To trade any market requires knowledge and practice, but you know more than these two when it comes to Forex trading. Forex depends on a lot of factors other than the ones included in technical analysis. These are fundamental factors, and they vary extensively from one country to the other. This makes predicting price movements in the Forex market more difficult. However, with the help of specific tools and indicators, it can be made possible. In this article, you will get to know all about Forex and how to predict forex movement.

How to predict forex movement?

To predict forex movement, traders use past market price data, trading patterns, market sentiment, and fundamental analysis. However, the future price is tough to predict accurately, so professional traders create several possible price movement scenarios and analyze basic price levels.

Foreign exchange, or Forex, is one of the most traded assets in the world. Even though it is banned in many Asian countries, currency worth over $5 trillion is sold every day. The majority of this trade comes from big corporations and banks; however, even small and individual traders collectively move currencies worth trillions of dollars every day.

Two driving forces have a significant impact on Forex: demand and supply. There is one more thing that influences these driving forces. We call it sentiment, which innumerable factors can mold. Investors’ moods depend heavily on the news and data received from official sources. They also keep an eye on the development in different countries, especially in the countries where the Forex market operates 24/7.

This is called fundamental analysis. The strength of a currency depends directly on the development and socio-economic stability of its respective country. Therefore, every positive or negative effect of a country has the power to appreciate or depreciate the value of the said currency. Since it is almost impossible to predict all these events, investors use various tools and indicators to remove most risk factors. Fortunately, compared to the initial days, the tools and indicators available today allow traders and investors to make better trading strategies. They can implement a range of approaches and employ different methodologies to help them stay ahead in the game.

We have created an outlook in this article on using different tools and indicators to make different approaches.

What Approach is Ideal to Predict Forex Movements

Before we discuss the types of approaches and decide which one is perfect for you, it is always better to brush up on the basics. First, you should know all about the currency pairs. Forex is only traded in two currencies where the first currency is known as the base currency, and the other currency is called the counter or quote currency. For example, in the pair USD/GBP, USD will be your base currency, and GBP will be your counter currency. It is essential to choose a pair wisely because most of the trading strategies depend on it. The most popular currency pairs are EUR/USD, USD/JPY, and GBP/USD. These are major currencies, but you can find good opportunities by trading less popular currencies as well.

Along with the choice of currency, you also need to give due importance to the time frame as it impacts the trading approach. Since the Forex market operates 24 hours, seven days a week, many traders open and close their position on the same day. This is called day trading. Traders open a new position every day when the market opens and close it at the end of the day, irrespective of their stand. This is done to avoid any drastic price fluctuation that may happen overnight. Some traders believe in holding a position for a slightly more extended period. This period is up to 14 days, and this type of trading is called swing trading. The strategies adopted by swing traders are similar to those that long-term traders, who hold a position for even years, use. Swing traders, like long-term traders, also refrain from acting to every price movement.

Other than these proactive tradings, there are different types of Forex trading strategies that focus on the bigger picture. Take momentum and range trading, for example, where traders look at price movements and analyze them to find long-term trends. In momentum trading, traders pay attention to an unusual price movement, whether up or down, to see if there is a scope for the beginning of a long-term trend. In range trading, traders lay stress on the levels of support or resistance. They spot these levels in the past data with the expectation of seeing these levels again in the future. Range trading is suitable for currencies that show noticeable price movements, but there is no clear long-term trend.

Using Fundamental and Technical Analysis to Predict Forex Movements

There are two types of analysis that traders do to see where the Forex market is heading and which currency pairs are more profitable. These two analysis types are fundamental analysis and technical analysis. Let’s read about the significant differences between these two before dissecting them in detail in the next section.

Fundamental analysis is based on the external and internal events that can influence the value or strength. These include the country’s financial markets and economic state and various government and monetary policies.

On the other hand, technical analysis is solely concerned with patterns and trends. It predicts all the price movements based on the data that is available in historical price charts. The aim is to predict future Forex trends based on stats, facts, and figures.

