What is tp in trading?

Take profit or tp is a pending order placed to close a profitable position once the market reaches a specific price. Take profit order allows the trader to set a predefined level to lock in any profits. When your take profit order is hit on a trade, the trade is closed at the current market value. For example, if your Buy price is $1.1 and your target price is $1.2, you take the profit price when your trade reaches $1.2.

One of the most important pre-calculated price levels used by traders today is called Take Profit. This is a type of As the name suggests, it allows the trader to set a predefined level to lock in any profits.

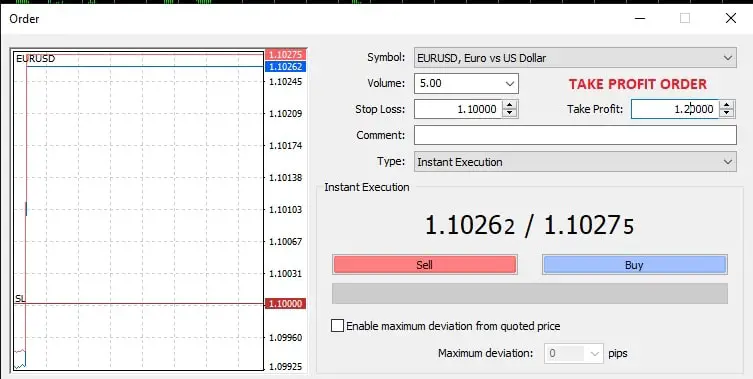

In this image above, 1.2 takes profit order.

The foreign exchange (forex) rates are unpredictable; they can increase or decrease at any time. Since it is usually difficult for the forex trader to continuously monitor the forex rates, one of the options to automate forex trading is to use the Take profit forex strategy. To take profit is executed after the trade has reached the specified profit level at the market price. These orders also call limit orders.

Take profit forex strategy.

The trader’s risk-reward ratio is defined as the stop loss and takes the order’s profit levels. Some of the most important factors determining how successful forex traders are the trade’s size and the risk ratio to the reward. The take profit order ensures that the forex trader’s exposure is limited, and he exits the market as soon as he gets the price he wants, and not taking the risk of remaining invested for a longer period. For short term trading, it is better to use a take profit strategy.

If the short term forex trader does not have a target for taking profit, they may find that the profit they are looking for has disappeared because they did not exist at the right time. Many forex traders are using the average true range or pivot points for defining the right level for taking profit forex-order. For intraday forex trading, the target is usually calculated using the true range average and adding the extreme overnight. Alternately the weekly or daily pivot points are also used. These levels are usually the extreme levels for the market, and the market can retrace its levels.

How to take profit in forex trading

Take profit price can be :

1) Previous low and high prices. For example, yesterday’s high or weekly high or weekly close can be interesting “take profit price level.”

2) Fib level can be an interesting target level.

3) The regression formula prediction price level can be the target level.

4) Pattern recognition and levels based on pattern levels.

Placing a take profit type order

Every forex trader’s experience and risk profile varies, so not everyone will find that the take profit option is ideal for forex trading. Many long term traders are interested in taking advantage of the trends in the long term. These traders may feel frustrated when they exited very early despite predicting the trend accurately because of their take profit trading. When the forex rates are fluctuating between specified ranges, take profit is a better strategy. This is because the forex pair’s resistance levels ensure that the price does not increase beyond the specified level, and support levels limit the decrease in forex rates. Hence if a forex trader is purchasing forex at the low rates and waits till the resistance level is reached, a take-profit order is recommended since the rates are again likely to decline to the lower rates in the range-bound market.

Indicator for deciding trading strategy

Forex traders can use many indicators like the relative strength index, moving average to determine the forex market trends. The average directional index (ADX) is one of the most popular indices among the new forex traders. The value of the ADX varies from 0 to 100 and determines how strong the trends for the forex pair are. If the level is above 30, the pair is trending strongly, and a stop profit is not recommended. If the ADX value is below 30, it indicates that the forex market is ranging. It is better to place an order for taking profit instead of trying to time the exit correctly.