Precious metals have long been seen as a safe investment, but for some, it is more than just an asset. For many, working with precious metals can be a great career path. Whether looking to buy or sell jewelry, coins, bullion, or works of art, such investments can provide a solid revenue stream.

Is Precious Metals a Good Career Path?

Yes, precious metals can be a good career path because it is related to 9 interesting job profiles such as:

- Mining engineer: Mining engineers extract and process precious metals from the earth.

- Metallurgist: Metallurgists work with metals, including precious metals, to develop and improve manufacturing processes.

- Precious metals trader: They buy and sell precious metals for clients or employers.

- Jeweler: Jewelers work with precious metals to design, create, and repair jewelry.

- Refinery worker: Refinery workers are involved in the processing and refining of precious metals, including separating them from other minerals and metals.

- Assayer: Assayers test and analyze the purity and quality of precious metals to ensure that they meet industry standards and regulations.

- Precious metals analyst: Precious metals analysts study market trends and provide insights into the supply and demand of precious metals, as well as their prices and value.

- Coin dealer: Coin dealers buy and sell rare and valuable coins, many of which are made from precious metals.

- Pawnbroker: Pawnbrokers often deal in precious metals, including buying and selling gold and silver jewelry.

When considering this career path, the first consideration is the ability to understand the different types of precious metals and how their prices react in the marketplace. As with any other commodity, there are volatile moments when certain precious metals may rise in value while others decrease. When starting in this field, it’s essential to understand these fluctuations and anticipate them so that you can make intelligent decisions when buying and selling your commodities.

Another factor to consider is the cost of getting started in precious metal trading. While it may not be as expensive as some forms of financial investing (such as stocks), specialized equipment and tools must be purchased upfront before dealing with precious metals. Additionally, having access to reliable sources that can provide accurate information on market trends and prices will also help you maximize profits from this venture.

Beyond the financial aspects of trading precious metals, there is also the potential to create beautiful works of art from these materials. Jewelers and goldsmiths have been working with precious metals for centuries, crafting items with monetary value and aesthetic appeal. Making jewelry or artwork from precious metals requires skill and experience – something that will take time and effort to acquire if someone begins from scratch. Once mastered, it can be both a creative outlet and a lucrative career opportunity.

Why are precious metals dealers lucrative job profiles?

A precious metals dealer can be a lucrative job for several reasons, including:

- High demand: Precious metals, such as gold and silver, have been used as a store of value and a medium of exchange for centuries. As such, these metals are constantly demanded, particularly during economic uncertainty or inflation.

- Price appreciation: Precious metals have historically appreciated over time, making them a valuable long-term investment for individuals and institutions. This price appreciation can result in significant profits for precious metals dealers who buy and sell these metals at the right time.

- Limited supply: Precious metals are relatively rare, and their supply is limited. As such, the prices of these metals can be volatile and subject to market fluctuations, which can create opportunities for dealers to buy and sell at favorable prices.

- Diversification: Precious metals are often used as a hedge against inflation and market volatility, and as such, they can be an essential component of a diversified investment portfolio. Dealers who offer a range of precious metal products and services can attract a broader customer base and potentially increase their profits.

- Value-added services: Many precious metals dealers offer value-added services, such as storage, grading, and authentication, which can increase their revenue streams and differentiate them from their competitors.

Overall, a precious metals dealer can be a lucrative job because of the high demand for these metals, their potential for price appreciation, and the limited supply of these metals. Additionally, dealers offering value-added services and a broad range of products can increase their profitability and attract a loyal customer base.

For those interested in investing in rare coins or antique pieces made with gold or silver, many outlets are available to learn more about these marketplaces and what makes certain items valuable. Research into numismatics (the study of coins) or understanding how specific craftsmen’s work has become increasingly sought after over time due to its scarcity or quality craftsmanship can pay off significantly when trading in these areas if appropriately done – though again, expertise will need to be acquired here too before entering these markets confidently.

Overall, becoming involved with buying or selling precious metals takes dedication and effort – however, if done correctly, it can be gratifying, financially and creatively speaking too!

In my opinion, the most lucrative precious metals job is gold and silver trading because you can use leverage and start with a smaller investment. In general, it is recommended to start with a smaller investment amount and gradually increase as you gain experience and confidence in your trading strategy. This can help you manage your risk and avoid significant losses. It’s also a good idea to seek advice from a financial advisor or other professional before investing.

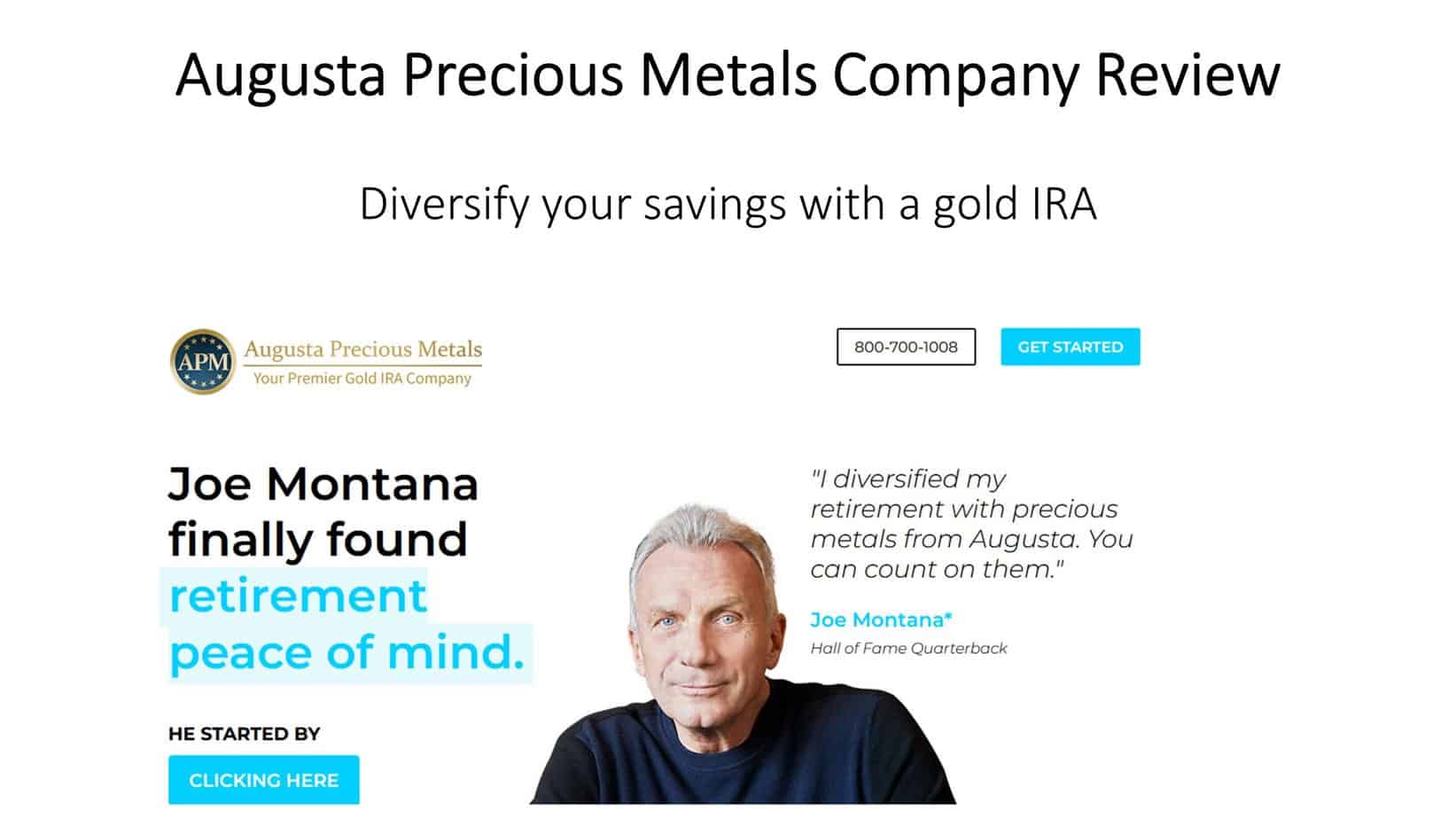

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: