Table of Contents

Stock screening is the concept in which investors identify, review and analyze the existing stocks and exchange-traded funds per the benchmarks created by the investors themselves. Screeners are available on brokerage trading platforms that are usually free, but there are independent monthly subscription-based stock screeners. Screeners allow investors to utilize their perceptions and methodology regarding stocks leading to the enhancement of trading opportunities for both long-term and shorter-term traders. It is a methodology that outlines establishments that accomplish an individual’s criteria financially and commercially. This approach consists of three pillars which are:

1. A database of companies

2. A cohort of variables

3. A screening platform or outlet that brings forward a list of companies aligning and complying with variables that generates a helpful list.

Screening is ideal for clouded traders perplexed about which stocks to pick. Consequently, this concept would provide a vast inventory of filters and a sound search engine platform to help and assist current and potential investors narrow their search results among a wide range of stocks. It acts as a filter; the screening will give them better opportunities and prospects for the stocks.

Main pillars of stock screeners

Different platforms of stock screeners are well-appointed with particular characteristics. Primarily, the following should be available in all stock screeners:

• Stock exchange

• Country or region

• Industry

• Market capitalization (cap)

• Dividend return

• Price

• Target amount

• Trading volume (current, average, or relative)

• Unpredictability

• Price-to-earnings ratio (P/E)

• Earnings per share (EPS)

Some stock screeners also provide a unique algorithm to rate stock in funds. However, reliable screeners should be prepared with flexibility for the investors with the possibility of precision and accuracy for beginners and experts.

What is the Best Free Stock Screener?

The best free stock screeners are Zack screener and Finviz. They offer the most important list of criteria and a massive database of companies for a free version. Data is up to date with great accuracy.

Following are some well-known and renowned stock screeners highly recognized in the traders market.

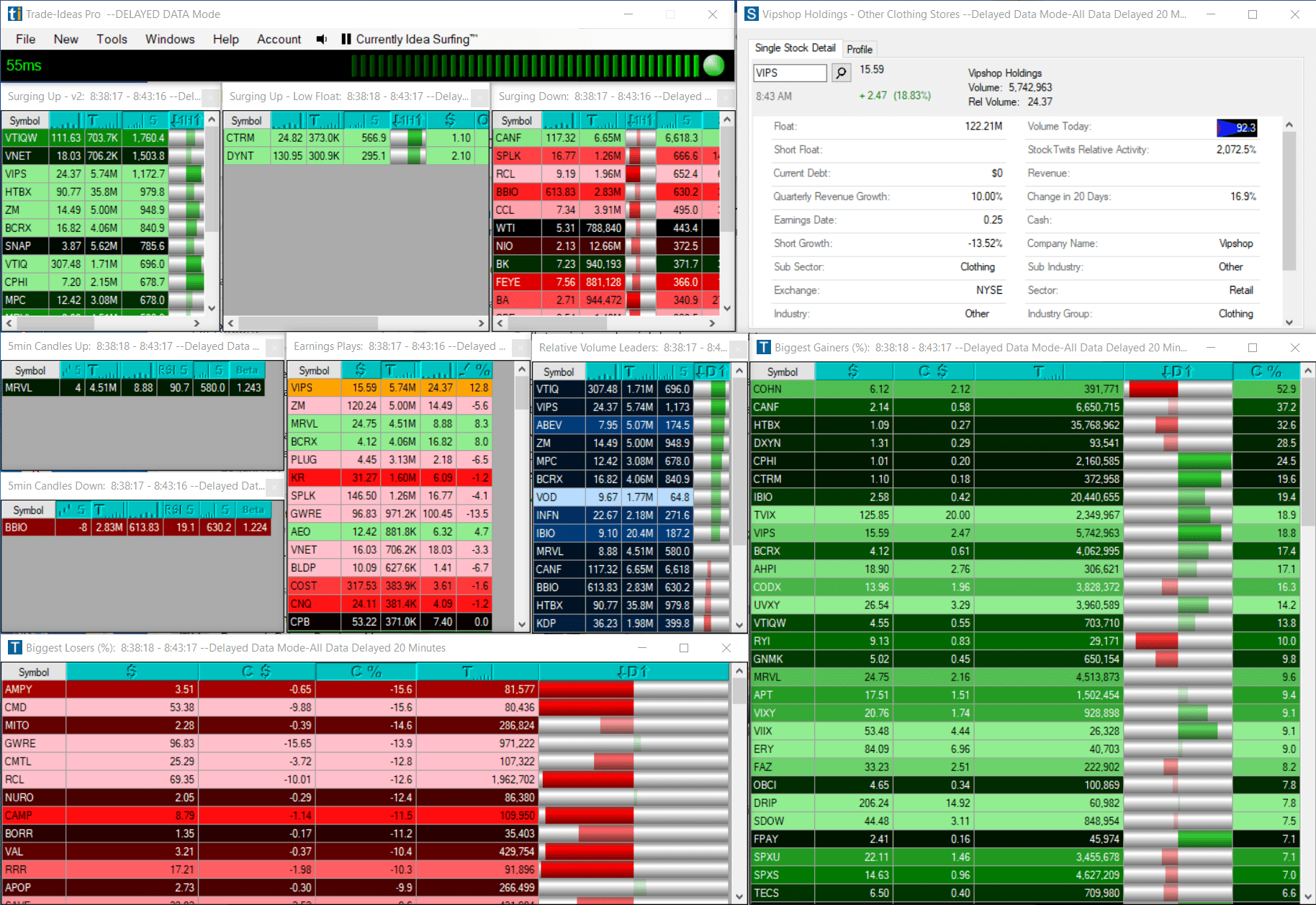

Trade-Ideas

Trade-Ideas is a realistic platform known for its fast and prompt services. It has strategically set data centers that are sited near leading stock exchanges. It also propounds an extensive range of preset scans tailored and personalized investors’ ideas and criteria. In addition, investors can perform a backtest via this platform to examine their current standing and gauge their accomplishments in trading scenarios.

Trade-Ideas is also equipped with artificial intelligence named Holly. It is a tech-savvy and tech-oriented social data platform that has two options to scan multiple trading opportunities, directly notifying investors when it comes across a strong potential in the trading domain. This novel concept allows investors to encounter opportunities that would not have been perceived otherwise. Trade Ideas are only related to US and Canadian stock exchanges. It has a free trial for beginners, but my premium account starting account starts from $118 per month.

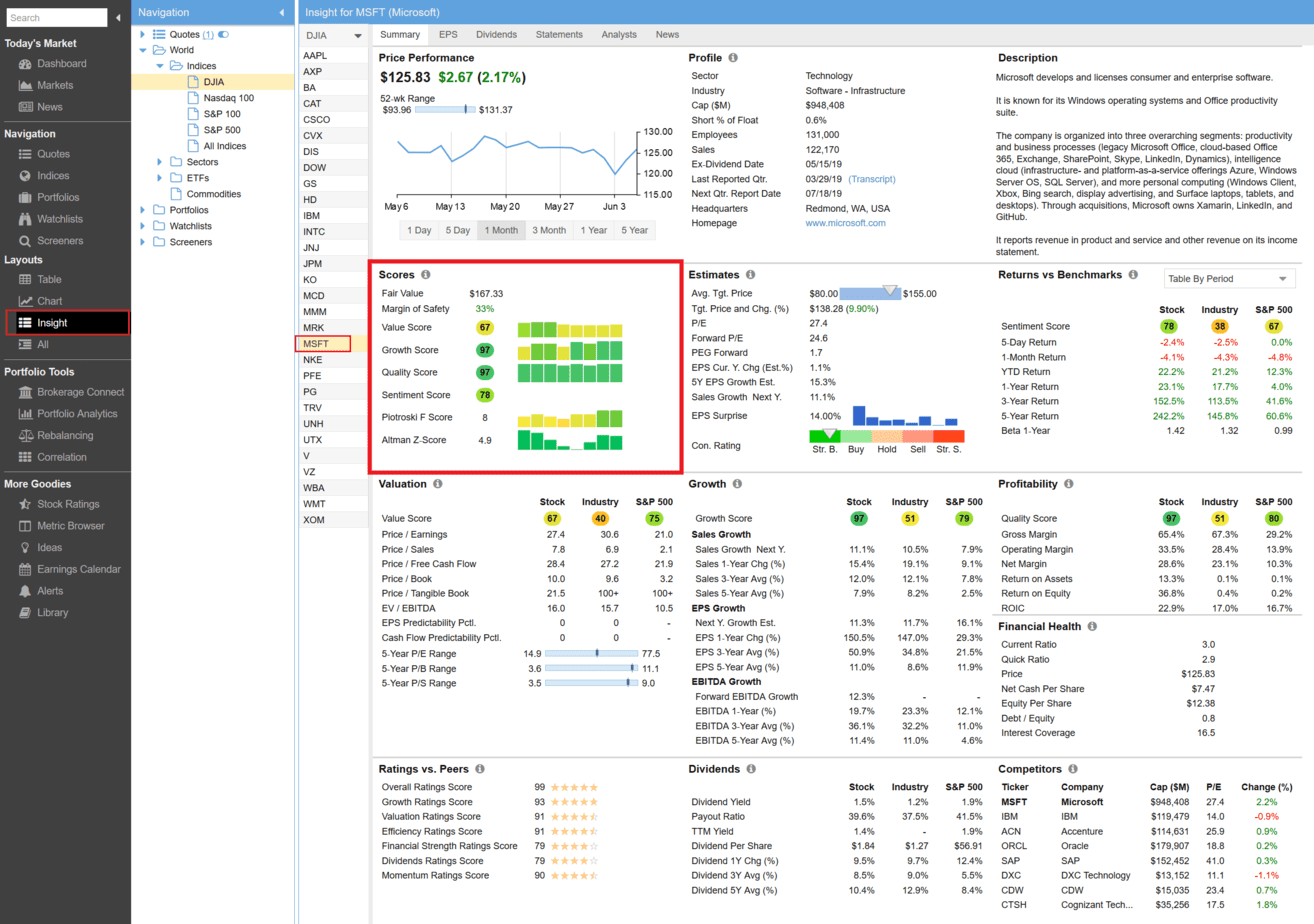

Stock Rover

Another next best trading option is Stock Rover which is exceptionally functional at US and Canadian stock screening. This database system has for allowing stockholders to quickly low stockholders to screen and review ETFs as structural funds rapidly. Investors can initiate multifaceted equations by integrating different centers to comply with their criteria. It has robust scanning features as far as its data and watchlist are concerned; the filter keeps updating every minute. This platform is suitable for long-term investors.

It is combined with brokerage accounts such as Vanguard, Charles Schwab, and Fidelity. Once it has been amalgamated, the results are beyond belief, and more it also provides portfolio rebalancing recommendations for the investors, which is known to discuss collection and portfolio analysis. It also delivers rating scores among different groupings concerning security, such as overall, valuation, efficiency, success, financial health, momentum, and dividends. Investors can begin by utilizing a free for premium usage; you can, for premium usage, spend $8 per month.

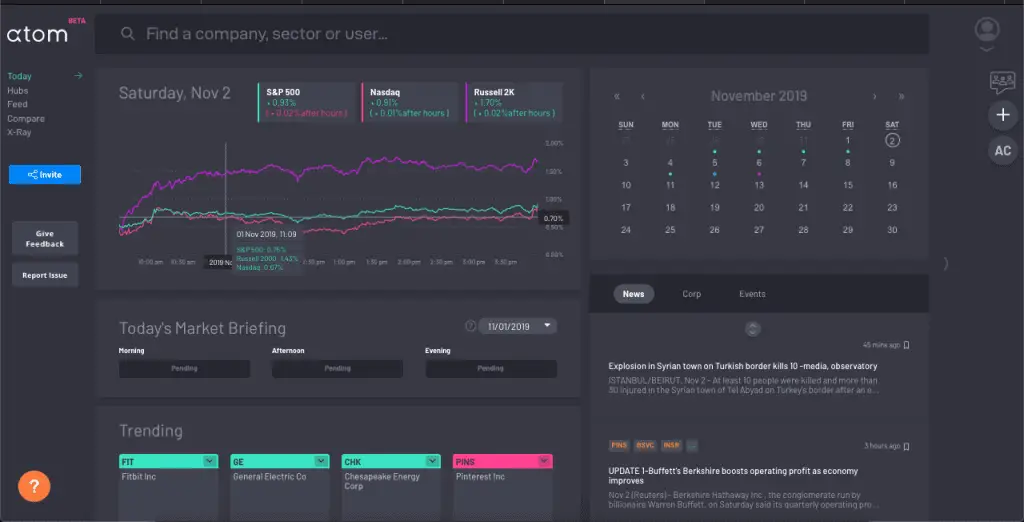

Atom Finance

This is a successful platform that aims to provide institutional-level insight. You can also integrate other brokerage accounts with this platform. Providing you with an overall and comprehensive analysis of your complete investment portfolio, you can analyze, review, evaluate total asset allocation, and receive recommendations and suggestions to add versatility. It has advanced/screening instruments and features that provide research-oriented characteristics for stocks and traders.

It also offers real-time stock quotes and an institutional-level financial trading news feed. Data is accumulated through information and insight, including equity research from popular banks and financial firms, SEC filings, and class clips. They provide analysis, recommendations, and detailed historical financial reviews and data. You can also unravel trends and patterns To check the potential move. Combined, all these aspects provide you with an overall and comprehensive picture of current and prospects.

You can avail of the premium services at $7 per month, consisting of expert commentary, explanations for the price change, and equity research.

Zacks and Nasdaq Screener

Zacks operates the Nasdaq screener. It offers a substantial list of instruments and tools. However, its operational policy allows investors to have a customs value range instead of choosing from the pull-down ideas and options of the preset range. This provides precision and accuracy for intense episodes. Furthermore, this platform is known to provide EPS search criteria instead of other platforms. For instance, you can check the EPS price percentages comprising the current and previous EPS surprise and fit every EPS surprise by evaluating the last quarters. EPS Surprise refers to a company’s earnings that have differed from expectations.

Investors can also export the results and paste them for a profound breakdown into the spreadsheet. This option also provides multiple screening criteria lists for export ratings that consist of updates, downgrades, and precise rating changes. However, only premium users can experience services for $249 annually.

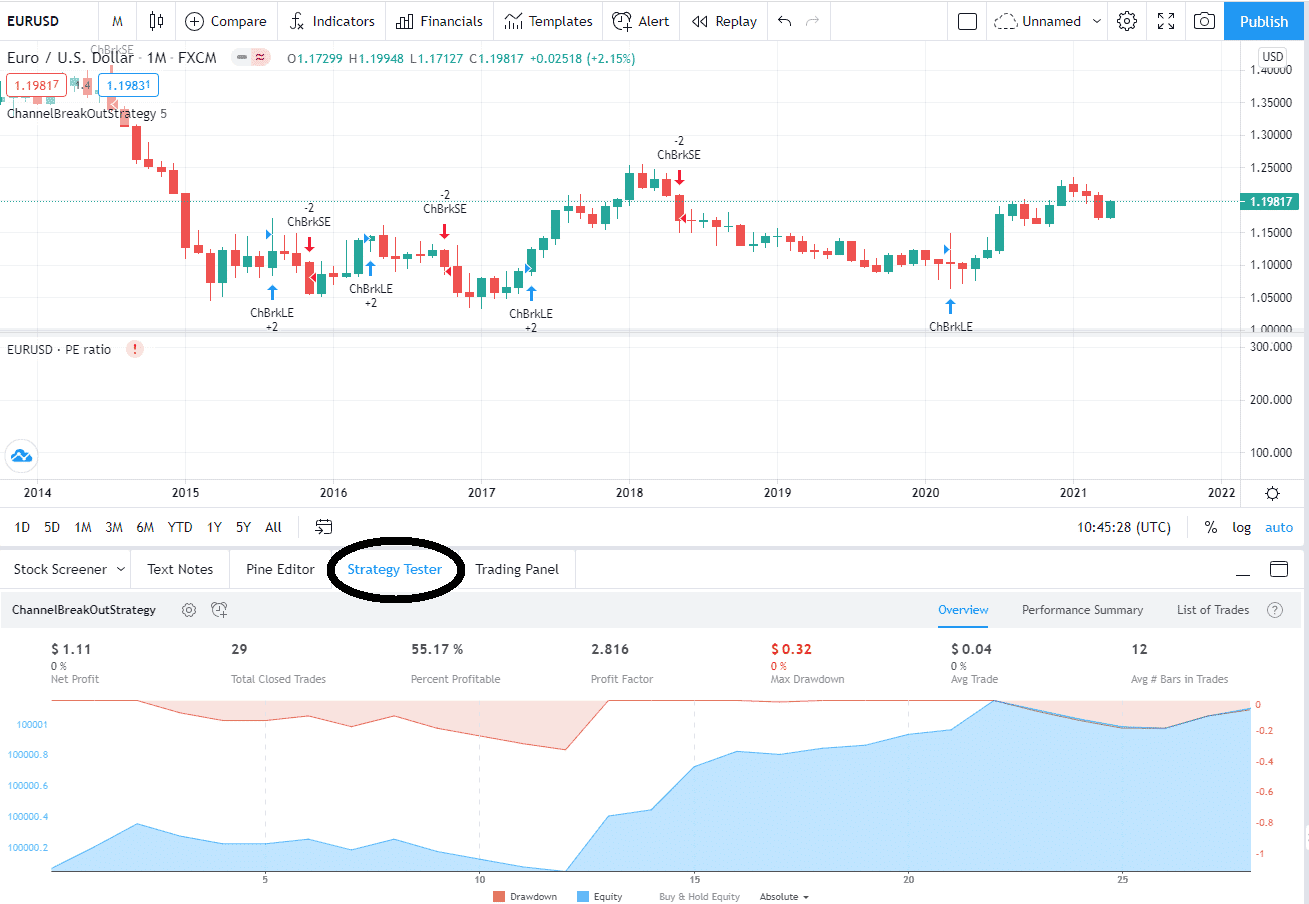

TradingView

TradingView is an excellent platform for proficient and scholarly investors, offering screening options at a low cost. It is highly flexible but may provide an overwhelming experience for beginners. Without any sign up you can study screening ETFs and stocks-related research by acclimatizing yourself with a wide range of decisions available. More than 150 stock filters are available for technical aspects leading to complete precision, and if you want, you can easily switch between the EFT and stock.

It has an edge on providing securities and investment opportunities compared to other platforms. You can reach American or international stocks with the same perception that it comprises foreign supply collected worldwide. In addition, investors get access to cryptocurrencies and foreign exchange (forex) currency comparisons. To avail of its facilities, you can book for a monthly free trial, and by paying $15 per month, you can enjoy premium services.

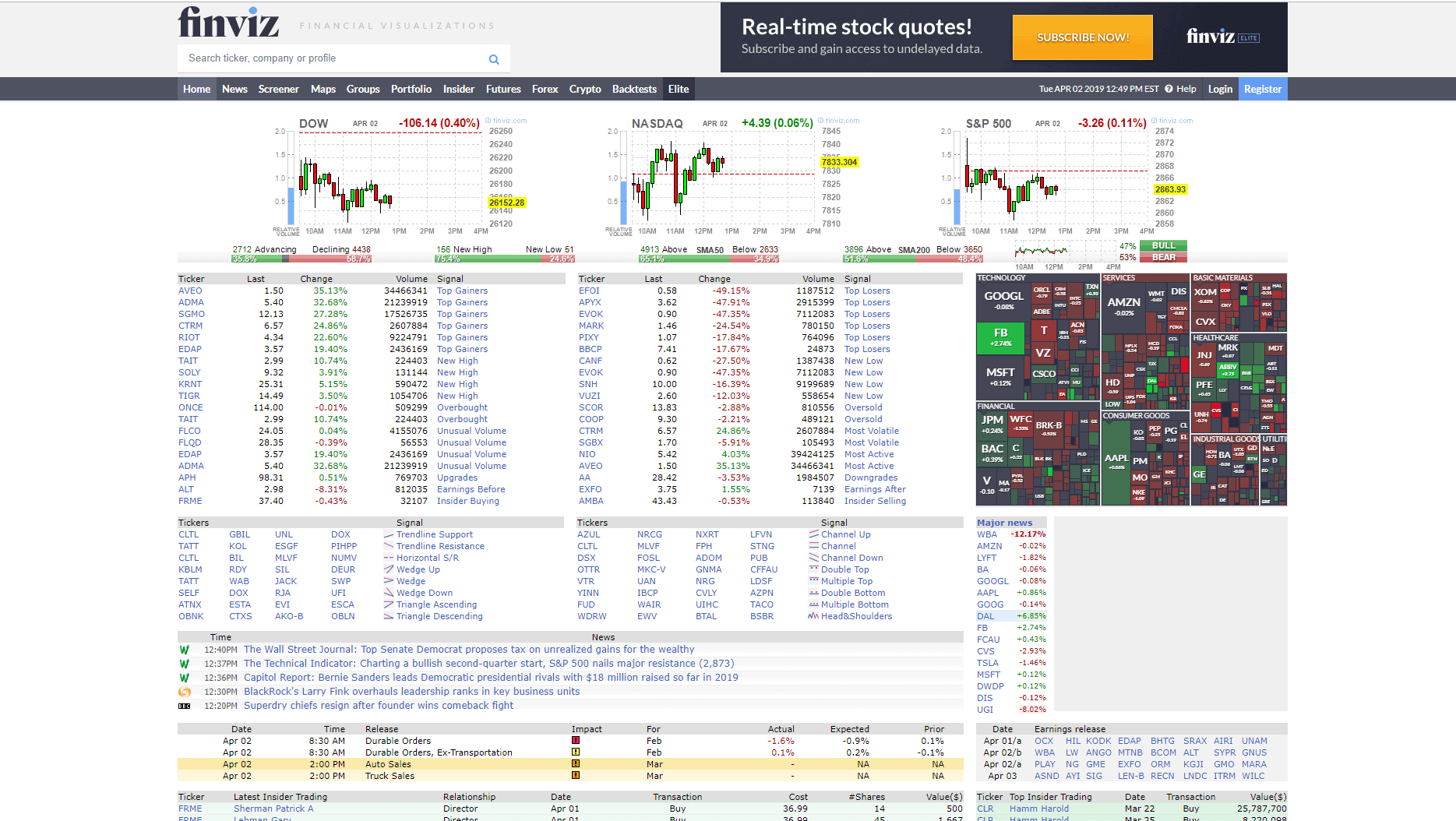

Finviz screener

What is Finviz?

Finz represents a contemporary stock screener that provides real-time stock screening, aftermath data, data relationship with stocks, and backtests, giving a general analysis and historical scrutiny to review the current performance. This plan is available at $25 per month. To avail of free services, investors need not sign up and enjoy the sea of screening filters.

Is Finviz free?

Finviz stock screener is a free tool for stock screening. However, if you are a day trader and need fresh daily updates with backtesting, you must pay the premium version (Finviz elite).

However, one of its limitations includes slow time in data updating, which unpleasantly upsets the day traders compared to the buy and hold investors. The buy-and-hold investors can therefore utilize Finviz once the market concludes.

It has a relatively undemanding and basic online platform system making it less overwhelming for beginner investors and traders. It has 29 fundamental filters and 17 technical filters. Finviz is a moderately more straightforward and primary platform; therefore, you can activate your investment activities and stock-related screening here and move to advanced versions later.

TC2000

This platform has excelled in screening and scanning, offering fundamental and technical criteria. However, investors can customize and tailor screen criteria integrated with stock charts. In addition, personalized and customized data can be combined with visual charts making it highly demanding in the stock screener field.

Unfortunately, TC2000 is only affiliated with the US and Canadian-based stock markets. However, this software can be downloaded and installed; some users complain that its web-based platform fails to deliver a quality response.

Like other screeners, TC2000 offers both free sign-up and premium options, with the latter revolving around $10 per month.

Individual stock pickers and daytime trades need to have better access to data than buy and hold index fund investors. They need access to helpful, practical stock screeners that help them provide valuable knowledge and screening in the pool of unlimited data.