Table of Contents

Robinhood, the investment app that has become a favorite among young investors, offers its users the ability to buy precious metals through its platform. Now you can buy gold, silver, and other metals in addition to your stock portfolio.

Can You Buy Precious Metals on Robinhood?

You can not buy precious metals directly on Robinhood because this broker does not offer commodities, forex, futures, or mutual funds. However, you can indirectly invest in precious metals ETFs or stocks highly correlated with the precious metals price. For example, you can invest in gold if you buy SPDR® Gold Shares (GLD) ETF or in palladium if you invest in PALL ETF.

When trading precious metals on Robinhood, you’ll need to remember how Robinhood charges for these transactions. The commission fee is often different from stocks and options trades. For example, there are no fees for buying or selling gold, silver, palladium, or platinum coins; however, you will pay a commission when buying and selling bars of authorized products from other sellers.

Precious metals can also be bought as Exchange Traded Funds (ETFs) on Robinhood. ETFs track the price of commodities such as gold and silver but are traded like stocks. As a result, investors can buy into these funds without physically storing the metal itself and benefit from exposure to a basket of underlying assets.

Investing in precious metals via Robinhood is attractive because it offers fractional shares so investors can purchase any desired amount instead of being limited by high minimum purchases often required by other platforms. It also provides an easy way to diversify your investments with minimal effort while still having access to various metal types, including copper, palladium, and platinum.

Another great feature Robinhood offers is its Gold subscription program, which allows customers who sign up for the service to pay discounted broker fees when trading certain ETFs related to precious metals. This makes it much easier for investors looking to get started in metal investments with small amounts of money because they won’t have to worry about expensive commissions eating away their profits over time.

The Aberdeen Standard Physical Palladium Shares ETF (PALL) is an exchange-traded fund that tracks the price of palladium. Palladium is a precious metal used in many industrial applications, particularly in the automotive industry for catalytic converters. Palladium is also used in electronics, dentistry, and jewelry.

How to invest in Palladium Precious Metal ETF on Robinhood?

The PALL ETF is managed by Aberdeen Standard Investments and is listed on the New York Stock Exchange. The fund seeks to expose investors to the performance of the palladium price by holding physical palladium bars in a secure vault. The ETF is designed to reflect the price of palladium and provide investors with a convenient way to invest in the precious metal without needing physical storage.

- PALL ETF exposes investors to the price performance of physical palladium, a rare and valuable metal used in various industrial applications.

- As a physically-backed ETF, PALL allows investors to own palladium bullion without needing physical storage or the hassle of trading futures contracts.

- PALL is managed by Aberdeen Standard Investments, a leading global asset manager with a strong track record of managing commodity-focused funds.

- Aberdeen Standard Investments has extensive experience in the palladium market and actively manages the PALL ETF to optimize its performance and mitigate risk.

- PALL offers low expense ratios and relatively low trading costs, making it a cost-effective investment in palladium.

- PALL is highly liquid and trades on major stock exchanges, providing investors flexibility and ease of trading.

- PALL provides transparency in pricing and holdings through regular disclosures of the fund’s net asset value (NAV) and holdings.

- PALL can potentially provide diversification benefits to an investment portfolio due to its low correlation with traditional asset classes like stocks and bonds.

- As a regulated investment product, PALL provides a secure and trustworthy investment option compared to purchasing physical palladium from potentially untrustworthy sources.

Investors who buy shares in the PALL ETF on Robinhood can benefit from the liquidity and low costs associated with ETFs. The fund has a relatively low expense ratio of 0.60%, the annual fee that investors pay the fund manager for managing the ETF. The PALL ETF also allows investors to trade the ETF intraday, allowing greater flexibility and control over their investments.

It is important to note that investing in the PALL ETF involves risks, including the possibility of a loss of principal. The price of palladium can be volatile and may be affected by various factors, such as changes in supply and demand, economic conditions, and geopolitical events. Investors should carefully consider their investment objectives, risk tolerance, and financial situation before investing in the PALL ETF or any other investment.

Overall, the Aberdeen Standard Physical Palladium Shares ETF on Robinhood provides investors with a convenient and cost-effective way to invest in the price of palladium, which can serve as a diversification tool within a broader investment portfolio.

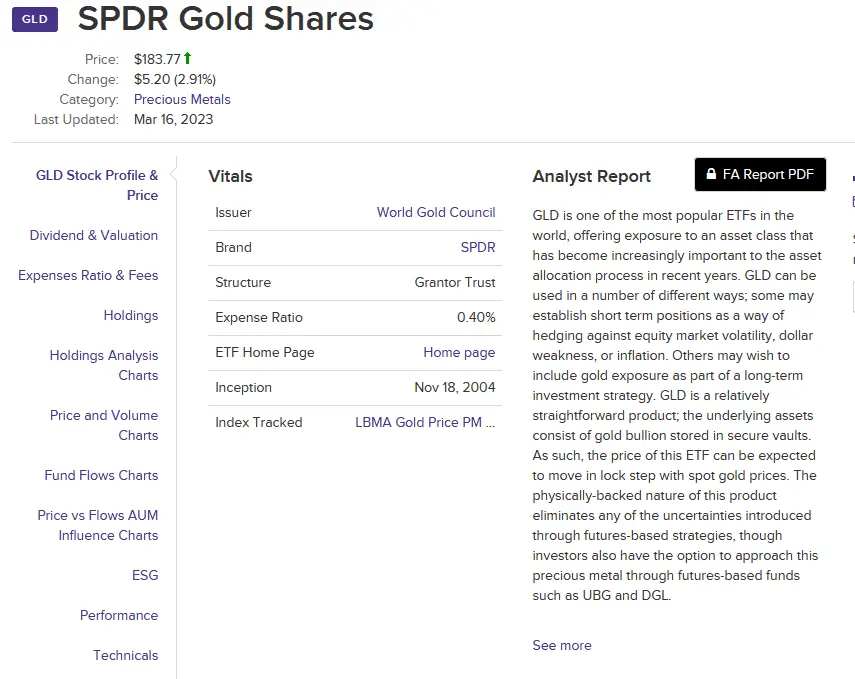

How to invest in Gold using SPDR® Gold Shares Precious Metals ETF on Robinhood?

