Table of Contents

This intricate dance of investment requires a thorough understanding of a wide range of concepts and strategies, each more intricate than the last. Among these, buying power and leverage are pivotal, serving as powerful tools for traders to enhance their potential returns while introducing additional risk layers.

This article explores the importance of buying power and leverage in trading, highlighting how they form the backbone of many successful trading strategies.

What is leverage in trading?

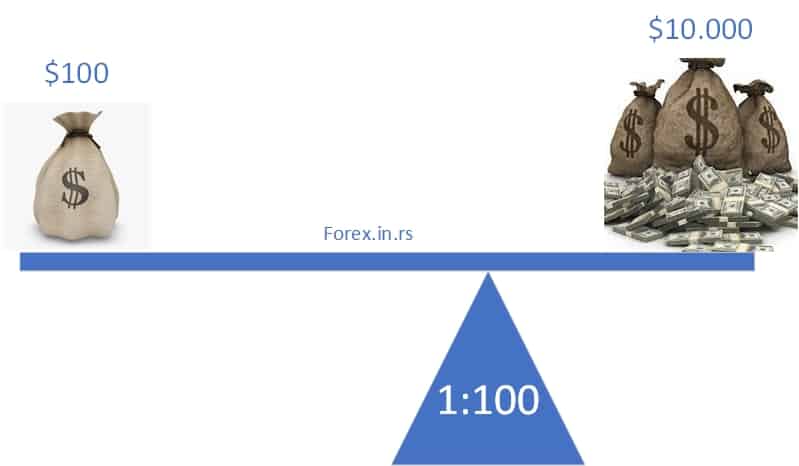

Leverage in trading refers to using borrowed funds as buying power, usually from a brokerage, to amplify potential profits from a trade. Leverage 1:100 means that for every $100 in your account, you can trade up to $10,000 in value.

Buying power refers to the total value of assets a trader can buy in their trading account without additional capital infusion, providing a clear picture of their potential trading scope. On the other hand, leverage refers to using borrowed capital to increase the potential return on investment. When leveraged judiciously, even a small initial investment can yield substantial returns.

However, these tools are not without their risks. The exact mechanisms that magnify profits can also amplify losses, presenting double-edged sword traders must handle cautiously. Thus, understanding the importance and application of buying power and leverage becomes critical to designing a robust trading strategy.

Can You Trade Forex Without Leverage?

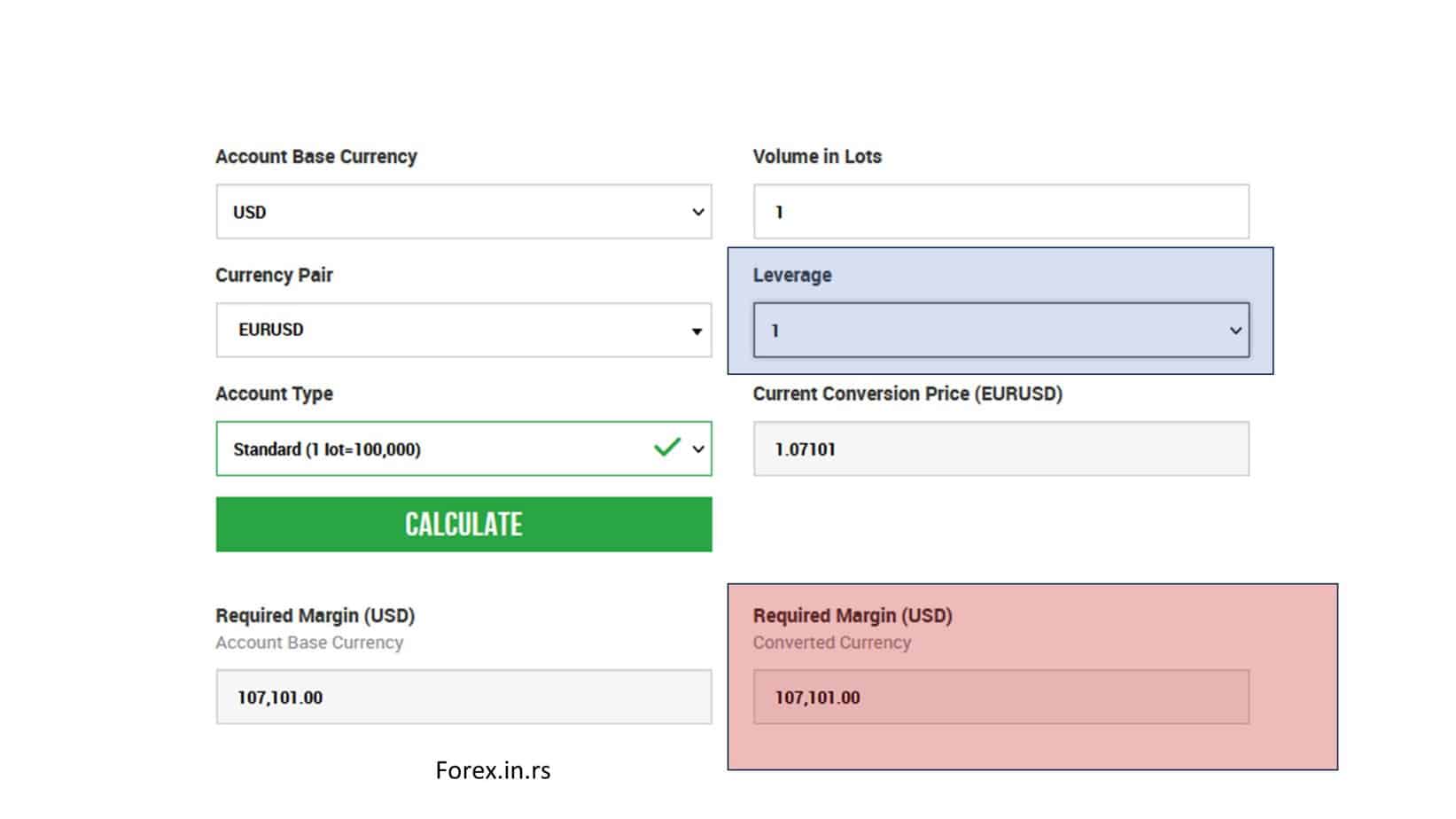

Yes, you can trade without leverage (1:1 buying power), but in that case, you need to have a large deposit in your portfolio to open trades. For example, if you trade without leverage, to open one lot EURUSD trading size order, you will need more than 107,000 dollars in your account.

Please watch my video about this topic:

We can see one example if we test 1:1 leverage on the margin calculator:

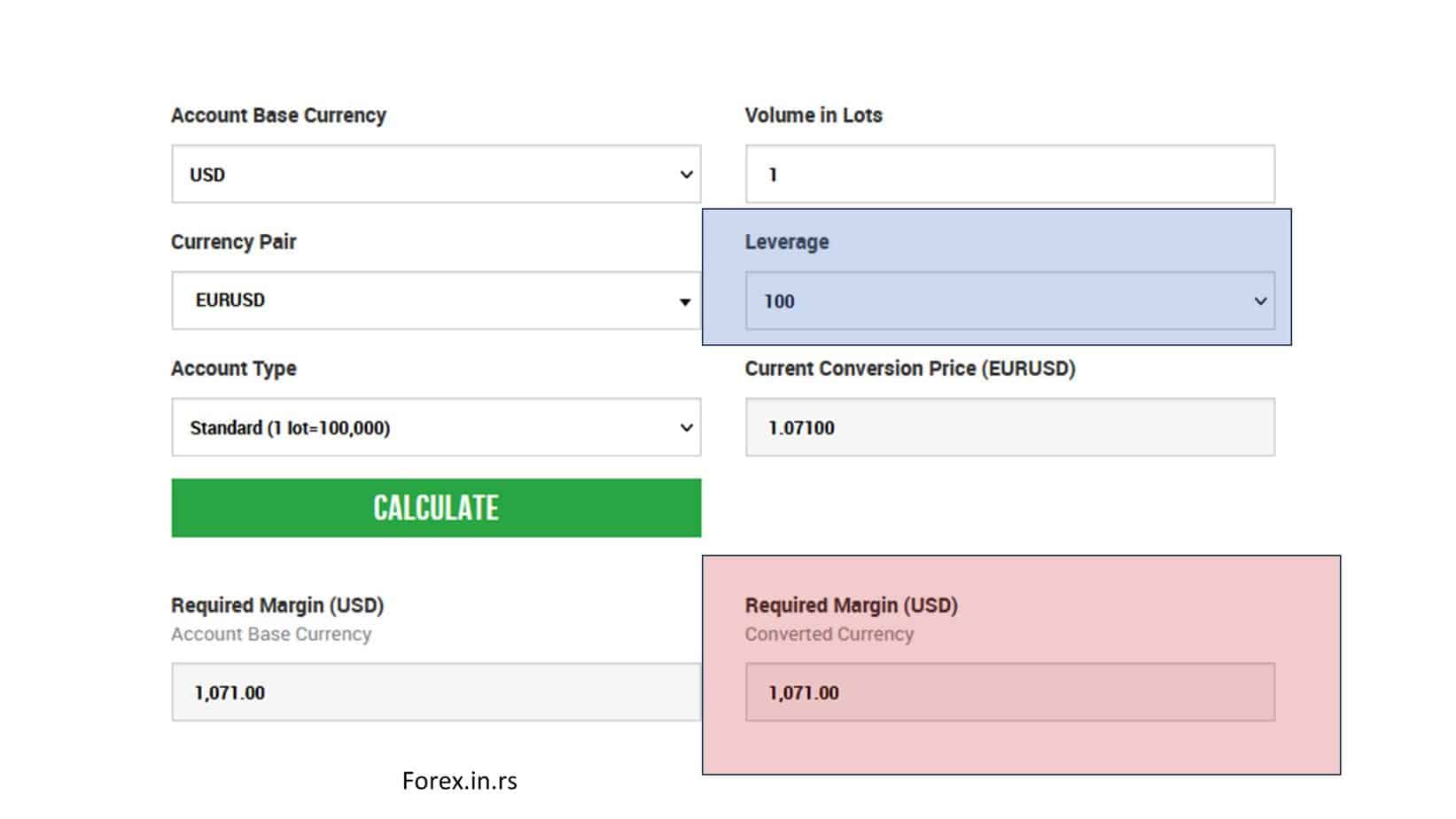

However, if you have a 1:100 leverage size, you can open one lot EURUSD trading size with only 1070 dollars:

Trading without leverage, also called unleveraged trading, means only using your capital to trade without borrowing any money from your broker to increase your buying power. This type of trading can be less risky, as you’re not increasing your potential for loss with borrowed money. However, it requires more initial capital and can limit your trading opportunities due to capital constraints. Let’s discuss this with a practical example.

Let’s assume you have $10,000 in your trading account, and you decide to trade without using any leverage.

Trading Stocks: If you want to buy shares in Company XYZ, currently priced at $50 per share, with your $10,000, you can buy 200 shares ($10,000 / $50 = 200 shares). If the stock price goes up to $55, your investment would be worth $11,000 (200 shares * $55 per share), providing a profit of $1,000. However, if the stock price goes down to $45, your investment would be worth $9,000, resulting in a loss of $1,000.

Trading Forex: In the case of Forex trading, a lot size typically refers to 100,000 units of the base currency. Let’s consider a EUR/USD trade. If the current exchange rate is 1.07 (meaning you need $1.07 to buy 1 euro), you would need $107,000 to buy a standard lot of EUR/USD. However, with just $10,000 in your account, you could only buy approximately 0.093 lots ($10,000 / $107,000). If the EUR/USD rate moves from 1.07 to 1.10, the value of your 0.093 lots will increase to $10,300, giving you a profit of $300. If the rate decreases to 1.04, the value of your 0.093 lots will decrease to $9,720, resulting in a loss of $280.

In these examples, you can see that trading without leverage limits the size of the positions you can open. Moreover, the potential gains and losses are directly proportional to your capital without being amplified by borrowed funds.

While trading with leverage can provide the opportunity for more significant gains with a smaller deposit, it can also magnify losses. If you had used leverage in the above examples, a small adverse price change could result in significant losses that could exceed your original investment. Hence, although trading without leverage may provide smaller returns, it also provides a degree of protection against such severe losses.

Trading Without Leverage Downsides

- Limited Profits: Without leverage, your potential profits are proportionately smaller. For instance, when trading one lot of EURUSD without leverage, even if the currency pair’s price increases significantly, your return will be limited compared to a leveraged trade.

- Higher Capital Requirement: Trading without leverage requires you to have a substantial amount of capital. To open a one-lot EURUSD trading size order, you’ll need more than $107,000. In contrast, if you’re using 1:100 leverage, you would only need $1,070.

- Less Capital Efficiency: Without leverage, your capital is less efficiently used. With leverage, you can control a larger position with the same amount of capital, potentially increasing the efficiency of your trading capital.

- Lower Risk, Lower Reward: While trading without leverage decreases the risk of losing more than your investment, it limits the potential reward. Your gains are directly proportional to your investment without the potential multiplier effect of leverage.

- Reduced Flexibility: Without leverage, you have less flexibility regarding the number and size of trades you can make. This could potentially limit your ability to take advantage of trading opportunities.

- Limited Diversification Opportunities: Because of the high capital requirement per trade, trading without leverage may restrict your ability to diversify your investments across various trades or markets.

- Impact of Market Fluctuations: Without leverage, smaller price movements might have a less noticeable impact on your trading profits. This can be disadvantageous if you’re aiming to profit from short-term price fluctuations.

- Slow Capital Growth: Compared to leveraged trading, trading without leverage might result in slower capital growth, as the size of potential profits is directly related to the size of your investment.

For most traders, Forex trading without leverage is not an option. The concept of trading without leverage means that any changes in the price of an asset directly influence the trader’s bottom line. This may sound like an enticing option by decreasing the risk one takes, but it also comes with a significant drawback: the need for substantial trading capital. Without leverage, traders would need to invest more money to generate the same returns they could achieve with leverage.

It’s not all doom and gloom, though – there are benefits to trading without leverage. It can reduce the risk exposure for traders and force them to become better investors. When you trade without leverage, you only use the money you have in your trading account, so no additional leverage is available to help you increase your exposure. This means traders will only ever lose what is in their account; any profits or losses become directly proportional to your invested capital.

However, this does not mean there are no risks in trading without leverage. Without the option of leverage, traders are forced to take on more exposure to the market, and this increase in exposure can lead to more significant losses. Trading without leverage may decrease the risk for a trader, but it does not eliminate the possibility of loss.

Let’s now take a closer look at trading without leverage. For example, a trader wants to deposit $10,000 into their trading account without leverage. They will only be able to trade with that $10,000, meaning that if the market moves against them, the trader will only lose the portion of their capital used in the trade. On the other hand, a trader using leverage can trade with multiple times the deposit.

While trading without leverage may seem less attractive, it does have its advantages. Traders can avoid the risk of overleveraging themselves, challenge themselves to be better investors, and learn to make trades with lower risk. It is also worth noting that trading without leverage can be better for long-term investments. As a trader, you would not have the constant fear of being margin-called and forced to close trades early.

In conclusion, trading without leverage has its advantages and disadvantages. It can reduce the risk exposure for traders, force them to make better trades and be beneficial for long-term investments. However, trading without leverage can also require substantial trading capital, limiting access to traders with less money to invest. Ultimately, traders should determine which option best suits them based on their goals and risk tolerance.

Institutional Traders Can Trade Without Leverage.

In the fast-paced world of foreign exchange trading, institutional traders have a distinct advantage over the average trader. With access to billions in capital, institutions can trade on attractive entry signals and take positions that can be held for months or even years.

If you are an institutional trader, you do not need leverage because you already have billions of dollars, you do not need to borrow money for your positions, and buying power is not an issue for you.

One of the critical advantages of institutional trading is the ability to avoid leverage. By using capital directly, institutions can reduce swap expenses and benefit or suffer from differences in interest rates. This contrasts with the average trader, who relies on leverage to magnify potential profits and losses.

Institutions have made some of the most significant Forex market trades without leverage. These trades, often worth billions of dollars, are motivated by speculation and require extensive capital.

But how do institutional traders manage to trade without leverage? One method is simply scaling up their investments. Whereas the average trader might invest $1,000 with 100:1 leverage to control a $100,000 position, an institutional trader could invest $100,000 without leverage to achieve the same result.

Another way institutions avoid leverage is by using futures contracts, which allow them to make large trades without paying upfront for the position’s total value. This means that they can take on prominent positions without taking on the risk of margin calls.

Should You Trade Forex Without Leverage?

No, traders do not need to trade forex without leverage because less buying power will not impact your trading results if you follow risk management. If you follow risk management rules correctly, trading with high leverage will not reduce trading success.

High leverage can be likened to driving a fast, expensive sports car, while low leverage is like driving a slower, more manageable car. Both types of cars (leverage) have their benefits and challenges and need to follow the rules of the road (financial regulations and wise investing principles) to reach the destination (financial goals) successfully.

High Leverage – The Fast, Expensive Sports Car

High leverage in trading is akin to driving a high-performance sports car on the financial freeway. Just as a sports car has the capacity for great speed, high leverage allows you to control a large position with a small amount of capital. This has the potential for rapid and sizable profits, similar to how a sports car can quickly reach your destination.

However, just as driving a sports car at high speeds comes with increased risks and responsibilities, so does trading with high leverage. The faster you go, the less time you have to react to unexpected changes in the road (market conditions), and the consequences of a crash (a sudden market shift against your position) could be devastating.

Moreover, high-performance sports cars are expensive to maintain and often require more fuel, just as high leverage can require higher margin maintenance and potentially lead to larger losses.

Low Leverage – The Slower, More Manageable Car

On the other hand, low leverage is like driving a slower, more manageable car. It may not have the potential to reach your destination as quickly as the sports car, but it’s often more fuel-efficient and easier to handle, especially for new drivers (novice traders).

Low leverage provides more control, and less risk of losing a large amount of your capital if the market moves against you, much like a slower car gives you more time to react to road conditions and lessens the severity of crashes.

Like the driver of a slower car, a trader using low leverage won’t see their capital grow as quickly. Still, they also won’t burn through their capital (fuel) as fast, and the risks of severe losses (major accidents) are generally lower.

Whether you’re driving a sports car or a slower car, or trading with high or low leverage, following the speed limit (rules of trading) is crucial. Just as speeding can lead to accidents and fines, overtrading or not having a solid risk management strategy can lead to significant financial losses.

In both scenarios, driving or trading within your limits is essential, as understanding the risks involved, and planning a clear route (strategy) to reach your destination successfully.

Brokers without Leverage

Each broker can remove leverage for you, but you do not need too low leverage because you will need significant capital. Additionally, if you open a EUR bank account and a USD dollar account and exchange money between accounts, you do forex trading without leverage. If you exchange money in an exchange office on the street, you do forex trading without leverage.

In Forex trading, brokers often offer the option to trade with leverage, allowing you to control a larger position with less capital. However, each broker also can remove or reduce this leverage based on your trading preference, risk tolerance, or regulatory requirements.

Lower leverage means you need more capital to open and maintain a position. For example, if you’re using the leverage of 1:1 (no leverage), you’d need a similar amount in your capital to trade a standard lot of EURUSD (100,000 units). This is why trading with too low leverage might not be feasible for many traders, as it requires substantial capital.

On the other hand, trading with no leverage, or ‘physical trading,’ happens in regular day-to-day activities too. If you have a EUR bank account and a USD bank account and transfer money between these two accounts, you are essentially trading EUR for USD or vice versa. This is a form of Forex trading without leverage because you physically exchange one currency for another without borrowing any money from a broker.

Similarly, when you exchange money at a street exchange office, you also do Forex trading without leverage. For instance, if you’re traveling from the United States to Europe and exchanging your USD for EUR at a currency exchange booth, you’re essentially selling USD to buy EUR, a Forex trade.

In both these examples, you’re not leveraging your position – you’re only trading with the capital you already possess. However, these transactions typically lack the potential for profit (or loss) that characterizes leveraged Forex trading, as they’re usually conducted for practical purposes rather than as speculative investments.