Table of Contents

In the world of trading, the movements of market prices are often described using various synonyms that encapsulate the direction and momentum of trends. A rising trend, indicating increasing prices, is commonly called a “bullish” trend, drawing from the imagery of a bull thrusting upwards. Conversely, a downtrend, marked by declining prices, is known as a “bearish” trend, akin to a bear swiping downward. These terms, along with others like “rally” for upward movements and “correction” for downward adjustments, enrich the financial vocabulary, providing nuanced ways to describe market dynamics.

Bullish definition

By general definition, the bullish term indicates certainty or hope that something or someone will be successful. Usually, this term refers to an optimistic future, such as rising stock prices (market price goes up).

What is the bullish trading market?

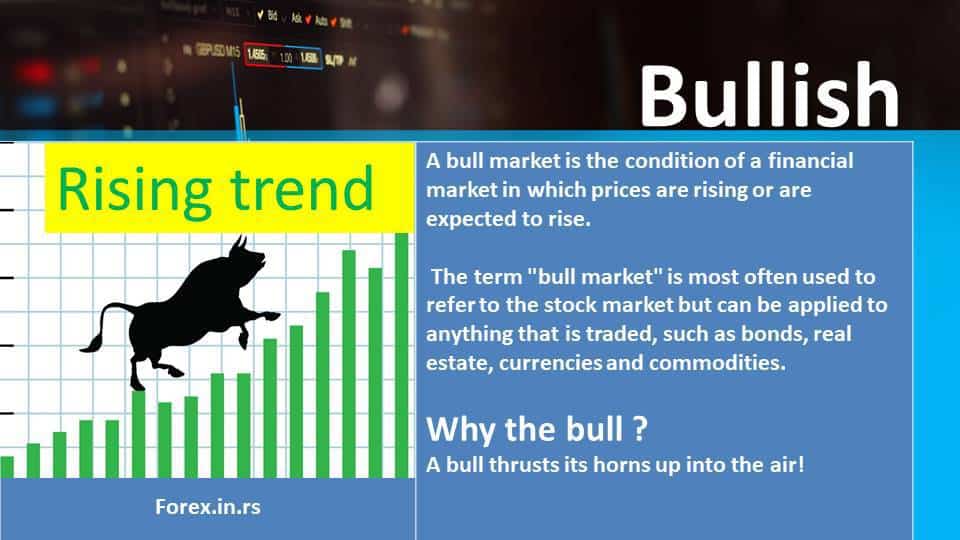

A bullish trend or bull market represents a rising market price or market price expected to rise. A bullish stock market meaning always refers to an optimistic rising price trend.

In financial markets, a “bullish trend” or “bull market” refers to a situation where market prices are either rising or expected to rise. This term is most commonly applied to the stock market, but it can describe any financial market, including commodities, real estate, or currencies.

The term “bullish” comes from how a bull attacks by thrusting its horns into the air. This is a metaphor for market prices that are moving upward. Here are some key points about a bullish market:

- Rising Prices: In a bull market, the prices of securities, like stocks, are rising. This increase in prices usually indicates a strong economy and high investor confidence.

- Optimism: Investors in a bull market are often optimistic about the future. They believe that strong results will continue, which encourages buying activity.

- Economic Strength: Bull markets often coincide with periods of economic growth, low unemployment, and strong corporate earnings.

- Investor Behavior: In a bullish market, investors are more likely to engage in buying activity due to the expectation of future price increases and potential profits.

- Duration: Bull markets can last for months or even years; a sustained increase in stock prices typically characterizes them.

Bull in forex

The trader is considered a bull, or his projection is bullish if he believes its value will increase.

Usually, they purchase a particular asset only if a trader is bullish. A person who is a bull on any help may have an opinion about the asset and not act on it since it is risky. The bullish stance may be particular to a specific asset or stock or a general opinion on the asset market.

What does bullish mean in trading? (see image below)

Very often, we will read on the internet “bull in forex,” “bullish stock,” or “bullish, bearish market,” etc. So, bull bullish is derived from a bully who strikes his horns upwards, increasing prices.

When an asset’s price rises or uptrend, it is called a bull market. This usually continues for a sustained period, typically some months or years. It should be noted that the terms long, bull, or bullish may be used interchangeably and indicate that asset prices will increase.

Like all other fields, many terms are unique to trading. A new trader will likely hear Bullish, bearish, long, and short terms and must understand their meaning to gauge the market and expert opinions. He must also understand these terms to communicate effectively with other traders. Understanding the term will also make it easier to determine a trader’s strategy and forecast for the market.

In trading, the term LONG is the same as BUY. If a person is going long on a stock, he plans to buy it. If a trader is extended on a stock, he has purchased and owns it. In trading, a trader will go long on or buy something whose value he believes will likely increase. The trader will plan to sell the asset at a higher price and make a profit. However, the value of the investment can also decrease.

Bearish and bullish definition

Bearish definition:

A bearish trend or bear market represents a falling market price, a financial market in which prices are falling or are expected to fall. Usually, a bearish equity market refers to a pessimistic downtrend.

For traders, being bearish, it believes that the asset value will decrease and is the opposite of bullish. A trade may be bearish about a particular category of assets or a specific company or currency. The trader may only have a bearish opinion and not act on it. Alternatively, he may sell his assets, going short on the asset. The term bear or bearish is derived from the bear’s behavior, which strikes downwards using its paws and pushes the prices downwards. A bear market also called a downtrend, is noticed when an asset’s prices fall over time, typically over the years or months.

The terms “bullish” and “bearish” in trading are derived from how bulls and bears attack, serving as metaphors for market movements.

- Bullish Trend: The term “bullish” comes from how a bull attacks its opponents. When a bullfights, it thrusts its horns up into the air. This upward movement symbolizes the upward trajectory of market prices in a bullish trend. In a bullish market, investors expect prices to rise, and this optimism often leads to increased buying activity, further driving prices upward.

- Bearish Trend: On the other hand, “bearish” is derived from the behavior of a bear. When a bear attacks, it swipes its paws downward. This motion represents the downward trend in market prices, as seen in a bearish market. In such a market, investors expect prices to fall, leading to increased selling or short selling, which further pushes prices down.

Why is it called a bear market? It is because of how a bear attacks its prey—swiping its paws downward.

Though trading is usually associated with purchasing at a low price and selling when the price increases, traders can also profit by selling when prices are high and purchasing the same asset when prices reduce. A trader who is shorting or being short will sell at a high price, hoping to buy the same asset later at a low price. The term short selling is also used for short. In the forex and futures market, traders can short it anytime. However, there are restrictions on the stocks that may be shorted in the stock market and when they can be shorted. If any trader claims to be shorting any asset, he believes prices will reduce.

Conclusion

A trader should act on his bullish or bearish opinion only if he has a clear trading strategy that is well-tested. A trader must understand these terms since they are used extensively in financial news, market analysis, and other articles on trading assets.