Below is presented a video with a full explanation, results, and tips:

Funded trading accounts have become famous for traders like me to access more considerable capital without risking personal funds. As I promote these funded accounts, I believe I must share authentic user experiences to maintain transparency and credibility. By sharing real stories, I can give others a genuine perspective of what to expect. I’ve always felt that transparency about successes and challenges builds trust and helps others make informed choices. These honest testimonials motivated me to undergo the evaluation phase myself. By going through the experience firsthand, I hope to gain a deeper understanding and relay it more authentically to potential traders.

You can learn more about instant funding prop firms on our page.

To try funded forex account evaluation, please read our article.

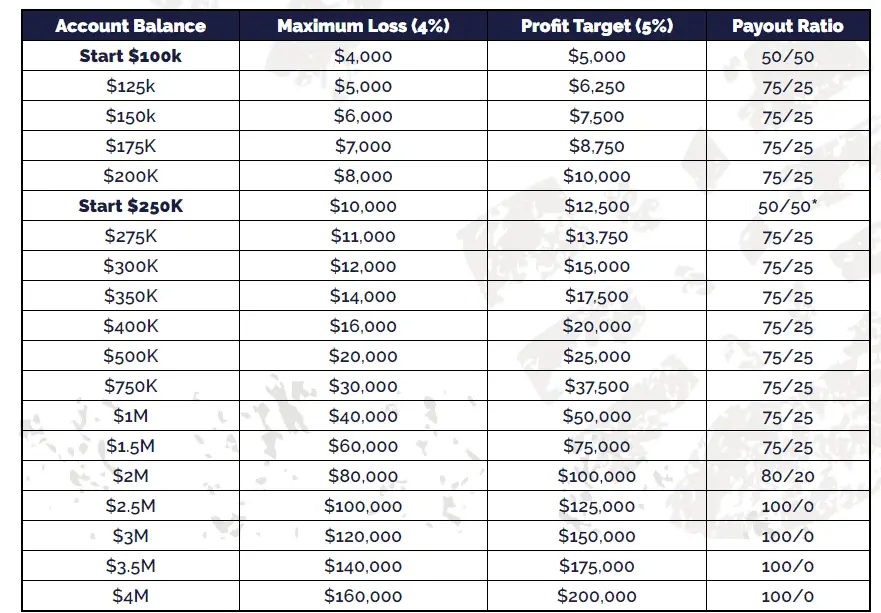

The Bootcamp growth plan offers a structured evaluation of traders through three challenge stages before providing access to a fully funded live trading account. Traders begin with a demo trade, showcasing their skills on account sizes of $100K or $250K, leveraging at 1:10, with no minimum trading days or specific time limit for the three stages. However, accounts expire after 14 days of inactivity. The three stages start with balances of $25K, $50K, and $75K, each with specific loss limits and profit targets. Upon successfully navigating these stages, traders can access a 6-figure live trading account, with costs only after passing challenges, offering a growth step-up with every 5% gain and varying profit splits based on the initial Bootcamp account size.

Below is presented Bootcamp evaluation Table:

So, in September, I applied to evaluation phase 1.

My Dashboard is presented below:

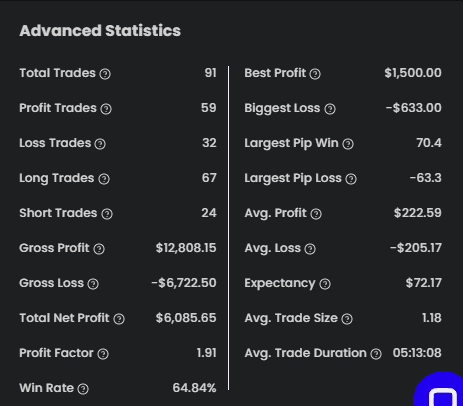

I executed 91 trades and achieved a winning rate of 64.84%. This means that nearly two-thirds of my trades were profitable. My risk-reward ratio was 1:1, showing that I balanced potential profits and losses for each trade. On average, I risked $205 for each of my positions. My average profit was a bit higher, coming in at $222 per trade.

My primary trading focus was on the EURUSD and GBPUSD currency pairs. I based my entry points on previous lows and highs of the price levels, which often act as crucial support or resistance zones. I utilized two distinct types of trades. One strategy involved a tight stop loss of 20 pips, placed just below or above the identified support or resistance levels.

The other approach I employed centered around a 1:1 risk-reward ratio, and for these trades, I used half-lot position sizes. Timing was essential in my strategy; I typically initiated trades at the start of the EU session. Most of my positions were closed by around 7 PM GMT. An integral part of my trading philosophy was to align with the predominant daily and weekly trends, ensuring I wasn’t trading against the market’s momentum.

I had a specific approach regarding the NFP (Non-Farm Payrolls) report, especially when faced with mixed results. In the instance where the NFP came in better than expected at 326K, but the unemployment rate remained worse than anticipated, I had a distinct trading plan. Usually, in such scenarios, the initial market reaction is a substantial pullback equivalent to 1 Daily ATR (Average True Range).

This is often a knee-jerk response to the mixed data. Following this immediate move, the market tends to exhibit a robust bullish push, often stretching to 1.5 times the Daily ATR. My strategy capitalized on these predictable movements by positioning myself for the initial pullback and then riding the subsequent bullish wave. Understanding the market’s typical reactions to such mixed news allowed me to make informed decisions and efficiently time my entries and exits. Following this strategy, I aimed to harness the market’s volatility post the NFP release and convert it into profitable opportunities. This method was beneficial as the NFP often induces significant market movements, and understanding its behavior is crucial for trading success.

Please check the funded Forex account offer:

Funded Account Phase 2

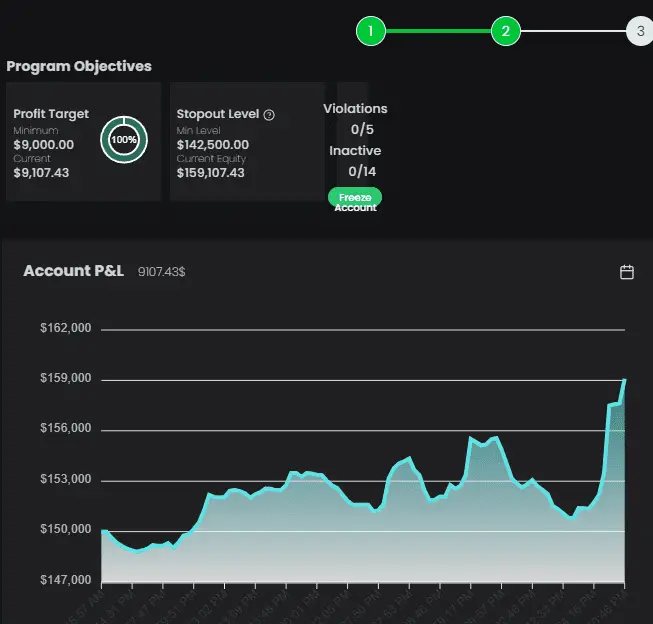

In the Phase 2, I had similar result, $9000 after two weeks of trading:

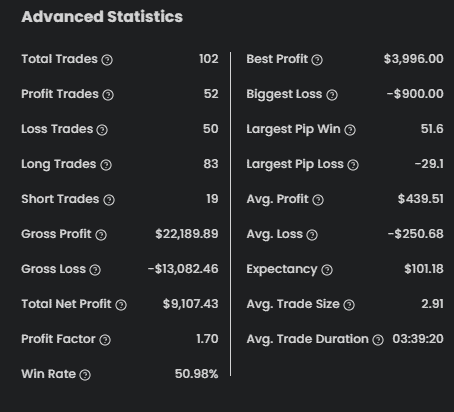

Statistics are very simlar as last time. I had 50% winning rate:

Below are portion of trading positions:

After I reach phase two, I created video:

Please check the funded Forex account offer: