Table of Contents

The stock market is a volatile and intimidating place for the average investor. With the myriad available stocks, deciding which ones to invest in can be challenging. Many investors rely on stock-picking services to help make informed investment decisions. In 2024, various stock-picking services will offer up-to-date stock data, easy navigation, real-time news, and a reasonable price.

The equity market generates approximately 10% on average and over the long run. Individuals who want to relax and unwind can automate their shares by investing in alternative investments with an enabled device or economic adviser. It’s simple, and it performs. And what if average profits aren’t enough for you? Companies ( i.e., those that outperform the market) are frequently sought after by investors looking for a competitive advantage. Although some prefer to examine these securities independently, utilizing strategies such as the CAN SLIM approach, others have been content to rely on equity professionals to do otherwise.

What is the Best Stock Picking Services in 2024?

The best Stock Picking Services in 2024 are Trade Ideas, MotleyFooll, Seeking Alpha Premium, Pilot Trading, and MindfulTraderss. They offer up-to-date stock data, easy navigation, real-time news, a lot of data, and a reasonable price. The best stock-picking service based on the provided tools and features is Trade Ideas.

Stock-selecting firms do precisely what their name implies: they fix individual equities that they feel will beat the overall equity markets. They propose such stocks to you; you may act on them or ignore them as appropriate. They appear to be easy, and they are, but many novice investors confuse them with other companies that appear alike. Stock scanners, for one, are programs that assist you in narrowing down the dozens of accessible stocks to a workable handful, depending on your specific criteria. Although similar, stock analyzers are a different internet investment tool that transmits securities data but instead notifies it instantaneously.

Brokerage firms provide the actual method for investing in the stock market online. Bear in mind that these present in the excess overlap. The majority of brokerage firms offer stock screening instrument tools. Several stock airport employees provide accurate market scanning.

Like anything else, stock-selecting systems are sometimes more robust than many others. However, stock pickers do not just differ in terms of competence. These also vary in words of emphasis. Most cater to today’s investors or swung trades, assisting them in identifying stocks set to rise or plummet significantly the next day or the subsequent month. Others cater to protracted purchase customers; selecting stocks, they feel will develop rapidly in the coming years.

First, most seek out stock picks with a proven track history of outperforming the marketplace. Nobody savvy investor will always succeed, but the intelligent ones will be correct far more frequently than mistaken. Before getting investing guidance from any fund manager, check their credentials with a record of success. When feasible, they compare the results of their choices to the economy. It would make little difference if their choices increased by 30% this year if the industry expanded by 32%—the greater the length of that record, the more remarkable. Search for knowledge in your trade picks because the first year or two of successful choices might be due to chance. Twenty-five years of excellent options demonstrate talent.

Trade-Ideas

Trade Ideas is another excellent choice for finding high-performing stocks in 2023. They provide an AI-powered platform with advanced analytics and sophisticated backtesting tools that allow you to evaluate different strategies before investing in them. Trade Ideas also offers customizable watchlists, alerts, and notifications so that you stay on top of changing trends in the market.

Trade ideas offer:

- Charting

- Artificial Intelligence

- Stock Scanning

- Entry & Exit Signals

- Real-time Alerts

- Market Breadth

- Backtesting

- Risk Analysis

- Performance Tracking

- Simulated Trading

- Live Trading

- News

- Cloud Storage

- Education

- Free Trading Room

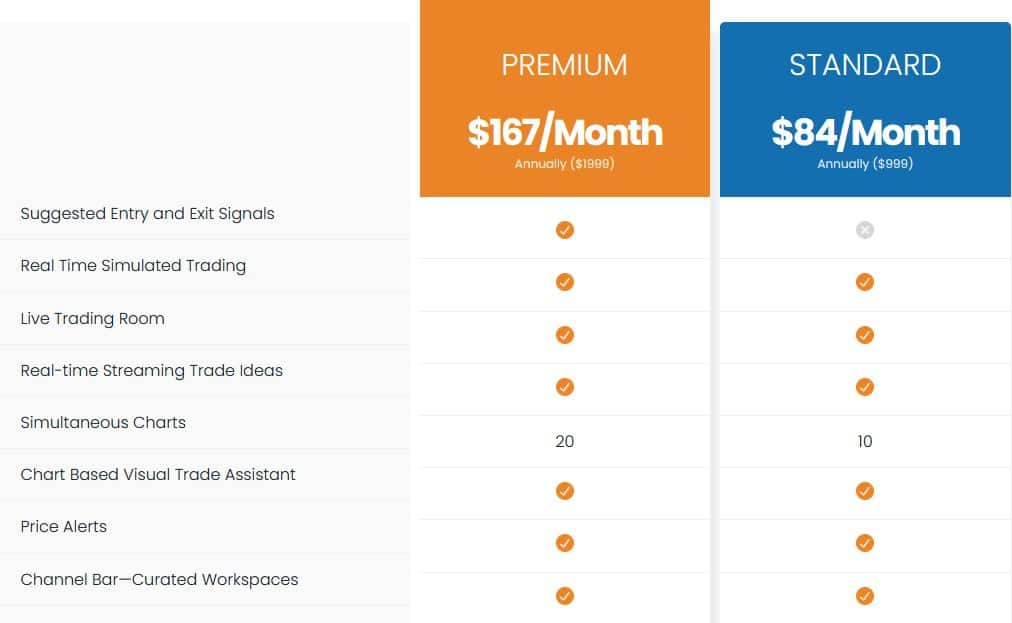

Please price for premium and standard features:

Trading Idea also has its corporate stockbroker, which allows you to authorize Holly to transact in your name instead of reselling through your independent brokerage firm. Trade Concepts also depend on the financial aspect, which is very appealing. It buys and sells with fictitious money and gains experience before throwing your damn difficult cash around the marketplace.

Trade Ideas Stock Picking Services is a comprehensive platform that provides investors the tools to make informed decisions regarding trading stocks. The service offers real-time market data, including stock quotes, news, and analysis of financial markets. It also allows investors to watch their portfolios closely with personalized alerts and notifications.

The platform’s best feature is its ability to generate stock picks for users based on their goals and objectives. Trade Ideas has developed a proprietary algorithm that identifies key trends in various markets, from commodities to equities, which can be used to identify attractive investment opportunities. The algorithm considers factors such as seasonality and financial figures from multiple exchanges worldwide, meaning it can produce more accurate predictions than most human traders. Investors can customize the algorithm’s parameters to suit their individual needs or objectives and set up notifications for when new signals are generated.

Besides its sophisticated stock-picking algorithms, Trade Ideas also provides a wide range of valuable tools, such as charting software and technical analysis tools. Users can access historical data spanning decades, which helps them gain insight into past market activity and better inform their future decisions. There are also options for real-time alerts to stay abreast of any relevant news or events related to your holdings or potential investments.

In addition, Trade Ideas provides an extensive library of educational materials, including tutorials, webinars, and courses designed specifically with new investors in mind. These educational resources provide valuable insights into the workings of the stock market while giving users the confidence they need before trading with natural capital.

Overall, Trade Ideas Stock Picking Services has become one of the most popular platforms due to its sophisticated technologies, user-friendly features, and generous educational support system. It offers a comprehensive solution where investors can access powerful algorithms for generating stock picks and easy-to-use charting software and technical analysis tools backed by an expansive library of educational material all wrapped together in an intuitive user interface. Whether you’re a novice investor or an experienced trader looking to optimize your approach to trading stocks, Trade Ideas deserves serious consideration due to its robust feature set at a competitive price point, making it one of my top recommendations today!

The Motley Fool stock picking service

Motley Fool is one of the most popular stock-picking services 2023 due to its thorough research and reliable data. Their team consists of experts who analyze stocks on dozens of criteria so that you get the best possible results. The service provides daily ratings, detailed analysis reports, real-time news feeds, and live tracking of stocks. It also includes an investment risk assessment tool to help determine how much risk you’re willing to take with your investments.

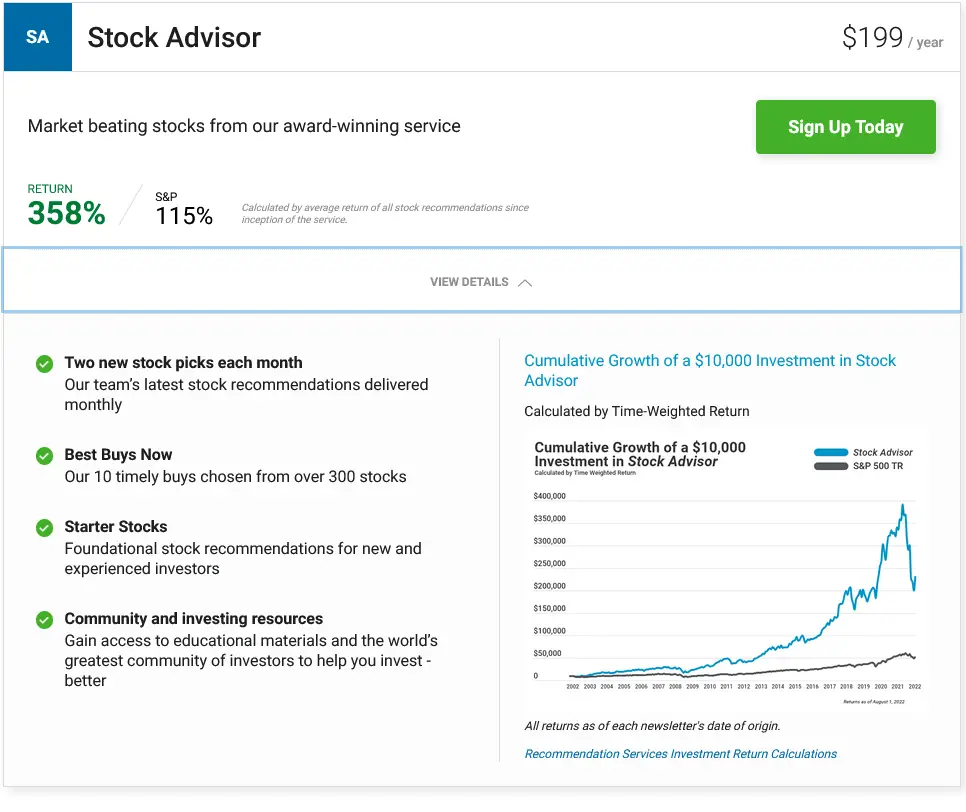

For only $199, you can get an excellent stock adviser:

This same Motley Fool has been doing this for over 30 years and has risen to the top of the list of individual stock pickers. Before April 2021, this Motley Fool’s Stock Planner selections generated roughly five times the S&P 500 500profits during their debut.

That’d be a lifetime yield of 585 percent vs. 136 percent for the S& P, creating a striking picture. Once you enlist, they want you to agree to three trading rules, thereby confirming the authenticity of the business methodology. Peter and Tommy Garden, two siblings, established The Motley Fool in 1993. Since then, the two boys have published the four most excellent books, collaborated with NPR on investment radio programs, and created many hugely successful programs. With over 700,000 members, its Stock Advisory program has done admirably by every measure.

Six newsletters are sent out every month, beginning on the first Wednesday of the fortnight and continuing regularly. The first or third emails provide a new stock suggestion, while the 2nd and 3rd Wednesday bulletins each have six different New Favorite Buys Immediately stock recommendations. The latter are prior choices that they always consider to be excellent purchases. In addition, users get real-time “sell” suggestion messages whenever the market situation changes. Users also have exposure to Moron’s “TopTenn Stocks to Buy RIGHT Today” analysis and their “BestFivee Beginning Stocks,” which they suggest for all holding assets. The Market Advisor service is $199 yearly, with a $99 reduction in the first year (recruits only)y. Before persisting, you may test a full weekly schedule with its 1-month financial warranty.

The Motley Fool provides more than just the Stock Advisor membership. The Rule Breaks magazine highlights the “hidden pearl” consumers make choices, focusing on firms ready to challenge their sectors. Per the Motley Fool, these Code Break company choices have earned 346 percent since their debut in 2004. The S&P 500 gained 117 percent during the same period. If any of that appears to be lower than Street Consultant’s selection yields, remember that Street Guide was founded some years ago. The Rule-Breaking stock choices are more likely to be available than gigantic entrenched ones. Because of this, Rule Breakers should only be considered if you’re seeking plucky growth companies that the rest of the industry hasn’t noticed.

Members of Stock Advisor get stock selections through the first and fourth Wednesdays of each month and five Suggested Best Bargains on the 2nd and 4th Fridays. In addition, you now receive real-time sale warnings and membership towards The Motley Fool’s Introductory Stock.

Seeking Alpha Premium

Seeking Alpha Premium provides investors with actionable insights based on fundamental and technical analysis from experienced analysts and traders. This helps investors decide which stocks to buy or sell based on current market conditions. The service provides ratings for various stocks and detailed reports, including target prices and stop loss levels for each security being researched.

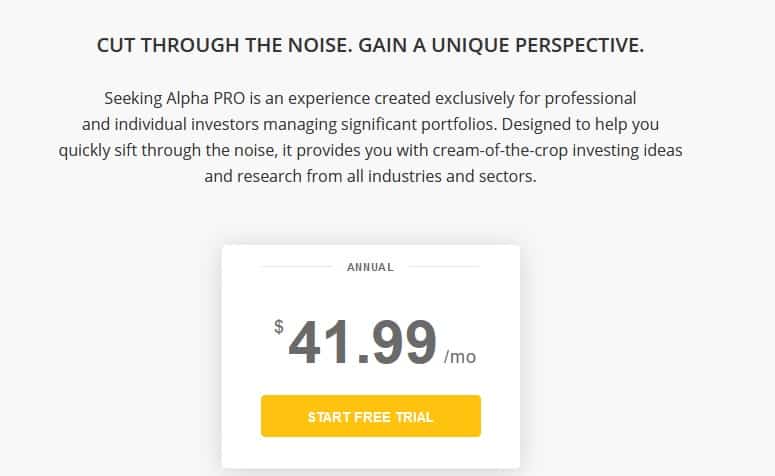

You can get the Pro version for $41.99.

They were seeking Alpha Premium Stock Picking Services to offer excellent value for investors looking to get the latest news, insights, and investment strategies in today’s stock market. With their comprehensive range of services, they provide everything necessary to make informed decisions when buying and selling stocks. The subscription model allows users to pick the level of coverage they need, allowing them to customize their approach based on risk tolerance and desired outcomes.

The analysis provided by Seeking Alpha is unparalleled in its depth and detail. Every article is thoroughly researched and analyzed before publication, with updates made available as soon as significant developments occur in the stock market. The team behind the research provides detailed assessments of stocks, sectors, and industry trends that help investors make savvy decisions regarding their investments. Moreover, subscribers can access exclusive reports prepared by experienced analysts and timely alerts that keep them up-to-date on what’s happening in the markets.

In addition to stock picks, Seeking Alpha offers a variety of educational materials aimed at helping users build a better understanding of investing concepts. These include tutorials covering fundamental topics such as stocks vs. bonds, portfolio diversification strategies, long-term financial planning tips, and more. Furthermore, Seeking Alpha also offers access to discussion boards where experts can participate in conversations about current events affecting the markets or discuss particular stocks with other investors. All this helps subscribers stay informed about their investments and make better decisions when buying or selling shares.

Seeking Alpha Premium Stock Picking Services provides an invaluable resource for investors looking to stay ahead of the pack in today’s volatile markets. With its wealth of resources designed to help new and seasoned investors understand how they can succeed in the stock market without spending countless hours doing manual research, there is no doubt that Seeking Alpha is a top choice among those looking for success in their investments.

Mindful Traders

The brilliance of Mindful Trading is that one doesn’t have to be continuously on the lookout for trade notifications. The advised swing bets might take up to a year to complete, so you can acquire them anytime throughout the market week. That was an essential benefit since most of us can’t seem to keep our eyes glued to the computer for the whole day, waiting for notifications to appear. Eric Ferguson, the developer of Thoughtful Trading, used empirical analyses of centuries of the stock market to build a program that warns him — and customers — of elevated price fluctuations.

Mindful Traders is a relatively new service compared to some of its competitors but has gained traction due to its focus on personalization when managing investments. It employs a unique algorithm that considers risk tolerance and investment goals when helping users choose which stocks to invest in or avoid altogether. This way, users have more control over their portfolio without sacrificing profitability or security – something many stock-picking services cannot guarantee without expert input from experienced traders or analysts.

Stock transactions, derivatives deals, and special bets are all included. Whenever Eric performs a trade, he updates his web page to log customers so that you may replicate anything. He conducts most of his transactions within those two dates every day, so you can only visit the website at very few key moments during the day. And these are not as things as quicker-day transactions like swung trades. I particularly appreciate how Mindful Trader’s future results are backtested. Eric’s investing technique might have generated a yearly return of 181 percent throughout the last two decades. The year revenue summary may be seen here. I’ve been tracking Eric’s transactions for about five days already. During the same period, I made a 59.7 percent annualized return.

Which doesn’t imply you don’t suffer losses now and then. Everyone experienced the stomach-churning sensation of running more losing deals. The average account decline in Eric’s carrying out the test is approximately 25%, which is impossible to do lightly. I cannot feel connected to how problematic it is to go between millions of dollars ahead for the quarter to six figures down a couple of times. Conscious TraderTrader $47 monthly service cost. And it is not inexpensive in and of itself; it is less affordable than several alternatives.

Pilot Trading

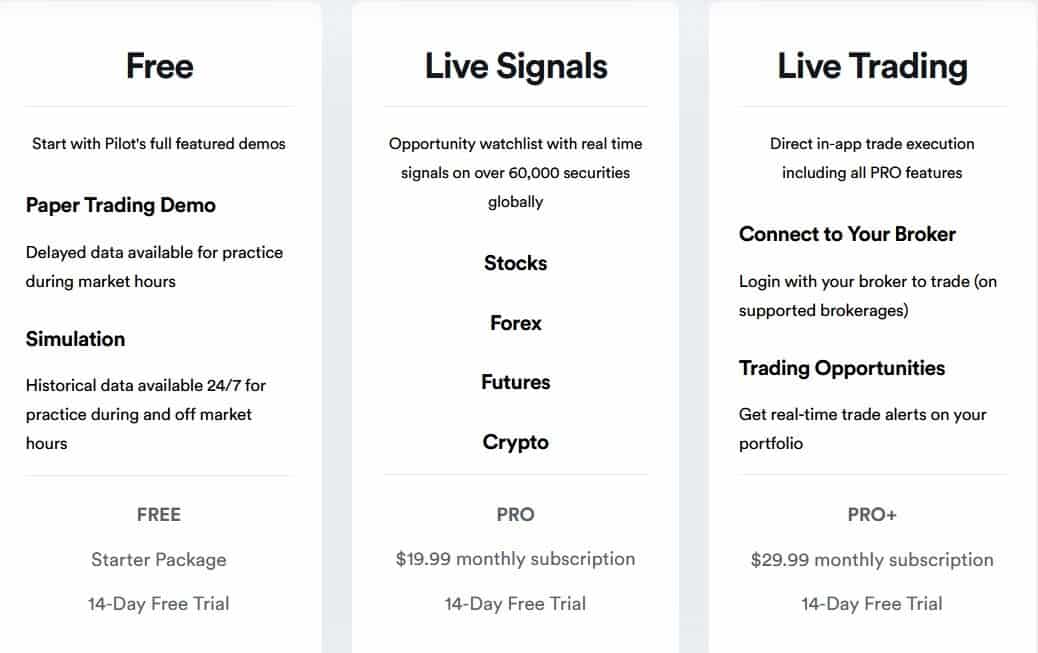

Pilot Trading is designed for experienced traders who want maximum investment control. The service focuses on trading strategies rather than simply selecting individual stocks; this allows users to develop portfolios tailored to their specific trading goals while taking advantage of market movements quickly and efficiently. Pilot Trading provides comprehensive support through resource guides and trading courses so that customers can become more knowledgeable about the markets they’re investing in.

Pilot Trading provides a synthetic paper brokerage account to get you started when you’re inexperienced in dealing with either of those commodities. Most importantly, Pilot Trading does not impose the exorbitant subscription fees that many rivals do. They offer a fixed monthly fee of $19.95 for full access to all services. There will be no sales promotion or different pricing for toys, and toys will be one low fee for all clients.

The reliability of your knowledge determines your probability of victory as a day or swinging trading. Trades may profit from timely, credible data; winning the market is extremely difficult without it. But, in addition to real-time financial notifications, speculators and long-term business owners want assistance reducing the need from hundreds of businesses to a dozen. Here is where stocks selecting companies may help. Furthermore, of all, they aid in the delivery of training. Individual securities trading is not as passive and simple as indexed fund investment. It takes extensive knowledge and skills, adequate stock selecting solutions to give notifications and government watch lists, and a methodology that can be replicated.