Table of Contents

Like all the activities an individual does to earn something, trading is no different. Traders trade on various markets to get profit in the end. However, the tricky thing here is when to exit. What is the right time to exit a trade to make a profit?

Getting into a trade is more accessible than exiting it. Exiting a trade requires much more conviction, as you must profit here. It results from all your hard work in researching, reading, analyzing, etc. For long-term trading, exiting can be easier than day trading; the trades are frequent in day trading, giving less time to think and act.

Day trading targets are predetermined price levels. An investor will exit a trade based on reasonable and objective price level analysis such as previous support or resistance level, Fibonacci levels, pivot points, etc.

For example, suppose you are trading in a US stock and buy the shares at $10. You want to make a 2-dollar profit, so you set the profit target to be $12. So, $12 is the rate you will exit the trade.

There are chances that the stock price may go beyond $12, and in such cases, you may lose the opportunity to make more money. Setting day trading targets comes with a few disadvantages, but it has proven to be a boon many times.

How to Set Profit Target in Trading?

To set a profit target in trading, you can use previous support and resistance levels or important levels such as Fibonacci or Privot points. Previous high and low prices (resistance and support levels) are levels where prices oscillate the most, which makes them an excellent target. Additionally, you can set an easy risk-reward ratio when you use essential price levels.

In trading, previous support and resistance levels are often considered the best price levels to set targets for a few key reasons:

- Psychological Significance: Support and resistance levels represent key prices at which many traders are willing to buy or sell a security. These levels gain psychological significance because they are well-known and closely watched by many market participants. When these levels are approached, traders often expect a reaction, creating a self-fulfilling prophecy.

- Historical Reference Points: These levels serve as historical reference points where the price of an asset has previously reversed or paused. This historical significance can influence future price movements as traders look to past behavior to indicate future performance. When a price approaches these levels, traders often anticipate a similar reaction, which can lead to increased buying or selling pressure.

- Basis for Technical Analysis: Support and resistance levels are fundamental concepts in technical analysis. They are used to identify potential entry and exit points. By setting targets at these levels, traders align their strategies with the principles of technical analysis, which many believe can increase the likelihood of successful trades.

- Risk Management: These levels can be used for effective risk management. Traders can set stop-loss orders near these levels to minimize losses if the market moves against their predictions. Similarly, setting target prices at these levels can help lock in profits before the market reverses.

- Indicators of Market Sentiment: Support and resistance levels can also indicate the prevailing market sentiment. A breakthrough in these levels can signal a change in market dynamics, such as a shift from a bullish to a bearish trend or vice versa. Traders often use these levels to gauge the strength of the current market trend.

- Increased Liquidity: Since many traders watch and act on these levels, they often see increased trading volume when the price approaches them. This increased liquidity can make it easier to enter or exit positions at the desired price, reducing slippage.

Why Should You Have a Profit, Target?

The ultimate goal of traders is to profit, but that area is vast and needs to be tamed by deciding the expectations in advance. It provides better rewards with the risk taken. It’s like you are traveling on a bus, so you must know which destination you want to stop the bus and leave.

Like setting a profit target, setting up a stop loss is also essential. Stop loss helps in limiting the loss. For example, if you want to buy a stock XYZ, then place the buy order at $15 and sell it at $17.5. But what if the price goes down? You would lose money as you don’t know at which rate it will go down, right? So, you put a stop loss at $12.5; if the price goes down beyond this rate, the trading system will automatically sell your stock to save you from further downward risk, limiting your loss to $2.5.

Day traders don’t take just one trade. They keep trading in various currency pairs or stocks, out of which some can be profitable, and some would lose deals. To be a profitable day trader, you must ensure that your winning deals exceed your losses. And that’s when setting a profit target proves helpful. It lets you fulfill day trading targets by providing a risk-reward ratio on all the trades.

What Are the Pros and Cons of Setting Profit Targets?

Every coin has two sides, as does day trading profit target setting.

The pros of setting profit targets

- Setting a profit target or a stop loss helps determine the risk/reward ratio of trades taken. You can analyze which trades would earn you income and which to avoid. Also, setting up a stop loss saves you from the downward risk of the price drop.

- It’s not hard to set profit targets; as a forex day trader, you can easily do so using available data, charts, research, and patterns.

- Setting profit targets helps day traders avoid the unwanted roller coaster of emotions and biases. If the profit target is based on real-time information and objective data, it can prove advantageous in placing a reasonable profit target.

- Reaching a profit target will give a sense of satisfaction to day traders and validate their analysis capabilities. It helps them build healthy trading emotions even if they lose, as they know the risks and rewards beforehand.

The cons of setting up profit targets

- Day trading profit targets require sound knowledge and skills as you cannot sway your trade-in any obviate hopes or fears. Doing so would only make you lose profit or would make you lose more money. If the profit target is too far and hopeful, the rate would not even touch your trading expectation, or if the stop loss is too near the buy price, your trade would get sold faster as a little up and down is normal in day-trading. Thus, you must be careful when placing a profit target or stopping loss.

- Placing incorrect profit targets or stopping loss can harm your overall trading. You won’t be compensated for risks taken and may lose your trading appetite in the long run.

- You lose the chance of more upward rewards as it’s not needed that your set profit target would be the high of that particular stock or currency. Thus, you miss the opportunity to earn beyond your profit target. However, you can again trade if the upward pace is still on by taking another trade.

How do you calculate the target profit in trading?

Placing a profit target is no less than an art. To make a profit in day trading, a day trader has to ace it through practice. However, there are a few methods in day trading for when to make profits, as stated below.

- Set fixed reward and risk profit targets

- Set trailing stop loss

- Set Measured move profit target based on technical analysis

- Set target based on market tendency and price action analysis

Set fixed reward and risk profit targets

This is the easiest way to decide when to book profit in day trading. It combines what you expect in reward for the risk you take to set a stop loss. It’s set as multiple of reward: risk; 2:1.

For example, the trader is entering a trade to buy a stock at $15 and wants to sell it at $17. She puts her stop loss at $14 to get a reward: risk ratio of 2:1. The same goes for forex trading. Suppose the trader wants to buy a currency pair at 2.2560 and places a stop loss at 2.2555. If she wants the reward-to-risk ratio to be 2.5:1, her profit target should be 2.2575.

This method works best with a calculated stop loss and profit target. It would ensure you make more profit while reducing your risk of losing. New-day traders should experiment with such methods on a demo account first to avoid the risk of losing money in innovation. A target of 1.5:1 or 2:1 is good to go, but in the end, it depends on the overall expectation of your trade.

Set a measured move profit target based on technical analysis

Setting a measured move profit target in Forex trading involves using technical analysis to predict potential price movements based on historical patterns. The “measured move” is a technique where traders use the size of a previous price move to forecast the size of a future move. Let’s go through a practical example:

Example: EUR/USD Currency Pair

Step 1: Identify a Chart Pattern

Suppose you identify a chart pattern in the EUR/USD currency pair. For instance, let’s say it’s a “flag” pattern, a continuation pattern. The price first makes a strong move upwards (the flagpole), then consolidates in a narrow range (the flag).

Step 2: Measure the Flagpole

Measure the height of the flagpole. For example, if the EUR/USD moved from 1.1200 to 1.1300 during the flagpole formation, the move is 100 pips.

Step 3: Identify the Breakout Point

Wait for the price to break out of the flag pattern. Let’s say the price breaks out of the flag pattern at 1.1250.

Step 4: Set the Measured Move Target

Add the flagpole height (100 pips) to the breakout point. In this case, 1.1250 + 0.0100 (100 pips) = 1.1350. This level (1.1350) is your measured move profit target.

Step 5: Place the Trade

- Entry Point: Enter the trade at the breakout point, 1.1250.

- Stop Loss: Set a stop loss below the lowest point of the flag or at a level that aligns with your risk management strategy.

- Profit Target: Based on the measured move calculation, set your profit target at 1.1350.

Step 6: Monitor the Trade

Regularly monitor the trade for any changes in market conditions. Be prepared to adjust your stop loss or take profit if necessary.

Important Considerations

- Risk Management: Always use proper risk management. Never risk more than a small percentage of your trading capital on a single trade.

- Market Conditions: Be aware that market conditions can change rapidly. News events, economic reports, and other factors can impact currency prices.

- Validation: Look for additional confirmation signals (like increased volume on the breakout) to validate the pattern.

- Flexibility: Be flexible with your strategy. Consider taking profits early if the market shows signs of reversing before reaching your target.

In trading, making a profit is, as stated earlier, an art, and you can always be creative with art (but here, be extra cautious).

Set profit target based on trailing stop.

Setting a profit target based on a trailing stop is a dynamic approach to lock in profits while allowing a trade to run. This method adjusts the stop loss level as the price moves in your favor, securing a certain percentage of the gain. Let’s delve into a full-depth example using a hypothetical Forex trade:

Example: GBP/USD Currency Pair

Initial Trade Setup

- Currency Pair: GBP/USD

- Entry Point: Assume you buy GBP/USD at 1.3000.

- Initial Stop Loss: You set an initial stop loss at 1.2950, 50 pips below your entry point.

- Risk Management: Your risk per trade is 2% of your total trading capital.

Implementing Trailing Stop

- Trailing Stop Distance: You decide to use a 30-pip trailing stop.

- Mechanism: This means that if GBP/USD moves 30 pips in your favor, the stop loss will also move 30 pips closer to the current market price, maintaining the 30-pip distance.

Trade Evolution and Trailing Stop Adjustment

- Price Increase to 1.3030: GBP/USD rises to 1.3030 (30 pips above your entry). Your trailing stop moves up to 1.3000 (your entry point), securing a break-even trade.

- Further Rise to 1.3060: The price rises to 1.3060. The trailing stop adjusts to 1.3030, locking in a profit of 30 pips.

- Price Peaks at 1.3090: GBP/USD peaks at 1.3090. The trailing stop is now at 1.3060, securing a 60-pip profit.

- Price Reversal: If the price reverses and hits the trailing stop at 1.3060, the trade closes, and you realize a 60-pip profit.

Monitoring and Adjustments

- Active Monitoring: You should monitor the trade, especially during volatile market conditions. Economic reports, news events, or market sentiment shifts can affect the GBP/USD pair.

- Adjustment Considerations: Depending on market analysis and your trading strategy, you may manually adjust the trailing stop if there are signs of a significant trend reversal or consolidation.

Day Trading Targets based on Pivot Points

A day trader can define targets based on the previous day: high, low, and close.

Pivot point = (High + Low + Close) / 3.

Resistance (R1) = (2 x PP) – Low.

Support (S1) = (2 x PP) – High.

Resistance (R2) = PP + (High – Low)

Support (S2) = PP – (High – Low)

Resistance (R3) = High + 2(PP – Low)

Support (S3) = Low – 2(High – PP)

These levels can be used for targets based on the current positions.

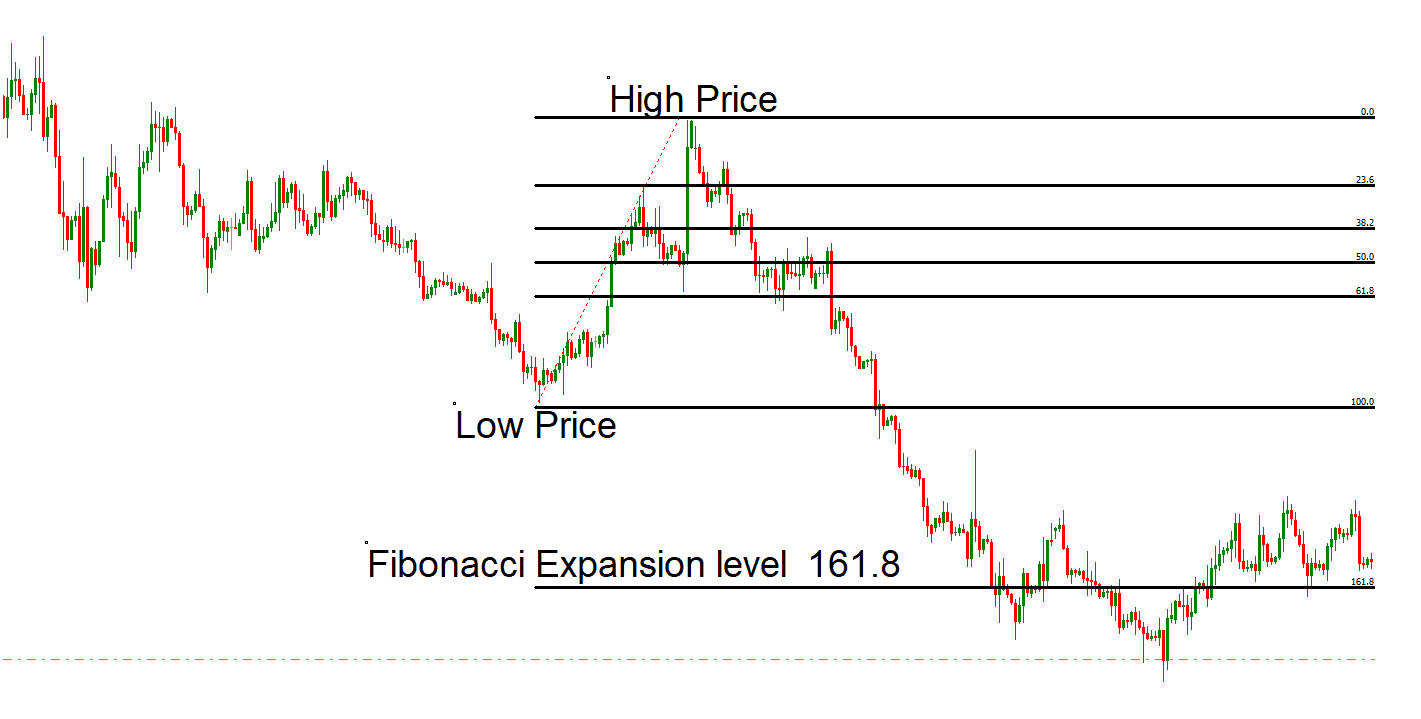

Day Trading Targets based on Fibonacci levels

Critical levels in trading are based on Fibonacci retracement levels, such as 23.6%, 38.2%, 61.8%, and 78.6%. This level trader can use between yesterday’s high and yesterday’s low, the same as weekly high and weekly low.

The Final Words

Reward to risk ratio is stated as how much risk you are willing to take for the expected reward or return. Based on this ratio, a day trader decides their day trading target and stops loss. However, in the end, it is just an estimation you put by researching and applying your skills for analysis.

Various strategies, as stated above, help in day trading for when to make a profit. Each of the strategies stated above has pros and cons. The fixed reward-to-risk strategy is a bit random but easy. The second strategy of measuring moves is based on technical analysis and works best if you master these technicalities, analyze the chart patterns, and trade faster. The last strategy of market tendency and price action analysis can require a day trader to spend long hours noticing prtrackingoves. It is time-consuming as a day trader has to notice the tendency or price trend for weeks or months to get their day trading target right.

As a day trader, you must get familiar with different strategies sooner or later, as randomness will only fool you. Start with a reward-to-risk target of 1.5:1 or 2:1; you can increase it with practice and experience in picking out the right stock or currency pairs at the right time. nDon’tt be over-ambitious and greedy, as that only leads to emotional and biased trading, making traders lose their trades and money.