To conclude, we can assert that fundamental analysis aims to identify either undervalued or overvalued currencies and find their real value in the process. Traders consider external factors that can potentially drive price. On the contrary, the technical analysis thinks of the laws of supply and demand as its principle. It focuses only on the currency price. The aim is to check if the market trends will repeat themselves by studying previous stats and data. The rest of the unquantifiable data is neglected in the process.

Practical Example how to predict forex movement

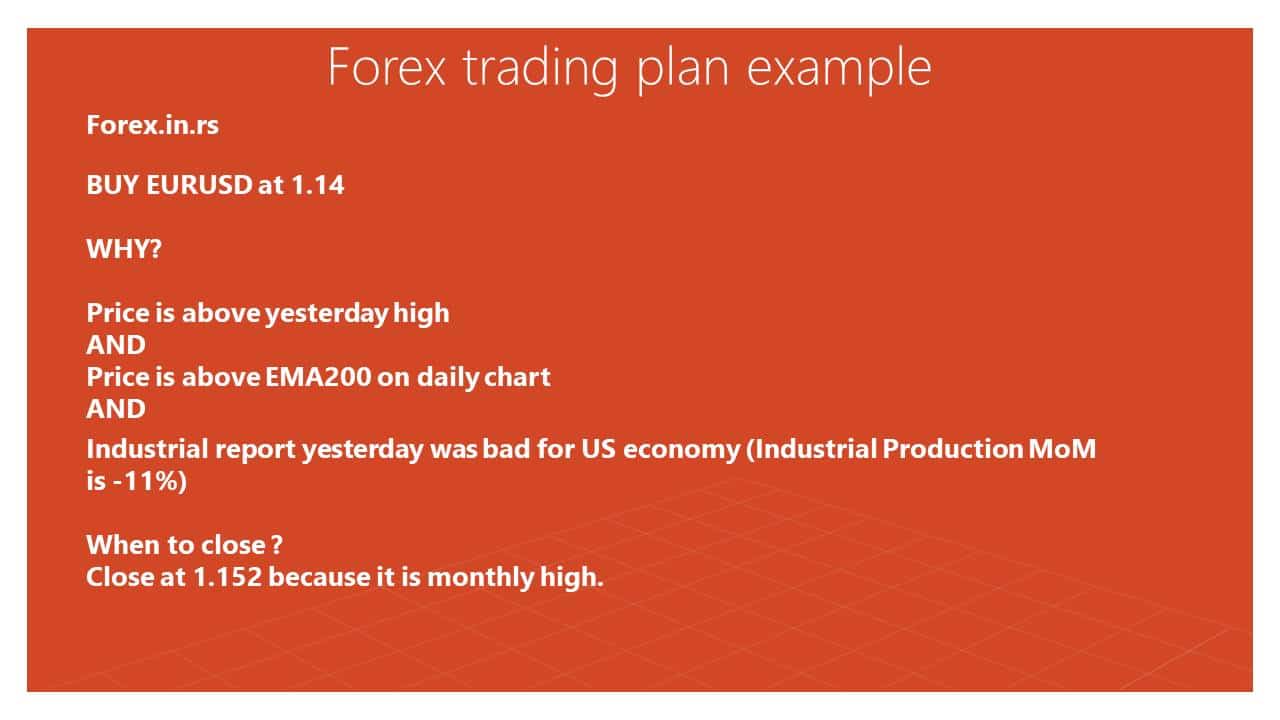

To enter into a trade, traders need to have several triggers based on technical and fundamental analysis. For example, a trader can enter into the trade after a strong bullish trend, for the example above yesterday high, during multi weeks bullish trend (price above EMA200), and when Industrial production has excellent results. See the example below:

Forex Trading and Fundamental Analysis

Fundamental analysis takes into consideration all the factors that can influence exchange rates. This method is all about studying the fundamentals like government policies, monetary policies, housing markets, rate of interest, and more to predict a currency’s strength. The main focus of fundamental analysis is identifying a mispriced currency that will correct itself over time as the external factors lose their power. Fundamental analysis is not particularly short-term trading, although it is used in various strategies. It predicts long-term price movements.

There are so many external factors that can influence the price of a currency. Some of these, like natural disasters or medical emergencies, cannot be predicted. However, there are some key economic indicators that you can learn about, as these are important in terms of fundamental analysis. The key economic indicators are:

- Economic Growth: As a general rule of thumb, it is seen that a country’s economic growth directly impacts the value of its currency. If the country is performing well, it will drive its respective currency’s prices up and vice versa. Traders analyze a country’s overall economic state by considering its GDP (Gross Domestic Product). It tells the traders if the economy is expanding or shrinking and at what rate. An improvement in economic growth assures that investments will remain safe, thus attracting more investors. An increased number of people will be willing to buy a developing or developed country’s financial assets or stocks.

- Inflation: Inflation refers to the rise in the prices of goods and services produced in a country over an economic period. This rise is good for the economy but in a controlled manner. It affects the monetary policies as the central authorities will like to maintain their control over it. Inflation weighs on the exchange rates. For fundamental analysis, the crucial inflation measures considered are the RPI (Retail Price Index) and the CPI (Consumer Price Index).

- Interest Rates: Here, we are talking about the interest on savings given by the government. It has one of the biggest influences on the Forex market. If the interest rates are on the higher side, more investors would be eager to invest as their investment will fetch a higher interest rate. They will hold more money in savings accounts or in the form of other instruments to take advantage of the higher savings rates. This will increase the demand for the local currency, which is always beneficial for the economy.

- Trade and Capital Balances: To maintain the currency’s value, every country strives to achieve trade balances, that is, the balance between imports and exports. More imports mean more outflow of the currency and vice versa. Countries that rely heavily on exports need to be careful at all times. Since the primary source of income for them is an investment from foreigners, the currency value will drop if their exports drop. For example, if more investors are taking their assets out of the country, it shows that the market sentiments have changed. There will be more outflow of currency than inflow, and it is not a good sign.

- Employment and Wages: Employment and corresponding wages are essential determinants of a country’s economic growth. If a country has been dealing with a lack of vacancies and unemployment, it proves that the economy is not growing. Additionally, a constant increase in employment is also not an assured sign of growth. If the vacancies are rising, but the wages remain stagnant, there is disguised unemployment in a country. Therefore, employment and wages both should increase.

- Geopolitics: You cannot see a country and its currencies as two separate entities. A currency represents the state of its respective country. It is natural to presume that a politically stable country will have a stronger currency. If there is political instability or estranged foreign relationships, the value of the currency will suffer. This is why a currency sees a slight fall every time there are important elections of war-like situations between any two countries.

How to Use an Economic Calendar for Forex Movement Prediction

When it comes to fundamental analysis, it isn’t easy to track all the significant events. Fortunately, most events are scheduled. Traders can check that calendar and stay in the know. An economic calendar includes all the essential political and economic events that are likely to happen in a country and can affect the currency, the financial markets, or the Forex in any way. These economic calendars are essential guides to traders and investors.

Various brokers offer economic calendars on their platform, including important central or federal banks like the Federal Reserve, the Bank of England, the Bank of Japan, and the European Central Bank. These calendars also tell you about international political meetings’ schedules or when the world leaders will be coming together to declare something important.

Which key drivers are essential for you will be subjective as different external factors affect other economies. Not every key driver is equally important for every country. Therefore, you need to be careful while selecting your indicators. For example, the service sector dominates the UK economy. This makes the service sector’s overall performance a crucial determinant in finalizing if the UK economy performed well or not. Another example would be China, which is a manufacturing economy. Even if the service sector remains stagnant, but the manufacturing unit shows steady growth, we will consider the Chinese economy to be expanding.

Forex Trading and Technical Analysis

Technical analysis doesn’t concern itself with the future of exchange rates or the reasons behind it. This is because the technical analysis does not revolve around price movements. It is centered around the concept of demand and supply. Traders rely on technical analysis using various price charts with data regarding the historical performance and exchange rate.

