Table of Contents

Are brokers prone to trading in opposition to clients?

My question is easy: Do forex brokers trade against you?

Forex brokers, in some cases, act as market makers and “trade against clients” or, better say, make counterparty trades. The market-making broker acts as an intermediary, executing trades on behalf of the trader while simultaneously hedging its position with the liquidity provider.

This hedging positions many traders see as a problem and process where brokers trade against their clients. However, it is the only way brokerage companies manage their risk and execute orders.

That doesn’t mean that if clients earn a million dollars, they will not pay you earnings. Regulated brokers usually pay clients’ earnings, so clients do not need to worry. Traders do not need to consider that; it is the broker’s execution type.

If a client deposits $100, brokers know there is a high probability that the client will lose $100 in trading. Therefore, dealing desk brokers can decide to make counterparty trades.

Dealing Desk brokers, also known as market-making brokers, offer a trading model where they can act as the counterparty to client trades. Dealing Desk brokers can provide fixed spreads, easy access to liquidity, and contribute to market stability, making them a viable option for traders.

Dealing desk brokers or market makers are usually regulated brokers that will pay you your earnings without question. Therefore, traders do not need to worry about brokerage execution types. It would help if you thought only about brokers’ regulations, commissions, spreads, and leverage.

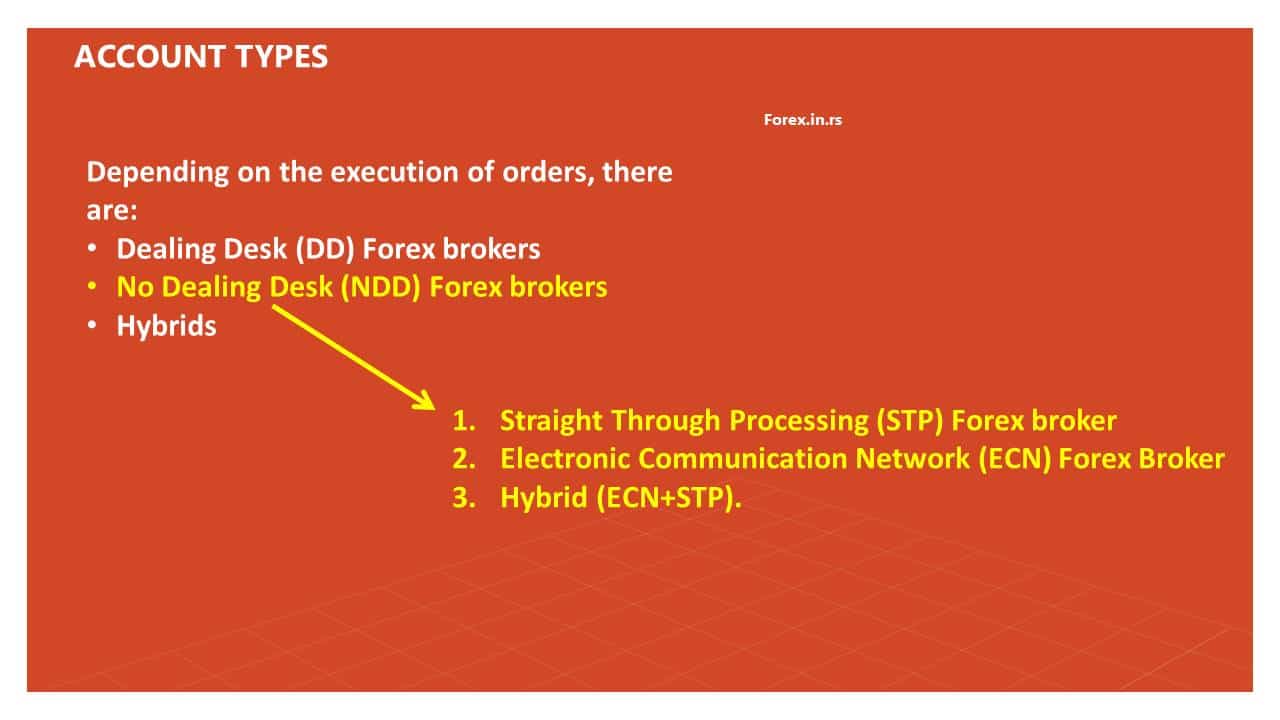

No Dealing Desks Brokers (NDD)

NDD brokers, Non-Dealing Desk brokers, operate on a different model than Dealing Desk brokers. NDD brokers use Straight-Through Processing (STP) or Electronic Communication Network (ECN) technology to connect clients directly to liquidity providers, such as banks, financial institutions, and other participants in the market. The primary goal of NDD brokers is to provide clients with access to the most competitive bid and ask prices available in the market.

Here’s a detailed explanation of NDD brokers and how they operate:

- Straight-Through Processing (STP): NDD brokers employ STP technology to facilitate the seamless and direct execution of client trades. When a client places a trade, the order is electronically transmitted without intervention or dealing desk involvement. The trade is executed at the best available bid and ask prices liquidity providers provide.

- Access to Multiple Liquidity Providers: One of the critical advantages of NDD brokers is their ability to access a vast network of liquidity providers. These liquidity providers compete to offer the most favorable prices and spread to attract order flow. By accessing multiple liquidity sources, NDD brokers can aggregate prices from different providers and offer clients more competitive trading conditions.

- Competitive Bid and Ask Prices: NDD brokers strive to offer clients the best bid and ask prices available in the market. Since the brokers connect clients directly to liquidity providers, clients can benefit from tighter spreads as they trade at market rates. This transparency in pricing can be particularly advantageous for traders, as they can potentially obtain more favorable entry and exit levels for their trades.

Additionally, there are delays during order fulfillment because a larger shipment can increase the likelihood of human error and lead to significant losses.

