The “US30” typically refers to the Dow Jones Industrial Average (DJIA), often called “the Dow.” The DJIA is one of the oldest and most well-known stock market indices in the United States. Created by Charles Dow in 1896, it originally consisted of 12 companies but has since expanded to 30 major publicly owned companies based in the United States. These companies span various industries, and the index aims to give a general sense of the health of the U.S. economy and stock market by tracking their collective performance.

The Dow’s 30 companies are not the largest by market capitalization (that title generally goes to companies within the S&P 500); they are still considered major players in their respective industries and hold significant influence in the stock market. If you’re referencing “US30” in trading, it could be the instrument ticker for trading the Dow Jones Industrial Average on specific platforms. As always, if you are considering trading, do thorough research and possibly consult with a financial advisor.

How to Trade US30 in Forex?

To trade US30 indices in forex platforms, you must choose a CFD (forex broker) offering indices as trading instruments. Usually, all major regulated brokers offer Dow (US30 index). However, you must add the US30 instrument to the visible Symbol list in the MT4 platform.

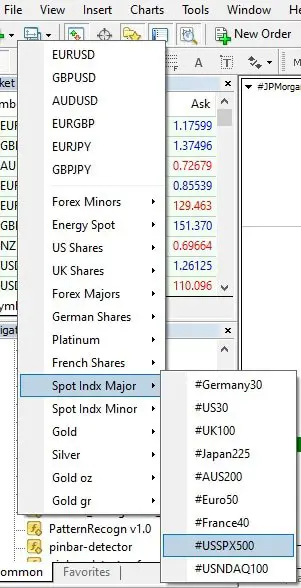

Here is an example of adding S&P500. To add US30, pick the US30 index.

Please read our article on how to add indices to MT4.

To add the US30 (Dow Jones Industrial Average) to your MT4 platform, you’d follow a procedure similar to adding any other instrument. Here’s a step-by-step guide explicitly tailored to adding US30:

- Open MT4 Platform: Start the MetaTrader 4 application on your computer.

- Access Symbols:

- Go to the top menu bar.

- Click on “View.”

- From the dropdown menu, select “Symbols” or press

Ctrl+Uon your keyboard.

- Locate the Indices Folder:

- You’ll find a list of folders in the Symbols window on the left.

- Find a folder that might be named “Indices,” “CFDs,” “Futures,” or something similar, as naming can vary based on the broker.

- Find US30:

- Expand the relevant folder (e.g., “Indices”) to view all available indices.

- Scroll through the list to find “US30” or a similar name representing the Dow Jones. The exact name might differ based on the broker – for instance, it could be “Dow,” “DJIA,” “US30,” or “US 30.”

- Enable US30:

- Click on the name (e.g., “US30”) to highlight it.

- With the index highlighted, click the “Show” button on the right-hand side. This will make the US30 available in the Market Watch window.

- Open a New Chart:

- Close the Symbols window.

- Go to the top menu bar.

- Click on “File.”

- From the dropdown, select “New Chart.”

- Please navigate to the Indices folder (or its equivalent name as given by your broker) and choose US30 or its equivalent name. A chart for the Dow Jones will then appear.

- Alternatively, Use Market Watch:

- If you have the Market Watch window open (activate it from the “View” menu or by pressing

Ctrl+M), you should see the US30 index listed. - To open a chart, drag and drop the index onto the main window or right-click it and choose “Chart Window.”

- If you have the Market Watch window open (activate it from the “View” menu or by pressing

Let us see how to add the US30 index on MT4y correctly.

It would help to have the US30 (Dow) chart on your MT4 platform. Remember, the exact availability and naming of the US30 may vary based on your broker’s offerings. If you can’t find it, consider contacting your broker’s customer service for clarification.

