Investing in precious metals can be a great way to diversify your portfolio and hedge against inflation. Owning physical gold, silver, or platinum can provide stability, protection, and even potential profits. But how much of these metals should you have in your portfolio?

The right amount depends on your individual financial goals, but there are some general guidelines you should consider when deciding how much precious metal to own. First, consider whether gold, silver, platinum or another option is best for you. Each metal has unique properties and might fit into different types of portfolios better than others.

For example, gold is often seen as a haven that can protect investors against inflation or market volatility. It also has industrial applications that could benefit those looking for growth potential. Silver tends to move with the stock market instead of against it and has more industrial uses than gold, making it a potentially lucrative investment option during specific periods. Platinum is rarer than gold or silver and usually follows their prices closely, but it also has many industrial applications that make it an attractive option for specific portfolios.

Let us see how much precious metal you should own:

How much of your portfolio should be in precious metals?

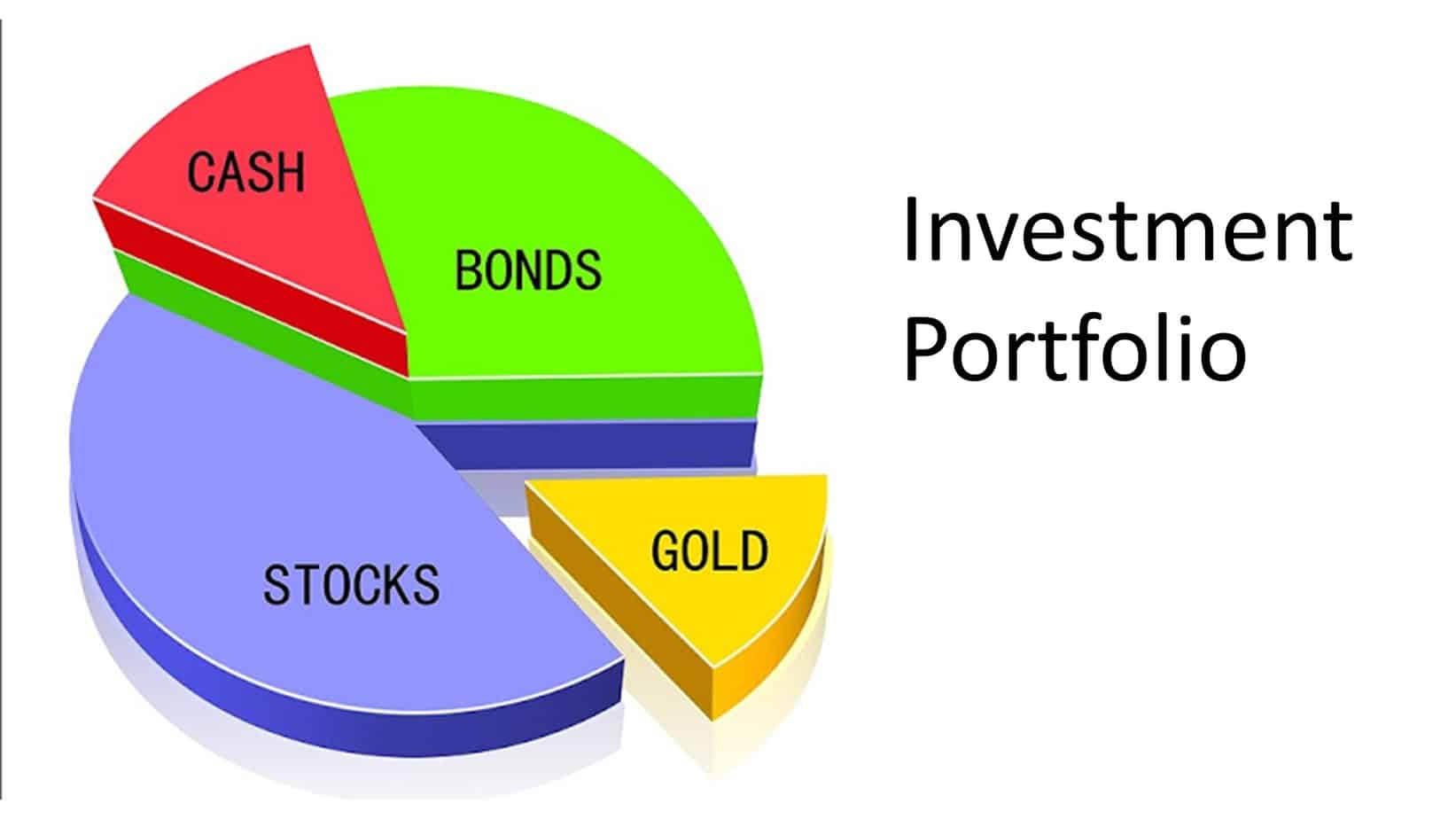

Usually, investing funds allocate between 5%-10% in the metals during the bull stock market while increasing the precious metals percentage during the bear stock market from 10% up to 20%. Using this diversification strategy, investors decrease risk and portfolio volatility.

This is not advice or some rule. Traders and investors sometimes invest 100% of their assets in precious metals, and some investors avoid investing at all in metals.

Once you’ve decided which type of metal to invest, you must determine how much of your portfolio should consist of precious metals. Financial advisors typically recommend allocating between 5% and 10% of your portfolio to these metals. If you have $100,000 in investments, anywhere between $5,000-$10,000 should go towards buying precious metals like gold or silver coins or bars.

It’s important to remember that while owning some precious metals can benefit any investor’s portfolio in the long run, holding too much will lead to an overly concentrated position that could put your investments at risk if prices fall unexpectedly. To minimize this risk, it’s best to round off any positions with an equal amount in cash so that when prices drop there is still liquidity available while keeping most of your holdings invested in safer assets such as bonds or stocks.

When comparing different types of precious metal investments, such as bars vs. coins vs. ETFs vs. futures contracts, etc., there are numerous factors to consider, such as costs associated with each product (e.g., storage fees), ease-of-accessibility (ability to liquidate quickly) and level of security offered by each vehicle before deciding which one would fit best into your portfolio strategy.

In conclusion, investing in some form of physical or online precious metal can be a great way to safeguard yourself from market fluctuations and inflation risks while adding another layer of diversification within your existing investment strategy. However, it is essential not to become over-exposed by allocating too large a portion towards this asset class; therefor,e one should aim for an allocation no larger than 10% – ideally somewhere between 5% – 10%. With these basic principles considered, investors can now confidently begin building their portfolios with the right mix of precious physical metals and other stable investments like bonds or stocks to ensure optimal returns over the long run!

Please read our article “What are Precious Metals.” If you want to know more about how to invest in precious metals, read our extended version article.

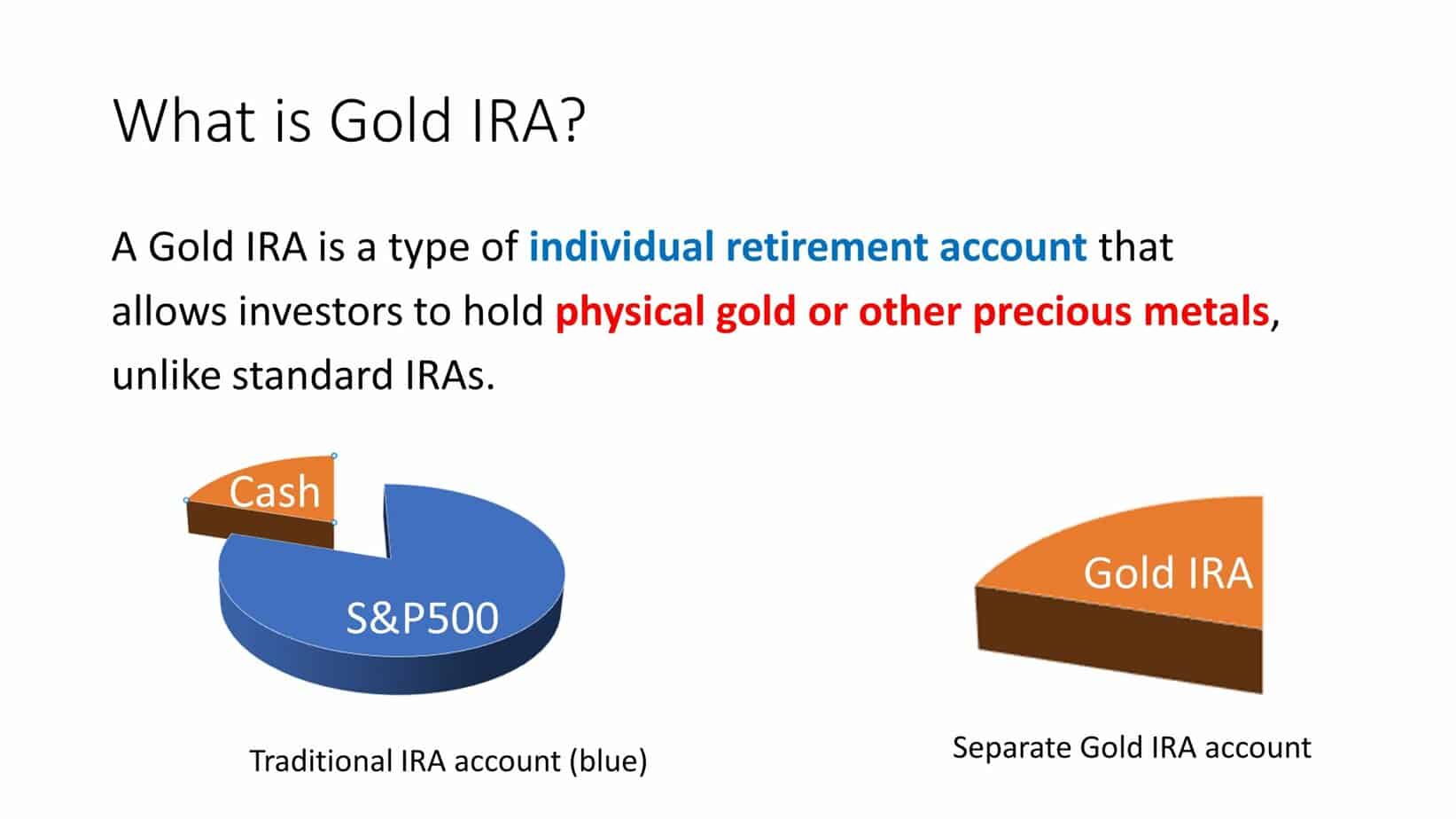

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: