Table of Contents

Investing in precious metals can significantly diversify an investor’s portfolio and hedge against inflation. Gold is the most popular investment in this sector, but silver, platinum, and palladium are viable options for investors. Each of these metals has unique advantages and risks that should be considered when investing.

How to Invest in Precious metals?

You can invest in precious metals in one of the following ways:

- Buy physically precious metals in the form of coins, bars, rounds

- Invest in Precious Metals Stocks because precious metals mining companies are leveraged to price movements in the precious metals.

- Invest indirectly in precious metals by investing in Mutual Funds that are leveraged to price movements in the precious metals.

- Invest in precious metals-related ETFs

- Invest in futures and options.

- Buy or Sell precious metals using CFDs brokerage companies starting from a $1 investing amount with a low commission. See an example of how to trade gold and silver.

- Invest in Precious Metals IRA such as Gold IRA or Silver IRA. In this case, investors use funds from a retirement account to physically invest in precious metals.

Now I will share my opinion:

In my opinion, the best way to invest in Precious metals is to buy long-term gold or silver CFDs (if you live outside the US) because you can close the trade in less than a second, and you have the minimum commission (buy an average of less than 3%). However, if you live in the US and have a retirement IRA account, you can invest 20%-50% of that money in protecting your funds during the stock market’s bearish trend (recession).

Buy physically precious metals.

Physical precious metals can be purchased from various sources, including coin dealers or online retailers. Investors must ensure that they buy certified coins or bars, as these have been subjected to rigorous quality control standards. The cost of gold and other precious metals can fluctuate due to several factors, such as supply and demand, so investors must consider this when deciding how much to purchase.

When it comes to purchasing physical gold, there are a lot of options available. Whether you’re looking for bullion, coins, bars, or any other form of physical gold, you need to know the best places to buy them. Here is a guide to help you make an informed decision when purchasing physical gold.

One of the best overall places to purchase physical gold is Money Metals Exchange. This company offers a variety of forms of gold, including coins, rounds, and bars in various sizes and weights ranging from 1 gram up to 10 ounces or more. The selection also includes rare, collectible, and foreign coins with competitive prices that allow customers to get the most value for their money. Money Metals Exchange also provides free shipping on orders over $75 and offers convenient payment options such as checks or wire transfers.

The American Precious Metals Exchange (APMEX) is one of the top choices for those who want a comprehensive offering of gold products. APMEX carries a wide range of gold bars, coins, and rounds in various weights from 1 gram up to kilo bars and provides storage solutions for long-term investments such as Gold IRAs. What sets this company apart is that they offer incremental pricing discounts on larger purchases which can be beneficial if you buy in bulk. In addition, APMEX has rigorous quality standards regarding their products, so customers can be sure they are getting high-quality metal when they purchase from this site.

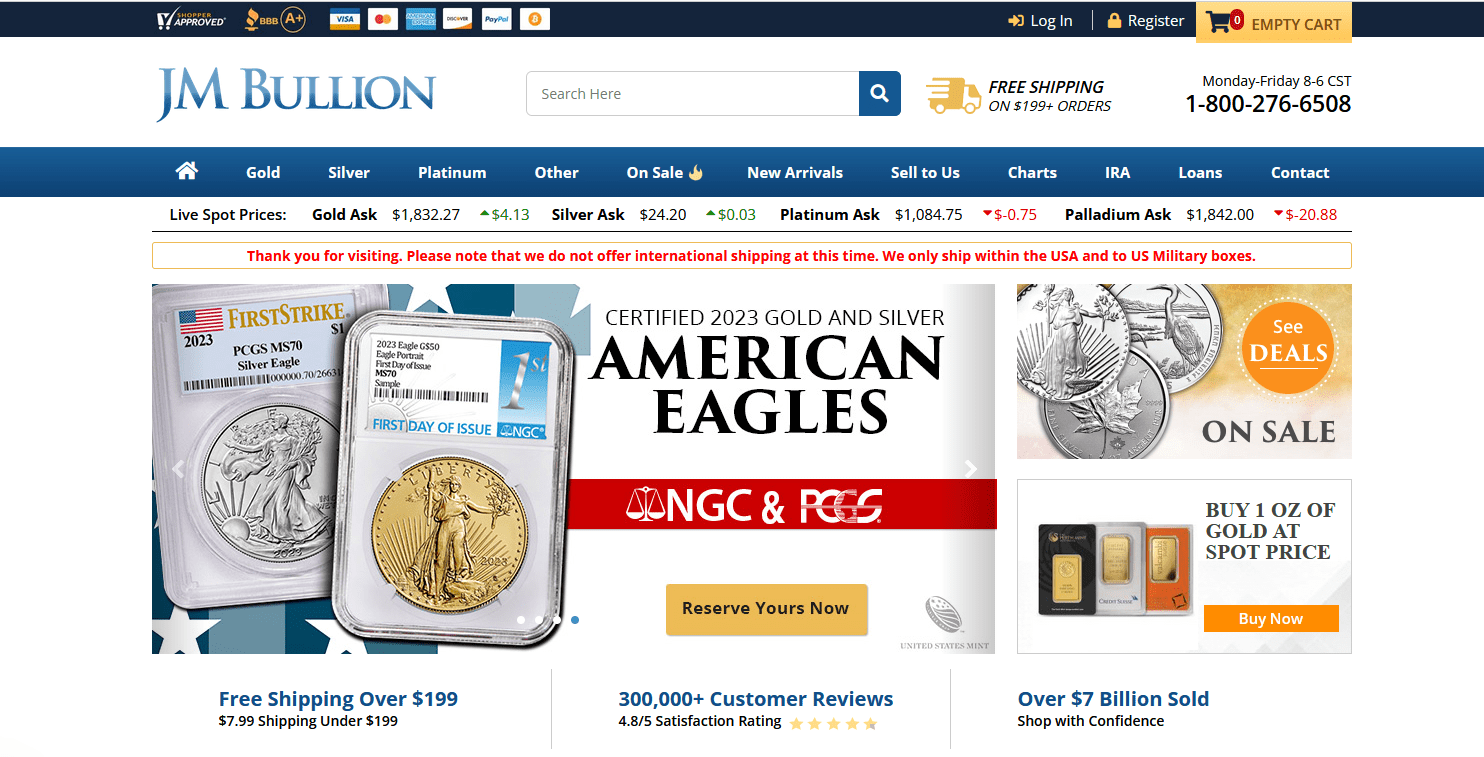

If customer experience is essential to you, JM Bullion should be at the top of your list when buying physical gold. Customers can rest assured knowing that all products purchased from JM Bullion adhere strictly to industry standards in terms of purity and weight plus, they provide photos/descriptions so customers can make an informed decision before buying anything from them. This site also offers free shipping on all orders over $99 plus; they have some great rewards programs so frequent shoppers can maximize their savings even more while making purchases here.

