The US government has laws and regulations for trading precious metals that sellers must follow. Depending on your state, you may need different licenses to buy, sell, or trade precious metals. To ensure compliance with all applicable laws and regulations, obtaining the necessary licenses is essential before engaging in any buying or selling activities.

Do you Need a License to Sell Precious Metals?

Yes, to sell precious metals in large quantities, you need to have precious metals dealer’s license. Usually, each State will provide you a commission if you do not have a crime eviction or criminal or administrative investigation. However, you must pay an annual fee of up to $200. Additionally, some states, such as Ohio, can require at least 10K net worth.

Of course, if you are a commodity trader working as a retail trader or for a prop company, you do not need a license for buying and selling precious metals.

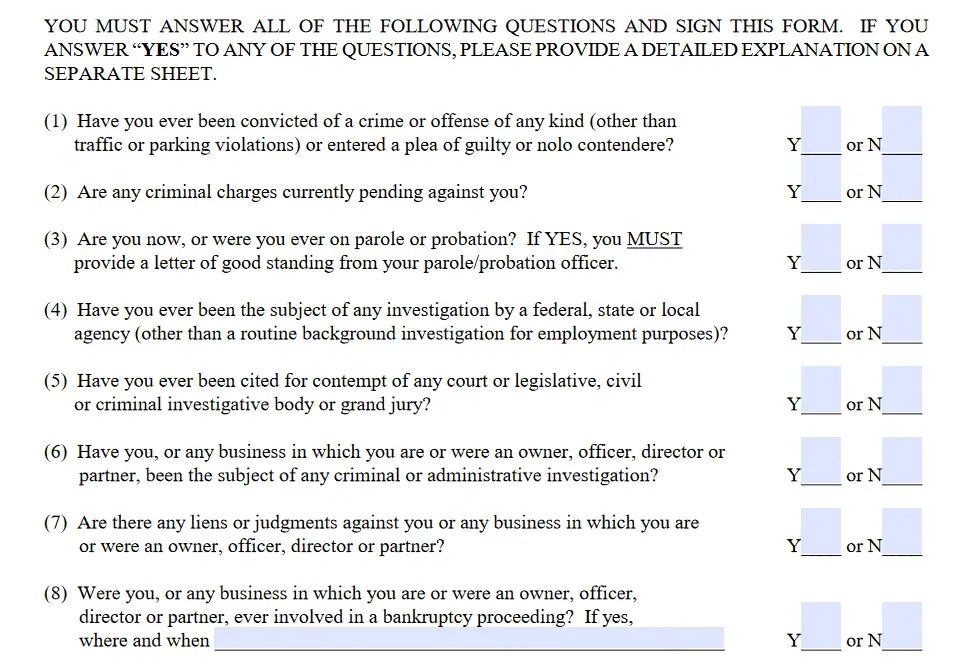

See, for example, some questions that you need to answer to get a Precious Metals Dealer license:

The laws that govern the sale of precious metals vary from state to state. In general, sellers must register as a dealer with their local government and have at least one type of license issued by their state. However, each state may require additional paperwork and documentation for dealers wishing to buy or sell gold, silver, platinum, and other valuable metals. For instance, many states require sellers to obtain an appropriate business license and a specific type of dealer permit; some states may even require licensing for individual transactions.

Aside from needing a license, sellers must adhere to specific federal guidelines related to precious metals. Particular Federal Trade Commission (FTC) enforces these rules under its authority granted by the Federal Trade Commission Act (FTCA). For example, under FTCA regulations, anyone buying or selling precious metals must disclose any potential conflicts of interest and accurately represent facts regarding the sold items. Furthermore, all sales must include detailed purchase orders that specify each transaction element, including pricing and bullion weight information.

Of course, there are some exceptions for those who do not need licenses when buying and selling precious metals within the US. These exceptions depend on several factors, such as whether you are dealing with coins or bullion bars; if you are operating through an established auction house; or if your transactions involve rare coins or antiques, which can be exempt from certain laws related to transactions involving numismatic specific or currency instruments that are over 50 years old. Additionally, suppose you plan on investing in exchange-traded funds (ETFs) rather than physical gold or silver coin. In that case, s then no license will be required as ETF investments follow different investment rules than those set forth by state governments regarding coin/bullion dealing activities.

In summary, while there are some exceptions when buying and selling precious metals without a license in the US, most dealers will require one before engaging in any trade activity within the country’s borders. Therefore, potential traders must carefully research their state’s regulations before engaging in buying or selling activities to ensure compliance with all applicable laws governing such transactions, including those imposed by local and federal governments.

Doing so will help protect both buyers and sellers during these delicate economic times when it is essential for parties involved in such trades to have an understanding of their rights and responsibilities under current law before entering into any financial agreements via precious metal exchanges within the US market.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: