Table of Contents

Individual retirement accounts (IRAs) that allow you to keep real gold, silver, platinum, or palladium bullion as a component of your superannuation assets are known as gold IRAs.

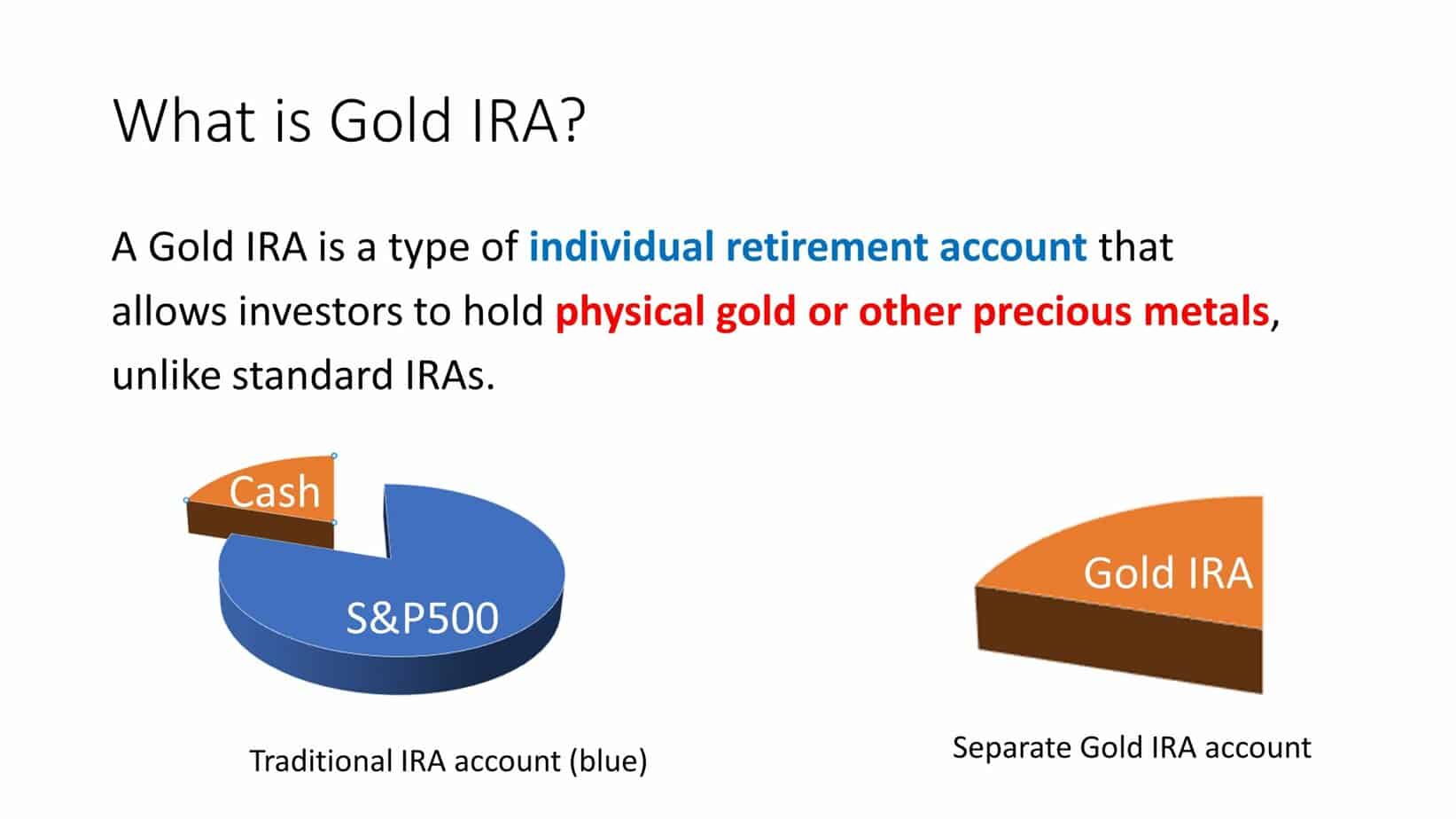

What is Gold IRA?

Gold IRA represents a specialized individual retirement account that allows investors to hold gold as a qualified retirement investment. Gold IRA accounts offer diversification for your investment and protection from potential recession.

(Read our article Augusta Precious Metals Review to learn more about this topic.)

You may set up these retirement accounts with an IRS-ratified, gold IRA defender prepared to keep actual precious metals, such as coins, bars, and rounds. An expensive metals IRA may protect your retirement assets from risks like stock market instability and price rises.

GET GOLD IRA GUIDESelf-Directed Individual Retirement Accounts

Self-directed retirement accounts, such as gold and precious metals, give you more control over your retirement funds.

A third party manages mutual funds, and you have no say in what investments are made. If you possess stock in a company, the CEO has the power to make choices shorn of your involvement.

On the contrary, you have complete control over your assets using a self-directed IRA since you can make all the purchase and sell choices for each asset. When it comes to independent IRAs, you may invest in everything from real estate to private jets.

Physical assets such as precious metals, land, and tightly owned businesses, corporations, and LLCs may also be kept in an IRA account. Many investment options are available for precious metals, including equities and bonds, shared treasuries, and ETFs.

Custodians of Precious Metal IRAs

Investment and insurance businesses that provide IRA accounts on Wall Street tend to exclude gold IRAs from their offerings.

This is because they aren’t set up to profit from selling gold or other precious metal. As an IRS-ratified IRA upholder and stockpile capability, they cannot retain substantial quantities of actual gold, silver, and other valuable metals.

It is common for a custodian to contract for the safe keeping of your coins, bars, or rounds in more than one third-party vault storing amenities. It is possible to open a standard or Roth gold IRA.

Given that you fulfill the income requirements for a Roth IRA contribution, you may create either kind of account or both and contribute. The phrase “precious metals IRA” may be used conversely with “gold IRA” for this article.

No tax or prohibited transaction rules differ between a regular and Roth IRA.

Advantages of a Gold IRA

Any other IRA, whether a regular or Roth, may benefit from a gold or other precious metals IRA. The details will differ based on the IRA account type you choose.

As with other IRAs, independent gold IRAs and gold 401(k) accounts have identical creditor security as other IRAs. To be clear, the creditor protection afforded to jointly-funded IRAs does not extend to inherited funds.

Advantages of a Gold Traditional Individual Retirement Account

Outdated gold IRA contributions raise suspended tax as long as the account’s assets stay in it. Physical gold does not pay dividends; hence dividend taxes are not a concern. Taxes on capital gains are seldom a problem. You may purchase and sell as much gold as you like in your IRA without paying any returns or resource advance taxes on the transactions.

Traditional IRA donations, including gold IRA contributions, may be tax deductible. If you have a workplace superannuation proposal or not, you may be able to deduct a certain amount from your income.

Disadvantages of the Gold Traditional Individual Retirement Account (IRA).

As with any other suspended tax retirement proposal, gold IRAs have the same drawbacks as standard IRAs. When you accept distributions, you forfeit the lower enduring principal advances tax rate. Instead, you’ll be subject to the higher average deduction on any withdrawals.

Additional RMD requirements exist for classic Individual Retirement Accounts, commonly known as IRAs. Deferring taxes for as long as possible is not an option with standard IRAs, 401(k), Simple IRAs, or SEP-IRAs.

When you reach the age of 72, you are generally required to begin drawing an annual least payout and compensating dues on such payments.

A qualified longevity annuity allows you to postpone RMDs until you reach the age of 85. A QLAC may be purchased for as little as $135,000 or 25% of your IRA resources, whichever is smaller.

Advantages of a gold Roth IRA

You may find all the benefits and downsides of a Roth IRA in a Gold Roth IRA. Unlimited tax-free growth is the most crucial benefit of Roth IRAs and Roth 401(k)s. It is tax-free for the first five years of the Roth IRA’s existence.

If you’re 59 1/2 or older, you may take penalty-free distributions from your Roth IRA for duty-free income. Because Roth distribution income is not taxed, it does not count in contrast to you when calculating Communal Safety profits in stepping down, another benefit of Roth IRA accounts, including precious metals IRA accounts.

Income Taxes on Unrelated Debt (UDIT)

If you use leverage to purchase gold or other possessions for your gold IRA, you might be liable for recent-year tax on a percentage of your gains. UDIT stands for special liability-funded returns tax. However, it does not apply to profits directly due to your efforts.

An IRA UDIT in Gold as an Illustration

An individual retirement account (IRA) uses UDIT.

With a gold IRA, if you acquire $100,000 of gold bars, coins, or other precious metal, and its value rises to $120,000, you’ll pay capital gains tax on $8,000 of your earnings, or 40% of the profit.

To avoid paying capital gains tax on your gold IRA’s $8,000 profits, you would need to hold the gold for at least a year (to qualify for the more advantageous long-term fund advances taxes).

If you contributed a part of the gain, the IRS does not impose a tax on that piece. You’d be subject to the usual IRA tax restrictions if you were to make a sale in your IRA or another leaving plan.

GET GOLD IRA GUIDEGold IRA Rollover

Many individuals opt to transfer a part of their retirement assets into a gold IRA, silver IRA, or other precious metals IRA from existing IRA and 401(k) accounts.

A gold IRA rollover has no tax ramifications if done correctly. Here’s the breakdown:

- Open a Gold IRA Investment Account.

Open a new Gold IRA account with a valuable metals trader or independent IRA corporation specializing in this investment strategy.

- The Account Should Be Funded

Arrange with your current investing firm to issue an intra-IRA check. You have 60 days to deposit the check. To pay due income taxes, your existing 401(k) upholder will hold back 20% of your assets.

Conversely, it would be best if you still handed over your total payout to your new IRA, or you may be subject to duties and fines on the amount you didn’t transfer.

A “trustee to trustee” transfer between the two fiscal administrations is also possible. Your former share corporation, compensation business, or defender handovers the cash immediately to your new account under this arrangement.

The money is never yours to keep. Your former asset defender will not withhold 20% of the funds from sending to the IRS but will transfer the whole amount into your IRA. There is no 60-day limit for this.

- Choose A Trustworthy, Valuable Metals Brokerage Firm to Work With

Decide how much gold bullion, silver bullion, platinum, and palladium bullion you need in your IRA account by working with a trustworthy precious metals broker.

- Ensure that all of your actions are legal.

Before making any purchases for your gold IRA, double-check to be sure they are all approved assets.

- Instructions should be sent.

As part of the onboarding process for your new IRA defender or mediator manager, provide inscribed directions on which costly metals broker, what assets, and at what worth you wish to buy. Be careful to keep an eye on your bank statements to be sure the transaction went through as planned.

Investments in precious metals are permitted in an IRA.

Tax code section 408(m) restricts the sorts of precious metals you may hold in an IRA. Only bullion coins, bars, and rounds produced at a qualified facility or by a general administration mint may be owned by a U.S. citizen.

There are precise clarity and quality requirements for certain bullion products, detailed in the following paragraphs.

To utilize an IRA, you must fulfill the IRS fineness criteria for coins, bars, and rounds. Non-bullion breakables and numismatics are likewise prohibited from IRA ownership.

If you have an independent IRA, you can’t hold life insurance, collectibles, or companies. This includes coins, bars, and rounds, except for bullion coinage of acceptable purity.

There must be 99.5 percent purity in gold bullion coins, bars, and rounds. Gold American Eagle coins, which contain 92.7 percent pure gold combined with silver and copper, are exempt from the law’s definition of “gold.”

Gold is a delicate and malleable metal that is easily scratched and scuffed, making it vulnerable to tarnishing. The crown gold blend coins are significantly more durable and resistant because of the combination of gold, silver, and copper.

Only the American Eagle coin, which has a purity level of less than 99.5 percent, may be used to invest in an Individual Retirement Account (IRA).

Even though the South African Krugerrand is made of the same crown gold blend and has the same amount of gold as the American Eagle, it is not permitted for retirement share in IRA accounts.

IRA Investment in Gold Coins Is Now Legally Acceptable

- Canadian Gold Wildlife Portrait Series

- Canadian Gold Maple Leafs

- Austrian Gold Philharmonic coins

- Australian Kangaroo/Nuggets

- Chinese Gold Pandas

- American Gold Eagle bullion coins

- American Gold Eagle proof coins

- American Gold Buffalo coins (not proof coins)

The minimum fineness standard of the IRS is 99.5 percent for gold bars and rounds produced by national government mints, NYMEX-certified facilities, or COMEX-licensed facilities to be invested in IRAs.

You may buy gold bars from your precious metals broker that are eligible for your gold IRA account, such as:

- Valcambi Gold CombiBars

- Valcambi Gold Bars

- Royal Canadian Mint Gold Bars

- Johnson Matthey Gold Bars

- Credit Suisse Gold Bars

- UBS Gold Bars

- Sunshine Mint Gold Bars

- Credit Suisse Gold Bars

Silver Coins Are Now Acceptable for IRA Purchase

If you think the price of gold is too high, you may choose to diversify your IRA retirement portfolio by purchasing silver bullion bars or rounds.

For your silver IRA, you may participate in the following forms of bullion:

- Austrian Silver Philharmonic coins

- Australian Silver Kookaburra coins

- American Silver Eagle bullion coins

- American Silver Eagle proof coins

- Mexican Libertads

- Chinese Silver Pandas

- Canadian Silver Wildlife Portrait Series

- Canadian Silver Maple Leafs

Silver bars and rounds formed by an NYMEX or COMEX processing plant may also fulfill the minimum IRS fineness standard for silver bullion of 99.9 percent.

For Individual Retirement Accounts, Platinum Coins Are Allowed for Investment.

Platinum bullion in the following types is permitted to be invested in IRAs.

- Australian Platinum Koala coins

- Australian Platinum Emperor Penguins

- Canadian Platinum Maple Leafs

- Isle of Man Noble coins

- American Platinum Eagle coins

- American Platinum Eagle proof coins

- Various Platinum bars and rounds are prepared in NYMEX/COMEX-ratified refiners and assayers, meeting the least obligation of 99.95% unalloyed platinum.

Palladium Coins Allowed in Individual Retirement Accounts

Palladium bullion may be purchased using IRA funds in the subsequent forms:

- American Eagle palladium coins

- Palladium Canadian Maple Leaf

NYMEX/COMEX-certified or permitted refinery may make palladium bars and rounds with appropriate purity (a minimum fineness of 99.99%).

- Valcambi Suisse palladium bars are an example of this.

- Fortuna palladium bars from PAMP Switzerland

Home Storage Gold IRAs Should Be Avoided

Again, until you receive a distribution, You cannot access IRA-owned gold and other precious metals for personal use. A better option is to use an IRS-approved depository facility to safeguard your gold IRA assets and other physical bullion.

You risk having your whole IRA confiscated by the IRS, paying taxes on the total amount, and facing additional penalties if you don’t comply. Do not try to set up a gold IRA in your house or do anything similar.

An IRS-approved custodian should always keep your IRA gold and other physical metals.

Owning Gold in Other Ways

You may also use gold ETFs (Exchange Traded Funds) and mining stocks to obtain experience with gold as an ability class. Third-party managers may conduct fraud or otherwise not behave in your best interests while managing gold ETFs.

It is possible to take direct control of your financial situation by owning actual gold, silver, platinum, and palladium in your retirement portfolio or by doing so in your name.

GET GOLD IRA GUIDE