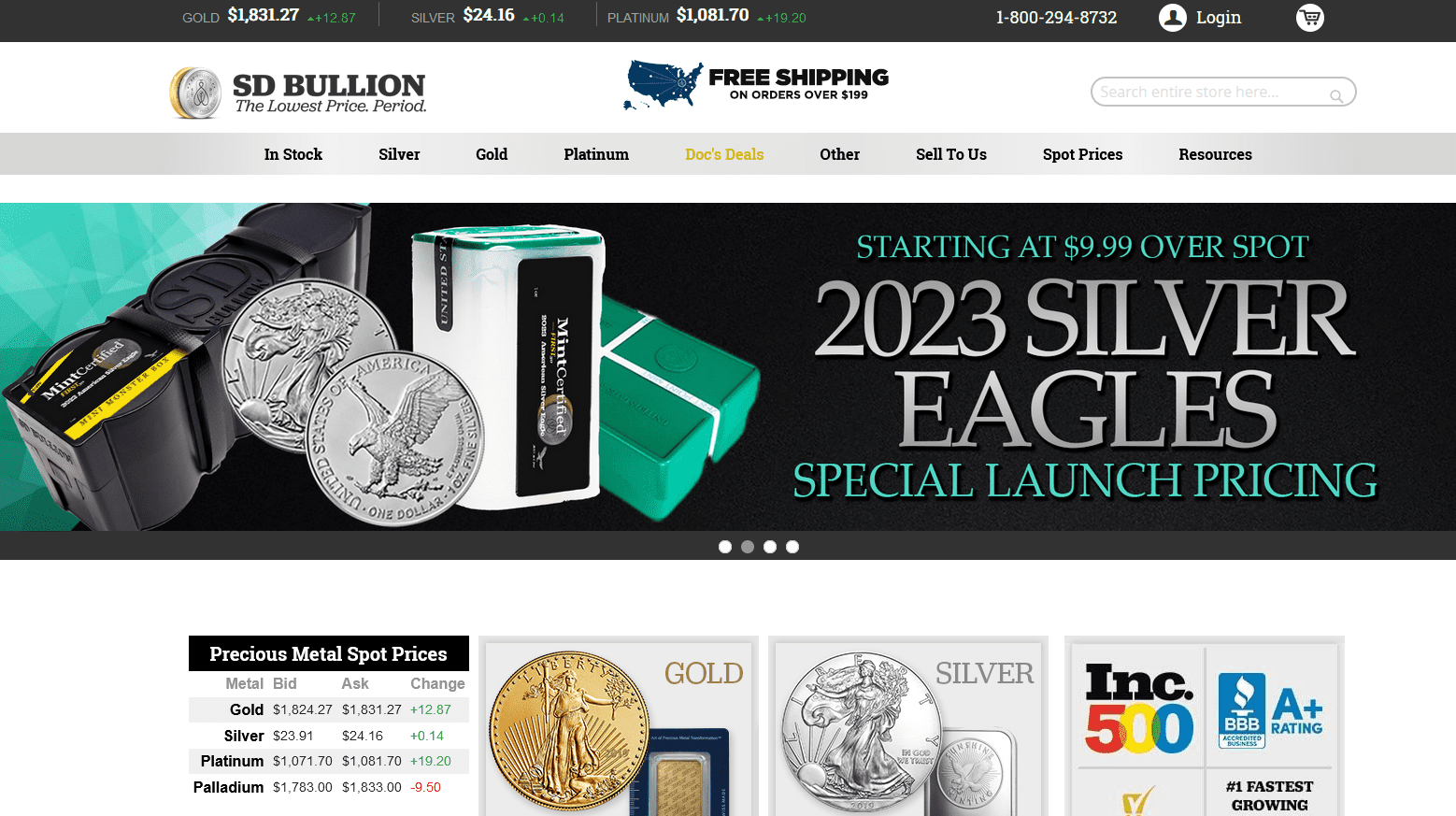

For those looking for the lowest price option, SD Bullion should be considered, as this site offers cheap bullion at competitive rates with no hidden charges or markups tacked on at checkout, as some other sites do. On top of this low pricing, SD Bullion also offers a unique loyalty program that grants customers bonuses depending on how much money they spend each month. Plus, they offer free shipping on orders over $500, which makes it very cost-effective for larger purchases.

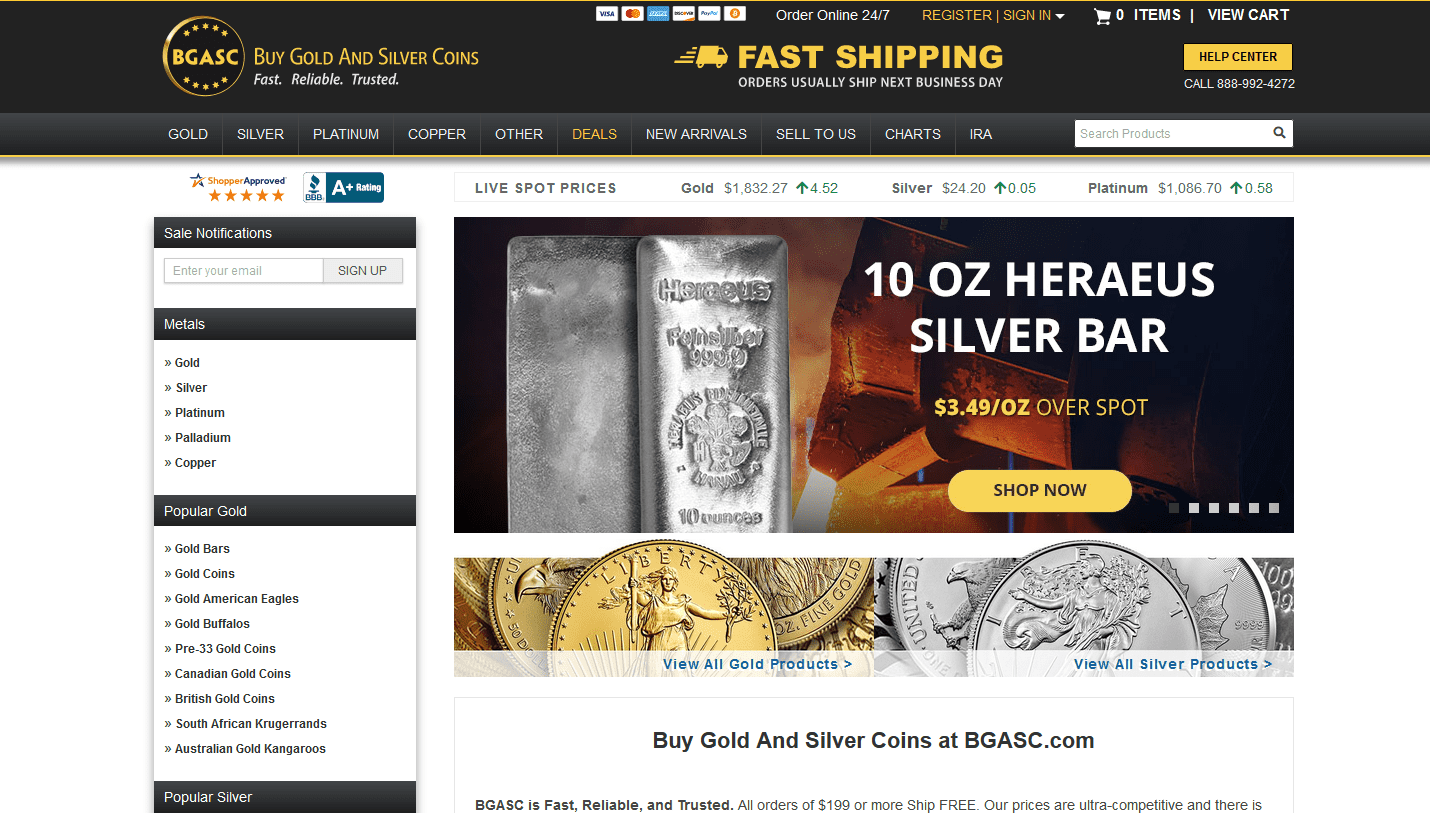

BGASC is another excellent destination for anyone interested in purchasing gold coins, primarily since this site specializes exclusively in coin sales with every type imaginable available, regardless if it is modern or vintage, with prices starting at just one dollar per coin depending on what you choose! They also provide top-notch customer service and free shipping on orders over $250 – so if you’re looking specifically for coins, then BGASC should be considered as an option here!

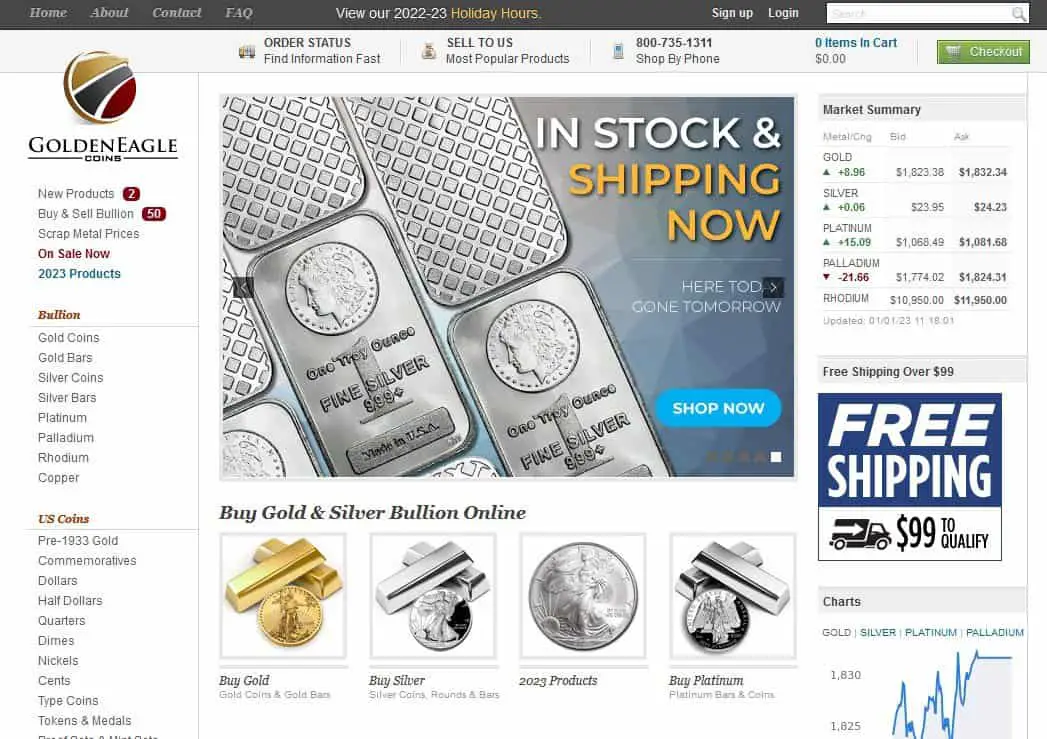

Lastly, Golden Eagle Coins should be considered when shopping around for physical gold due to their reputation as one of the most trusted names in precious metal trading today, having been established more than 20 years ago! Their selection spans all types and sizes, ranging from fractional silver pieces to full-size unallocated bars and graded coins, too – whatever kind of metal you prefer, Golden Eagle Coins has something for everyone! Plus, all purchases come with a 14-day return policy just in case anything isn’t quite what was expected!

Ultimately no matter what type or size of the physical gold product you’re looking for, there are many great companies out there offering competitive rates with excellent customer service that will ensure your satisfaction before, during, and after your purchase, so make sure to do your research first before selecting one above any other!

Precious Metals Stocks

Precious metals stocks represent company stocks that are usually precious metals producers. For example, if you want to buy gold, you can invest in stocks of gold producer companies.

Investing in mining companies allows you access not just the metal itself but also potential profits from production activities such as exploration or extraction operations in various parts of the world where resources may exist underground. Precious Metals miner companies also often offer dividends from ongoing operations and share buybacks if they become profitable enough after expenditure costs have been met. However, investors here need to understand the risks associated with operating mines far away from home country supervision and be aware that commodity prices can fluctuate significantly over short periods affecting profitability levels quickly, too, so doing your research thoroughly here is paramount!

Let us discuss five interesting precious stock examples.

- The first stock on the list is Barrick Gold Corp (NYSE: ABX). This company is one of the largest gold producers in the world, with a market capitalization of $27 billion. The company operates gold mines throughout the globe and produces more than 5 million ounces of gold annually. Barrick’s stock has performed very well over the past year, with its share price up 45%. This is due to rising gold prices, cost-cutting measures, and new acquisitions.

- The second stock on this list is Newmont Mining Corp (NYSE: NEM). Like Barrick, Newmont is another large gold producer with a market cap of around $22 billion. The company has mines in North and South America, Africa, and Australia and produced approximately 6 million ounces of gold last year. Its share price has also outperformed over the past year by more than 30%.

- The third stock is Royal Gold Inc (NASDAQ: RGLD). It is one of the leading royalty companies in the precious metals space, with a portfolio containing more than 200 properties. It boasts an impressive dividend yield of 1.8%, and its share price has increased by 28% over the past year.

- Silver Wheaton Corp (NYSE: SLW) is coming in at number four, which specializes in streaming agreements for silver production from their partner miners all around the globe. It currently holds more than 20 streaming contracts worldwide, with an annual silver production target above 50 million ounces yearly. Its share price has increased nearly 40% since last summer due to higher silver prices and substantial dividend payments.

- Finally, Pan American Silver Corp (NASDAQ: PAAS) ranks our list as number five. PAAS owns numerous active mining sites throughout Mexico, Peru, Argentina, and Bolivia that produce about 25 million ounces of silver annually. Over the past 12 months, its share price has risen by 35% due to higher silver prices combined with cost control measures implemented by the management team.

All five companies mentioned are great investments for anyone looking to increase exposure to precious metals – be it through direct ownership or royalty arrangements – while also benefiting from the potential upside associated with increasing global demand for these valuable commodities and rising commodity prices across most markets today. From experienced investors to novice traders alike, each of these stocks provides unique benefits that make them attractive investments regardless of the investor’s risk profile or objectives!

Precious Metals Mutual Funds

A precious metals mutual fund is an investment portfolio managed by an investment company that pools money from many investors. Precious metals mutual fund invests the most significant amount of money in commodities such as precious metals.

Mutual funds offer access to professional management but may also come with higher fees than ETFs since active management is required; however, they may still provide good returns over time depending on performance relative to benchmarks for similar investments.

