Table of Contents

Many traders are no longer confined to managing funds for just one entity or trading desk. Instead, they have branched out to trade for multiple proprietary (prop) trading firms simultaneously. Prop trading firms allocate company capital to traders, allowing them to profit without risking their own money. As traders diversify their trading portfolios and obligations across these firms, there arises a need for efficient and synchronized trade management.

Enter forex trading copiers: these sophisticated software solutions have become indispensable tools for such traders. They allow a single executed trade on one platform to be instantaneously replicated across several other accounts, ensuring that all accounts under a trader’s purview move harmoniously. This ensures consistency and maximizes efficiency, allowing traders to capitalize on opportunities swiftly without replicating trades across different platforms or accounts manually.

Forex trade copiers are more than just convenience tools for those navigating the intricacies of working with multiple prop companies; they are essential components that streamline operations, reduce manual errors, and ensure that all accounts align with the trader’s strategies and decisions. This introduction delves into the significance of forex trade copiers in the modern world, where trading across multiple proprietary firms is an exception and an emerging norm.

How to Place Same Order in Multiple Trading Accounts?

You must use a VPS Trade Copier Script or cloud trades copier platforms to place the same order in multiple trading accounts. If you choose Virtual Private Server VPS and Copier Script, you can cheaply copy trades from “master” to multiple “slave” accounts. Cloud trading copier platforms charge by account or the number of trades.

In our article, we explained the best trade copiers.

In the long run, based on my experience, if you trade using MT4 or MT5, the best way is to purchase one time. Trading copier, buying VPS, and copying multiple trades. Cloud platforms are better if you are a company with many trading accounts.

Cloud platforms are better when you want to copy from one platform to another. In that case, try Duplikium.

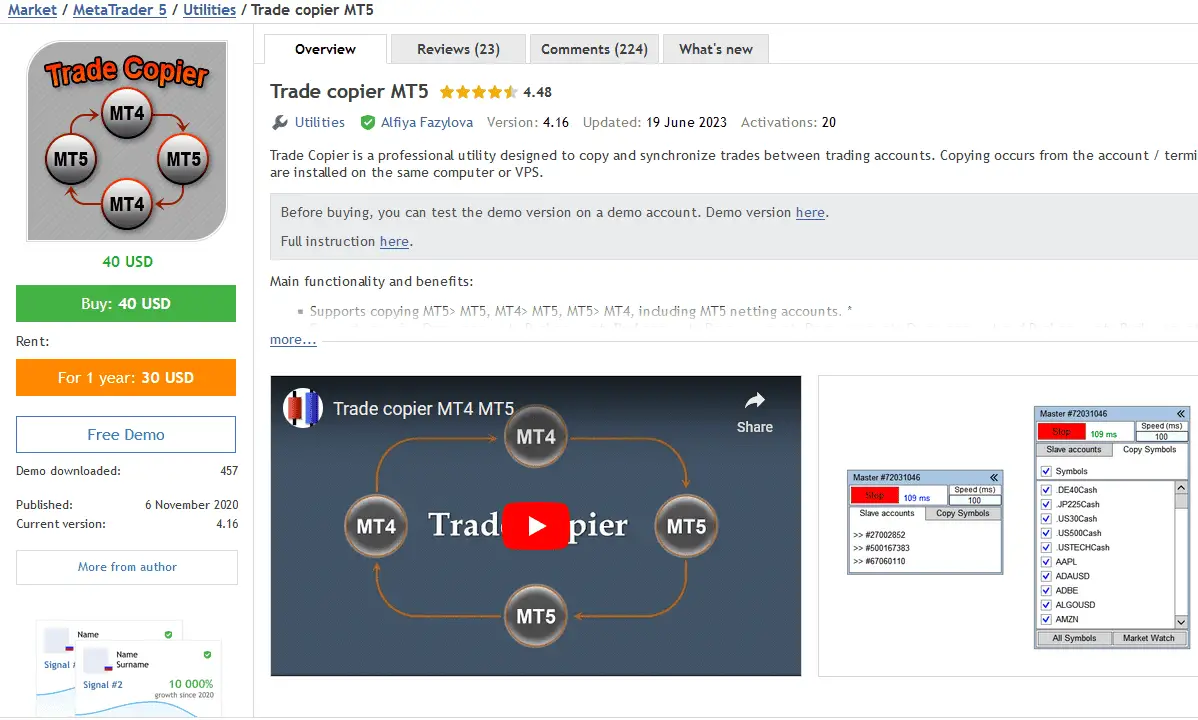

Below is a screenshot of the MT5 trade copier:

If you want to place the same order in multiple trading accounts, using a trade copier is one of the most effective methods. Let’s break down the process for both VPS Trade Copier Script and cloud trades copier platforms:

1. VPS (Virtual Private Server) with Trade Copier Script:

a. Setting Up a VPS:

- Choose a reliable VPS provider. For forex trading, many traders prefer providers with servers close to the broker’s data center to minimize latency.

- After purchasing, set up your VPS and install MT4/MT5 platforms for all the accounts you wish to manage.

b. Installing the Trade Copier Script:

- Purchase/download a trade copier script.

- Install the “Master” version of the script on the MT4/MT5 platform from which you wish to copy trades.

- Install the “Slave” version of the script on all other MT4/MT5 platforms on which you want the trades to be copied.

c. Configuration:

- On the “Master” MT4/MT5 platform, configure the settings to dictate which trades should be copied, risk parameters, symbols/pairs, etc.

- On the “Slave” platforms, adjust the settings based on the preferences for each account. This could include adjusting trade sizes, risk settings, and more.

d. Placing Trades:

- Once everything is set up, trades placed on the master account will automatically be replicated on all slave accounts according to the predetermined configurations.

2. Cloud Trade Copier Platforms:

a. Registration:

- Sign up with the cloud trade copier platform of your choice.

b. Linking Accounts:

- Integrate or link your enslaver and enslaved person accounts to the platform. Most platforms require you to input your broker’s API or other credentials.

c. Configuration:

- Set up trade parameters. Decide which trades you want to copy, how they should be sized on different accounts, risk parameters, currency pairs, etc.

d. Placing Trades:

- Once accounts are linked, and configurations set, trades made on the master account will be automatically copied to slave accounts via the cloud platform.

Considerations:

- Latency: Especially with VPS setups, ensure the VPS server is geographically close to your broker’s server to reduce trade execution delays.

- Cost: Compare the costs of running a VPS (along with copier script licenses) versus cloud platform subscription or transactional fees.

- Security: Always ensure your VPS is secure. Regularly update passwords and install necessary security tools. With cloud platforms, ensure you use a trusted service with suitable security protocols.

- Updates & Maintenance: With both setups, update all software and regularly review configurations to ensure trades are copying as intended.

Regardless of your chosen method, it’s essential to continually monitor trade activity, performance, and the accuracy of copied trades. Always start with a small amount or a demo setup until you’re confident in the reliability of your chosen method.

How to trade multiple MT4 accounts?

Trading multiple MT4 (MetaTrader 4) accounts using Forex copier platforms or scripts allows traders to manage several accounts simultaneously, distributing trades proportionally based on account sizes or other criteria. This is particularly useful for account managers, signal providers, or traders who want to manage multiple personal accounts with different risk profiles.

Here’s how you can set up and use a Forex copier on MT4:

- Choose a Forex Copier Software: There are many copier programs available. Some popular choices include:

- MT4i Personal Trade Copier

- Forex Copier

- Local Trade Copier

- SimpleTrader

Select one based on your requirements, like cost, ease of use, features, etc.

- Installation:

- Once you have chosen a copier, download and install the software on your VPS.

- Usually, you need to install a ‘Controller’ module on the account from which you want to copy trades and an ‘Agent’ module on the accounts to which you want trades to be copied.

- Configuration:

- Open MT4 and attach the Master EA (Expert Advisor) to a chart on the main account.

- On the other MT4 platforms/accounts, attach the Slave EA to a chart.

- Configure the settings on the Master account, like the amount to be traded, risk ratios, which pairs to trade, etc.

- On the Slave accounts, set your preferences. For instance, you might want different accounts to receive trades in different sizes or only certain types.

- Adjust Risk Parameters:

- Depending on the software, you can set various risk parameters. For example, if one account is half the size of your main account, you may want to risk half the amount on trades for that account.

- You can also usually set fixed lot sizes, risk percentages, or scales based on equity/balance ratios.

- Select Symbols/Pairs:

- Decide if you want to copy all trades from all currency pairs or only specific ones.

- Adjust settings on the Enslaver and enslaved person’s sides to align.

- Filters:

- Some copiers provide advanced filters, only allowing you to copy trades meeting specific criteria. This could be based on trade size, currency pair, time of day, and other factors.

- Monitor & Adjust:

- Regularly check to ensure that trades are being copied correctly.

- Make adjustments as necessary based on performance and changing strategies.

- Updates & Maintenance:

- Always ensure your copier software is updated to the latest version.

- Backup settings and configurations regularly.

Note: Using a trade copier does carry risks. There can be instances where trades don’t copy over correctly due to connection issues, software bugs, or other factors. Always use with caution and start with a demo or small account to test and understand the settings and outcomes.

Remember, even with a trade copier, the primary responsibility for trade outcomes still lies with the trader. Use this tool to enhance efficiency, not to distance oneself from the trading process.