Contracts for Difference (CFDs) and Forex (foreign exchange) are often mistakenly interchanged but represent different financial instruments. CFDs are derivatives that allow investors to speculate on the price movements of various assets, including indices, without owning the underlying asset. On the other hand, Forex is specific to the foreign exchange market and tracks the performance of currencies or currency pairs.

However, brokerage companies can create currency index baskets, similar to stock indices, and traders can trade forex indices.

What are the best Forex Indices to Trade?

There are no best forex indices to trade because, over time, forex indices do not have a bullish overall direction like stock indices. Stock indexes tend to rise over time, while currency baskets do not have statistically significant clear trends over time.

Therefore, if traders invest in the US dollar or EUR indices, prices cannot go long in US indices such as NAS100, DAX, and S&P500. Usually, indices have more consistent trends than currencies and lower volatility than stocks.

For example, all major brokers remove currency baskets and do not currently offer forex indices. Traders are not interested in investing in forex indices because, in the long run, US indices such as NAS100, DAX, and S&P500 provide better results.

Currently, I only find CMC Markets forex indices as the last broker that offers this kind of service (see screenshot above).

Forex indices consolidate individual foreign exchange (FX) pairs with the same base currency into a ‘basket’ to track the collective performance of these currencies, offering a broader market view. The value of a forex index rises or falls based on the underlying prices of the currency pairs within it, mirroring their collective movements.

Trading forex indices can be more cost-effective and efficient than engaging with individual pairs. It allows traders to speculate on broader market trends without opening positions on each currency pair. This method also offers portfolio diversification and risk management benefits, as exposure to a range of currencies can mitigate the impact of volatility on any single currency pair.

Forex Indices Do not Have a Clear Bull Market Potential.

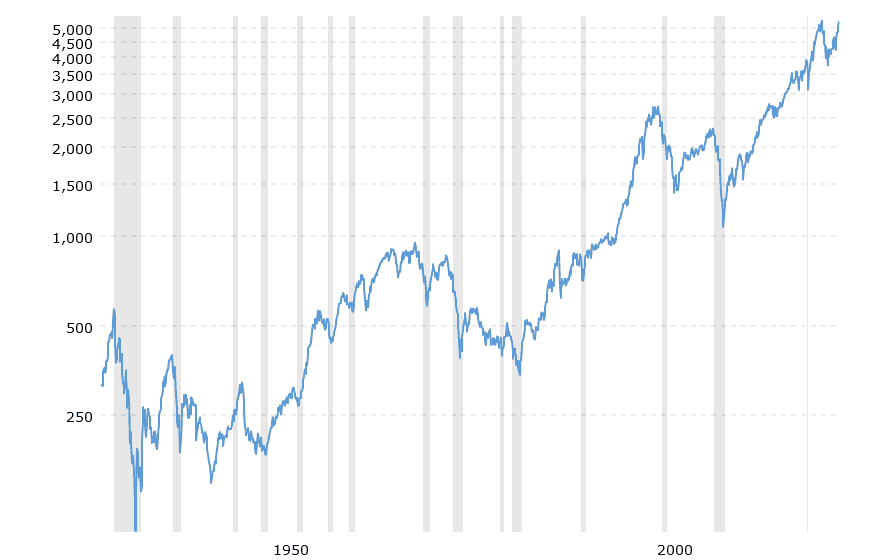

Bull and bear markets represent opposing trends in stock indices, such as the S&P 500, signaling different phases of market sentiment and investment behavior. A bear market is identified when the S&P 500, or a similar stock index, experiences a decline of at least 20% from its most recent high during a bull market. This significant drop reflects widespread pessimism and negative investor sentiment, often triggered by economic downturns, geopolitical crises, or market bubbles bursting.

Conversely, a bull market begins when the S&P 500 rebounds from its bear market low by at least 20% and eventually sets a new record high. This rise indicates a recovery and a period of increasing investor confidence, economic improvement, or positive market drivers that push stock prices upward. The transition from a bear to a bull market signals a shift in investor sentiment from fear to optimism, encouraging more buying and investment.

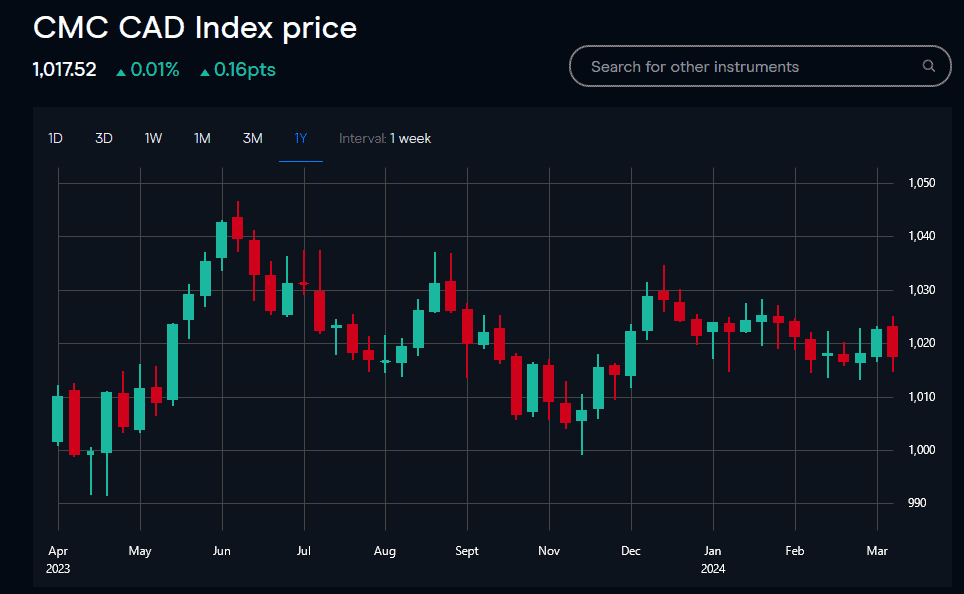

Forex Indices without bullish potential example:

These cycles of bull and bear markets are natural parts of the financial markets ebb and flow. They reflect broader economic and financial trends, influencing investment strategies and decisions. Understanding these cycles is crucial for investors to make informed decisions, as each phase offers different risks and opportunities.

For example, in the S&P500, in the last 90 years, the increase from $350 to $5254 represents a percentage increase of approximately 1401.14%.

Conclusion

Stock indices generally tend to increase over time, reflecting the economy’s growth and corporate earnings. This upward trajectory is supported by the historical performance of major stock indices, such as the S&P 500, which have shown substantial growth over decades, driven by reinvestment of dividends, expansion of companies, and economic progress.

In contrast, forex or currency baskets, which aggregate the value of different currencies against a base currency, do not show a similar statistically significant trend over time.

This difference is due to the nature of currencies, which fluctuate based on trade balances, interest rates, and geopolitical factors without the inherent growth bias in stock markets. Thus, while stock indices are seen as vehicles for long-term investment growth, forex indices are often used for speculation, hedging, and diversification, reflecting short-term changes in economic indicators rather than long-term growth.