.

When there is a downtrend: an asset’s prices reach a new low before closing near the last day’s highs.

Keep in mind that these key reversals are more reliable when there has been a strong trend. This is what you should look for when a trend has ended:

When an uptrend has ended:

- The Open has to be above the previous day’s close.

- There has to be a new high for the new day.

- The close has to be below the last day’s low.

When a downtrend has ended:

- First, the Open has to be below the previous day’s close.

- Next, there has to be a new low for the new day.

- Finally, the close has to be above the last day’s high.

Understand the Key Reversal Bar

A key reversal can be used to identify both bullish and bearish signals.

A bullish ley reversal can be identified when the bar opens below the last day’s low but closes above it. A bearish can be identified when the bar opens above the previous day’s high but closes below.

If you are using signals for trading, you should wait for confirmation. First, open a position above the bar of a bullish key reversal. If you are doubtful, let the price close above the bar before buying. Sell or close a position below the bar of a bearish key reversal. To be sure, you can allow the price to close below the bar before you sell.

Related Terms

- Reversal Day: A change in trend is highlighted by reversal days. More than their occurrences, traders must focus on their potency.

- Closing Price Reversal: This is a powerful indicator that helps in the identification of trend reversals. If large spikes follow a substantial advance, this indicator becomes more critical.

- Hook Reversal: It is a candlestick pattern that does not last long and tells traders about possible reversals.

- Island Reversal: Island reversals help the traders to see the gaps between different signal days. It is a powerful reversal signal.

- Open-Close Reversal: This indicator can help you speculate a trend reversal after a strong trend.

- Pivot Point Reversal: This indicator is easy to understand, making it one of the most popular and widely used reversal patterns.