Forex trading is buying and selling currencies on the foreign exchange market. The goal of forex trading is to make money off of the changing values of currencies.

The foreign exchange market is a decentralized global market for the trading of currencies. This means forex trading occurs between two parties over the internet rather than in a physical location. The forex market is open 24 hours a day, five days a week.

What is Forex Trader?

A forex trader represents a person who buys and sells currencies on the foreign exchange market intending to make a profit. Forex trading activity is speculating on the price movement of currency pairs.

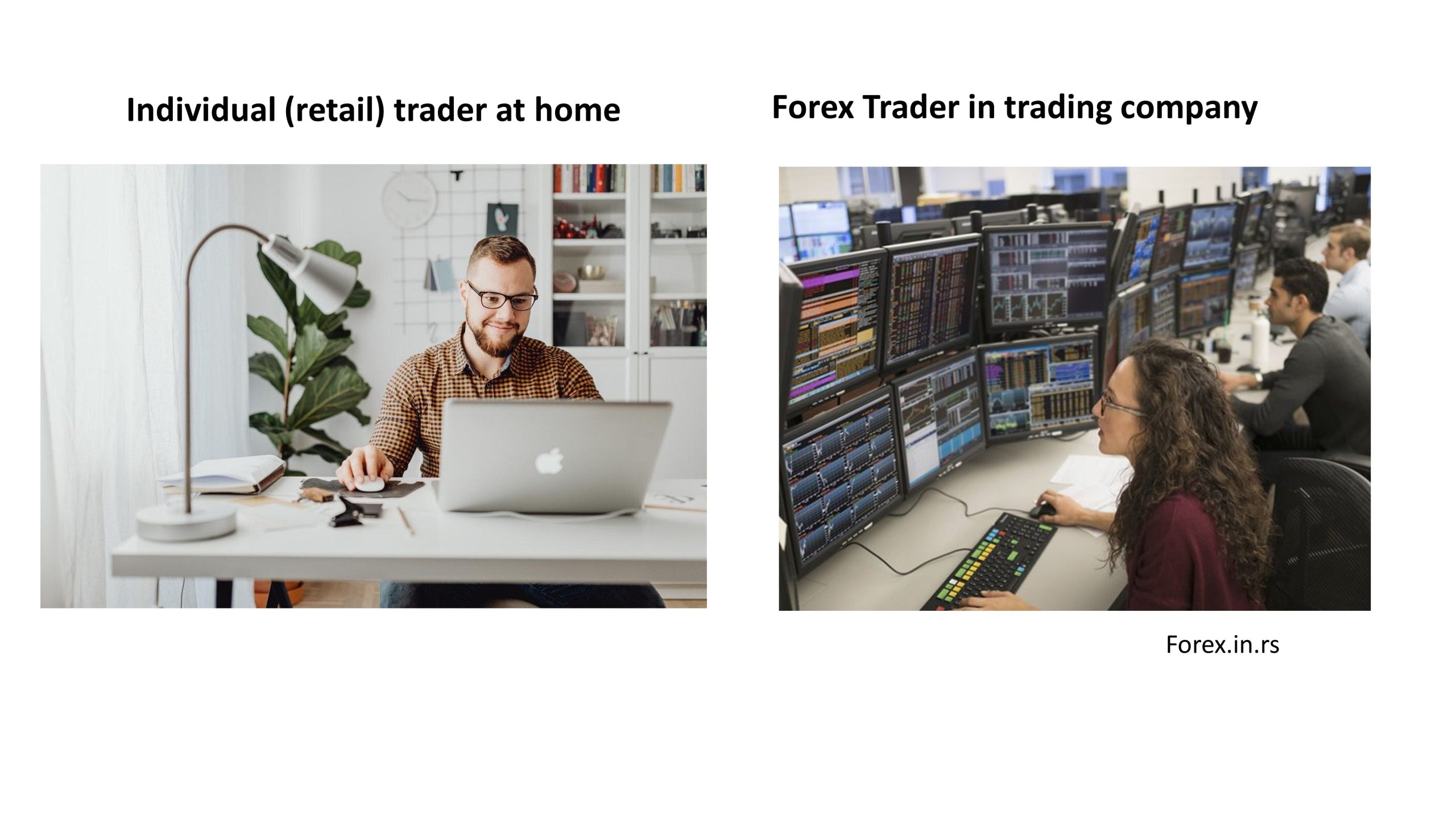

In my opinion, a forex trader is not just a professional who works in a trading company and makes profit trading currencies. Forex traders can be any person who individually trades using a personal trading account at a brokerage company. Therefore, for forex trading, we should analyze from two points of view – the professional business side and the retail trading side (individual accounts).

Please see my video related to this question:

Let us analyze basic terms:

Currencies are traded on the forex market through currency pairs. A currency pair is made up of two currencies, representing one currency’s value in terms of the other. For example, the EUR/USD currency pair represents the value of 1 Euro in terms of US dollars.

When you trade on the forex market, you are essentially betting on the direction a particular currency pair will take. If you think the EUR/USD currency pair’s value will increase, you will buy it. If you think it will go down, then you will sell it.

Forex trading can be highly lucrative but comes with a high degree of risk. This is because the value of currencies can fluctuate rapidly and unexpectedly. It is essential to always be aware of these risks before investing any money in forex trading.

Recently we wrote an article about how many forex traders are in the world, and you can check the stats in our article.

Forex traders’ responsibilities

The responsibilities of a forex trader include:

- Monitoring financial news and economic data: Forex traders must stay informed about economic and political events that may impact currency exchange rates.

- Analyzing market trends: Forex traders use technical and fundamental analysis to identify trends and make informed trading decisions.

- Making trading decisions: Based on market analysis, forex traders decide when to enter or exit a trade to maximize their profits.

- Managing risk: Forex traders must be able to manage their risk by setting stop-loss orders and properly sizing their trades.

- Keeping a trading journal: Forex traders should keep a record of their trades to analyze their performance and identify areas for improvement.

- Continuously learning: Forex trading is a dynamic field, and traders must constantly learn about new trading strategies and stay up-to-date with market developments.

A forex trader is responsible for several things to be successful. First and foremost, they must stay informed about economic and political events that could impact currency exchange rates. They do this by monitoring financial news and reading economic data. In addition, forex traders must be able to analyze market trends to identify opportunities and make informed trading decisions.

This requires both technical and fundamental analysis. Once a forex trader has identified a potential trade, they must decide when to enter or exit the trade to maximize their profits. This can be a complicated decision, as it involves managing risk. Forex traders must carefully set stop-loss orders and size their trades properly to minimize risk. Finally, forex traders should keep a journal of their trades to track their performance and identify areas for improvement.

I suggest you read our article to learn more about is forex trading is profitable!

Forex traders’ skills

Here is a list of skills that a successful forex trader should possess:

- Strong analytical skills: Forex traders must be able to analyze market data, identify trends and make informed trading decisions.

- Risk management: Forex traders must be able to assess and manage risk effectively.

- Discipline: Forex trading requires following a trading plan and sticking to rules.

- Patience: Forex traders must be patient and not make impulsive decisions based on emotions.

- Technical analysis: Forex traders must proficiently use technical analysis tools to identify market trends.

- Fundamental analysis: Forex traders must understand economic and political events that can impact currency exchange rates.

- Adaptability: Forex trading is a dynamic field, and traders must be able to adapt to changing market conditions.

- Attention to detail: Forex traders must be detail-oriented and accurately track their trades and performance.

- Strong communication skills: Forex traders must communicate their thoughts and ideas verbally and in writing.

- Continuous learning: Forex traders must learn about new trading strategies and stay up-to-date with market developments.

Forex trading requires discipline, patience, and a solid understanding of the markets. It can be a rewarding and lucrative career, but it also comes with significant risks, so traders must have a well-thought-out trading plan and manage their risk effectively.