On the contrary, a non-dealing desk mechanism can readily use liquidity providers to link orders with traders. Since this system is digitized, there is a low probability of delays. This isn’t to say that all dealing desk brokers can’t be trusted; however, with increasing cases of dealing desk scams, perhaps it is time to move on to a more automated system to avoid such instances.

STP Execution

Principal counterparty trades by an STP (Straight-Through Processing) broker involves the broker acting as an intermediary between the trader and external liquidity providers. Here’s a breakdown of how these trades work:

- The trader places an order: The trader submits an order to the STP broker, specifying the desired trade parameters such as currency pair, volume, and execution type.

- Broker seeks external liquidity: Upon receiving the trader’s order, the STP broker immediately attempts to find an exact or matching order with an external liquidity provider. This step ensures the trade can be executed without the broker taking excessive market risk.

- Riskless principal transaction: The STP broker acts as the middleman or riskless principal in the transaction. It buys from the liquidity provider for its account (as principal) and records the transaction in its trading book. The broker then sells to the trader (also as principal) at the same price or markup with no commission.

- Matching or filling the order: The trade is executed if the broker finds a matching order with the liquidity provider. The broker then opens or closes the position on the trader’s account, reflecting the executed trade.

STP brokers facilitate trades with minimal market risk exposure by following this process. The riskless principal nature of the transaction ensures that the broker does not take on significant market risk, as they are essentially passing the trade onto an external liquidity provider. This execution model benefits both the trader, who gains access to market liquidity, and the broker, who mitigates risk exposure.

STP execution is widely regarded as a trusted and reliable method for forex trading. It provides traders access to external liquidity while minimizing the broker’s risk exposure. By acting as an intermediary, STP brokers ensure traders can execute trades efficiently and transparently, fostering trust and confidence in the forex trading process.

NDD vs. ND brokers

NDD Brokers (Direct Market Access brokers):

- Provide direct market access; orders go straight to liquidity providers without a dealing desk.

- Trades are priced directly by liquidity providers, with a separate commission or increased spread.

- Suitable for short-term traders, allowing them to see minor price fluctuations.

- Do not act against trades.

DD Brokers (Dealing Desk brokers):

- Execute orders internally within their “dealing desk department” by buying prominent positions from liquidity providers.

- DD brokers take the other side of the trade and may hedge positions to mitigate market risks.

- Set their prices and spreads; traders trade at the broker’s specific prices.

- Offer smoother price fluctuations and potentially quicker trade execution compared to NDD brokers.

- Can act against traders in some moments.

Advantages and Disadvantages of Non-Dealing Desk (NDD) Brokers and Dealing Desk (DD) Brokers

Brokers working on a non-dealing desk mechanism probably take the cake regarding smaller spreads between asking prices and bids. They can rely on the ECN system and its links with top tiers and similar liquidity providers to offer clients the best possible prices. This spread may vary as liquidity providers quote different prices, but it does not cost an additional commission.

Advantages of Dealing Desk Brokers:

- Fixed Spreads: One advantage of Dealing Desk brokers is that they often offer fixed spreads. This means that the spread (the difference between the bid and ask price) remains constant regardless of market conditions. Fixed spreads can give traders more predictable trading costs, especially during high market volatility.

- Easy Access to Liquidity: Dealing Desk brokers have liquidity pools and can provide immediate execution for client trades. This easy access to liquidity is one of the significant advantages of Dealing Desk brokers, as it ensures that traders can enter and exit positions quickly.

- Market Stability: Dealing Desk brokers are crucial in maintaining market stability. Market makers ensure liquidity and facilitate trading by providing continuous bid and ask prices. Their presence helps ensure clients can always find a counterparty for their trades, even in less liquid markets.

There is still some disagreement regarding including clients’ interests in having a DD broker. However, it is not necessary that either party, i.e., the client or the broker has to lose money while the other is getting profits. This is because the broker can link a client’s order to a proper order from another client.

The comparison between a DD and NDD provides widespread access to the best bid spreads that can reach as less as 2% or as high as 5%. Some moral conflicts surround the use of dealing desks. However, this is still several advantages to using a dealing desk system.

The Forex market seems to be the most regularly overlooked part of the stock market, so much so that it is considered the most primarily unregulated international financial and stock sector.

The reality is that this does not seem like it will probably change shortly. However, it is also known that even the most highly controlled stock exchanges most commonly regulate the financial marketplace.

This further allows for more detailed oversight, supervision, and auditing. It is essential to address a need for more investors to be involved in the stocks/bonds sector to stay sheltered. This is because these particular tools are regarded as highly potent factors to protect and preserve national institutions, such as the institution for retirees, provision of pension finances, and similar investors similar to those above.

Therefore, we have observed specific values and changing mindsets about these particular markets. It is still true that there are a lot of misconceptions and confusion surrounding these types of brokers and the trading sector in general. However, the best course of action is to stay informed and avoid forming opinions based on previous biases.

Even though one type of trade or broker might seem better off the bat, it is essential to keep an open mind and understand your trading needs before deciding because certain brokers are better suited to certain trading accounts. Therefore, watching for changes in the coming years is best.

Conclusion

It is common in the forex market today to find hybrid brokers that do not strictly fall into the categories of NDD (No Dealing Desk) or DD (Dealing Desk) brokers. Pure ECN (Electronic Communication Network) brokers, which provide direct access to the interbank market without any intervention, can be harder to find.

Many brokers combine elements of both NDD and DD models to optimize trade execution, liquidity, and overall client experience. They may have a dealing desk to handle specific orders internally and offer direct market access for other trades. This hybrid model allows them to provide competitive spreads, faster execution, and increased liquidity.

You do not need to consider whether a broker trades against you; making payments and having low commissions and fees are essential.