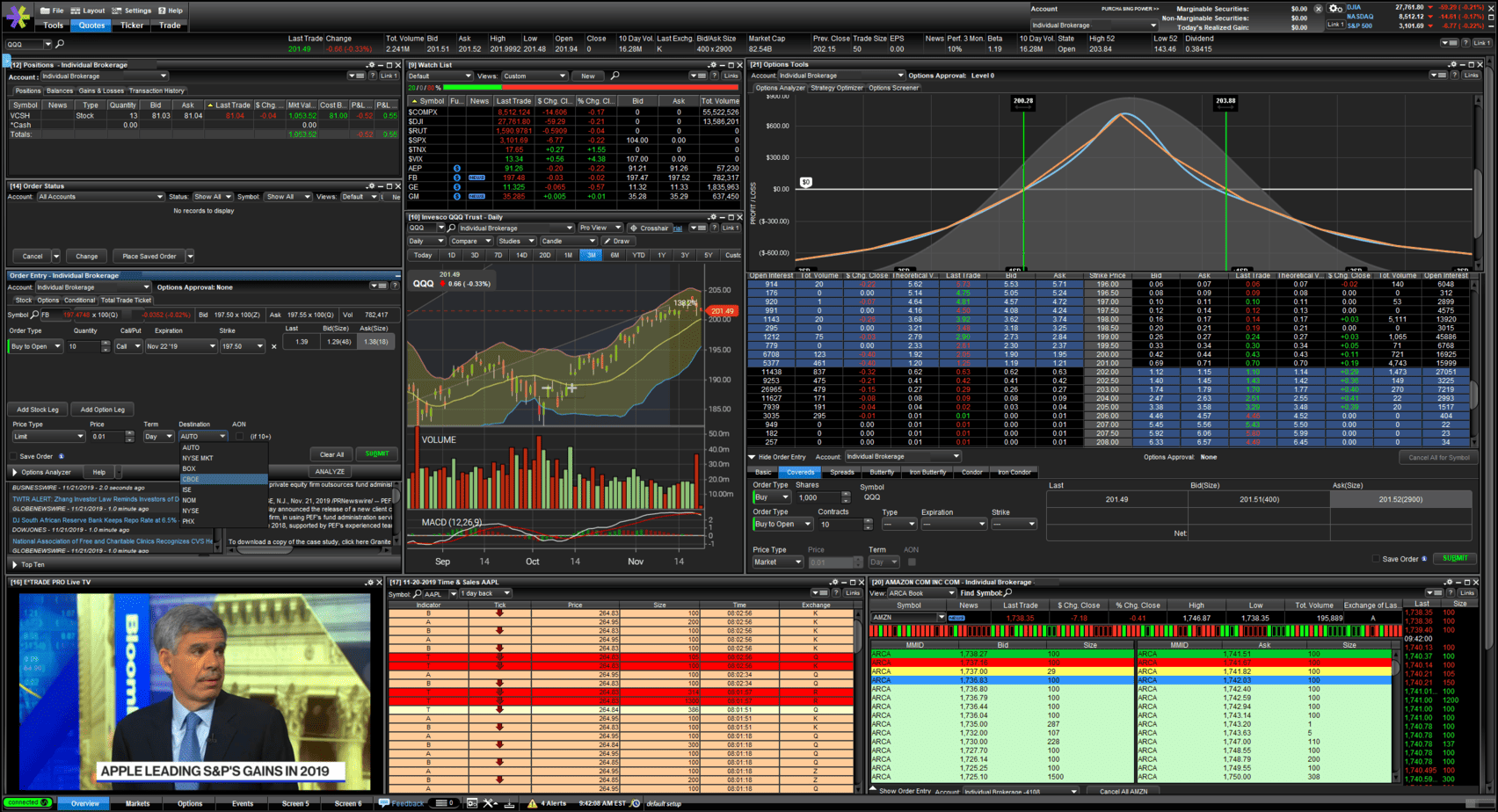

Etrade is lauded for its user-friendly interface, designed to simplify the trading process and make navigating the financial markets more accessible. The platform also values user education, offering a comprehensive resource library that helps equip investors with the knowledge they need to make informed decisions.

Whether you’re looking to build a diversified portfolio, speculate on market trends, or plan for retirement, Etrade provides a comprehensive platform to help you achieve your financial goals. It’s more than just a brokerage—a partner dedicated to helping you navigate your financial journey.

Can I Trade Forex on Etrade?

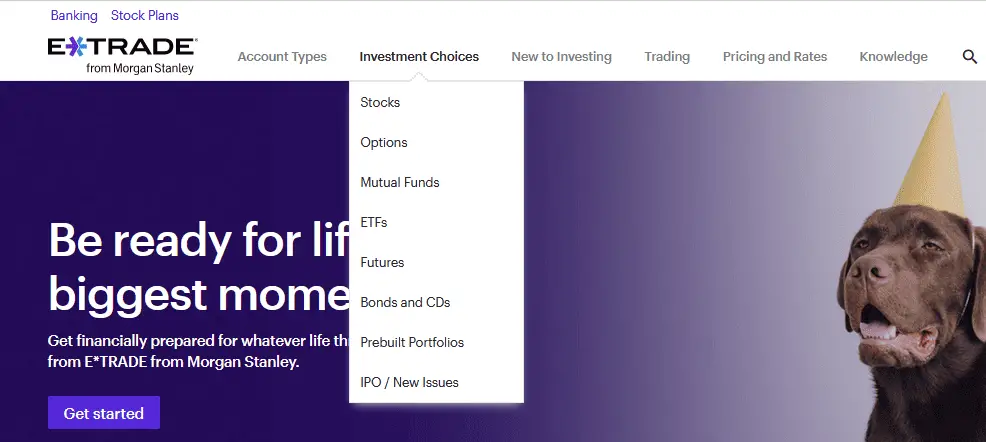

You can not trade forex on the Etrade platform. Etrade offers stocks, options, mutual funds, ETFs, futures, bonds, and IPOs. However, you can trade futures currency using contract specifications such as Yen, Dollar, Euro, Pound, etc.

Here is the proof of Etrade allowed instruments for trading on the website homepage without forex:

So Etrade offers for trading:

- Stocks: You can trade shares of publicly traded companies. This includes large (blue-chip) companies, small and mid-cap companies, and international stocks.

- Bonds: This includes corporate bonds, municipal bonds, and U.S. Treasury bonds.

- Options: Options contracts give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price before a certain date.

- Mutual Funds: These are professionally managed investment schemes that pool money from many investors to purchase securities.

- Exchange-Traded Funds (ETFs): Like mutual funds, ETFs hold an array of assets such as stocks, commodities, or bonds. However, ETFs trade on stock exchanges, much like individual stocks.

- Futures: These are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price.

- Certificates of Deposit (CDs): Fixed income investment with a set maturity date.

- Retirement Accounts include traditional IRAs, Roth IRAs, and Rollover IRAs.

- Managed Portfolios: Etrade has portfolio management services where they will manage your investments for you for a fee.

How to trade currency futures on Etrade?

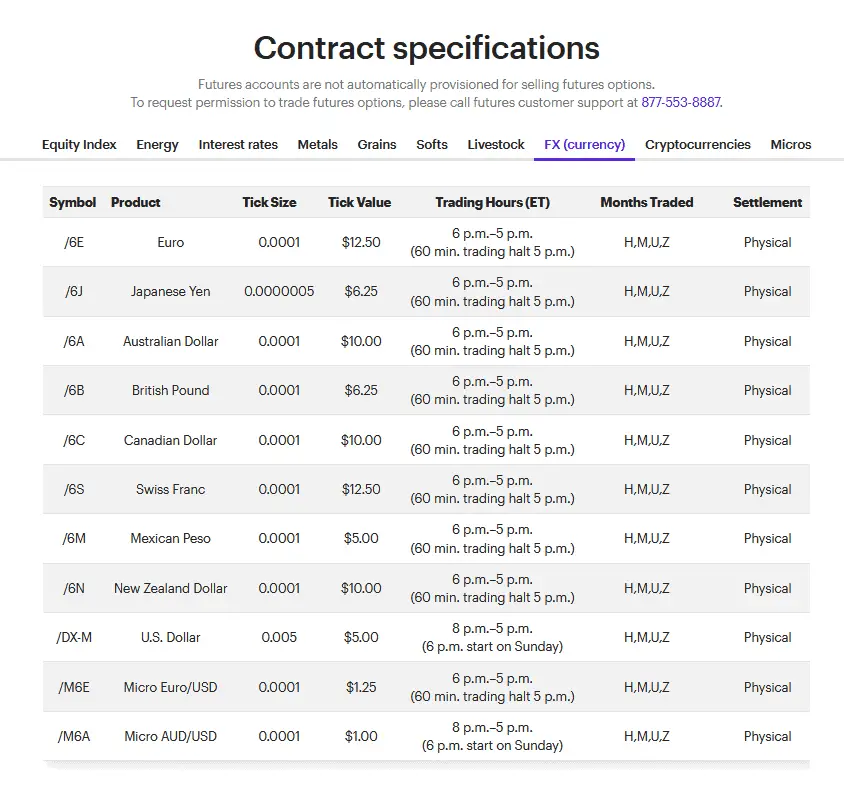

Trading currencies on Etrade as futures contract specifications involves a few key steps. First, you’ll need to understand the various symbols representing different types of futures contracts or currencies, each with a specific tick size and value. For example, “/6E” stands for Euro, “/6J” for Japanese Yen, “/6A” for Australian Dollar, and so on. Each of these symbols has a specific tick size or minimum price movement (like 0.0001 for Euro) and a tick value, which is the monetary value of each tick (like $12.50 for the Euro).

Next, you need to be aware of the trading hours for each contract, most of which typically run from 6 p.m. to 5 p.m. ET with a 60-minute trading halt at 5 p.m. Some contracts, like the U.S. Dollar (“/DX-M”) and Micro AUD/USD (“/M6A”), have different starting times, like 8 p.m. or 6 p.m. on Sundays.

The “Months Traded” column indicates the contract months using single-letter month codes (H for March, M for June, U for September, and Z for December).

Finally, note that settlement for these contracts is physical, meaning if held until expiration, you would be obligated to take or make delivery of the underlying currency.

Before trading, you typically conduct technical and fundamental analysis to predict future price movements and decide your trading strategy. Once you’re ready, you can execute trades through the Etrade platform by specifying the contract symbol, whether you want to buy (if you predict the price will go up) or sell (if you predict it will go down), the quantity, and other details like your order type and price.

Conclusion

In conclusion, while you cannot directly trade forex on the Etrade platform, you have a wide variety of other investment options available, including stocks, options, mutual funds, ETFs, futures, bonds, and IPOs.

Additionally, you can engage in futures trading involving various currencies like the Yen, Dollar, Euro, Pound, etc., providing an alternative way to speculate on currency movements. Trading in futures contracts requires understanding the contract specifications and carries its risks, making it essential to understand the process and potential implications thoroughly.