Table of Contents

Reversals in the forex market are common. There will always be changes until the trends go live. This fundamental principle is at the heart of several market reversal investment approaches and methodologies. It’s now a question of how to employ the correct tools to spot reversals and market patterns. One of the various reversal trading techniques available is the Lucky reversal indicator. However, distinguishing characteristics distinguish it from most other forex trading market reversal markers.

What is a lucky reversal indicator?

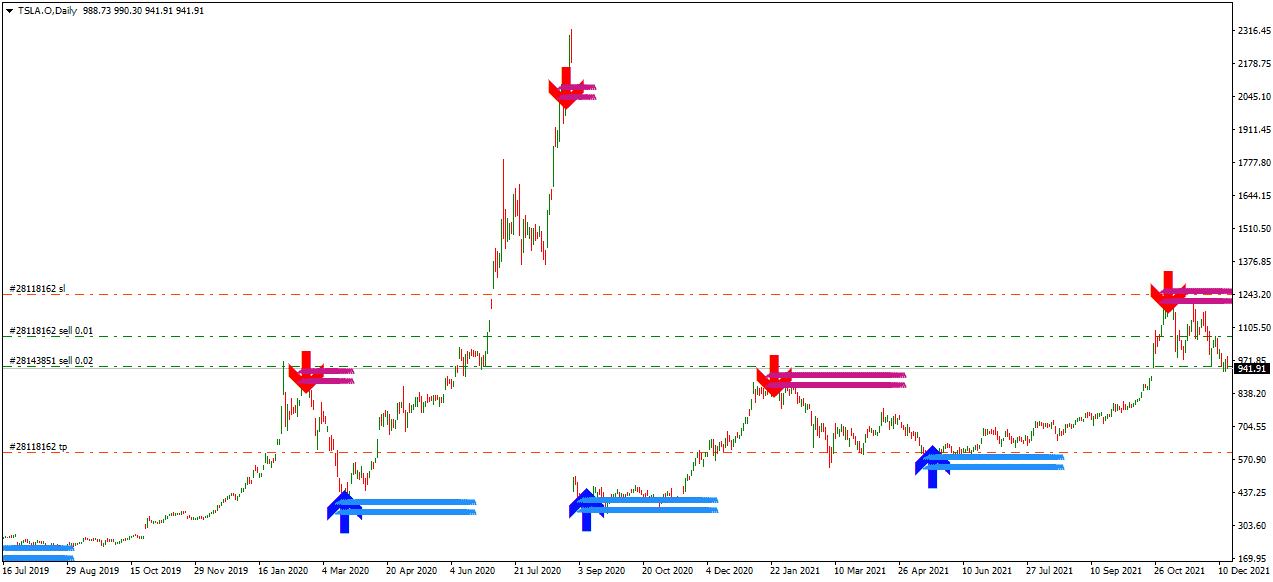

The lucky reversal indicator suggests when the market has shifted. It indicates whether the market has elevated or descended. Red and blue arrows characterize it, and curvy horizontal lines accompany each of these arrows. The red arrows depict when a trend reversal has descended, while the blue arrows show the commencement of an upraise.

Download the Lucky trend reversal indicator for MT4 below:

When there is a potential or temporary reversal, the indicators show a white square at that period. This characteristic of the Lucky reversal indicator might not be visible to many individuals at first glance.

Lucky reversal indicator flaws

Unfortunately, the Lucky reversal indicator has flaws like the other reversal indicators in the market. The primary cause is that it’s lagging, which results in traders being unable to trade for trade breakouts.

Many dealers have already had their fair share of annoying experiences with this indicator while trying to catch the trend during the commencement of the market. However, if you post-evaluate the indicator, you might notice that insignificant trend reversal. The bearish and bullish signals are at the top center or lowest center.

During a live exchange, once the market is wholly reversed, you can only notice the bearing or bullish signals. Once the market reversal has been confirmed, the arrows indicate the regressions show up. This ensures the lagging of the Lucky reversal indicator.

Advantages of Lucky reversal indicator

Who knew the significant shortfall of lucky indicators was its major advantage? During an emerging trend, the property of the lagging Lucky indicator can be used to approve trades, as it can barely catch up with the reversals. So, for example, you can buy or sell an uptrend that appears once the market has finished its cycle of reversal from a downtrend to an uptrend.

Trading Methods of Lucky Reversal Indicator

By including the Lucky reversal indicator in the trading system, you can easily use it parallel with the other trading tools. At the same time, the additional trading tools can be different market structures or indicators such as chart patterns, candlestick patterns, resistance, support, etc.

Now, we’ll check out the first trading strategy by merging the Lucky reversal indicator and the other tools with the help of the Moving Average Indicator.

Merging Lucky reversal indicator with Moving Average Indicator

Add the Lucky reversal indicator and the two moving averages on your chart. Change the timeframe of a single moving average to 20 while leaving the other as it is. Change the color of the averages so you can differentiate between the two. The fast-moving average will be the default, while the one with 20 as the timeframe is the slow-moving average.

Hold up until the Lucky indicator signals you to sell or buy. Remember that, as this indicator is slow, we are not considering looking at the trading signals provided by the indicator. Instead, we will look into the trends confirmed by the indicator, and we are only interested in trading at the entry opportunities. And this is done with the help of the moving averages.

Also, when the indicator gives an uptrend signal, remember only to purchase when the fast-moving average crosses the slow one in the upward direction. You can consider selling once the Lucky reversal indicator has changed the arrow from blue to red. It would help if you only sold when the indicator gives a downtrend signal and the fast-moving average passes the slow one in the downward direction.

This was how you could merge other indicators with the Lucky reversal indicator. If you consider using your technique, then there is no need to use the moving averages and their periods. All you have to do is find a trend indicator for trading and merge it with reversal indicators, as we did above.

Another technique still exists associated with trading the Lucky reversal indicator.

Buying and selling signals of Lucky reversal indicator

Whenever a trend reversal is possible, the Lucky reversal indicator shows a white square. The white square stays still from that moment while the price keeps fluctuating. When the reverse is fixed, the white square switches to either a downtrend or an uptrend. Make a suitable trade when the white square switches to buying or selling indicator at the close of the candle.

For example, when the indicator signals a downtrend, then sell the trade, whereas when the indicator signals an uptrend, buy the trade.

Management of Trade

Setting price goals is the ideal technique for profits for either of the trading methods listed above. However, before exiting a trade, don’t rely upon either of the signals to generate an opposite signal.

Also, remember not to increase your risk when you can’t afford it, to get a stop order. A general guideline is never to risk more than 2 percent of your investment on a single exchange. Keeping this in the account, you can create a stop order with whichever method suits you better.

An advantage of the Lucky reversal indicator is that the prices hardly pass over to another side once its curvy horizontal lines are drawn. Though you won’t consistently achieve an acceptable risk-to-return ratio, you can still take advantage of establishing your stop orders.

For moderate and skilled forex traders, the Lucky reversal indicator is ideal. Novice forex traders who know what delaying forex signals are and how to buy or sell them can also utilize the indicator, but they should take extra precautions. Beginners need first to learn how to spot forex trend-pattern reversals to gain the most out of them. Along with this, the trend reversal traders and the trend can benefit from these trend reversal markers.