Table of Contents

The break-even point in business is the point at which total cost and revenue are equal, in other words, “even.” To calculate the break-even point in business, you must divide your total fixed costs by the difference between the unit price and variable costs per unit.

But, in trading, we have a break-even term too.

What is Break-Even in Forex?

Break-even in forex means that your trading position neither makes nor loses money. So, for example, if you buy EURUSD at a 1.3120 price level and then a close position at a 1.3120 price level with zero profit and zero dollars loss, you are break-even.

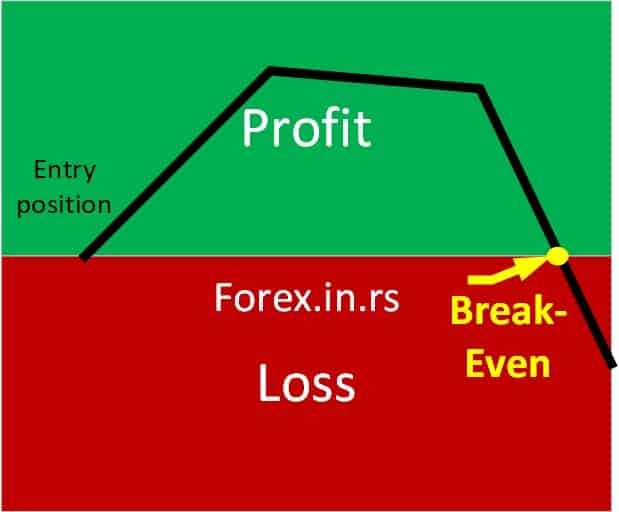

Usually, break-even in trading works when you move from your first stop position into your original entry position once the price has moved in your favor.

Break-even example in forex trading (without spread calculation):

- You buy EURUSD at 1.3120

- The price goes to the 1.32 level.

- You set a stop loss at 1.3120 (break-even level).

- If the price falls to 1.3120, you will have zero profit and loss and break even.

The percentage for break-even while trading is a valuable statistic because it shows how often the trader has to win to break even. This will help in decision-making. He will use different stop losses to manage the risk and set targets for the rewards he wishes to achieve. For a break, even the trader does not make money and does not lose money, though he is investing his time. The trader makes a profit if the number of trades won exceeds the break-even percentage. The trader would lose money if the percentage of trades won is lower than the break-even calculated.

How to set break-even in forex?

To set a break-even point in forex trading, you need to determine the price level at which you will exit the trade without incurring any loss. Here’s a step-by-step guide on how to do it:

- Determine your entry price: This is when you bought the currency pair.

- Determine your stop-loss price: This is the price at which you will exit the trade if the market moves against you. You should set your stop-loss order at a level that limits your potential loss to an amount you are comfortable with.

- Calculate your pip value: This is the value of each pip movement in the currency pair. You can use an online pip calculator to determine this.

- Determine your trade size: This is the number of units of the currency pair you will trade.

- Calculate your break-even price: To calculate your break-even price, you must add your trade’s spread to your entry price. For example, if the spread is two pips and your entry price is 1.1200, your break-even price would be 1.1202. If the price moves to 1.1202, you will have covered your spread costs and break even on the trade.

- Adjust your stop-loss: Once the price moves in your favor, you can adjust your stop-loss to your break-even point. This will help you lock in your profits and reduce your risk.

Remember that setting a break-even point is just one aspect of successful forex trading. You should also have a solid trading strategy, manage your risk effectively, and have a disciplined approach to trading.

Break-even percentage calculation

To calculate the break-even percentage in forex trading, you need to divide stop loss and stop loss and target price sum like in the following formula:

Breakeven= (Stop-loss/(Target + Stop-loss)) X 100

The settings for stop-loss and target defined by the trader are considered to calculate the break-even percentage for a particular trading strategy. Different parameters are used for measuring the target, and stop-loss, like ticks for futures trading, cents for stocks, and pips for forex trading. In other cases, the amount of money is used for specifying stop loss and target profit. The calculation shows the number of winning trades for break-even in percentage terms.

Many traders do not use the same target or stop-loss for each trade. In these cases, the average profit or win and average loss for the different trades are considered for calculations. Thus, the average stop-loss is the average loss, while the average profit becomes the average target. The estimate for the break-even percentage is provided below.

What does break-even mean in options?

In options trading, the break-even price can be Call Break-even or Put Break-even as the price at which investors can choose to exercise or dispose of the contract without incurring a loss. In the case when a trader buys an option, the call position you own can be profitable at expiration, If remains above the strike price plus your initial investment:

Call Break-even = Call Strike Price + Call Purchase Premium

In the case when a trader sells an option, “Put position,” you can be profitable at expiration if it remains below the strike price minus your initial investment:

Put Break-even = Put Strike Price – Put Purchase Premium

Break-even options trading example:

For example, if you have a call option with a strike price of $40, your cost per option share is $1.50. Therefore, adding $1.50 to $40 tells you that your break-even price is $41.50.

For example, if you have a put option with a strike price of $40, your cost per option share is $1.50. Then, subtracting $1.50 from $40 tell you your break-even price is $38.50.

Application of the break-even percentage

The break-even percentage determines whether the trading strategy formulated will provide sufficient winning trades. The trader makes a profit, using different settings for stop-loss and targets. It will help if the trader is using a new trading strategy; it will help determine the number of trades required to profit when the stop-loss and target settings are optimized.

The trader winning a more significant percentage of trades than the break-even will profit, while a trader losing a more substantial number of trades compared to break-even will make a loss.

The win rate and risk/reward ratio are calculations related to the trade. The risk/reward compares the risk for each trade with the reward targetted. The win rate calculates the number of trades the trader wins, expressed in percentage terms. These calculations and statistics can complement the trader’s break-even calculation to decide and formulate the right strategy.

Setting the right target.

Traders should know that setting targets that cannot produce break-even percentages is misleading because they are unrealistic. For example, a trader may feel tempted to set the target significantly higher than the stop-loss, thinking he will require only a few winning trades to break even under these conditions. Yet, the trader is unaware of the reality of achieving challenging targets.

If the target is exceptionally high, the trader will never achieve it since the prices or value of the security will not increase greatly in most cases. In other cases, there will be very few winning trades for high targets, so the trader will lose money since the percentage of losing trades will be higher.

So while developing a trading strategy or system, the trader should first determine the target profit and realistic stop-loss levels, easily achieved, and then calculate the break-even levels.

Though most beginners are happy to break even when they start trading, traders should know that their goal is to make a reasonable profit since they are spending time and taking the risk of investing their money. At the same time could be utilized elsewhere to make some money with far lower risk. Hence the trader should aspire to win more trades than the break-even he has calculated. Thus, the trader’s first target has to achieve while perfecting his trading strategy is not the ultimate goal for profitable trading.