Table of Contents

A few years back, the proprietary (prop) trading landscape began witnessing a novel transformation. Traditionally, prop trading firms employed traders to trade the firm’s capital, earning a share of the profits in return. However, as the financial markets evolved and technology democratized access to these markets, a need for innovative approaches emerged. Inspired by the insurance industry’s risk-sharing model, several prop companies began offering funded accounts. This new paradigm, like an insurance policy, shifted some of the trading risks from individual traders to the company while providing opportunities for skilled traders lacking significant personal capital. Let’s delve into this intriguing turn in the prop trading world and understand its underpinnings.

What is a Funded Account in Forex?

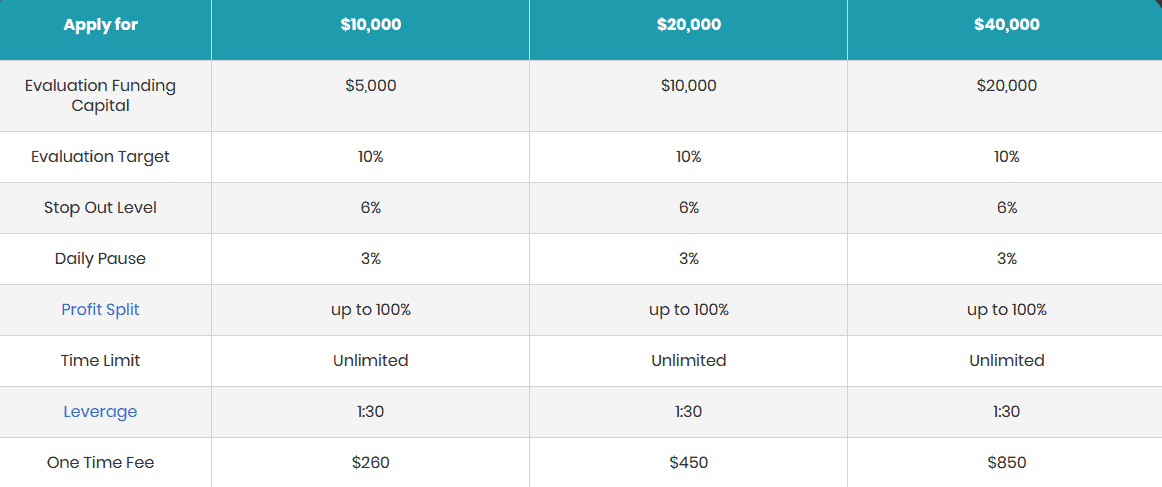

A funded account in Forex represents a trading account where a trader is given access to a certain amount of capital by a third party, typically a company, to trade the markets. The trader does not deposit their capital to start trading. Instead, traders pay one-time fees and prove their trading skills through tests or evaluations. Once they pass, they gain access to a funded account.

My personal opinion about funding accounts is different than others.

Proprietary trading firms, commonly called prop companies, that offer funded accounts have carved out a unique niche in the trading world. At the heart of their revenue model lies the upfront fees traders pay. When a trader seeks to demonstrate their prowess and perhaps gain access to more significant capital, they start by paying an evaluation fee. Depending on the amount of capital a trader wants to access, these fees can range anywhere from $100 to a substantial $10,000. It’s a tiered approach: the more you pay, the more capital you stand to manage.

Please see my full video explanation from my FxIgor Youtube channel:

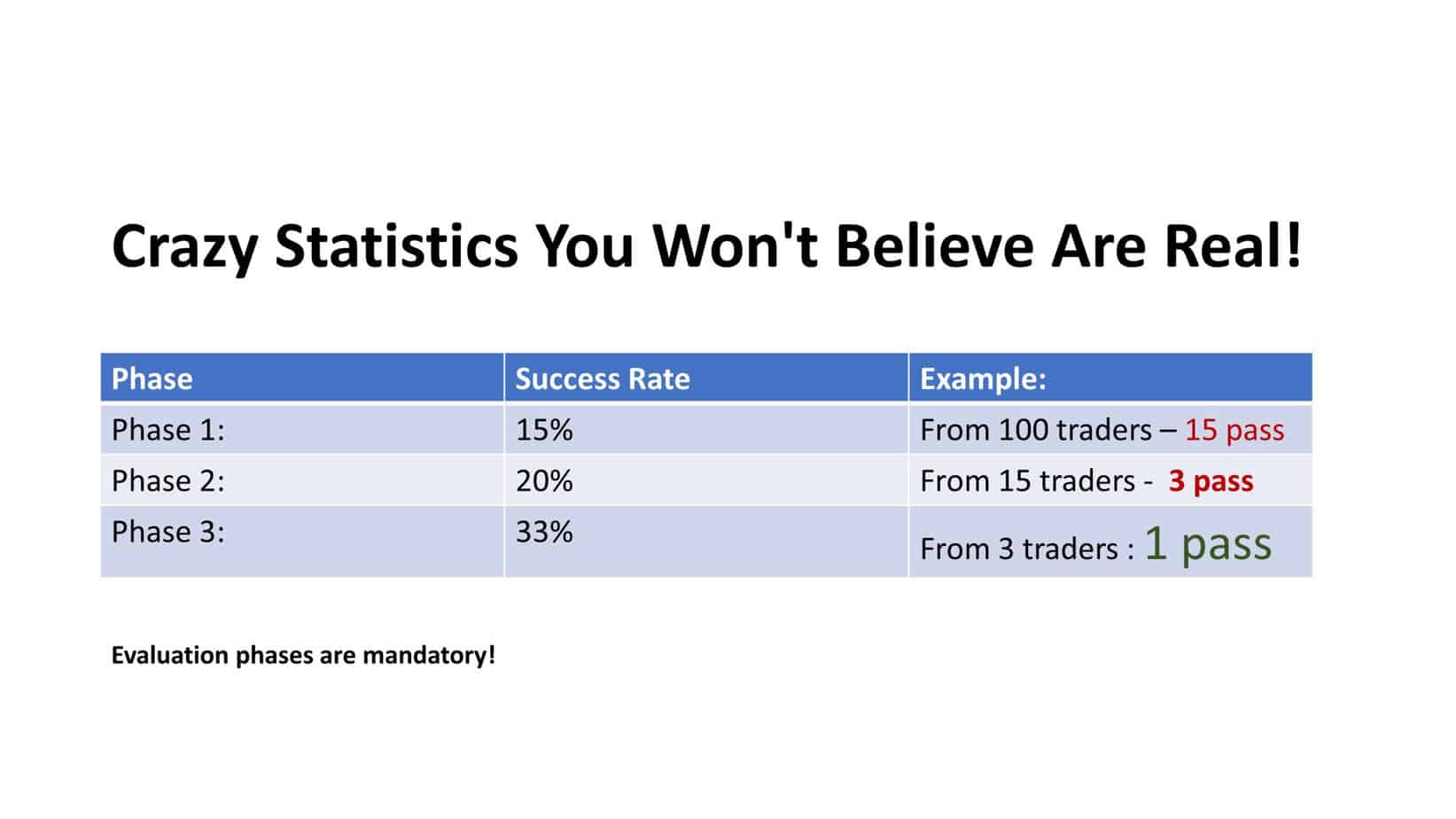

Interestingly, this fee-based model is heavily influenced by the inherent realities of the trading ecosystem. A vast majority of traders, roughly 95%, end up losing money, with many facing significant losses, effectively “blowing” their accounts. This high failure rate isn’t necessarily a product of deception by the prop firms. Still, it stems from the volatility of the markets, emotional trading decisions, and sometimes a lack of experience or strategy.

For prop companies, this presents an intriguing profit mechanism. While they stand to gain when their affiliated traders succeed, the primary driver of their profitability remains the fees collected from the large pool of traders, most of whom won’t see long-term success. In essence, by leveraging the upfront fees and banking on the statistical likelihood of trader losses, prop firms have established a business model where they remain profitable, regardless of individual trader performance. This dynamic stresses the importance of well-educated, strategic, and cautious traders in their endeavors.

Why Do Funded Accounts Exist?

Funded accounts exist to bridge the gap between traders with the skills but lack the necessary capital to trade effectively and those entities (typically companies) with the capital but want skilled traders to grow it. It’s a mutually beneficial arrangement.

I will provide you with an example. Let’s assume there are no evaluation periods, only instant-funded accounts.

See my video below about instant funding accounts:

The funded account model in proprietary trading has introduced a win-win dynamic for traders and prop companies. To fully grasp the benefits of this setup, let’s consider a practical example:

Scenario 1: Let’s say you’re an individual trader. You have $10,000 of your capital. If you were to invest this amount and achieve a 20% return on your investment over a year, you would earn a profit of $2,000. This leaves you with $12,000 at the end of the year.

Now, consider the funded account alternative:

Scenario 2: You approach a prop trading company and pay them a fee of $10,000 for access to a funded account worth $200,000. With the same trading skill and a 20% return, you now stand to earn a whopping $40,000 in a year.

Benefits for the Trader:

- Leveraged Capital: Even after paying a fee, the trader gets access to a capital amount far more extensive than they could have independently traded with.

- Higher Earnings Potential: As seen in the example, the potential earnings with a funded account can be substantially higher.

- Limited Personal Financial Risk: The trader’s personal capital risk is limited to their paid fee. They don’t have to worry about the losses beyond that amount.

