One of the most important things to understand when trading with Metatrader 4 is how to call the collate margin. With a small capital, traders use leverage to increase their buying power.

This article will show you something many traders do not know – calculating the margin in MetaTrader for precious metals, stocks, and indices. I will show in this article that the margin formula is the same for gold and currency pairs but different when calculating the margin for stocks and indices.

Please see the whole video about how to calculate margin in MT4 from my YouTube channel:

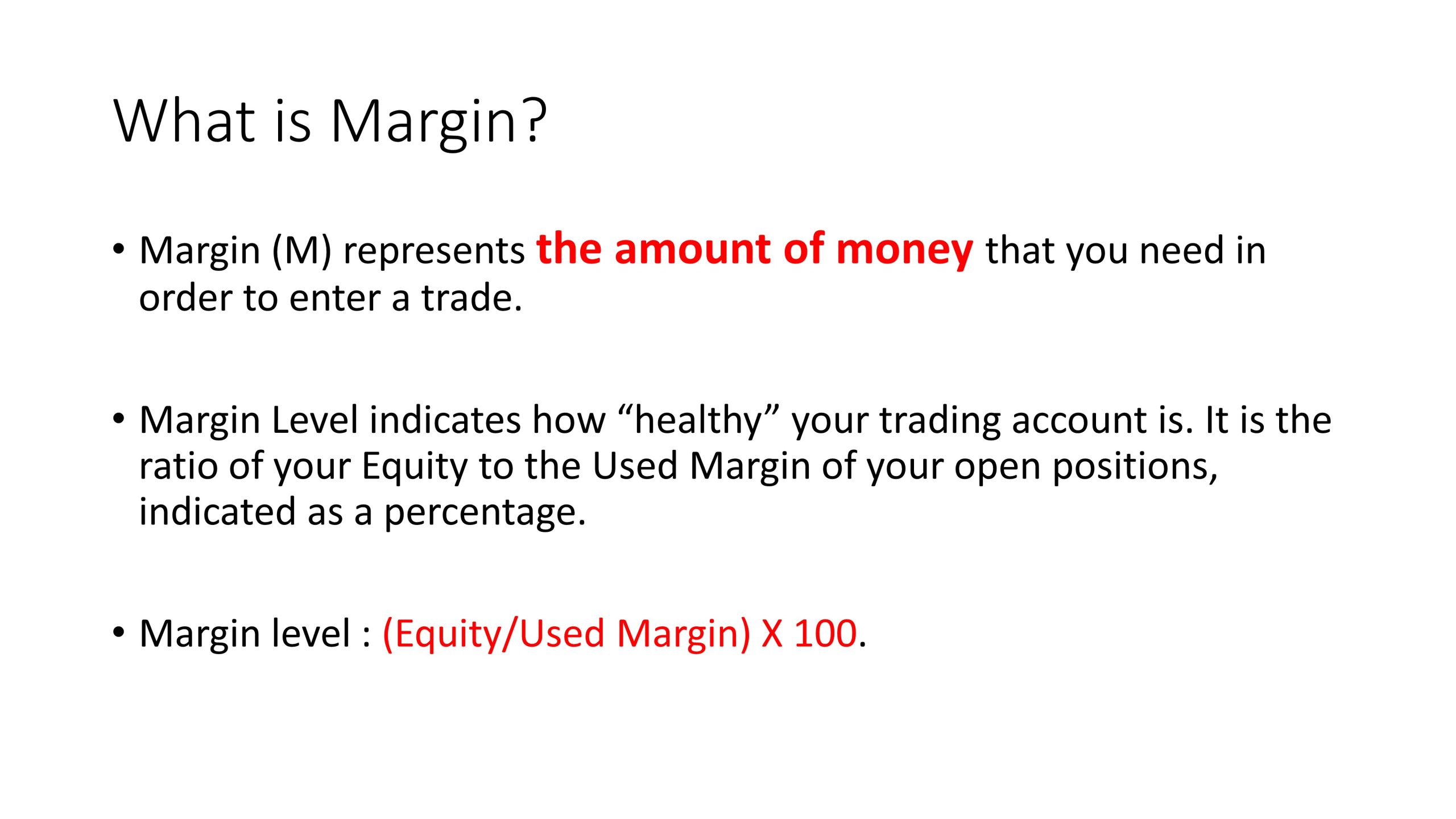

Margin (M) in Metatrader represents the money that you need to enter a trade. The margin level shows the healthiness of your account and represents the ratio (percentage) of your Equity to the Used Margin of your open positions.

How do you calculate Metatrader 4 or 5 margin?

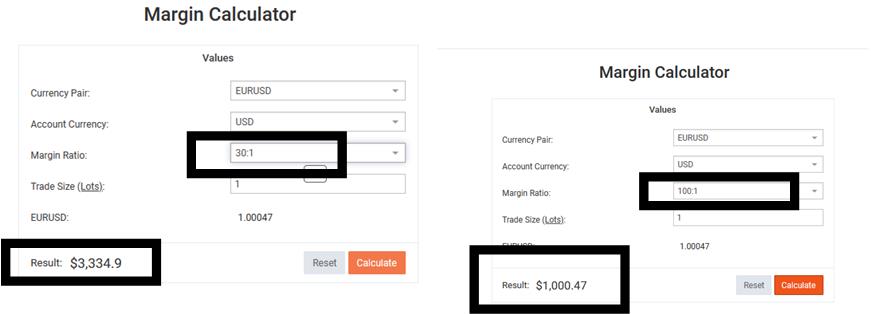

To calculate Metatrader 4 margin, multiply position size units and price and divide with leverage. For example, if you BUY 1 lot EURUSD with 1:500 leverage and the price is 1.06, then your margin will be :

1.06*100,000/500 = $212

The formula to calculate the margin for forex pairs is:

Let us see another example of calculating margin in Metatrader if the price is 1.06 and leverage 1:100, and I bought one mini lot.

First, determine the value of 1 mini lot in the trading account’s base currency. In this case, a mini lot is 0.1 standard lots, so the value of 1 mini lot of the currency pair being traded (let’s assume it’s EUR/USD) is:

10 000 (mini lot size) * 1.06 (the current price) = 10,600 USD

Next, determine the required margin based on the leverage provided by the broker. In this case, the leverage is 1:100, which means that the margin required to open a position is 1% of the total position size. Therefore, the required margin for a 1 mini lot position is:

10,600 / 100 = 106 USD

So, the required margin for this trade is 106 USD.

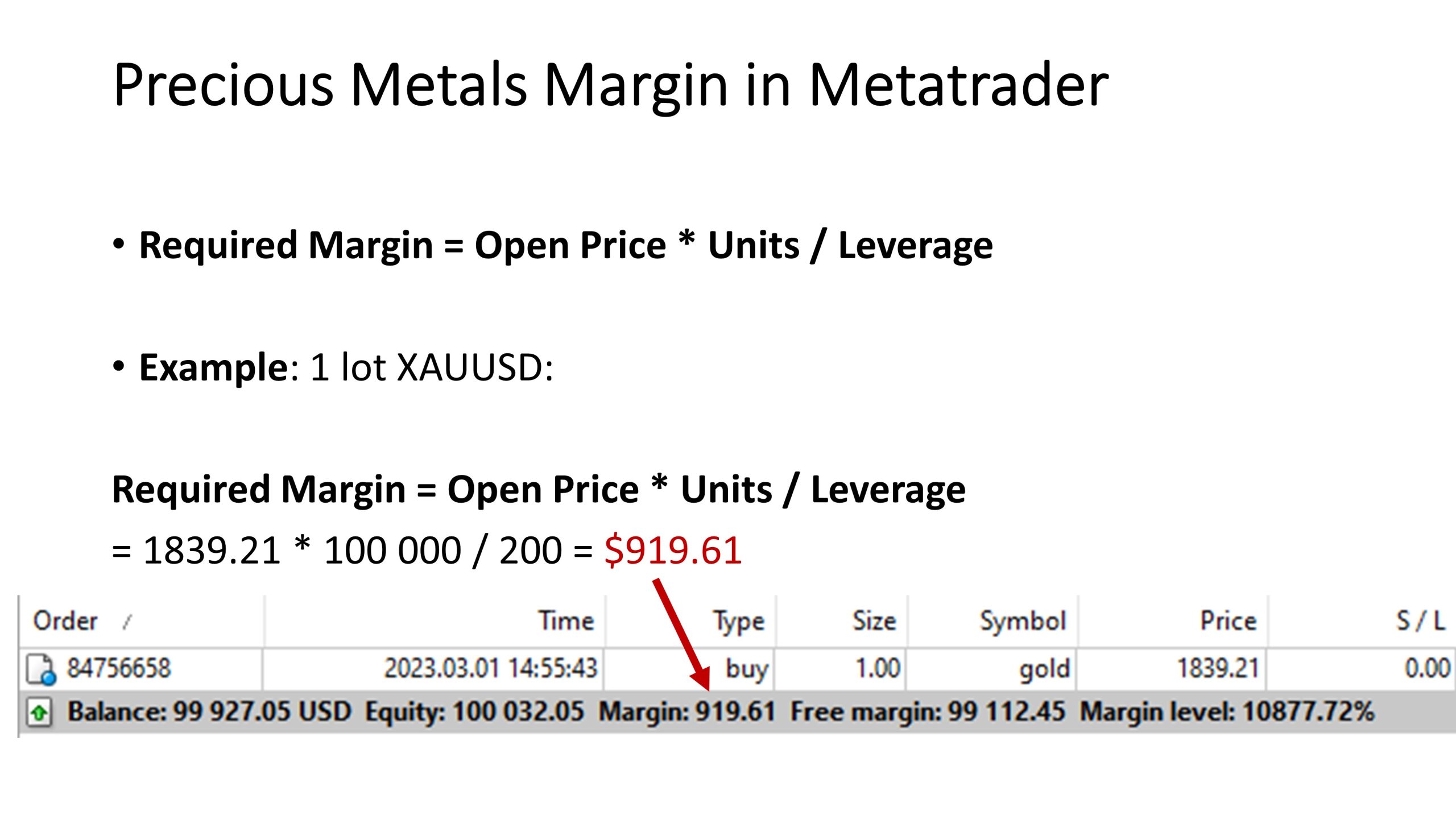

Precious Metals Margin in Metatrader

To calculate the margin for gold or silver in MetaTrader, you need to multiply the price and units and then divide with leverage. Please check your leverage because, for precious metals, leverage usually differs from forex pairs.

Example: 1 lot XAUUSD for leverage 1:200:

100000 * 1839 / 200 = $919.61

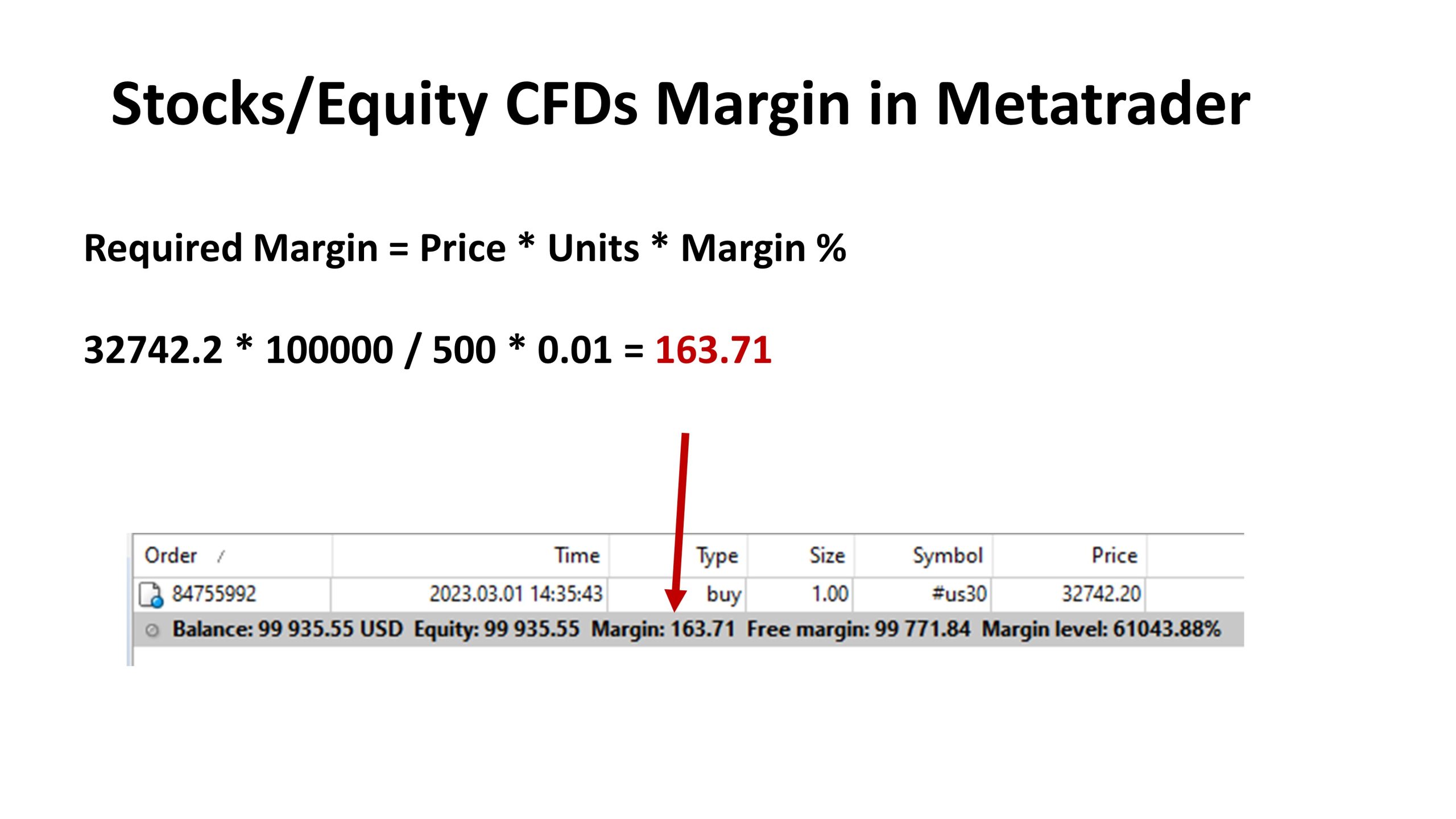

Stocks/Equity CFDs Margin in Metatrader

To calculate the margin for indices and stocks in MetaTrader, multiply the price, units, and percentage and divide it with leverage. Please check your leverage because, for stocks and indices, leverage usually differs from forex pairs.

Required Margin = Price * Units * Margin %

32742.2 * 100000 / 500 * 0.01 = 163.71

As you can see from the previous example, brokerage companies decrease the margin value for stocks and indices and ensure that even with $10 or $100, you can trade indices and stocks in MT4.

But let us again analyze the procedure:

First, it’s essential to understand that to use margin, you must have an account with a broker offering this feature. It is also necessary for the trader to be aware of the contract size for each currency pair they are trading, as this will determine how much margin they need for each trade.

In conclusion, calculating the margin in MT4 involves two key factors: the lot size and the leverage. To determine the required margin, you first need to calculate the value of the position size in the base currency of the trading account based on the current market price.

In my opinion, there are a lot of wrong formulas for margin on the internet for Metatrader because they use contracts or ounces instead of mini, micro, and lots units. Remember, in MT4, traders can use micro lots, mini lots, and lots for position sizes for position sizes.

Next, you need to determine the required margin based on the leverage provided by the broker, which is usually expressed as a percentage of the total position size. MT4 provides a margin calculation tool that can be used to determine the required margin for a particular trade quickly and easily.

Remember that margin requirements vary depending on the broker, and the trading instrument being traded is essential. So, it’s always a good idea to double-check with your broker or consult the relevant documentation before placing trades. Your leverage can be different for different types of assets as well (one leverage for forex pairs and another for precious metals)