Traders and investors use various tools and indicators to find past patterns and trends. It is done with the belief that these patterns will repeat themselves. Technical analysts are of the view that one can gauge crucial information from even a single chart. With these patterns’ help, you can detect the market’s mood and predict if that will change soon. Technical analysis aims to let you know in advance when the mood might change and how you can leverage it for your benefit.

While fundamental analysis is more competent for finding long-term trends, technical analysis is majorly used for short-term plans and strategies. Day traders and swing traders rely heavily on technical analysis.

There are various ways in which you can conduct technical analysis. But, there are a few historical data points and references that occur repeatedly. For example, the opening price, the closing price, the lowest price, and the highest price. These are some of the standard parameters that technical analysts refer to while conducting the analysis.

Technical Tools to Predict Forex

One of the most critical technical analysis practices is to predict future exchange rate movements by using past data. Traders look deep into the market data and look for similar signals and patterns. With the help of the past patterns that emerge in past data, traders analyze where the market is headed next. This may not sound very easy to you, but traders use many tools to identify these patterns possible.

Spot the Trend and Predict Forex

A sequence or similar occurrence of patterns creates a trend. It tells you that the most recent exchange rates of currencies will start a long-term trend. The length of this trend is stipulated by studying how an identical or similar trend panned out earlier.

Forex traders need to pay attention to three types of trends – Downtrend, Uptrend, and Sideways Trend. All the Forex trends are explained below:

A rising trend is an overall move higher in price, created by higher swing lows and higher swing highs. If you spot a rising trend or uptrend according to your technical analysis, you should see the exchange rate heading higher, and it will continue to climb up.

The downtrend is an overall move lower in price, created by lower swing highs and lower swing lows. You do not need to spot a different trend to spot a downtrend. Since currencies are traded in pairs, if one currency gets stronger, the other one gets weaker. This means that if one currency shows an uptrend, the other one will automatically display a downtrend.

Sideways Trend: A sideways market or a sideways drift occurs when the prices of investments remain in a tight price range for any period.

Manually, it is not easy to identify trends. The data is limitless, and the movements in the market are quick. You cannot get lost in the data because you always have to act quickly. To make technical analysis easier, traders use several tools. The most popular ones use moving averages as their principle. Moving averages, in simple terms, identifies Forex market trends. Let’s read more about moving averages and other tools.

- Moving Averages (MA): The moving averages aim to smoothen the historical price data and calculate an exchange’s average rate over a defined time. The tool has a default setting, but you can change the time at your convenience. For example, let’s assume that your moving averages are set for 20 days. Then, it will provide you with the average exchange rate of this defined period. This rate is recalculated each day. On the next day, that is the 21st day; the tool will drop the first day and accept the 21st day as the last day. The MA helps the traders in comparing the current exchange rate with the averages. This allows them to filter out any unexplained or sudden movements that hold the potential to distort the previous price data.

- Moving Average Convergence Divergence (MACD): The MACD uses averages in two ways, the MA for a short period and the general average for a long time period. Traders keep an eye for the moment when the Ma will cross over with the other average. If the MA surpasses the general average, it is a sign that the exchange rate will be moving higher.

Both these tools are based on averages and are used by the traders to predict stability and strength. It is crucial to know these two aspects when predicting Forex, but traders should understand these trends better. Instead of using only one of these tools, you should use them in conjunction with other tools and indicators. The result will clear your doubts regarding the volatility of a currency pair along with its trend. The following tools are also widely used by Forex traders and investors:

- Ichimoku: It is a club-based tool that is also called Ichimoku Kinko Hyo. Along with identifying these trends, the Ichimoku Cloud also helps traders test the momentum or the strength of the trend as it defines the places where the levels of resistance and support sit. In addition to defining these levels’ present place, the Ichimoku Cloud, unlike other tools and indicators, also defines where these levels are expected to occur next or in the future. It is, without a doubt, a valuable Forex tool.