Benefits for the Prop Company:

- Risk Protection: The fee paid by the trader acts as a buffer or insurance for the prop company. It can absorb losses up to that amount, protecting the firm against potential adverse trading outcomes.

- Profit Sharing: Even though the prop company provides a more significant capital, they also get a share of the profits. For instance, in an 80/20 profit split, from the $40,000 profit, the trader takes $32,000, while the prop company earns $8,000. Remember, this is on top of the initial fee.

- Tapping into External Talent: Prop companies can access a broader pool of trading talent without hiring them as employees by providing funded accounts.

Features of a Funded Account

- Evaluation Phase: Before a trader gains access to a funded account, they typically undergo an evaluation phase. During this phase, they trade a demo or a real account, showcasing their skills and adhering to specific risk parameters set by the funding company.

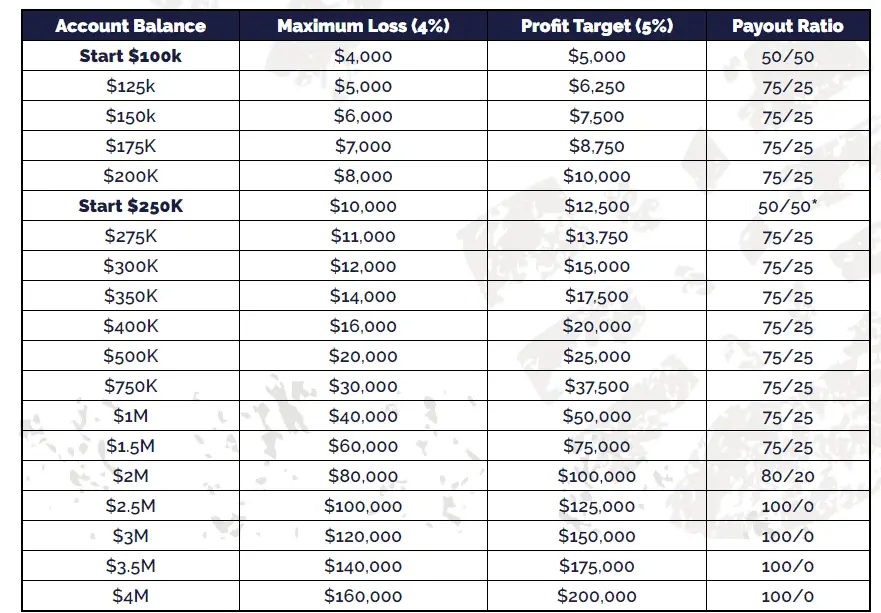

- Profit Split: When profits are generated from trading the funded account, they are typically split between the trader and the funding entity. Common splits might be 50/50, 60/40, or 70/30, with the more significant percentage often going to the trader.

- Risk Parameters: Funded accounts usually come with strict risk management rules. This could be a maximum drawdown limit, a cap on the daily loss, or rules about scaling up positions. If traders breach these rules, they might lose access to the funded account.

- Account Size: Depending on the program and the company, funded accounts can range from as little as $10,000 to over $1,000,000.

See the evaluation phase example:

See the targets example:

VISIT BOOTCAMP FUNDED PROGRAM

Benefits of a Funded Account

- No Personal Capital at Risk: The most significant advantage is that traders don’t risk their money. This can lead to better psychological well-being while trading.

- Capital Access: Skilled traders who lack sufficient capital can leverage their skills to access and manage much larger accounts than they could on their own.

- Learning and Growth: Some funded account programs offer educational content, mentoring, and feedback to help traders grow and refine their skills.

Drawbacks of a Funded Account

- Risk Parameters: While these parameters protect the capital, they can sometimes be restrictive and might not align with every trader’s style.

- Profit Sharing: While traders use someone else’s money, they also share their profits. In a personal account, they would keep all their gains.

- Potential Fees: Some companies might charge for the evaluation phase or monthly fees to stay in the program.

Choosing a Funded Account Program

With the popularity of funded accounts, many companies now offer such programs. Here’s what to consider when choosing:

- Reputation: Go for companies with a proven track record and positive reviews.

- Profit Split: Understand how profits (and sometimes losses) will be divided.

- Risk Rules: Ensure the program’s parameters align with your trading style.

- Support: Consider the quality of support and education offered by the program.

Conclusion

Funded accounts in Forex have democratized access to significant trading capital. For skilled traders without financial backing, it’s a golden opportunity. However, as with everything in the trading world, it’s essential to proceed cautiously, research, and ensure that the chosen funded account program aligns with your goals and trading style. Prop companies should not limit traders to how many months they can trade funded accounts to achieve profit targets.

You can learn more about instant funding prop firms on our page.