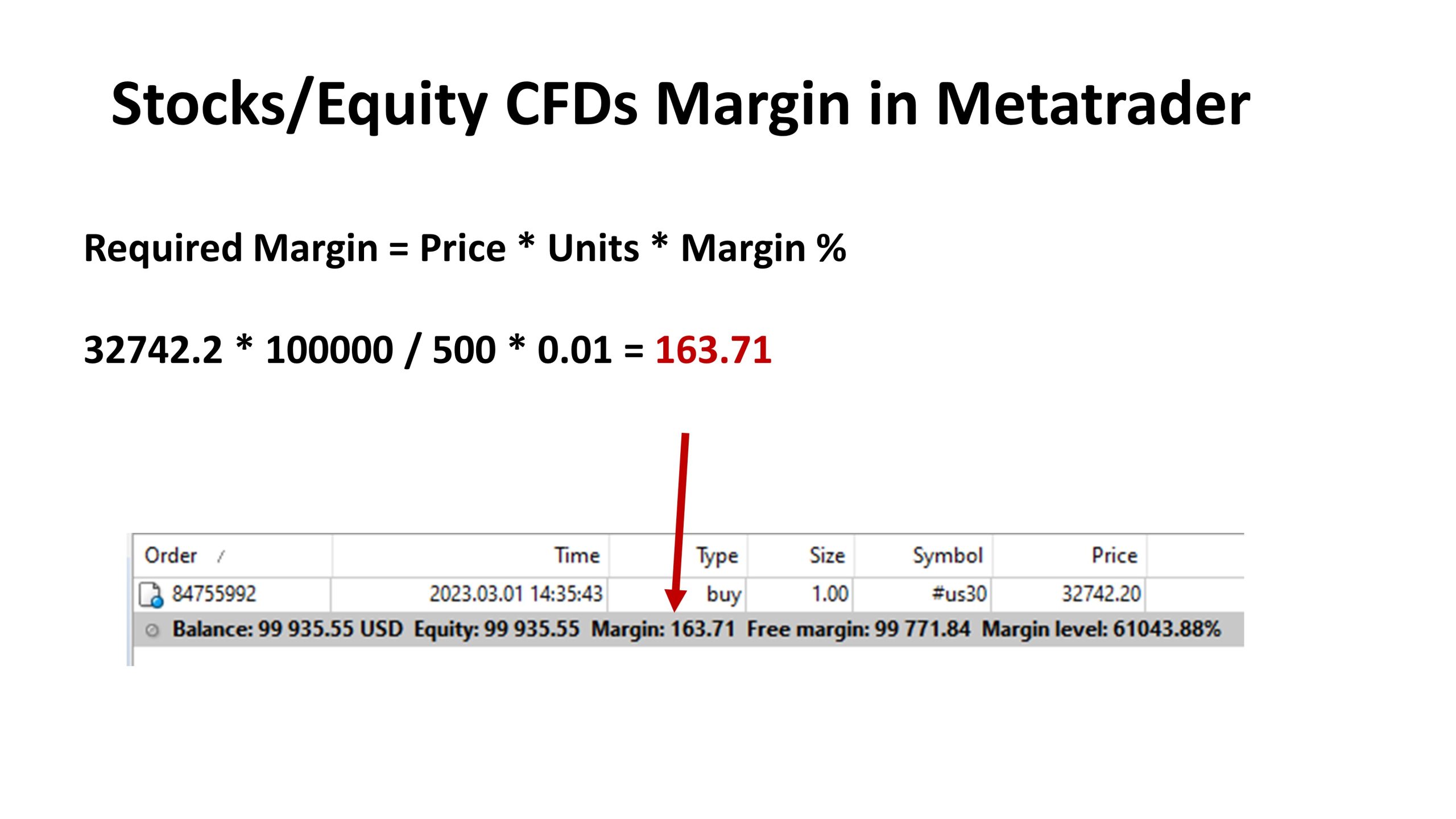

Calculate the Margin for the US30 index.

To calculate the Margin for trading instruments, including indices like the US30 on the MetaTrader platform, you need to consider factors like the instrument’s price, the number of units or contracts you wish to trade, the margin percentage set by the broker, and the Leverage provided.

Here’s a step-by-step breakdown based on the formula you provided:

- Identify the Parameters:

- Price: This is the current market price of the US30.

- Units: The number of contracts or lots you wish to trade.

- Percentage: The margin requirement set by the broker, expressed as a percentage.

- Leverage: The Leverage provided by your broker for trading the US30. Remember, as you pointed out, leverage for stocks and indices might differ from forex pairs.

- Plug into the Formula:

- Calculate:

- First, multiply the Price, Units, and Percentage together.

- Then, divide the result by the Leverage to get the required Margin.

For instance, let’s use a hypothetical scenario:

- Price of US30: 30,000

- Units (or lots): 1

- Percentage (or margin requirement): 1% (or 0.01 in decimal form)

- Leverage: 1:100 (This means for every dollar of your Margin, you can control $100 in the market)

Margin=

In this example, you’d need a margin of $300 to control one lot of US30 at the price of 30,000 with 1:100 Leverage.

Always know your broker’s leverage and margin requirements, as these can vary. It’s also essential to understand that Leverage amplifies both potential profits and potential losses. So, trade wisely and ensure you’re managing risk appropriately.

Conclusion

Trading the US30 in the forex market involves speculating on the price movements of the Dow Jones Industrial Average through CFDs, allowing traders to benefit from price changes without owning the underlying assets. It’s essential to understand the 30 companies within the DJIA, as their performance will impact the index. Before trading, one should choose a reputable broker that offers CFDs on indices and confirm their margin and leverage offerings.

Risk management is crucial, so employing strategies such as setting stop-loss and take-profit orders can be beneficial. As with all trading, continuous learning and staying updated with economic news and events that influence the U.S. economy will enhance decision-making. Remember, trading involves risks, so it’s wise to start with a demo account to practice and refine strategies before committing to real funds.