Investing in precious metals mutual funds can be a great way to diversify your portfolio. Precious metals are known for their stability, low correlation to other asset classes, and potential for capital appreciation. In this article, we’ll discuss the different types of precious metals mutual funds available and provide details on some of the best ones to consider investing in.

The two most common types of precious metals mutual funds are those that invest solely in gold and a basket of different kinds of metals. Gold-focused funds typically buy bullion or coins, while multi-metal funds involve investing in stocks or ETFs that track the price movements of a specific basket of precious metals such as gold, silver, palladium, and platinum.

When deciding which type of fund is right for you, it’s essential to understand your investment goals. For example, suppose you’re looking for long-term capital appreciation. In that case, a multi-metal fund may be more suitable because it provides diversification across different types of metals, which helps reduce volatility associated with any single metal price movement. Alternatively, suppose you’re looking to benefit from gold’s status as an inflationary hedge. In that case, a gold-specific fund may be more attractive because its returns are often relatively unaffected by stock market fluctuations.

For investors who want exposure to gold and other types of precious metals, there are hybrid funds that allow them to spread their risk across more than one metal. These funds typically invest in physical bullion and stocks or ETFs tracking different indices, such as the MVIS Global Precious Metals Index or the Bloomberg Commodity Index (BCOM).

When selecting a precious metals mutual fund, it’s important to sift through its fees and expenses since these can significantly impact returns over time. For instance, some funds may have higher management or administrative costs than others, so research before committing any money to any particular fund. Some funds may also impose redemption fees on short-selling positions, so check with the issuer before buying units in a specific mutual fund.

Overall there is no one size fits all when choosing a precious metals mutual fund; however, there are several top contenders worth considering depending on your investment goals:

- The UBS Precious Metals Fund invests primarily in gold but also has exposure to other commodity markets, including silver and platinum;

- The Fidelity Select Gold Portfolio focuses exclusively on gold bullion investments through investments in Exchange Traded Funds (ETFs)

- The World Precious Metals Fund offers exposure to both physical bullion holdings as well as equity instruments linked to various commodities markets;

- The Credit Suisse Gold Shares Fund invests primarily in physical gold bullion but also has exposure to other markets like silver and finally.

- The Goldman Sachs Precious Metals Mutual Fund is designed for long-term investors seeking capital appreciation through exposure to multiple global commodity markets, including but not limited to gold and silver.

In conclusion, investing in precious metals mutual funds can be an attractive option for many investors looking for the potential for capital appreciation and diversification benefits from holding assets uncorrelated with traditional stock or bond investments. When selecting a fund, it’s essential to pay close attention to factors like costs and expenses, so you don’t inadvertently reduce or erode any potential gains from your investment decisions over time. With careful research into the best options available, you should be able to find an appropriate choice that meets your individual needs!

Precious metals-related ETFs

Precious metals ETFs represent trading funds you trade on exchanges, generally tracking multiple precious metals-related companies within a packaged bundle. Therefore, ETFs are very similar to stocks. However, you do not invest in one company.

Investing in precious metals has become an increasingly popular way for investors to diversify their portfolios and hedge against economic instability. Exchange-traded funds (ETFs) make it easy to add exposure to gold, silver, platinum, and other precious metals to a portfolio. There is a variety of ETFs available that offer access to these assets, but some are more suitable than others depending on the investor’s goals.

The SPDR Gold Shares (GLD) ETF is the largest gold exchange-traded fund in the world, with over $45 billion in assets under management as of June 2020. It tracks the price of gold bullion and is backed by physical gold held by custodians in London. GLD has a relatively low expense ratio of 0.40%, making it an excellent choice for investors looking for cost-effective exposure to gold prices. GLD also offers tax advantages because capital gains from shares held more than one year are taxed at a lower rate than those held less than one year.

The iShares Silver Trust (SLV) ETF is another popular choice for investors interested in gaining exposure to silver prices without owning physical metal. SLV holds actual physical silver bars stored in vaults worldwide, and its holdings are audited regularly by Inspectorate International Ltd., ensuring they accurately reflect SLV’s underlying holdings. With over $8 billion in AUM and an expense ratio of 0.50%, SLV provides cost-effective access to silver prices and is well suited for long-term investments as capital gains on shares held over one year are taxed at a lower rate than those held less than one year.

The iShares Platinum Trust (PLTM) ETF focuses exclusively on platinum prices, providing direct exposure to this precious metal without buying physical metal or futures contracts. PLTM holds actual physical platinum bars stored in vaults worldwide, and its holdings are audited regularly by Inspectorate International Ltd., ensuring they accurately reflect PLTM’s underlying holdings. With an expense ratio of 0.60% and approximately $2 billion in AUM as of June 2020, PLTM offers cost-efficient access to platinum prices without any complications associated with owning a tangible asset like platinum coins or bullion bars directly.

Finally, the VanEck Vectors Junior Gold Miners ETF (GDXJ) seeks to track the performance of small-cap companies involved in gold mining operations worldwide through its holdings of equity securities such as common stocks and American Depositary Receipts (ADRs). GDXJ has approximately $13 billion in AUM as of June 2020 and an expense ratio of 0.54%. This makes GDXJ an attractive option for investors looking for indirect exposure to gold prices through exposure to companies engaged in gold mining operations worldwide instead of owning physical metal directly, like with GLD or SLV mentioned above.

Precious metals trading CFDs using a forex broker platform Metatrader

You can open a forex account at a forex broker (see our list). You can trade gold, silver, and precious metals using the MT4 or MT5 trading platform with a minimum deposit starting from $1.

If you live outside the US, you can trade precious metals at:

CFDs allow traders to speculate on the price movements of assets without actually owning them; instead, they enter into a contract with another party who agrees to pay out if the asset changes value over time according to predefined terms. This type of trading carries high risk but also offers potentially large rewards if trades are successful; however, it is only suitable for experienced investors who understand the fundamentals of CFD trading.

Remember, when you trade gold and silver using CFDs brokers, you do not own precious metals; you only buy when the price is low and try to sell when the price is high.

Precious Metals IRA

Investing in an individual retirement account (IRA) is one of the best ways to secure your financial future when the stock market is in a bearish trend during the recession. With an IRA, you can take advantage of tax-deferred growth on your investments and access various investment options. One such option is a precious metals IRA, which allows you to invest in gold, silver, platinum, and other precious metals. Augusta Precious Metals IRA is a leading provider of these accounts and offers some unique advantages over other IRA providers.

Gold IRA represents a specialized individual retirement account that allows investors to hold gold as a qualified retirement investment. This way of investment you can use if you live in the UNITED STATES.

Augusta Precious Metals provides investors access to physical gold, silver, platinum, and palladium without the frustration or hassle of buying physical metals. The company has established valuable relationships with mints, refineries, and dealers worldwide, giving them access to various products. They also offer competitive pricing on their products as well as free shipping for orders over $99.

In addition to its wide selection of precious metals, Augusta Precious Metals offers several IRA solutions. These include traditional IRAs and Roth IRAs (which are funded by after-tax contributions). For those who don’t already have an existing retirement account, Augusta Precious Metals will assist in setting up new accounts for their customers and rolling over funds from existing 401(k)s or other IRAs into new ones. Their knowledgeable staff can also help investors understand their options for setting up custodian services and storage options for what they hold within their self-directed precious metals IRAs.

Augusta Precious Metals makes it easy for customers to purchase gold, silver, and other investments in physical form with just a few clicks online or over the phone – no need to search various coin shops or worry about whether you’re getting a fair price on your purchases. Their convenient online ordering process allows you to quickly select coins or bullion bars and pay by credit card or bank transfer – all from the comfort of your home! Plus, there are no setup fees when opening an Augusta Precious Metals IRA account – only applicable taxes are due when transferring funds from another retirement account into a new one.

When purchasing products from Augusta Precious Metals, customers can rest assured they are getting a quality product at competitive prices without any hidden fees or surprise charges down the line. All purchases come guaranteed by the US Mint or accredited bullion dealer – so investors know they’re getting what they paid for!

Augusta Precious Metals is dedicated to providing its customers with quality service and offering sound financial advice regarding investing in gold, silver, platinum, or palladium. The company’s website features helpful information such as market outlooks, industry news, and educational resources like how-to guides and ebooks designed to help educate potential investors about the ins and outs of investing in precious metals. And if that doesn’t provide enough support, the company also provides 24/7 customer service via phone, email, and web chat.

Please read our article “What are Precious Metals.” If you want to know more about how to invest in precious metals, read our extended version article.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: