Table of Contents

The Commodity Channel Index was created by Donald Lambert and is a very reliable tool for forex traders. It helps to find the newly emerging trends and the divergence between the indicator and the price. If you spot divergence, it means the trend is losing its momentum, and a reversal is looming. Moreover, the CCI indicator is also an oscillator; hence it determines the oversold and overbought situation in the market.

What is Commodity Channel Index Indicator?

Commodity Channel Index Indicator represents an oscillator indicator that calculates the difference between the current price and the historical average price. If CCI is above 0, trends are bullish, and the price is above average.

Download Commodity Channel Index Indicator

Download Commodity Channel Index Indicator

Trading strategy for CCI

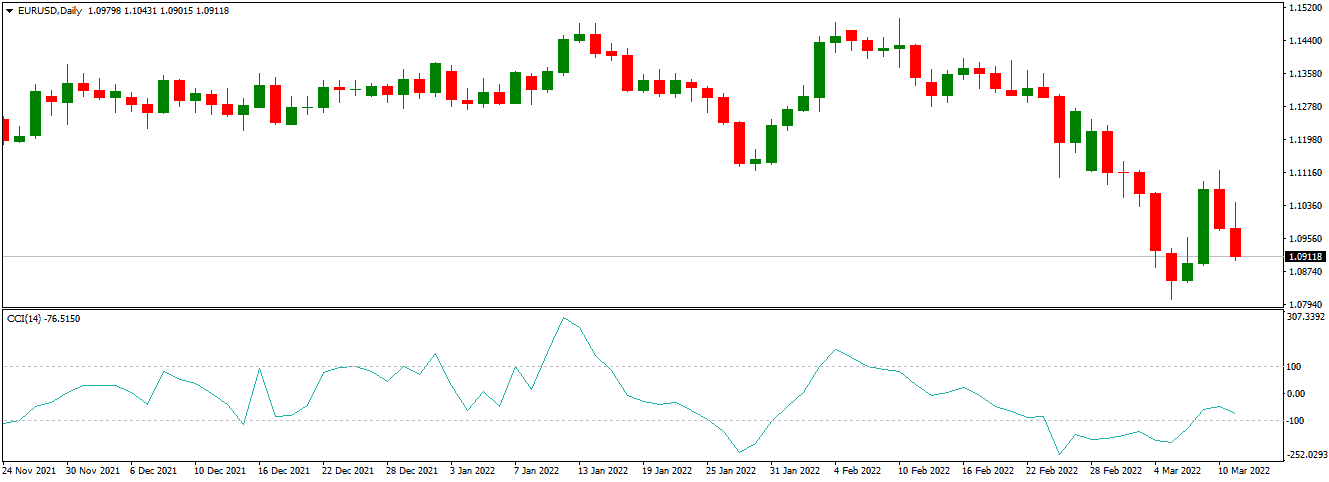

You can use a EURUSD chart to see the CCI indicator in operation. The overbought situation is depicted at 200+ levels, while the oversold condition is depicted at -200 levels through red lines. It means zero if you see a pale green color, while the royal blue color defines the 50+ and 50- levels. The red oscillator line shows the TURBO CCI. And the dodger blue line represents the oscillator line.

The CCI indicator will create a buy signal if the turbo CCI or CCI value crosses the 50+ level. If these values go below the zero line, traders exit the position.

Similarly, if the turbo CCI or CCI value falls below the -50 level, the indicator will create a sell signal. If these values go below the zero level, you should exit the position.

Forex traders will find this indicator very useful as it all depicts the buy and sell trigger levels based on the trend and helps prevent losses. On the other hand, experienced traders find this indicator to find the divergence and enter more positions.

CCI can be implemented on other trading instruments, regardless of the commodity word added to it. It is an oscillator with different levels on both the negative and positive sides. It’s also called an unbound indicator that differs from oscillators that have stipulated high and low values. Hence, you must be precocious while defining the overbought and oversold positions through this indicator. It’s an unbound indicator, and therefore the situation may sustain for a more extended period. Consequently, you should always confirm the signals of CCI via price action.

Conclusion

The CCI indicator MT4 helps the forex traders in the market to comprehend the position of the price of a security in regards to history. Hence, forex traders can create successful trading strategies by understanding different profiles through the CCI indicators.