The SPDR® Gold Shares (GLD) ETF is an exchange-traded fund that proposes the price of gold to investors. The ETF is managed by State Street Global Advisors and is listed on the New York Stock Exchange.

Investors who buy shares in the GLD ETF on Robinhood can benefit from the liquidity and low costs associated with ETFs. The fund has a relatively low expense ratio of 0.40%, the annual fee that investors pay the fund manager for managing the ETF. The GLD ETF also allows investors to trade the ETF intraday, allowing greater flexibility and control over their investments.

The GLD ETF holds physical gold bars in a secure vault, and the price of the ETF is designed to reflect the price of gold. As a result, the ETF provides investors with a convenient way to invest in gold without needing physical storage, making it a popular choice for investors who want exposure to the price of gold as a diversification tool within their investment portfolios.

Investing in Gold using ETFs at Robinhood, you can get the following advantages:

- It provides exposure to the price performance of gold bullion without physically buying and storing it.

- Allows easy and convenient trading on major stock exchanges, providing liquidity and flexibility.

- It offers lower transaction costs compared to purchasing physical gold.

- Provides a relatively stable and diversified investment option compared to individual gold mining stocks.

- Offers transparency in pricing and holdings through daily reports of the fund’s net asset value (NAV).

- It provides a way to hedge against inflation and currency risks potentially.

- It allows for fractional ownership, allowing investors to buy small amounts of gold.

- It offers tax advantages compared to physical gold ownership, such as avoiding sales tax and providing potential tax benefits for long-term investors.

- It provides a regulated and secure investment option compared to purchasing gold from potentially untrustworthy sources.

It is important to note that investing in the GLD ETF involves risks, including the possibility of a loss of principal. The price of gold can be volatile and may be affected by a range of factors, such as changes in supply and demand, economic conditions, and geopolitical events. Investors should carefully consider their investment objectives, risk tolerance, and financial situation before investing in the GLD ETF or any other investment.

How to invest in Silver using iShares Silver Trust Precious Metals ETF at Robinhood?

iShares Silver Trust ETF is also available for trading on the Robinhood platform, offering investors several advantages. These include:

- Ease of use: Robinhood provides a user-friendly interface that makes it easy for investors to buy and sell iShares Silver Trust shares. The platform is designed to be accessible to novice and experienced investors alike.

- Low fees: Robinhood offers commission-free trading for iShares Silver Trust shares, which can help investors save money on transaction costs. Additionally, Robinhood does not charge account maintenance or inactivity fees.

- Fractional shares: Robinhood allows investors to buy fractional shares of iShares Silver Trust, which can be particularly beneficial for those who want to invest small amounts of money.

- Mobile access: Robinhood is a mobile-first platform, meaning investors can trade iShares Silver Trust shares from anywhere using their smartphone or tablet. This can be particularly convenient for investors who want to stay on top of their portfolio while on the go.

- Educational resources: Robinhood provides various educational resources to help investors learn about investing in iShares Silver Trust ETF and other investment products. These resources can include articles, podcasts, and videos which can be particularly beneficial for novice investors just starting.

Overall, iShares Silver Trust ETF is a popular investment option for those who want exposure to physical silver, and Robinhood provides a convenient and cost-effective way to trade the ETF.

See Ishares Silver trust advantages to invest in precious silver metal:

- iShares Silver Trust ETF exposes investors to the price performance of physical silver, a precious metal with various industrial and investment applications.

- As a physically-backed ETF, iShares Silver Trust allows investors to own silver bullion without needing physical storage or the hassle of trading futures contracts.

- iShares Silver Trust is one of the largest and most liquid silver-focused ETFs, offering investors high liquidity and flexibility.

- iShares Silver Trust provides transparency in pricing and holdings through regular disclosures of the fund’s net asset value (NAV) and holdings.

- iShares Silver Trust is managed by BlackRock, one of the world’s largest asset managers with extensive experience in commodity investing.

- Investing in iShares Silver Trust can provide diversification benefits to an investment portfolio due to its low correlation with traditional asset classes like stocks and bonds.

- iShares Silver Trust offers low expense ratios and relatively low trading costs, making it a cost-effective way to invest in silver.

- Investing in iShares Silver Trust can potentially provide a hedge against inflation and currency risks.

- As a regulated investment product, iShares Silver Trust provides a secure and trustworthy investment option compared to purchasing physical silver from potentially untrustworthy sources.

For those who want access to more specialized metal products like coins or bars from other sellers, there are some limitations with investing through Robinhood as it only offers spot prices versus premiums when buying individual pieces from other sellers outside of its platform. Additionally, there could be restrictions on how much metal one can buy depending on what type they are purchasing since most companies have limits based on risk management strategies implemented by their underwriters according to FINRA regulations.

Overall, investing in precious metals via Robinhood offers an excellent opportunity for those looking for an easy way to diversify their assets while taking advantage of features like discounted broker fees and fractional share capabilities, making it cheaper than many other platforms today. Additionally, with gold prices continuing to climb this year due in part to increased demand from investors seeking safety amid economic uncertainty, now may be a good time for those interested in metal investments to consider adding them to their portfolios via Robinhood’s platform.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: