Precious metals have long been considered a safe investment option for interested parties. Gold and silver, in particular, are often held in high regard due to their historical significance and the fact that they can be used as a form of currency or bartering tool. As such, these popular precious metals have become increasingly sought after by investors hoping to build wealth over the long term. But are they as secure an investment option as they seem?

Are Precious Metals a Good Long-Term Investment?

Yes, during the recession and bear market, precious metals can be an excellent long-term investment. However, during a bull market or high volatile, unstable precious metals market, this asset can be a risky or non-profitable investment.

Precious metals, such as gold, silver, and platinum, are often considered suitable investments during a recession for several reasons:

- Safe-haven asset: During a recession, investors tend to seek out safe-haven assets that are considered to be relatively stable and secure. Precious metals have historically been viewed as safe-haven assets because they are tangible assets with intrinsic value and are not subject to the same volatility as other investments, such as stocks or real estate.

- Store of value: Precious metals are also considered a store of value, meaning they retain their purchasing power over time. This can be particularly important during a recession when inflation is a concern, and the importance of paper currency may be eroded.

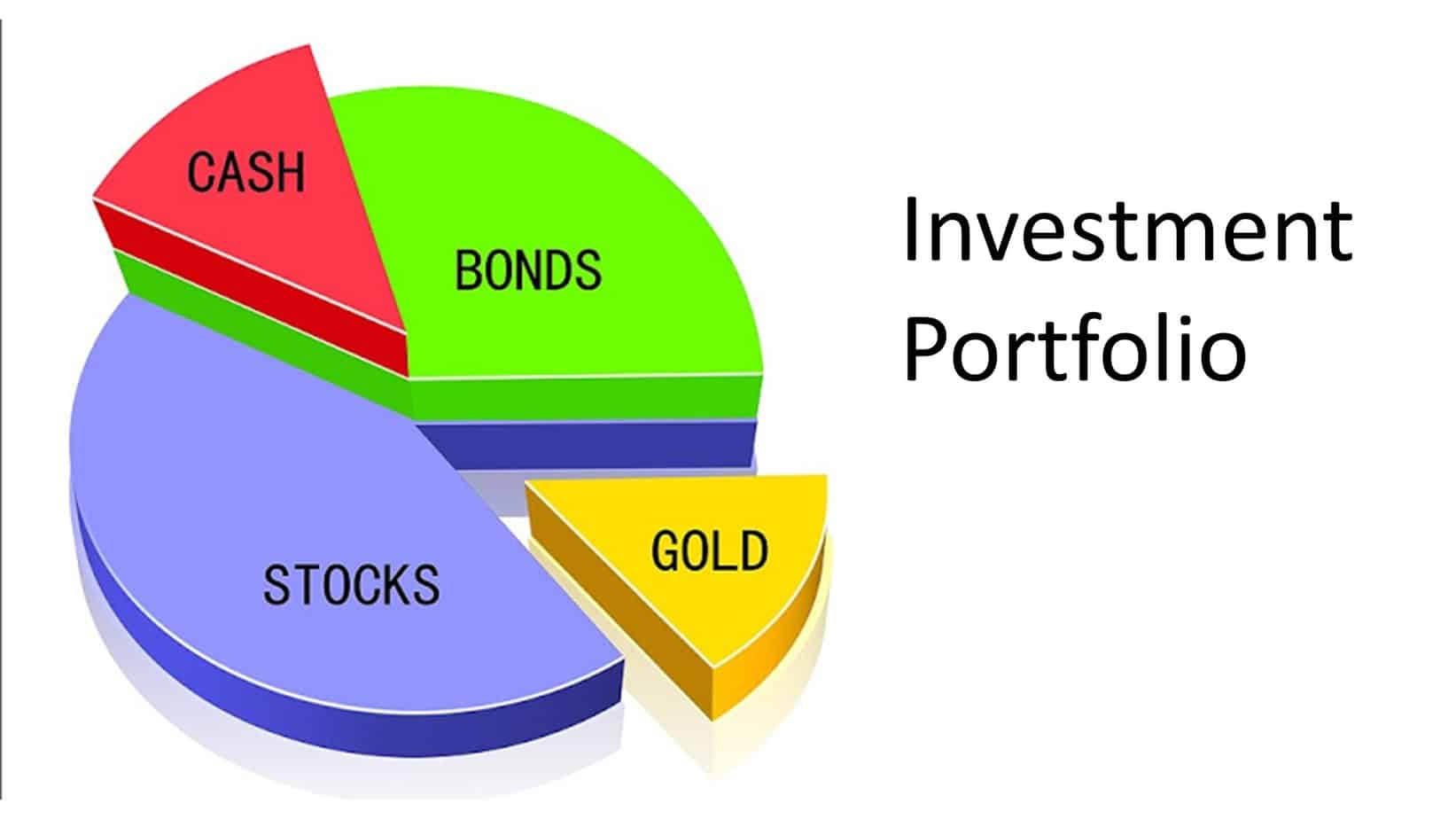

- Diversification: Investing in precious metals can benefit an investor’s portfolio. Precious metals are not highly correlated with other assets, such as stocks or bonds, which can help reduce overall portfolio risk and volatility.

- Limited supply: Precious metals are a finite resource and are difficult and expensive to mine. This limited supply can help to support their value during a recession when other investments may be experiencing significant losses.

- Demand from central banks: Central banks worldwide hold significant amounts of gold as part of their foreign exchange reserves. During a recession, central banks may increase their demand for gold to diversify their holdings and protect against currency devaluation.

It’s worth noting that investing in precious metals carries some risks, such as fluctuations in market prices, storage, and insurance costs, and the possibility of fraud or counterfeiting. Therefore, it’s essential to consider these risks carefully before investing and consult with a financial advisor or professional who can guide you on incorporating precious metals into a diversified investment portfolio.

While it’s true that investing in gold and silver can provide some degree of protection against inflation, market volatility, and other economic factors, there is also a risk associated with these investments. For one thing, gold and silver prices can fluctuate significantly depending on supply and demand—which means your profits may not always be guaranteed. Additionally, some forms of gold investments (such as ETFs or futures contracts) come with higher fees than other types of investments. And if you decide to store your precious metal holdings in physical form (for example, coins or bars), you’ll need to consider whether you have secure storage solutions.

Still, given the current economic climate—which has seen increasing levels of uncertainty due in part to political turmoil and trade tensions—it’s understandable why many investors are looking for alternative forms of security. In this regard, gold and silver provide a compelling option for those who want something tangible that can hold its value over time. The key is understanding how to diversify your portfolio so that any downturns experienced in one area don’t necessarily affect the rest of your investments too severely.

One way to do this is by investing in different types of precious metals; At the same time, gold tends to be the primary focus when it comes to long-term investments; silver may offer more potential upside over time due to its lower cost and broader availability (as compared with gold). In addition, platinum and palladium are relatively rare metals that can provide additional diversity within a portfolio when invested at appropriate levels.

In addition to diversifying between types of precious metals, investors need to understand how these assets can be purchased or sold on the market. For example, exchange-traded funds (ETFs) offer exposure without having ownership of physical metal; alternatively, bullion coins allow for direct ownership but involve storage considerations that should not be taken lightly. Finally, buying futures contracts will enable investors access to large quantities without needing substantial capital upfront; however, they come with significant risks because they involve leveraged positions, which could result in losses exceeding an investor’s original deposit if market conditions don’t turn out favorably over time.

Overall then, it’s clear that investing in precious metals carries both advantages and risks; however, done correctly with sufficient research beforehand and with an eye towards diversification throughout the portfolio – there is likely potential for those seeking protection from inflation or volatility through long-term investments in brief periods where stock markets decline significantly.

If coupled with a more traditional ‘buy-hold’ approach across several asset classes, such as equities & bonds, as well as commodities like energy & agricultural products – such positioning could act as an effective hedge against downturns across each asset class. We provide liquidity during difficult times while still allowing for upside capture during more favorable cycles overall, given combined diversification benefits across different asset classes, including precious metals themselves – thus making them an attractive proposition for many long-term investors seeking reliable returns over multiple years.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: