Table of Contents

Liquidity Providers, often large banks, ensure market liquidity by providing bids and requesting quotes for assets like currencies. When traders initiate a market order, brokers with STP or ECN models relay it to their liquidity providers to secure the best rate. This order is promptly paired with the most favorable counter-offer among the liquidity providers’ quotes.

However, due to the dynamic nature of markets, there’s a chance of slippage, meaning the final executed price might slightly deviate from the expected one. To optimize order fulfillment, brokers often collaborate with multiple liquidity providers, especially during periods of high volatility or limited liquidity.

What is an STP account?

STP (Straight Through Processing) account represents no dealing desk technology where all trading orders are routed directly to liquidity providers using DMA (Direct Market Access). Using an STP account, all trades will be routed first to the liquidity pool, and then all orders will be filled at the best possible price.

STP brokers send orders directly from clients to the liquidity providers (often big banks or sometimes other brokers) without passing these orders through a dealing desk. This type of execution minimizes the possibility of a conflict of interest between the broker and the trader.

- When a trader places an order with an STP broker, the broker will not handle the order internally but instead passes it on directly to its liquidity providers.

- These liquidity providers will then quote a bid/ask spread. The STP broker will add its markup, and the resulting bid/ask spread is presented to the trader.

- The order is executed at the best available price among the liquidity providers.

STP account Advantages

- Speed of Execution: Since there’s no dealing desk involvement, orders are processed faster.

- Transparency: Traders are often given access to the market’s depth and prices.

- No Conflict of Interest: The broker is not taking the other side of the trade, so there’s less potential for manipulation of prices.

- Better Prices: With multiple liquidity providers, traders can get more competitive bid/ask spreads.

Notwithstanding, STP records should not be considered a genuine option in contrast to ECN accounts. ECN accounts are a non-managing work area model that empowers merchants to exchange the ongoing business sectors by sending orders straightforwardly to the market. To a greater degree, STP accounts are viewed as a crossbreed of the ECN and market creator (managing work area) models. STP Forex exchanging accounts are becoming more appealing than conventional managing work area accounts because of the assortment of benefits merchants appreciate. Yet, STP likewise has a couple of downsides over the further developed ECN accounts.

What are the Different Types of Currency Brokers?

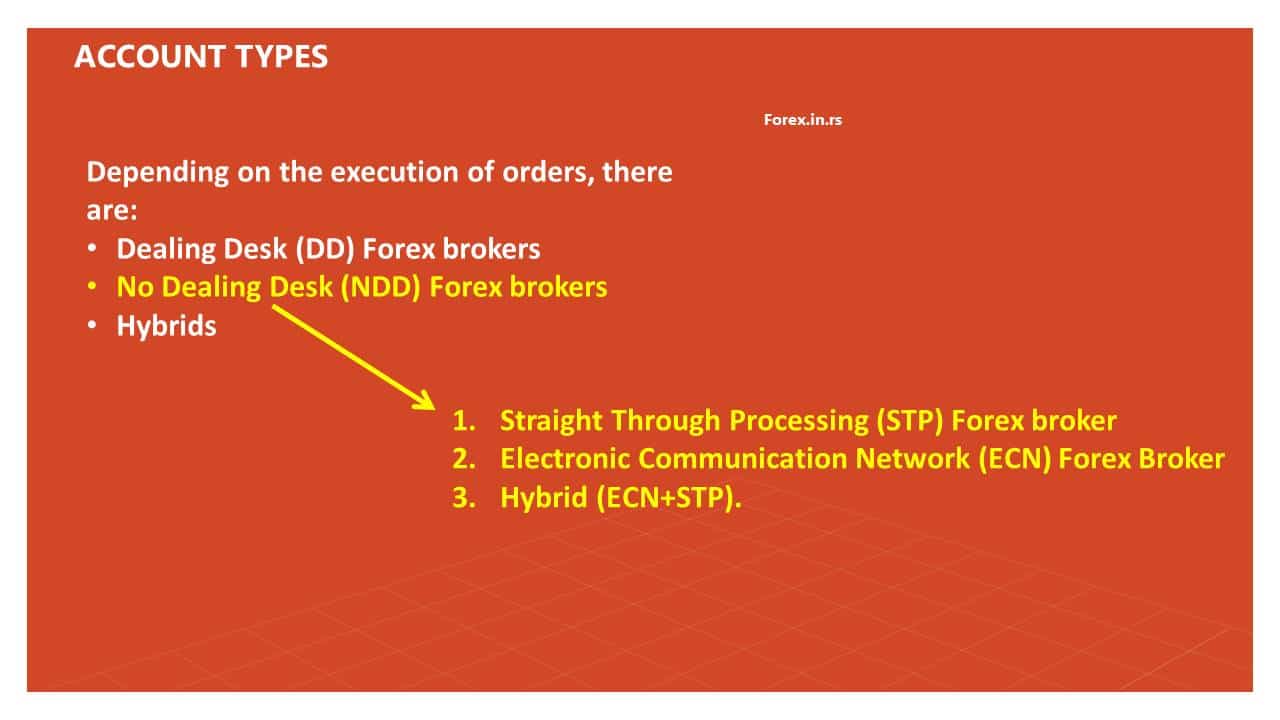

Due to several parameters, we can discriminate between many Forex brokers. Forex brokers may typically be separated into categories by:

- Reputable and licensed brokers

- Non-licensed brokers that are non-reputable

As per the trading platforms:

- MT4 Forex brokers

- MT5 Forex brokers

- MT4 & MT5 Forex brokers

- Brokers with a proprietary platform

As per odder executions:

- No Dealing Desk (NDD) Forex brokers

- Dealing Desk (DD) Forex brokers

- Hybrids Forex brokers

NDD brokers are:

- Electronic Communication Network (ECN) Forex Broker

- Straight Through Processing (STP) Forex broker

- Hybrid broker(ECN+STP).

How Are STP Forex Brokers Different from Market Makers?

Market producer representatives manage work area organizations that ingest customer orders and either pass them inside to different customers or take the far edge of the exchange. Market producers or managing work area agents don’t interface dealers to a worldwide liquidity pool or the interbank trade. Along these lines, all orders are circulated among customers, and the dealer can either take care of their customers’ requests or reject them as per the market’s liquidity.

Because of the 24-hour nature of the FX market, representatives experience variable liquidity and conflicting volumes for the day. It is nearly unthinkable for the merchant to discover purchasers and dealers for a similar volume without fail; subsequently, most intermediaries resort to taking the contrary side of their broker’s position. Since the FX market tends to make more victors than failures, expedites, as a rule, prevail regarding benefitting from their customer’s misfortunes. Aside from the spreads, customers’ misfortunes are the essential wellspring of income for managing work area representatives.

Since market creators benefit from their customers’ misfortunes, all managing work area merchants have irreconcilable circumstances with their clients. Loads of specialist tricks and untrustworthy representative practices emerge from the dealer’s covetousness to bring in cash from their customers. Most market creators resort to strategies, for example, cost control, disengaging the cost takes care of, expanding the spreads, taking care of requests at ominous value levels, and, in any event, turning to change customer orders without their consent. Like this, a more significant part of brokers will generally lose cash with market producers.

STP Forex intermediaries are more transparent in their contributions, as they mostly don’t have an irreconcilable situation with their customers. All customer orders are passed straightforwardly to the liquidity supplier, and the business sectors often ingest the request without mediation from the representative. STP representatives bring in cash from the spreads charged for each exchange, which is helpful for the two players.

It isn’t unexpected to encounter a critical number of re-statements and enormous slippages from market creator specialists during low liquidity seasons in the business sectors. Now and again, managing work area specialists will set aside a great deal of effort to take care of requests, which can go from a few seconds to minutes.

Dealers may likewise confront stage-down occasions, which can keep them from opening or shutting their situations under excellent conditions. Despite what might be expected, STP accounts help decrease the number of re-cites as a dealer is associated with a bigger liquidity pool, and orders are filled moderately quicker than regular market producer accounts. One of the fundamental benefits of STP dealers is how orders are filled all the more rapidly and exchange execution is consistent, which causes merchants to exploit economic situations without the intermediary meddling in any way.

What Can be Called a Dealing Desk?

Many times, as market makers, we typically mean DD brokers. Since these brokers typically hold the opposite direction of traders’ deals, the controversial word “market makers” has been used. They generally create money by spreads or by liquidity provision. Before taking a countertrade or handing it over to a liquidity supplier, they even attempt to find a suitable short or long order with their other customers. They are proven to produce artificial quotations; however, on a proportionate basis, orders are completed.

What Can Be Called a No Dealing Desk?

NDD brokers employ software without needing a dealing desk and channel trading orders straight to liquidity suppliers instead of a DD broker. Stronger and quicker loads help consumers enter actual markets. It is a connection between consumers and suppliers of liquidity, and if an order has to be completed, there are no requotes. We distinguish between the STP and the ECN, two main types of NDD Forex Brokerage firms.

STP Forex Broker Definition

A no-dealing desk is required for the Straight Through Processing (STP) system. Both requests are directed to the liquidity suppliers of the broker, and rates are handled at the bid or ask rate issued by the liquidity suppliers. Liquidity suppliers in this situation are hedge funds, large banks, plus investors who essentially serve as counterparties to each transaction. The STP currency broker typically seems to have an internal liquidity stream represented by multiple suppliers of liquidity who negotiate for the highest bid or ask ranges for STP broker trades.

In a broader context, STP implies that instead of a dealing desk reprocessing transaction, the broker firm plays a quiet link supplier between the client and the dealer. A ‘DMA’ is another advantage of an STP currency broker. DMA refers to Entry from the Direct Markets. DMA applies when dealers specifically transfer their customer requests to their liquidity pool; thus, transactions are fulfilled at the highest possible price, with the dealer spreading only a slight markup.

The brokerage with one of the most adjustable spreads is the one that you can always reach for. The explanation is that the dealer with the most flexible spreads can choose from their collection the winning offer from one of the liquidity suppliers and the better spread from some other liquidity supplier. That gives their customers the finest spread. The STP implementation goes with no requirements, and owing to its lightning pace, it is perfect for traders that like to scalp and exchange information.

What Does It Mean by an ECN Forex Broker?

Both STP and ECN Forex dealers seem to be several links, but the only real distinction is navigation. As described, the STP can negotiate with various liquidity suppliers out of the liquidity pool, whereas the ECN functions as a hub. This hub serves efficiently as a significant funding outlet, as it is embodied by banks, fund managers, and all the prominent market participants.

They become all intertwined to locate counterparties with the instructions they seem unable to manage individually. Another distinction is that ECN trade is often limited at a nominal lot size of 0.1 between the STP and the ECN. That’s because there are only a few sources of liquidity that accept only about 0.1 lots, which is tough for novice traders who need to exchange lower sums of capital (like between 1000-2000 EURO). Thus, as a response, a hybrid model was constructed.

Does A STP Account Guarantee No Intervention from A Broker?

STP works through a scaffold associating a dealer’s terminal with a liquidity supplier or an interbank. More modest representatives likewise utilize STP spans to interface their dealers to giant intermediaries, who will, thus, associate the merchant straightforwardly with the market or choose to ingest the exchanges inside. In this way, STP is undoubtedly not a genuine ECN elective, as ECN dealers have no job topping off their customers’ orders. STP, then again, permits intermediaries to take advantage of a bigger liquidity pool given by the worldwide trade houses or by more considerable specialists. This way, STP Forex representatives are not liberated from irreconcilable situations. Yet, STP accounts give a more prominent suspicion that all is well and good than conventional market producer merchants.

Difference between ECN and STP broker

Differences between ECN and STP brokers are:

- ECN accounts use a hub routing system for trading orders, while STP brokers use a liquidity pool.

- ECN minimum lot size is one mini lot while STP broker minimum lot size is one micro lot.

- ECN accounts traders will be charged a fixed commission for opening and closing trades, while STP accounts charge a commission using spreads from liquidity providers.

STP and ECN have a few comparable qualities. Yet, a few dealers lean toward STP in its unadulterated structure because of the absence of a commission for each exchange typically connected with ECN accounts. Most institutional merchants open ECN records to appreciate tight spreads at the expense of a commission for each exchange charged as a level of the exchanged parcels. Hawkers are additionally known to exchange with ECN conditions to get in and out of the business sectors as fast as expected and appreciate tight spreads for better market execution.

Some retail merchants are more right with the higher STP spreads instead of representing each exchange’s commission. Hence, if commission-streamlined commerce is your need, STP records can give more benefits than ECN accounts.

ECN has a high ground over ordinary STP accounts as brokers are presented to the real liquidity accessible on the lookout regarding exchange execution speed. STP records might be crossed over to more considerable specialists or trade houses, resulting in slower exchange execution times and a couple of re-cites. ECN accounts have negligible occurrences of re-statements. It is ensured that a dealer’s position will be filled at the strike cost, regardless of whether it is a fractional satisfaction of the request.

How Do I Make the Choice Between ECN and STP Forex Brokers?

If you think it’s hard to settle on ECN and STP’s decision, you should exchange on a demo record to get comfortable with the two stages and settle on a framework that suits your exchanging style. A few dealers may discover ECN to be more costly from a commission perspective. However, they might be astounded to discover that ECN records may be more prudent over the long haul. ECN accounts give the best exchanging conditions; in any case, STP accounts are not far behind the speed of exchanging and the general exchanging climate.

Despite your decision, consistently pick a Forex intermediary that a legitimate administrative office directs and guarantee that the agent of your decision has a decent standing on the lookout. Straight Through Processing or STP Brokers are sending merchants’ orders straightforwardly to the market without managing work area mediation (or NDD), which implies directly to the liquidity suppliers the market is predictable of and the one’s specific specialist participating with.

- Understand the Difference:

- ECN (Electronic Communication Network):

- Provides direct access to market participants.

- Displays the order book showing volume at different price levels.

- Typically, it has tighter spreads but may charge a commission.

- STP (Straight Through Processing):

- Sends orders directly from clients to liquidity providers without passing through a dealing desk.

- Spreads might be more comprehensive than ECN but often without added commission.

- Faster order execution due to the lack of a dealing desk.

- ECN (Electronic Communication Network):

- Consider Trading Volume:

- High-frequency traders or scalpers might prefer ECN for tighter spreads and more transparency.

- Casual traders might be more suited to STP because of its simplicity and lower fees.

- Evaluate Costs:

- Check for commission charges (familiar with ECN brokers).

- Analyze the spread markup (more prevalent with STP brokers).

- Platform and Trading Tools:

- Some ECN brokers offer advanced platforms with in-depth market analysis tools.

- STP platforms might be more straightforward and more user-friendly for beginners.

- Transparency and Order Execution:

- Traders seeking more transparency in the market might prefer ECN due to its visibility in the order book.

- Those valuing speed might lean towards STP for its streamlined execution process.

- Account Size and Initial Deposit:

- Some ECN brokers may require a higher initial deposit.

- STP brokers might be more flexible with smaller account sizes.

- Customer Support and Educational Resources:

- For beginners, choose a broker offering robust educational resources and customer support.

- Veteran traders might prioritize execution speed and cost over educational tools.

- Regulation and Reputation:

- Always opt for brokers regulated in reputable jurisdictions.

- Check reviews and user testimonials for insights into broker reliability and trustworthiness.

The representative regularly has numerous liquidity suppliers: banks or more giant intermediaries producing their offer and ask cost. Notwithstanding, executing through one liquidity supplier is an alternative, as certain representatives rehearsing that, thus bringing further liquidity pool.

The STP execution likewise implies no re-statement or deferral in taking care of requests. The innovation executes at extraordinary speed, sorts cite among the contribution, and takes care of requests at the best accessible cost, adding little fixed markup, normally one pip, to the statement. Frequently, the STP type brings variable spreads because of the evolving offer/ask costs, yet at a serious spread it is generally lower than Market Makers.

In any case, one of the benefits of STP execution is that the specialist never makes benefits on customers’ misfortunes since the organization acquires its net from various executed requests and is keener on the exchanging sizes.

What is the hybrid account?

A mix of the ECN and the STP can be called the Hybrid account model. Generally, dealers are willing to offer excellent client support, training, and multiple industry assessments for this arrangement. A complete electronic Forex trading operation is possible by combining the ECN and STP versions. This famous combination enables a Forex broker to completely optimize the customer orders, coping with spread prices and the facets of their transaction execution company’s trading activity.

Conclusion

For Currency traders, nevertheless, the hybrid version is an excellent choice. Brokers prevent market manipulation with both the STP and the ECN versions. For dealers and brokers, too, that is a winning scenario. Brokers would not want traders to fail because the more customers choose their platform to sell, the more they can gain money from spread or commission.