- Relative Strength Index: The relative strength index or the RSI is a momentum indicator. It compares your average losses and average profits made for the same time period; let’s assume for 14 days when the exchange rates rise. It tells the traders if a currency is likely to become over or undervalued in the future.

- Average True Range: Also known as the ATR, the tool does not identify the trend but helps measure its volatility. It is another type of MA that compares an exchange rate’s highs and lows over a defined period of time. The comparison is drawn near the most recent closing, thus, giving you the five current trading price ranges. This is finally averaged, producing the ATR.

- Standard Deviation: This tool measures the movement of a price size. It hopes to identify if the rates will be more or less volatile shortly. Like the Average True Range, this tool is also concerned with volatility rather than finding the trend.

- Bollinger Bands: Two Bollinger bands set the upper and the lower exchange rate, and the trade generally happen within this set of bands. The width between the bands may increase or decrease, thus defining volatility. If the rate goes outside the bands, you can tell that it will either break lower or higher depending on its direction.

Different approaches use these tools. Let’s read about some of the most popular ones:

1. Econometric Approach

All the tools explained above facilitate traders in making profitable trading strategies. However, it must be focused that every tool serves a different purpose, and none is without any limitations. This is why traders are always advised to use these tools in conjunction to get a more defined picture of trends and their volatility.

The most technical approach possible in Forex would be the econometric approach. As every trader puts trust in different variables, they create different strategies using different tools. This is why the econometric model differs a lot. Many variables influence Forex, and it depends on a trader’s individual perspective, which they consider more important or influential. And everything about this is subjective; thus, models are different.

The econometric model is a good technical model as it allows traders to use different tools for different currencies. For example, if you are trading GBP, it would be better to use a tool that focuses on the service rather than the production of goods as the UK is a service sector.

2. Relative Economic Strength Approach

While every data report has something different to offer, everything is truly interlinked. The central banks create monetary policies after considering the economic data, especially inflation. Wage growth, and GDP. When you predict in which direction the exchange rate will be heading after considering the country’s overall economic health, you are using relative economic strength as your primary approach.

3. Purchase Power Parity

This approach is different from the previous approach as it is not focused on predicting the direction of the exchange rates, but it tries to figure out the actual rate. This approach is based on one assumption – prices of services and goods should be equalized everywhere.

4. Asset Market Model and Balance Payment Theory

The two models focus on the flow of investment and trade of different countries. The import-export balance has a huge impact on the exchange rate. There has to be a trade balance in the country. If the country is importing more goods than exporting, its value is likely to depreciate and vice versa. It is also better to have a trade surplus.

Similarly, there has to be more foreign investment in the country as well. Not only does it increase the value of the currency, but it also shows that investors have faith in its economy, which, in turn, invites more investment.

5. Market Sentiments

Understanding market sentiments is essential as it influences demand and supply. Demand and supply can push the exchange rates in either direction. While with other instruments, like stocks, you can look at the volume traded to assess the market conditions, it is not applicable in Forex. The trade is made over-the-counter. Traders should focus on the Forex futures market. This will tell us about the sentiments that are there in the market regarding the current exchange rate.

Most traders use the reports by Commitment of Traders for this purpose. It is an official report and completely reliable. However, do keep in mind that this market is still a tiny entity compared to the spot market. Therefore, the mood of the future’s market cannot always be accepted at its face value.

Conclusion

To predict Forex movements can be overwhelming, especially for new traders. Both fundamental and technical analysis are important parts of this journey, and it is easy to get confused. Keep in mind that you should focus on one of these analyses without completely neglecting the other one.

Some many tools and indicators can guide you. Before you begin trading, make yourself aware of all the things that can aid you. Every trader will have a different strategy. Since the currency and the country are conjoined, you must read the official authorities’ financial and geopolitical statements to confirm the stability. Always remember to start slow and gradually increase your investment.

Never try to shoot blind arrows in the Forex market, as you will not get any profits. It is important to educate oneself on different tools and their functions. Instead of relying on just one tool, find the ones that are compatible with each other and your trading strategy.